Morning Call For Wednesday, July 19

OVERNIGHT MARKETS AND NEWS

Sep E-mini S&Ps (ESU17 +0.07%) this morning are up +0.03% and European stocks are up +0.17%. Stronger-than-expected Q2 earnings results from Morgan Stanley is boosting the stock nearly 3% in pre-market trading and is leading the overall market higher. Also, energy stocks are higher with Aug WTI crude oil (CLQ17 +0.19%) up +0.41% as crude shook off overnight losses after API data late Tuesday showed U.S. crude inventories rose +1.63 million bbl last week. Strength in gasoline is leading crude higher with Aug ROB gasoline (RBQ17 +0.99%) up +1.20% at a 1-1/2 month high after the crack spread rose to a 3-1/4 month high, which may boost refinery demand for crude to refine into gasoline. Gains in European stocks were limited ahead of Thursday's ECB meeting where policy makers may announce changes to its QE program. Asian stocks settled higher: Japan +0.10%, Hong Kong +0.56%, China +1.36%, Taiwan +0.24%, Australia +0.75%, Singapore +0.57%, South Korea +0.08%, India +0.77%. Japanese stocks moved higher on short-covering ahead of the BOJ policy meeting on Thursday and China's Shanghai Composite rose to a 3-month high, led by a rally in mining stocks, after Reuters reported that China is considering a merger of two of its biggest state-run metals companies, China Minmetals, and China National Gold Corp.

The dollar index (DXY00 +0.21%) is up +0.18%. EUR/USD (^EURUSD) is down -0.23%. USD/JPY (^USDJPY) is down -0.05%.

Sep 10-year T-note prices (ZNU17 -0.07%) are down -3.5 ticks.

U.S. STOCK PREVIEW

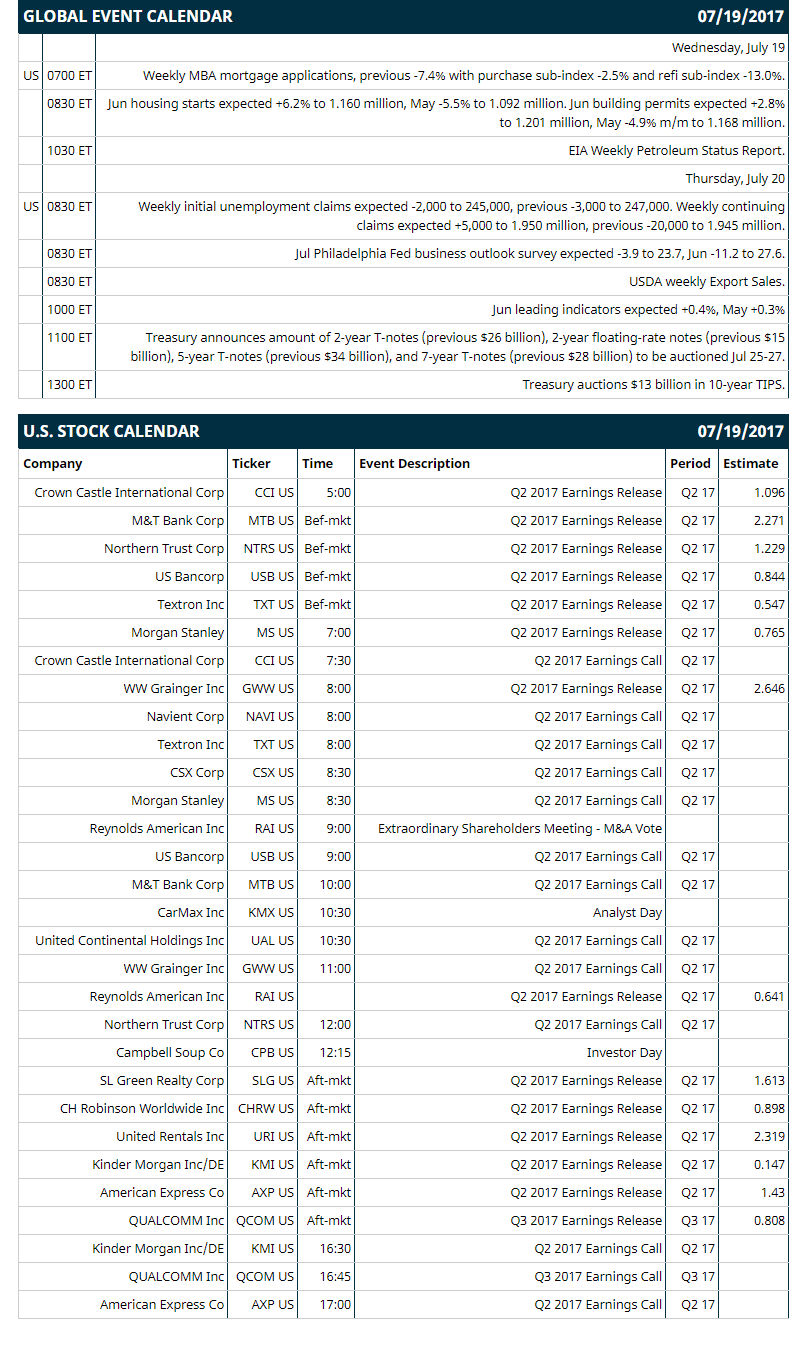

Key U.S. news today includes: (1) weekly MBA mortgage applications (previous -7.4% with purchase sub-index -2.5% and refi sub-index -13.0%), (2) Jun housing starts (expected +6.2% to 1.160 million, May -5.5% to 1.092 million) and Jun building permits (expected +2.8% to 1.201 million, May -4.9% m/m to 1.168 million), (3) EIA Weekly Petroleum Status Report.

