Morning Call For Wednesday, March 22

OVERNIGHT MARKETS AND NEWS

OVERNIGHT MARKETS AND NEWS

Jun E-mini S&Ps (ESM17 -0.09%) this morning are down -0.07% at a 1-month low and European stocks are down -0.48% at a 1-week low amid uncertainty over the prospects that the Trump administration can pass its pro-growth policies. Top U.S. Republicans have warned that failure to repeal Obamacare could threaten the passage of the Trump administration's tax reform and infrastructure spending plans. Republican leaders said they are still short the votes needed to repeal and replace Obamacare when it comes up for vote in the House of Representatives on Thursday. Weakness in crude oil prices is also pressuring energy producing stocks with May WTI crude (CLK17 -1.16%) down -1.41% after API data late yesterday showed U.S. crude stockpiles rose by +4.53 million bbl last week. Asian stocks settled lower: Japan -2.13%, Hong Kong -1.11%, China 0.50%, Taiwan -0.50%, Australia -1.56%, Singapore -1.28%, South Korea -0.43%, India -1.08%. Japan's Nikkei Stock Index tumbled to a 5-week low as exporter stocks sold-off on reduced earnings prospects with a stronger yen after USD/JPY slumped -0.31% to a 3-3/4 month low.

The dollar index (DXY00 +0.04%) is down -0.01% at a 1-1/2 month low. EUR/USD (^EURUSD) is down -0.16%. USD/JPY (^USDJPY) is down -0.31% at a 3-3/4 month low.

Jun 10-year T-note prices (ZNM17 +0.14%) are up +7 ticks at a 3-week high as the slide in stocks boosts the safe-haven demand for T-notes.

Cleveland Fed President Mester said inflation is on track to continue moving toward the Fed's 2% goal and that she has built "a bit more than three" rate increases into her forecast for 2017.

The Japan Feb trade balance was in surplus by +813.4 billion yen, wider than expectations of +807.2 billion yen and the largest surplus in 6-3/4 years. Feb exports rose +11.3% y/y, stronger than expectations of +10.1% y/y and the biggest increase in 2 years. Feb imports rose +1.2% y/y, weaker than expectations of +1.3% y/y.

U.S. STOCK PREVIEW

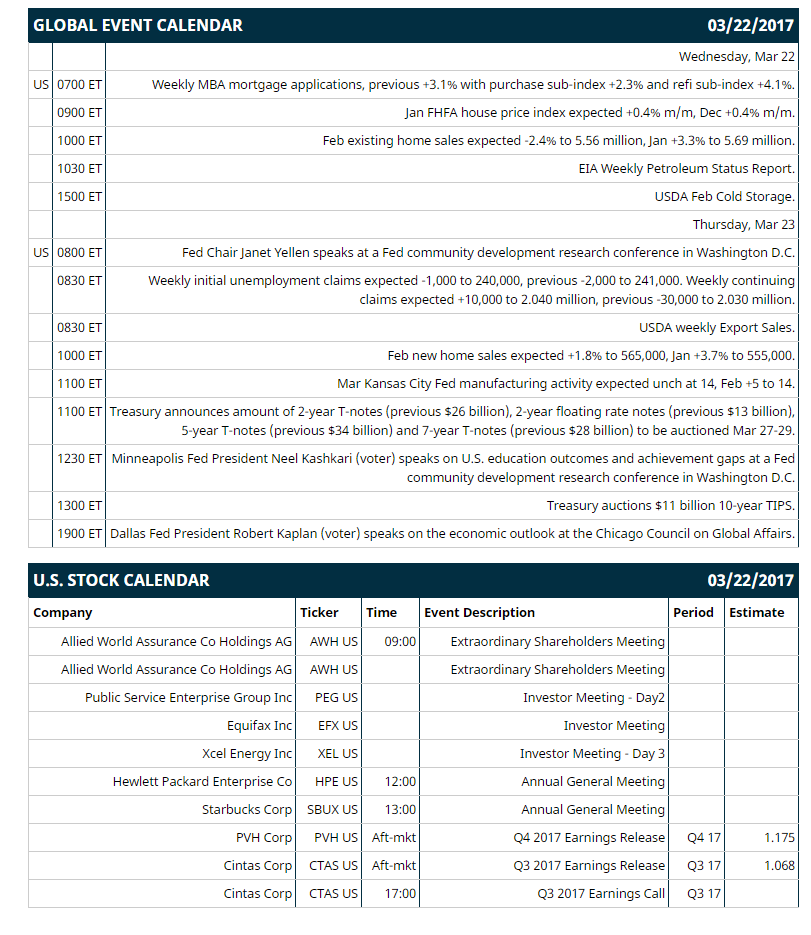

Key U.S. news today includes: (1) weekly MBA mortgage applications (previous +3.1% with purchase sub-index +2.3% and refi sub-index +4.1%), (2) Jan FHFA house price index (expected +0.4% m/m, Dec +0.4% m/m), (3) Feb existing home sales (expected -2.4% to 5.56 million, Jan +3.3% to 5.69 million), (4) EIA Weekly Petroleum Status Report, (5) USDA Feb Cold Storage.

Notable Russell 1000 earnings reports today include: Cintas (consensus $1.07), PVH Corp (1.18).

