Morning Call For Wednesday, May 17

OVERNIGHT MARKETS AND NEWS

Jun E-mini S&Ps (ESM17 -0.38%) this morning are down -0.42% and European stocks are down -0.39% on reports that President Trump asked then-FBI Director Comey to drop his investigation into former National Security Advisor Flynn. The dollar index tumbled to a 6-1/4 month low on the news while Jun COMEX gold (GCM17 +0.72%) jumped +0.72% to a 2-week high. The uncertainty caused by this latest political development has boosted the VIX volatility index which jumped to a 3-week high and fueled safe-haven demand for government debt as the 10-year T-note yield fell to a 3-week low. Also, concern that the White House political turmoil will impede the Republican growth agenda has led to long liquidation in equities. Asian stocks settled mostly lower: Japan -0.53%, Hong Kong -0.17%, China -0.27%, Taiwan -0.18%, Australia -1.10%, Singapore -0.11%, South Korea -0.11%, India +0.25%. The political turmoil that has engulfed the Trump administration has boosted safe-haven demand for the yen as USD/JPY fell to a 1-week low. That yen strength pressured Japanese exporter stocks and led the Nikkei Stock Index lower.

The dollar index (DXY00 -0.11%) is down -0.18% to a 6-1/4 month low. EUR/USD (^EURUSD) is up +0.21% to a 6-1/4 month high. USD/JPY (^USDJPY) is down -0.63% to a 1-week low.

Jun 10-year T-note prices (ZNM17 +0.17%) are up +8.5 ticks to a 3-week high.

U.S. STOCK PREVIEW

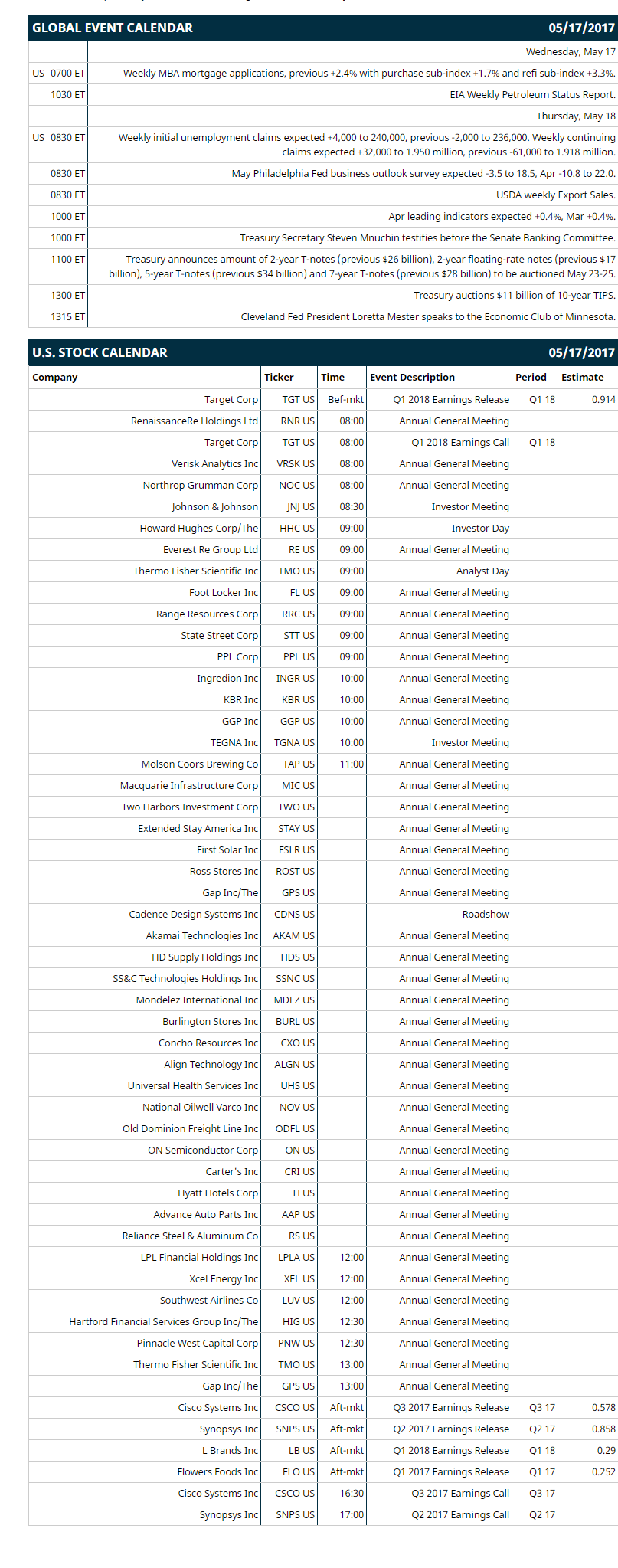

Key U.S. news today includes: (1) weekly MBA mortgage applications (previous +2.4% with purchase sub-index +1.7% and refi sub-index +3.3%), (2) EIA Weekly Petroleum Status Report.

Notable Russell 2000 earnings reports today include: Target (consensus $0.91), Cisco Systems (0.58), Synopsys (0.86), L Brands (0.29), Flowers Foods (0.25).

U.S. IPO's scheduled to price today: Argenx (ARGX), Bright Scholar Education Holdings (BEDU).