Notable S&P 500 earnings reports today include: Morgan Stanley (consensus $0.77), US Bancorp (0.84), Kinder Morgan (0.15), Textron (0.55), Qualcomm (0.81), CH Robinson (0.90), Crown Castle (1.10), Northern Trust (1.23), American Express (1.43), SL Green Realty (1.61), M&T Bank Corp (2.27), United Rentals (2.32), WW Grainger (2.65).

U.S. IPO's scheduled to price today: YogaWorks (YOGA), Kala Pharmaceuticals (KALA), Calyxt (CLXT), TPG RE Finance Trust (TRTX).

Equity conferences this week: none.

OVERNIGHT U.S. STOCK MOVERS

Morgan Stanley (MS -0.42%) is up over 2% in pre-market trading after it reported Q2 net revenue of $9.5 billion, above consensus of $9.13 billion.

Lululemon (LULU -0.60%) was initiated with a 'Buy' recommendation by Needham & Co. with a 12-month target price of $67.

The Financial Times reported that McCormick (MKC -0.14%) will buy the Reckitt Benckiser Group Plc's food business for $4 billion.

International Business Machines (IBM +0.65%) lost over 2% in pre-market trading after it reported Q2 revenue of $19.29 billion, below consensus of $19.47 billion.

Vertex Pharmaceuticals (VRTX +2.28%) surged over 20% in after-hours trading after it said that Phase 1 and Phase 2 studies show its VX-152 and VX-440 drugs, in combination with tezacaftor/Kalydeco, showed mean absolute improvements in lung functions of cystic fibrosis patients.

United Continental Holdings (UAL -1.10%) slipped nearly 4% in after-hours trading after it said it sees passenger revenue for each seat mile flown (PRASM) as up or down 1% this quarter, weaker than a recent forecast by Delta Airlines for an increase of at least 2.5%. Other airlines fell on the news with American Airlines Group (AAL -1.34%), Southwest Airlines (LUV -0.92%), and JetBlue Airways (JBLU) all down at least 1% in after-hours trading.

Wintrust Financial (WTFC -0.01%) gained over 1% in after-hours trading after it reported Q2 EPS of $1.11, well above consensus of 99 cents.

CSX Corp. (CSX +0.04%) lost almost 4% in after-hours trading after the company kept its full-year EPS view in place even after it reported Q2 adjusted EPS of 64 cents, better than consensus of 59 cents.

Exponent (EXPO +0.43%) jumped nearly 10% in after-hours trading after it reported Q2 EPS of 51 cents, well above consensus of 41 cents.

Hortonworks (HDP -0.70%) tumbled over 7% in after-hours trading after CFO Scott Davidson was said to assume the COO role immediately as COO Rajnish Verma steps down upon mutual agreement with the company "in light of the changes to its leadership structure."

Abercrombie & Fitch (ANF +0.11%) rose 2% in after-hours trading after holder SLS Management sends a letter to the ANF board recommending steps to maximize shareholder value including a $200 million stock buyback via a Dutch tender offer and or cutting the annual dividend to 18 cents per share from 80 cents.

Inovio Pharmaceuticals (INO +0.77%) dropped nearly 8% in after-hours trading after it announced that it intends to offer $75 million of its common stock in an underwritten public offering.

MARKET COMMENTS

Sep E-mini S&Ps (ESU17 +0.07%) this morning are up +0.75 of a point (+0.03%). Tuesday's closes: S&P 500 +0.06%, Dow Jones -0.25%, Nasdaq +0.69%. The S&P 500 on Tuesday closed slightly higher on strength in energy stocks after crude oil prices rallied +0.83% and on strength in technology stocks as the Nasdaq Composite rose +0.69%. Stocks were undercut by the -2 point decline to 64 in the U.S. Jul NAHB housing index versus expectations of unchanged at 67. Stocks were also undercut by the apparent failure of Senate Republicans to pass a health care bill, which raised questions about whether they will be able to pass tax reform.

Sep 10-year T-notes (ZNU17 -0.07%) this morning are down -3.5 ticks. Tuesday's closes: TYU7 +11.50, FVU7 +4.25. Sep 10-year T-notes on Tuesday rallied to a 2-1/2 week high and closed higher on the decline in the U.S. Jul NAHB housing market index to an 8-month low and the failure of the Senate Republican's health care bill, which raised questions about whether Republicans can pass tax reform.

The dollar index (DXY00 +0.21%) this morning is up +0.168 (+0.18%). EUR/USD (^EURUSD) is down -0.0036 (-0.23%) and USD/JPY (^USDJPY) is down -0.06 (-0.05%). Tuesday's closes: Dollar index -0.524 (-0.55%), EUR/USD +0.0076 (+0.66%), USD/JPY -0.56 (-0.50%). The dollar index on Tuesday tumbled to a 10-1/4 month low and closed lower on concern about the Republican agenda after the failure of health care in the Senate and on the fall in the 10-year T-note yield to a 2-week low, which reduced the dollar's interest rate differentials.

Aug WTI crude oil prices (CLQ17 +0.19%) this morning are up +19 cents (+0.41%) and Aug gasoline (RBQ17 +0.99%) is up +0.0189 (+1.20%) at a 1-1/2 month high. Tuesday's closes: Aug crude +0.38 (+0.83%), Aug gasoline +0.0222 (+1.43%). Aug crude oil and gasoline on Tuesday closed higher with Aug gasoline at a 1-1/2 month high. Crude oil prices were boosted by the sell-off in the dollar index to a 10-1/4 month low and by the increase in the crack spread to a 3-1/4 month high, which may boost refinery demand for crude oil to refine into gasoline. Crude oil prices were also boosted by expectations for EIA crude inventories on Wednesday to fall -3.5 million bbl.

Disclosure: None.