Morning Call For Wednesday, July 5

OVERNIGHT MARKETS AND NEWS

Sep E-mini S&Ps (ESU17 +0.02%) this morning are little changed, up +0.05%, and European stocks are up +0.13% as the markets await the minutes of the Jun 13-14 FOMC meeting for clues as to when the Fed may start to shrink its balance sheet. On the positive side for European stocks was the upward revision to the Eurozone Jun composite PMI to 56.3 from the previously reported 55.7. Weakness in energy stocks has limited the upside for equities as the price of Aug WTI crude oil (CLQ17 -1.40%) falls -1.78%. Crude oil prices came under pressure after Russia said it wants to stick to the current OPEC deal and would oppose any proposal for deeper crude production cuts when OPEC meets later this month. Asian stocks settled mostly higher: Japan +0.25%, Hong Kong +0.52%, China +0.76%, Taiwan +0.55%, Australia -0.36%, Singapore +1.17%, South Korea +0.42%, India +0.11%. China's Shanghai Composite rallied to a 2-1/2 month high on signs of ample liquidity in the financial system after China's seven-day repo rate fell -5.45 bp to 2.708%, a 2-1/2 month low. Japan's Nikkei Stock Index recovered from a 2-week low and closed higher as exporter stocks rallied after USD/JPY climbed to a 1-1/2 month high, which boosts the earnings prospects of exporters.

The dollar index (DXY00 +0.16%) is up +0.24%. EUR/USD (^EURUSD) is down -0.19%. USD/JPY (^USDJPY) is up +0.27% to a 1-1/2 month high.

Sep 10-year T-note prices (ZNU17 -0.02%) are down -1 tick to a 1=1/2 month low.

The Eurozone Jun Markit composite PMI was revised higher to 56.3 from the previously reported 55.7.

The UK Jun Markit/CIPS services PMI fell -0.4 to 53.4, weaker than expectations of -0.3 to 53.5.

U.S. STOCK PREVIEW

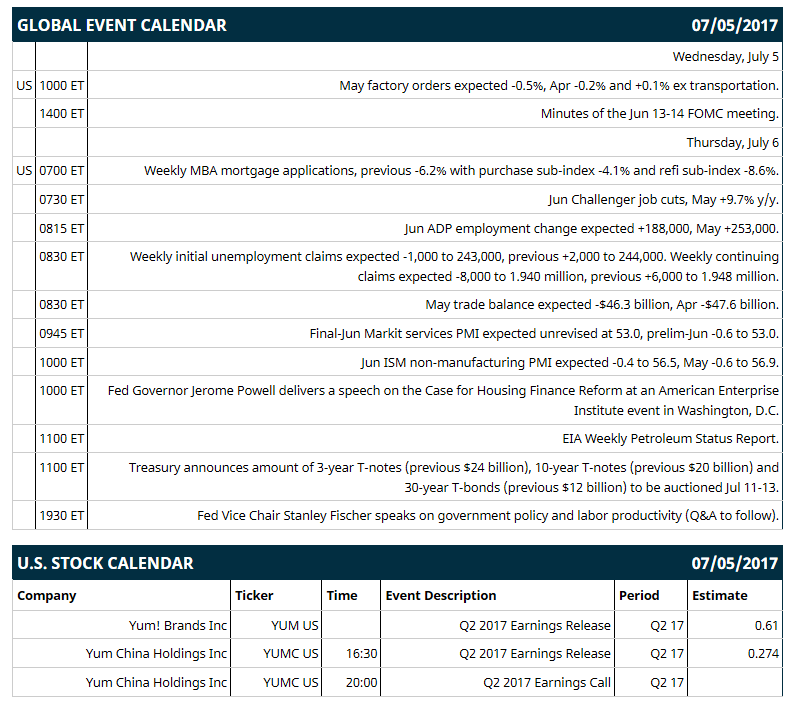

Key U.S. news today includes: (1) May factory orders (expected -0.5%, Apr -0.2% and +0.1% ex transportation), (2) minutes of the Jun 13-14 FOMC meeting.

Notable Russell 2000 earnings reports today include: Yum Brands (consensus $0.61).

U.S. IPO's scheduled to price today: none.

Equity conferences this week: none.

OVERNIGHT U.S. STOCK MOVERS

Cabela's (CAB +0.05%) is up almost 2% in pre-market trading after Bass Pro Shops received FTC approval for its acquisition of Cabela's.

