Morning Call For Wednesday, Dec. 13

OVERNIGHT MARKETS AND NEWS

Mar E-mini S&Ps (ESH18 -0.04%) this morning are little changed, down -0.02%, and European stocks are down -0.18% ahead of the conclusion of the 2-day FOMC meeting later today where the market expects the FOMC to raise the fed funds target range by 25 bp. The downside for stocks was limited with strength in energy and mining companies. Energy stocks rose with Jan WTI crude oil (CLF18 +0.67%) up +0.56% after the API reported late yesterday that U.S. crude inventories fell -7.38 million bbl last week. Mining stocks garnered support from a +0.86% gain in Mar COMEX copper prices (HGH18 +0.76%) to a 1-week high on signs of tighter supplies after LME copper inventories dropped -1,875 MT to a 1-week low of 191,600 MT. Asian stocks settled mixed: Japan -0.47%, Hong Kong +1.49%, China +0.68%, Taiwan +0.26%, Australia +0.14%, Singapore +0.09%, South Korea +0.65%, India -0.53%.

The dollar index (DXY00 -0.04%) is down -0.08%. EUR/USD (^EURUSD) is down -0.01%. USD/JPY (^USDJPY) is down -0.21%.

Mar 10-year T-note prices (ZNH18 -0.13%) are down -3.5 ticks at a 1-week low ahead of an expected rate hike by the FOMC later today.

The UK Oct employment change fell -56,000, weaker than expectations -40,000 and the largest decline in 2-1/3 years. The ILO unemployment rate was unch at 4.3% for the three months through Oct, weaker than expectations of -0.1 to 4.2%.

Eurozone Oct industrial production rose +0.2% m/m and +3.7% y/y, stronger than expectations of unch m/m and +3.2% y/y.

Japan Oct core machine orders rose +5.0% m/m and +2.3% y/y, stronger than expectations of +2.9% m/m and -3.4% y/y.

U.S. STOCK PREVIEW

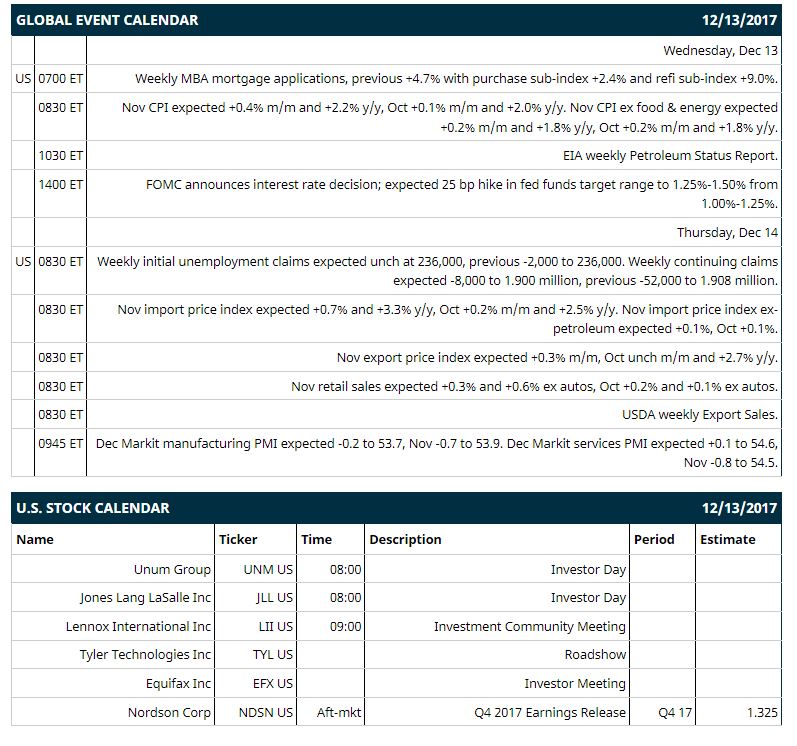

Key U.S. news today includes: (1) weekly MBA mortgage applications (previous +4.7% with purchase sub-index +2.4% and refi sub-index +9.0%), (2) Nov CPI (expected +0.4% m/m and +2.2% y/y, Oct +0.1% m/m and +2.0% y/y) and Nov CPI ex food & energy (expected +0.2% m/m and +1.8% y/y, Oct +0.2% m/m and +1.8% y/y), (3) EIA weekly Petroleum Status Report, (4) FOMC announces interest rate decision (expected 25 bp hike in fed funds target range to 1.25%-1.50% from 1.00%-1.25%).

Notable Russell 1000 earnings reports today include: Nordson Corp (consensus $1.33).

U.S. IPO's scheduled to price today: Casa Systems (CASA).

Equity conferences this week: Cowen Security and Networking Conference on Wed, Guggenheim Securities Boston Health Care Conference on Wed, BMO Capital Markets Prescriptions for Success Healthcare Conference on Thu, Jefferies Office & Industrial Summit on Thu, SunTrust Financial, Technology, Business & Government Services conference on Thu, Cowen Energy & Natural Resources Conference on Fri.

OVERNIGHT U.S. STOCK MOVERS

O'Reilly Automotive (ORLY -0.15%) was upgraded to 'Outperform' from 'Sector Perform' at RBC Capital Markets with a target price of $282.

Ralph Lauren (RL -1.04%) was downgraded to 'Underperform' from 'Neutral' at Bank of America/Merrill Lynch with a 12-month target price of $80.