Equity conferences: Needham Emerging Technology Conference on Tue-Wed, Goldman Sachs Basic Materials Conference on Tue-Wed, Bank of America Merrill Lynch Health Care Conference on Tue-Thu, Barclays Americas Select Franchise Conference on Tue-Fri, Stephens Energy Executive Summit on Wed, BMO Capital Markets Farm to Market Conference on Wed-Thu, J.P. Morgan Homebuilding & Building Products Conference on Wed-Thu, MoffettNathanson Media & Communications Summit on Wed-Thu, RBC Capital Markets Canadian Automotive, Transportation & Industrials Conference on Thu, Barclays Water Symposium - Panel on Thu.

OVERNIGHT U.S. STOCK MOVERS

Disney (DIS -1.05%) was downgraded to 'Neutral' from 'Outperform' at Macquarie.

Target (TGT -1.48%) jumped over 5% in pre-market trading after it reported Q1 adjusted EPS of $1,21, well above consensus of 91 cents, and said it sees Q2 adjusted EPS of 95 cents-$1.15, the midpoint higher than consensus of $1.00.

Marathon Oil (MRO -0.76%) was downgraded to 'Hold' from 'Buy' at Jefferies.

Transocean (RIG -1.02%) was initiated with a 'Sell' at Odeon Capital Group LLC with a 12-month target price of $8.

Toll Brothers (TOL +0.51%) was initiated with a 'Buy' at Mizuho Securities with a 12-month target price of $44.

Lennar (LEN +0.78%) was initiated with a 'Buy' at Mizuho Securities with a 12-month target price of $59.

Jack in the Box (JACK +2.34%) rose 10% in after-hours trading after it reported Q2 adjusted operating EPS of 98 cents, better than consensus of 91 cents.

Red Robin Gourmet Burgers (RRGB -2.11%) jumped 15% in after-hours trading after it reported Q1 adjusted EPS of 89 cents, higher than consensus of 57 cents, and then raised guidance on full-year EPS to $2.80-$3.10 from a prior view of $2.70-$3.00.

Atlas Air Worldwide Holdings (AAWW +0.51%) fell 3% in after-hours trading after it announced plans to offer $250 million of convertible senior notes due 2024.

Urban Outfitters (URBN -2.34%) dropped over 2% in after-hours trading after it reported Q1 adjusted EPS of 13 cents, below consensus of 15 cents as Q1 comparable retail segment sales fell -3.1%, weaker than expectations of -2.2%.

Advanced Micro Devices (AMD +11.65%) gained 1% in after-hours trading after the company said it sees double digit percentage revenue growth to 2020.

GNC Holdings (GNC +0.59%) rallied nearly 5% in after-hours trading after interim CEO Bob Moran disclosed a purchase of 300,000 shares of GNC at $6.69 on May 12.

Alcentra Capital Corp (ABDC -2.09%) slid over 2% in after-hours trading after announced an underwritten primary offering of 808,161 shares of its common stock and a concurrent underwritten secondary offering of 1,691,839 shares of its common stock on behalf of a selling stockholder.

MARKET COMMENTS

June E-mini S&Ps (ESM17 -0.38%) this morning are down -10.00 points (-0.42%). Tuesday's closes: S&P 500 -0.07%, Dow Jones -0.01%, Nasdaq +0.35%. The S&P 500 on Tuesday fell back from a new all-time high and closed lower. Stocks were undercut by the weak U.S. housing data after Apr housing starts unexpectedly fell -2.6% to 1.172 million, weaker than expectations of +3.7% to 1.26 million and a 5-month low, and Apr building permits unexpectedly fell -2.5% to 1.229 million, weaker than expectations of +0.2% to 1.27 million. Stocks were also undercut by concern that the White House political turmoil will impede the Republican growth agenda. Stocks found some support on the +1.0% increase in U.S. Apr manufacturing production, stronger than expectations of +0.4% and the biggest increase in 3 years.

June 10-year T-notes (ZNM17 +0.17%) this morning are up +8.5 ticks to a 3-week high. Tuesday's closes: TYM7 +3.00, FVM7 +1.25. Jun 10-year T-notes on Tuesday rose to a 1-1/2 week high and settled higher on the weaker-than-expected U.S. Apr housing starts and building permits data. T-notes were also supported by reduced inflation expectation after the 10-year T-note breakeven inflation rate fell to 6-1/4 month low.

The dollar index (DXY00 -0.11%) this morning is down -0.177 (-0.18%) to a 6-1/4 month low. EUR/USD (^EURUSD) is up +0.0023 (+0.21%) to a 6-1/4 month high and USD/JPY (^USDJPY) is down -0.71 (-0.63%) to a 1-week low. Tuesday's closes: Dollar index -0.806 (-0.81%), EUR/USD +0.0108 (+0.98%), USD/JPY -0.67 (-0.59%). The dollar index on Tuesday sold off to a 6-1/4 month low and closed lower on the unexpected declines in U.S. Apr housing starts and building permits and the slide in to 10-year T-note yield to a 1-1/2 week low, which reduces the dollar's interest rate differentials.

June WTI crude oil prices (CLM17 +0.33%) this morning are up +19 cents (+0.39%) and June gasoline (RBM17 +0.09%) is +0.0026 (+0.16%). Tuesday's closes: Jun crude -0.19 (-0.39%), Jun gasoline +0.0089 (+0.56%). Jun crude oil and gasoline on Tuesday settled mixed. Crude oil prices were boosted by the slump in the dollar index to a 6-1/4 month low and by expectations for Wednesday's EIA crude inventories to fall -2.75 million bbl. Crude prices erased their gains and closed lower after the IEA said that even if OPEC and non-OPEC crude producers extend their production cuts, global crude inventories will probably remain above average at the end of the year.

Disclosure: None.