Weyerhaeuser (WY +0.57%) was downgraded to 'Neutral' from 'Buy' at Bank of America/Merrill Lynch.

Teledyne (TDY +0.36%) was upgraded to 'Buy' from 'Hold' at Needham & Co. with a 12-month target price of $148.

Capital One Financial (COF +1.14%) lost over 1% in pre-market trading after it was downgraded to 'Underperform' from 'Neutral' at Wedbush.

PPG Industries (PPG +0.59%) was upgraded to 'Buy' from 'Hold' at Argus Research.

Sun Bancorp (SNBC +1.22%) was downgraded to 'Hold' from 'Buy' at Sandler O'Neill & Partners LP.

Newmont Mining (NEM -1.54%) was upgraded to 'Sector Outperform' from 'Sector Perform' at Scotia Capital.

Buffalo Wild Wings (BWLD +1.14%) was downgraded to 'Equal Weight' from 'Overweight' at Stephens.

Oracle (ORCL -1.56%) was upgraded to 'Overweight' from 'Sector Weight' at KeyBanc Capital Markets.

Lockheed Martin (LMT +0.47%) was awarded a $3.77 billion mufti-year contract from the U.S. Army for production and services associated with the Black Hawk helicopter.

Tesla (TSLA unch) may move lower this morning after the company announced late Monday that it delivered "just over" 22,000 vehicles in Q2, below consensus of 22,912.

MARKET COMMENTS

Sep E-mini S&Ps (ESU17 +0.02%) this morning are up +1.25 points (+0.05%). Monday's closes: S&P 500 +0.23%, Dow Jones +0.61%, Nasdaq -0.88%. The S&P 500 on Monday closed higher on signs of strength in global manufacturing activity that bodes well for the world economy after the China Jun Caixin manufacturing PMI rose +0.8 to 50.4, stronger than expectations of +0.2 to 49.8, and after the Eurozone Jun Markit manufacturing PMI was revised higher to 57.4 from 57.3, the fastest pace of expansion in over 3 years. In addition, the there was a +2.9 point increase in the U.S. Jun ISM manufacturing index to a 2-3/4 year high of 57.8, stronger than expectations of +0.4 to 55.3. Stock prices came off their best levels on a sell-off in technology stocks.

Sep 10-year T-notes (ZNU17 -0.02%) this morning are down -1 tick to a fresh 1-1/2 month low. Monday's closes: TYU7 -13.50, FVU7 -7.50. Sep 10-year T-notes on Monday fell to a 1-1/2 month low and closed lower on the 2-3/4 year high in the U.S. Jun ISM manufacturing index and on the continued rise in German 10-year bund yields.

The dollar index (DXY00 +0.16%) this morning is up +0.23 (+0.24%). EUR/USD (^EURUSD) is down -0.0021 (-0.19%) and USD/JPY (^USDJPY) is up +0.31 (+0.27%). Monday's closes: Dollar index +0.59 (+0.62%), EUR/USD -0.0069 (-0.60%), USD/JPY +1.00 (+0.89%). The dollar index on Monday closed higher on weakness in the yen with a 1-1/2 month high in the USD/JPY after Japan Prime Minister Abe's Liberal Democratic Party had an unexpected loss in an election for Tokyo's assembly, which fueled speculation Prime Minister Abe may resort to fresh economic stimulus to win support. The dollar was also boosted by the stronger-than-expected U.S. Jun ISM index which expanded at its fastest pace in 2-3/4 years and bolstered the case for additional Fed rate hikes.

Aug WTI crude oil prices (CLQ17 -1.40%) this morning are down -84 cents (-1.78%) and Aug gasoline (RBQ17 -1.23%) is -0.0250 (-1.63%). Monday's closes: Aug crude +1.03 (+2.23%), Aug gasoline +0.0211 (+1.39%). Aug crude oil and gasoline on Monday closed higher with Aug crude at a 3-week high and Aug gasoline at a 4-week high. Crude oil prices were boosted by questions about U.S. oil production after Friday's data from Baker Hughes showed U.S. drillers cut their active oil rigs by -2 rigs to 756, the first decline in 24 weeks. Crude oil prices were also boosted by stronger-than-expected global PMI reports and by the increase in the crack spread to a 1-month high, which may boost refinery demand for crude to refine into gasoline.

(Click on image to enlarge)

Disclosure: None.