Morning Call For Wednesday, June 21

OVERNIGHT MARKETS AND NEWS

Sep E-mini S&Ps (ESU17 -0.17%) this morning are down -0.13% and European stocks are down -0.66% as weakness in crude oil undercuts energy stocks. Aug WTI crude oil (CLQ17 -0.09%) is down -0.07% as production gains in Libya and the U.S. offset OPEC crude production cuts and boost the global oil glut. Libya reported Tuesday that its crude production rose to a 4-year high of 902,000 bpd, while Baker Hughes reported that U.S. oil drillers have added rigs to oil fields for 22 consecutive weeks, the longest run in 30-years. Crude oil prices slipped despite Tuesday's afternoon's data from API that showed U.S. crude supplies fell -2.72 million bbl last week. Asian stocks settled mixed: Japan -0.45%, Hong Kong -0.57%, China +0.52%, Taiwan +0.24%, Australia -1.59%, Singapore -0.9%, South Korea -0.58%, India -0.04%. China's Shanghai Composite climbed to a 1-week high after MSCI said it will add 222 China A-shares to its developing-market index starting in May 2018.

The dollar index (DXY00 -0.14%) is down -0.12%. EUR/USD (^EURUSD) is up +0.14%. USD/JPY (^USDJPY) is down -0.10%.

Sep 10-year T-note prices (ZNU17 -0.01%) are little changed, up +0.5 of a tick.

The Japan Apr all-industry activity index rose +2.1% m/m, stronger than expectations of +1.6% m/m and the biggest increase in 8-years.

U.K. May public sector net borrowing rose +6.0 billion pounds, weaker than expectations of +7.0 billion pounds.

U.S. STOCK PREVIEW

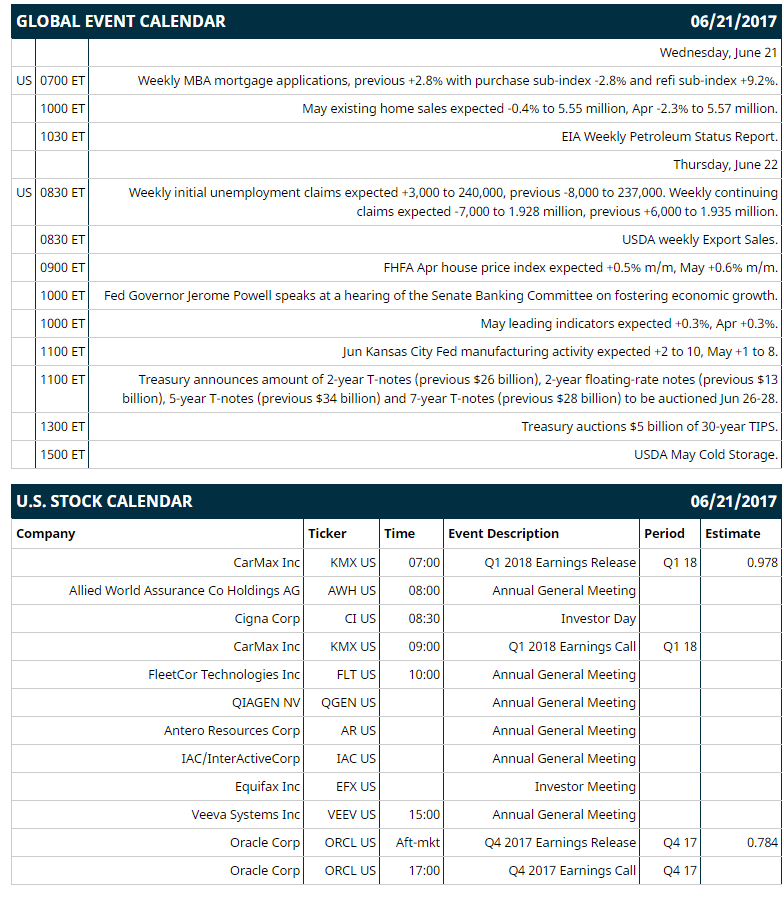

Key U.S. news today includes: (1) weekly MBA mortgage applications (previous +2.8% with purchase sub-index -2.8% and refi sub-index +9.2%), (2) May existing home sales (expected -0.4% to 5.55 million, Apr -2.3% to 5.57 million), (3) EIA Weekly Petroleum Status Report.

Notable Russell 2000 earnings reports today include: Oracle (consensus $0.78), CarMax (0.98).

U.S. IPO's scheduled to price today: SG Blocks (SGBX), Mota Group (MOTA), Safety Income and Growth (SAFE).

Equity conferences this week: Jefferies Global Consumer Conference on Tue-Wed, Oppenheimer Consumer Conference on Tue-Wed, Tudor Picker & Holt Hotter N Hell Energy Conference on Tue-Thu, Wells Fargo Securities West Coast Energy Conference on Tue-Wed, SunTrust Robinson Utilities & Power Summit on Thu, Wells Fargo Securities 5G Forum on Thu.

