Morning Call For Wednesday, August 30

OVERNIGHT MARKETS AND NEWS

Sep E-mini S&Ps (ESU17 +0.08%) this morning are up +0.09% and European stocks are up +0.38% as they followed Asian markets higher after tensions surrounding North Korea eased. European stocks also received a lift after Eurozone Aug economic confidence rose more than expected to a 10-year high. Overall stock gains were muted on weakness in energy stocks as Oct WTI crude oil (CLV17 -0.54%) falls -0.60%. Asian stocks settled mostly higher: Japan +0.74%, Hong Kong +1.19%, China -0.05%, Taiwan +0.69%, Australia +0.01%, Singapore +0.49%, South Korea +0.33%, India +0.82%. Japan's Nikkei Stock Index rebounded from Tuesday's 3-3/4 month low as exporter stocks rallied when USD/JPY climbed to a 1-1/2 week high as an easing of North Korean tensions reduced safe-haven demand for the yen. Japanese stocks also found support on stronger-than-expected Japan Jul retail sales.

The dollar index (DXY00 +0.24%) is up +0.25%. EUR/USD (^EURUSD) is down -0.21%. USD/JPY (^USDJPY) is up +0.17%.

Sep 10-year T-note prices (ZNU17 -0.02%) are down -0.5 of a tick.

Eurozone Aug economic confidence rose +0.6 to 111.9, stronger than expectations of +0.1 to 111.3 and a 10-year high.

Japan Jul retail sales rose +1.1% m/m, stronger than expectations of +0.3% m/m.

U.S. STOCK PREVIEW

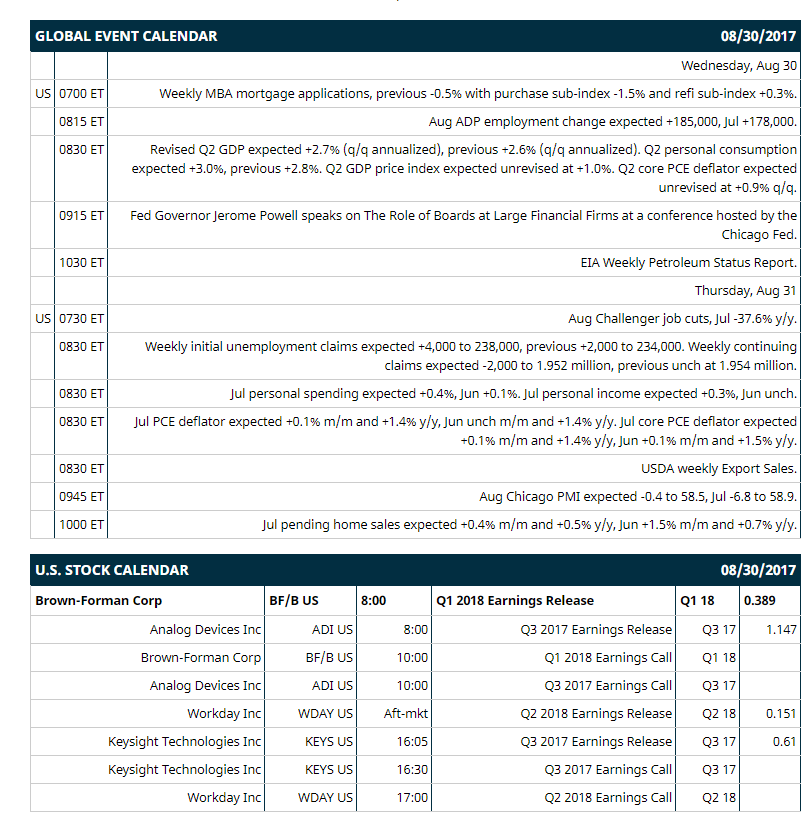

Key U.S. news today includes: (1) weekly MBA mortgage applications (previous -0.5% with purchase sub-index -1.5% and refi sub-index +0.3%), (2) Aug ADP employment change (expected +185,000, Jul +178,000), (3) revised Q2 GDP (expected +2.7% q/q annualized, previous +2.6%), (4) Fed Governor Jerome Powell speaks on “The Role of Boards at Large Financial Firms” at a conference hosted by the Chicago Fed, (5) EIA Weekly Petroleum Status Report.