Vulcan Materials (VMC -1.15%) was rated a new 'Overweight' at Barclays with a 12-month target price of $135.

Morgan Stanley (MS +2.05%) may move higher this morning after it was upgraded to 'Outperform' from 'Market Perform' at Keefe, Bruyette & Woods with a price target of $59.

Western Digital (WDC +0.70%) gained almost 2% in after-hours trading after it announced that it had entered into a global settlement agreement with Toshiba and agreed to extend the terms of its flash memory collaboration with Toshiba.

VeriFone Systems PAY=}) dropped over 7% in after-hours trading after it said it sees Q1 adjusted EPS of 22 cents, weaker than consensus of 33 cents, and aid it sees full-year adjusted EPS of $1.47 to $1.50 below consensus of $1.57.

Edison International (EIX -6.03%) rose over 1% in after-hours trading after the LAFD determined the Skirball Fire that broke out on Dec 6 was caused by an illegal cooking fire at an encampment in a brush area and not from electrical equipment from Edison.

Intellia Therapeutics (NTLA -4.39%) lost almost 3% in after-hours trading after holder Novartis AG offered a block of 1.52 million shares of Intellia at $17.50-$17.75.

Civitas Solutions (CIVI +4.49%) declined nearly 7% in after-hours trading after it reported Q4 net revenue of $380.4 million, below consensus of $386.8 million.

Helios & Matheson Analytics (HMNY +10.41%) dropped over 17% in after-hours trading after it announced that it had commenced an underwritten public offering $50 million in shares of its common stock and warrants to purchase shares of its common stock.

Proteostasis Therapeutics (PTI +161.28%) slid nearly 8% in after-hours trading after it announced that it intends to sell 7 million shares of its common stock in an underwritten public offering.

Fate Therapeutics (FATE +7.00%) fell 5% in after-hours trading after it said that it had commenced an underwritten public offering of $30 million in shares of its common stock.

MARKET COMMENTS

Mar S&P 500 E-mini stock futures (ESH18 -0.04%) this morning are down -0.50 points (-0.02%). Tuesday's closes: S&P 500 +0.15%, Dow Jones +0.49%, Nasdaq +0.16%. The S&P 500 on Tuesday pushed up to a new record high and closed higher on carry-over support from a rally in European technology stocks due to increased M&A activity after Atos SE offered to acquire Gemalto NV for over $5 billion. Stocks also garnered support on optimism that U.S. lawmakers will soon pass tax reform legislation.

Mar 10-year T-note prices (ZNH18 -0.13%) this morning are down -3.5 ticks to a fresh 1-week low. Tuesday's closes: TYH8 -4.50, FVH8 -2.00. Mar 10-year T-notes on Tuesday fell to a 1-week low and closed lower after U.S. Nov PPI final demand rose +3.1% y/y, stronger than expectations of +2.9% y/y and the largest year-on-year increase in 5-3/4 years, which bolsters the case for additional Fed rate hikes. T-notes were also undercut on an increase in inflation expectations after the 10-year T-note breakeven inflation rate jumped to a 7-month high.

The dollar index (DXY00 -0.04%) this morning is down -0.075 (-0.08%). EUR/USD (^EURUSD) is down -0.0001 (-0.01%) and USD/JPY (^USDJPY) is down -0.24 (-0.21%). Tuesday's closes: Dollar Index +0.235 (+0.25%), EUR/USD -0.0027 (-0.23%), USD/JPY -0.01 (-0.01%). The dollar index on Tuesday climbed to a 4-week high and settled higher after the U.S. Nov PPI final demand rose more than expected, which bolsters the case for tighter Fed policy. The dollar also gained on central bank policy divergence on expectations for the Fed to raise interest rates Wednesday while the ECB and BOJ continue with their QE programs, which sent EUR/USD to a 3-week low and USD/JPY to a 4-week high.

Jan crude oil (CLF18 +0.67%) this morning is up +32 cents (+0.56%) and Jan gasoline (RBF18 +0.51%) is +0.0064 (+0.38%). Tuesday's closes: Jan WTI crude -0.85 (-1.47%), Jan gasoline -0.0290 (-1.68%). Jan crude oil and gasoline on Tuesday closed lower after the dollar index rose to a 4-week high, and after Brent crude oil prices fell back from a 2-1/2 year high and closed lower as supply concerns eased on optimism the Forties Pipeline System, which supplies 400,000 bpd of crude oil, will reopen in 2-weeks after repairs to a cracked pipeline are made.

Metals prices this morning are stronger with Feb gold (GCG18 +0.08%) +1.3 (+0.10%), Mar silver (SIH18 +0.27%) +0.047 (+0.30%) and Mar copper (HGH18 +0.76%) +0.026 (+0.86%) at a 1-week high. Tuesday's closes: Feb gold -5.2 (-0.42%), Mar silver -0.117 (-0.74%), Mar copper +0.0115 (+0.38%). Metals on Tuesday settled mixed with Feb gold at a 4-3/4 month low and Mar silver at a 5-month low after the dollar index rose to a 4-week high, and after the S&P 500 rallied to a new record high, which reduced the safe-haven demand for precious metals. Copper prices rose on signs of tighter supplies after LME copper inventories fell -1,125 MT to a 1-week low of 193,475 MT.

(Click on image to enlarge)

Disclosure: None.