Morning Call For Wednesday, Feb. 8

OVERNIGHT MARKETS AND NEWS

Mar E-mini S&Ps (ESH17 -0.01%) are up +0.01 and European stocks are up +0.19% on improvement in company quarterly earnings results. Rio Tinto is up over 2% as it posted its first annual profit in 3 years. Rio Tinto also announced a $500 million share buyback after a recovery in iron ore prices helped boost its profits. Gains in stocks were muted after energy producing companies weakened as crude oil prices slide. Mar WTI crude oil (CLH17 -0.75%) is down -0.61% to a 3-week low and were undercut after the API reported late Tuesday that U.S. crude supplies last week surged +14.2 million bbl. Asian stocks settled mixed with China's Shanghai Composite climbing to a 3-week high: Japan +0.51%, Hong Kong +0.66%, China +0.44%, Taiwan-0.12%, Australia +0.52%, Singapore -0.17%, South Korea -0.46%, India -0.16%.

The dollar index (DXY00 +0.25%) is up +0.32%. EUR/USD (^EURUSD) is down -0.32% at a 1-week low on looming political risks from the upcoming elections in France and Italy along with comments from Bundesbank President Weidmann who said the ECB is not yet at a point where it can end QE. USD/JPY (^USDJPY) is down -0.09%.

Mar 10-year T-note prices (ZNH17 +0.06%) are unchanged.

Bundesbank President Weidmann said that German inflation concerns are topical and that the ECB is not yet at a point where it can end expansionary policy. He added "as the Eurozone economy grows more dynamically in a sustained way, interest rates will rise again."

U.S. STOCK PREVIEW

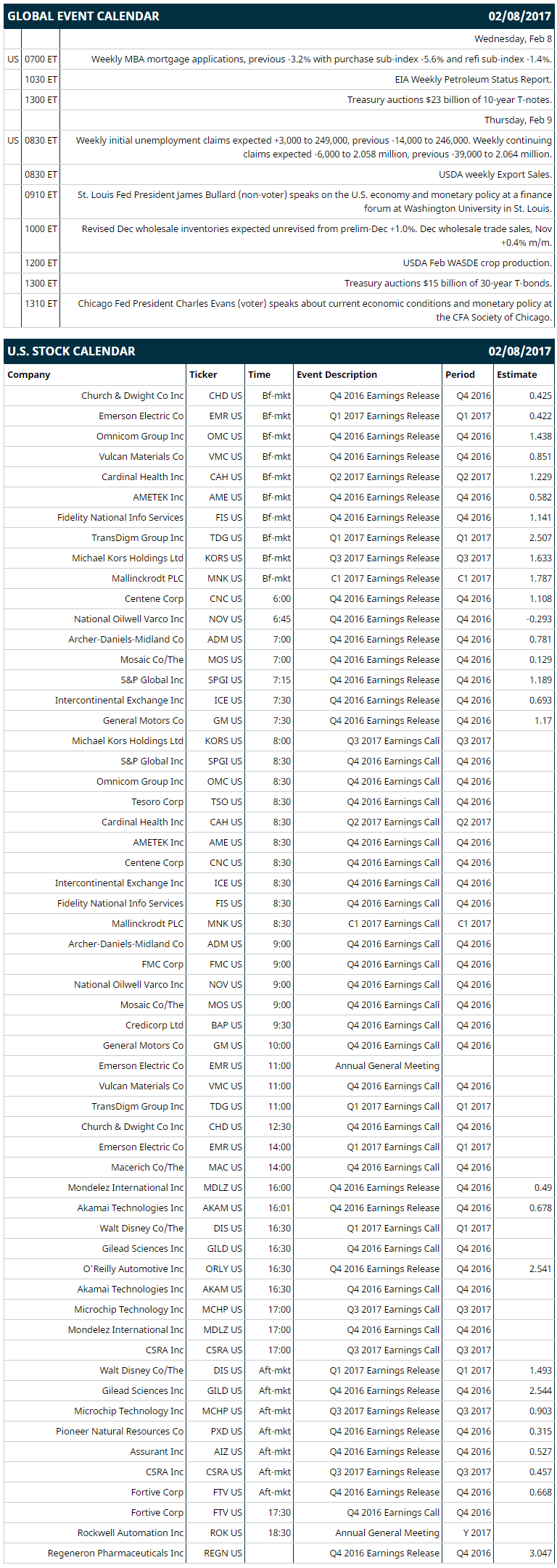

Key U.S. news today includes: (1) weekly MBA mortgage applications (previous -3.2% with purchase sub-index -5.6% and refi sub-index -1.4%), (2) Treasury auctions $23 billion of 10-year T-notes, EIA Weekly Petroleum Status Report.

Notable S&P 500 earnings reports today include: Time Warner (consensus $1.19), Goodyear Tire & Rubber (0.87), Exelon (0.45), Humana (2.05), Whole Foods (0.39), Prudential Financial (2.31), Level 3 Communications (0.44).

U.S. IPO's scheduled to price today: none.

Equity conferences: Credit Suisse Financial Services Forum on Tue-Wed, Cowen Aerospace/Defense & Industrials Conference on Wed-Thu.