OVERNIGHT U.S. STOCK MOVERS

Marathon Oil (MRO -3.44%) was downgraded to 'Equal-Weight' from 'Overweight' at Morgan Stanley.

PayPal (PYPL -0.77%) rose almost 1% in pre-market trading after it was upgraded to 'Overweight' from 'Sector-Weight' at Pacific Crest Securities

FedEx (FDX -0.95%) gained almost 2% in after-hours trading after it reported Q4 adjusted EPS of $4.25, higher than consensus of $3.88.

Adobe Systems (ADBE +0.40%) climbed over 3% in pre-market trading after it reported Q2 adjusted EPS of $1.02, better than expectations of 95 cents.

Red Hat (RHT -0.43%) rallied 11% in pre-market trading after it reported Q1 revenue of $677 million, above consensus of $648 million, and then raised guidance on full-year revenue to $2.79 billion-$2.83 billion from a prior view of $2.72 billion-$2.76 billion.

Delphi Automotive PLC (DLPH -2.52%) was rated a new 'Buy' at Guggenheim with a price target of $104.

Xylem (XYL -0.54%) was initiated with an 'Outperform' rating at BMO Capital Markets with as 12-month target price of $60.

Goodyear Tire & Rubber (GT -1.34%) was rated a new 'Buy' at Guggenheim with a price target of $39.

Korn/Ferry International (KFY -0.27%) rose 2% in after-hours trading after it reported Q4 adjusted EPS of 62 cents, better than consensus of 60 cents.

Teladoc (TDOC -8.80%) slipped nearly 3% in after-hours trading after it announced a proposed offering of $200 million of convertible senior notes due 2022.

Novo Nordisk A/S (NVO -1.17%) gained almost 1% in after-hours trading after an FDA advisory panel backed Novo's claim that its Victoza drug cuts heart risks in type 2 diabetics.

La-Z-Boy (LZB -3.85%) jumped nearly 10% in after-hours trading after it reported Q4 EPS of 57 cents, well above consensus of 46 cents.

Advanced Micro Devices (AMD +5.95%) gained almost 2% in after-hours trading after Microsoft and Baidu said they have committed to using AMD's new Epyc server chip in their data centers.

Sangamo Therapeutics (SGMO +3.14%) dropped over 8% in after-hours trading after it announced that it had commenced an underwritten public offering of $60 million in shares of its common stock.

MARKET COMMENTS

Sep E-mini S&Ps (ESU17 -0.17%) this morning are down -3.25 points (-0.13%). Tuesday's closes: S&P 500 -0.67%, Dow Jones -0.29%, Nasdaq -0.80%. The S&P 500 on Tuesday closed lower on a sell-off in energy stocks after crude oil prices tumbled -2.41% to a 7-month low and on weakness in mining stocks after copper prices fell -1.35% and gold prices slid -0.26% to a 1-month low.

Sep 10-year T-notes (ZNU17 -0.01%) this morning are up +0.5 of a tick. Tuesday's closes: TYU7 +9.50, FVU7 +5.00. Sep 10-year T-notes on Tuesday closed higher on dovish comments from Chicago Fed President Evans who said the Fed can go until December to see if inflation picks up before it decides to raise interest rates again. T-note prices were also supported by the plunge in crude oil prices to a 7-month low which reduced inflation expectations as the 10-year T-note breakeven inflation rate dropped to an 8-month low.

The dollar index (DXY00 -0.14%) this morning is down -0.113 (-0.12%). EUR/USD (^EURUSD) is up +0.0016 (+0.14%) and USD/JPY (^USDJPY) is down -0.11 (-0.10%). Tuesday's closes: Dollar index +0.212 (+0.22%), EUR/USD -0.0015 (-0.13%), USD/JPY -0.08 (-0.07%). The dollar index on Tuesday climbed to a 1-month high and closed higher on weakness in GBP/USD which tumbled to a 1-month low after comments from BOE Governor Carney quashed speculation the BOE will hike rates soon when he said that now is not the time to raise rates because of still-weak wage pressures and uncertainties over Brexit. There was also weakness in EUR/USD which dropped to a 3-week low after weaker-than-expected German May PPI bolstered the case for the ECB to maintain its QE program.

Aug WTI crude oil prices (CLQ17 -0.09%) this morning are down -3 cents (-0.07%) and Aug gasoline (RBQ17 +0.16%) is +0.0003 (+0.02%). Tuesday's closes: Aug crude -1.07 (-2.41%), Aug gasoline -0.0258 (-1.79%). Aug crude oil and gasoline on Tuesday closed lower with Aug crude at a 7-month low. Crude oil prices were undercut by the rally in the dollar index to a 1-month high and by concern that rising Libyan crude production will add to a global crude supply glut after an official at the Libyan National Oil Corp. said that Libyan oil output has now risen to 902,000 bpd, a 4-year high.

Disclosure: None.