U.S. IPO's scheduled to price today: none.

Equity conferences: Consumer Analyst Group of Europe (CAGE) Conference on Mon-Wed, Bank of America Merrill Lynch Global Industrials Conference on Tue-Wed, Oppenheimer Global Health Care Conference on Tue-Wed, Evercore ISI Retail Summit on Wed, Gabelli & Company Specialty Chemicals Conference on Wed, Bank of America Merrill Lynch Global Industrials & EU Autos Conference on Thu.

OVERNIGHT U.S. STOCK MOVERS

L Brands (LB -2.54%) was downgraded to 'Underweight' from 'Sector Weight' at Keybanc.

General Mills (GIS -0.83%) was downgraded to 'Hold' from 'Buy' at Stifel.

American Airlines Group (AAL -3.07%) was downgraded to 'Equalweight' from 'Overweight' at Morgan Stanley.

FedEx (FDX -0.22%) rose 3% in after-hours trading after the CEO said he sees an "excellent" fiscal Q4.

Nike (NKE -1.14%) lost almost 4% in after-hours trading after it reported Q3 revenue of $8.43 billion, below consensus of $8.47 billion, and said worldwide futures orders ex-currency were down 1%, weaker than estimates of up 3.4%.

Duluth Holdings (DLTH -0.21%) surged 19% in after-hours trading after it reported Q4 adjusted EPS of 37 cents, higher than consensus of 34 cents, and then said it sees full-year sales of $445 million to $465 million, above consensus of $444.2 million.

REGENXBIO (RGNX -8.30%) slid 6% in after-hours trading after it proposed a public offering of $75 million of its common stock.

AAR Corp (AIR -4.02%) jumped nearly 6% in after-hours trading after it reported Q3 sales of $446.7 million, above consensus of $418.5 million.

Silver Wheaton (SLW -0.45%) gained over 2% in after-hours trading after it reported Q4 revenue of $258 million, higher than consensus of $243.3 million.

HealthEquity (HQY -5.03%) rose 3% in after-hours trading after it reported Q4 revenue of $46.8 million, better than consensus of $45.6 million.

Snap (SNAP +2.26%) gained 1% in after-hours trading after it was rated a new 'Buy' at Drexel Hamilton with a price target of $30.

Easterly Government Properties (DEA +0.82%) slid nearly 4% in after-hours trading after it commenced a public offering of 4.3 million shares of its common stock.

Synergy Pharmaceuticals (SGYP -8.64%) gained 1% in after-hours trading after it slumped nearly 9% Tuesday and BTIG said that weakness has created a buying opportunity for the stock.

MARKET COMMENTS

Jun E-mini S&Ps (ESM17 -0.09%) this morning are down -1.75 points (-0.07%) at a new 1-month low. Tuesday's closes: S&P 500 -1.24%, Dow Jones -1.14%, Nasdaq -1.49%. The S&P 500 on Tuesday sold off to a 1-month low and closed lower on long liquidation pressure sparked by concern that the Trump administration's tax-reform and infrastructure spending plans will be delayed unless the Republican health-care replacement bill gets passed by Congress after President Trump said we "cannot do a very big tax cut until Obamacare is repealed." There was also weakness in energy producer stocks after crude oil prices fell -1.37%.

Jun 10-year T-notes (ZNM17 +0.14%) this morning are up +7 ticks at a fresh 3-week high. Tuesday's closes: TYM7 +9.00, FVM7 +5.25. Jun 10-year T-notes on Tuesday rallied to a 3-week high and closed higher on reduced inflation expectations after the 10-year T-note break-even inflation rate fell to a 5-week low and on increased safe-haven demand as stocks sold off.

The dollar index (DXY00 +0.04%) this morning is down -0.007 (-0.01%) ata 1-1/2 month low. EUR/USD (^EURUSD) is down -0.0017 (-0.16%) and USD/JPY (^USDJPY) is down -0.35 (-0.31%) at a 3-3/4 month low. Tuesday's closes: Dollar index -0.597 (-0.59%), EUR/USD +0.0072 (+0.67%), USD/JPY -0.84 (-0.75%). The dollar index on Tuesday tumbled to a 1-1/2 month low and closed lower on strength in EUR/USD which rallied to a 1-1/2 month high as European political risks eased after pro-EU candidate Macron was seen as the winner in a debate of five French presidential candidates Monday night. The yen was boosted by increased safe-haven demand after the S&P 500 slumped to to a 1-month low.

May WTI crude oil (CLK17 -1.16%)prices this morning are down -68 cents (-1.41%) and May gasoline (RBK17 -0.32%) is -0.0095 (-0.59%). Tuesday's closes: May crude -0.67 (-1.37%), May gasoline -0.0078 (-0.48%). May crude oil and gasoline on Tuesday closed lower on expectations that Wednesday's EIA crude inventories will climb +2.65 million bbl. Crude oil prices were also undercut by the resumption of crude exports from Libya, Africa's largest holder of crude reserves, after the Libyan oil ports of Es Sider and Ras Lanuf resumed operations after being closed for 2-weeks due to armed clashes between rebels and government forces. Crude oil found some underlying support as the dollar index fell to a 1-1/2 month low.

Disclosure: None.