OVERNIGHT U.S. STOCK MOVERS

Twitter (TWTR +1.84%) rose 3% in pre-market trading after it was upgraded to 'Buy' from 'Neutral' at BTIG LLC with a $25 price target.

Disney (DIS -0.52%) fell 1% in after-hours trading after it reported Q1 revenue of $14.8 billion, below consensus of $15.3 billion.

Cooper Tire & Rubber (CTB -3.61%) gained more than 3% in after-hours trading after it was named to replace ComScore in the S&P 400 Midcap index as of the close of trading Friday, Feb 10.

Akamai Technologies (AKAM +2.02%) dropped 3% in after-hours trading after it projected Q1 revenue of $596 million-$610 million, the midpoint below consensus of $604.8 million.

Buffalo Wild Wings (BWLD -0.89%) fell nearly 4% in after-hours trading after it forecast 2017 EPS of $5.60 to $6.00, well below consensus of $6.47.

Panera Bread (PNRA -0.56%) gained 2% in after-hours trading after it reported Q4 adjusted EPS of $2.05, better than consensus of $2.00.

Gilead Sciences (GILD +1.02%) slid 5% in after-hours trading after it said it expects 2017 sales of $22.5 billion to $24.5 billion, below consensus of $27.9 billion.

Coherent (COHR +2.46%) surged 14% in after-hours trading after it reported Q1 net sales of $346.1 million, well above consensus of $216.2 million.

DR Horton (DHI -0.24%) was rated a new 'Buy at BTIG LLC with a 12-month target price of $38.

Lennar (LEN -0.34%) was rated a new 'Buy' at BTIG LLC with a 12-month target price of $56.

Urban Outfitters (URBN -0.76%) lost nearly 3% in after-hours trading after it reported Q4 net sales of $1.03 billion, below consensus of $1.04 billion.

Tucows (TCX -0.41%) slumped 13% in after-hours trading after it reported Q4 revenue of $48.8 million, below consensus of $50.4 million.

Pier1 Imports ({=PIR =}) rose almost 4% in after-hours trading after it reported comparable sales in the quarter to date through Jan were up +0.6%.

Coherus Biosciences (CHRS -1.11%) dropped 6% in after-hours trading after it announced a public offering of $125 million of common stock.

Jive Software (JIVE unch) jumped over 7% in after-hours trading after it said it sees Q1 adjusted EPS of 4 cents to 5 cents, above consensus of 3 cents.

Genworth Financial (GNW -0.57%) fell 5% in after-hours trading after it reported an unexpected -27 cent loss per share, weaker than consensus of 19 cents EPS.

MARKET COMMENTS

Mar E-mini S&Ps (ESH17 -0.01%) this morning are up +0.25 of a point (+0.01%). Tuesday's closes: S&P 500 +0.02%, Dow Jones +0.19%, Nasdaq +0.35%. The S&P 500 on Tuesday rallied to a 1-week high and closed higher on strength in technology stocks as the Nasdaq Composite rose to a record high and on reduced interest rate concerns after the 10-year T-note yield fell to a 3-week low. Stock prices were undercut by the U.S. Dec JOLTS job openings report of -4,000 (weaker than expectations of an increase of +56,000) and by pressure on energy producing stocks after crude oil prices fell -2.47%.

Mar 10-year T-notes (ZNH17 +0.06%) this morning are unch. Tuesday's closes: TYH7 +5.50, FVH7 +1.25. Mar 10-year T-notes on Tuesday climbed to a 3-week high and closed higher on the unexpected decline in U.S. Dec JOLTS job openings (-4,000 versus expectations of +58,000) and on reduced inflation expectations after the 10-year T-note breakeven inflation rate fell to a 2-1/2 week low.

The dollar index (DXY00 +0.25%) this morning is up +0.32 (+0.32%). EUR/USD (^EURUSD) is down -0.0034 (-0.32%) at a 1-week low. USD/JPY (^USDJPY) is down -0.10 (-0.09%). Tuesday's closes: Dollar index +0.353 (+0.35%), EUR/USD -0.0067 (-0.62%), USD/JPY +0.65 (+0.58%). The dollar index on Tuesday rose to a 1-week high and closed higher on comments late Monday from Philadelphia Fed President Harker (voter) who said "I think March is on the table" for a rate hike. There was also weakness in EUR/USD which fell to a 1-week low after German Dec industrial production unexpectedly fell -3.0% m/m, the largest monthly decline in 7-3/4 years.

Mar WTI crude oil (CLH17 -0.75%) prices this morning are down -32 cents (-0.61%) at a 3-week low and Mar gasoline (RBH17 -0.40%) is -0.0006 (-0.04%) at a 2-1/4 month low. Tuesday's closes: Mar crude -1.31 (-2.47%), Mar gasoline -0.0228 (-1.51%). Mar crude oil and gasoline on Tuesday closed lower with Mar gasoline at a 2-1/4 month low. Crude oil prices were undercut by the rally in the dollar index to a 2-1/4 month high, by expectations for Wednesday's EIA crude inventories to climb +2.5 million bbl (their fifth straight increase), and by expectations for EIA gasoline stockpiles on Wednesday to increase by +1.5 million bbl.

Disclosure: None.