Notable Russell 1000 earnings reports today include: Brown-Forman (consensus $0.39), Analog Devices (1.15), Workday (0.15), Keysight Technologies (0.61).

U.S. IPO's scheduled to price today: none.

Equity conferences this week: Jefferies Semiconductor Hardware Summit on Tue-Wed, The Simmons European Energy Conference on Tue-Wed, Simmons European Energy Conference on Wed.

OVERNIGHT U.S. STOCK MOVERS

MDC Holdings (MDC -0.13%) was upgraded to 'Market Perform' from 'Underperform' at Wells Fargo Securities.

Ciena (CIEN +0.55%) was upgraded to 'Buy' from 'Neutral' at Citigroup with a price target of $29.

Vornado (VNO -0.39%) was downgraded to 'Hold' from 'Buy' at Stifel.

Coty (COTY +2.61%) was downgraded to 'Sell' from 'Hold' at Berenberg with a target price of $15.

Universal Display (OLED -0.13%) was rated a new 'Buy' at Deutsche Bank with a price target of $135.

Reata Pharmaceuticals (RETA -1.52%) was rated a new 'Buy' at Jeffries with a price target of $44.

Arc Logistics Partners (ARCX +14.80%) was downgraded to 'Hold' from 'Buy' at Stifel.

Ollie's Bargain Outlet Holdings (OLLI -1.25%) fell 2% in after-hours trading despite forecasting full-year adjusted EPS of $1.16 to $1.19, the midpoint above consensus of $1.17.

AeroVironment (AVAV +0.74%) jumped 9% in after-hours trading after it reported a Q1 adjusted loss per share of -19cents, narrower than expectations of -34 cents.

ScanSource (SCSC +3.59%) dropped 4% in after-hours trading after it forecast Q1 adjusted EPS of 74 cents-80 cents, below consensus of 81 cents.

H&R Block (HRB -1.28%) fell 4% in after-hours trading after it reported a Q1 adjusted loss per share from continuing operations of -62 cents, right on consensus.

Vitamin Shoppe (VSI -4.76%) is indicated to open 4% higher Wednesday after director John Bowlin reported a purchase of 40,000 shares of VSI on Aug 25.

DryShips (DRYS +11.33%) slid over 5% in after-hours trading after it announced a rights offering to buy up to 36.4 million shares of common stock as it seeks to raise up to $100 million.

MARKET COMMENTS

Sep S&P 500 E-mini stock futures (ESU17 +0.08%) this morning are up +2.25 points (+0.09%). Tuesday's closes: S&P 500 +0.08%, Dow Jones +0.26%, Nasdaq +0.41%. The S&P 500 on Tuesday recovered from a 1-week low and closed higher on the slide in the dollar index to a 2-1/2 year low and the unexpected +2.9 point rise in the Aug U.S. consumer confidence index to a 5-month high of 122.9 (stronger than expectations of -0.4 to 120.7). Stocks were undercut by geopolitical concerns that fueled an overnight slump in global equity markets after North Korea fired a missile over Japan. There was also weakness in energy stocks as crude oil prices fell to a 1-month low.

Sep 10-year T-note prices (ZNU17 -0.02%) this morning are down -0.5 of a tick. Tuesday's closes: TYU7 +6.00, FVU7 +4.00. Sep 10-year T-notes on Tuesday rallied to a 9-1/2 month nearest-futures high and closed higher on increased safe-haven demand for T-notes after North Korea fired a missile over Japan. T-note prices were also boosted by reduced inflation expectations after the 10-year T-note breakeven inflation rate fell to a 5-week low.

The dollar index (DXY00 +0.24%) this morning is up +0.234 (+0.25%). EUR/USD (^EURUSD) is down -0.0025 (-0.21%) and USD/JPY (^USDJPY) is up +0.19 (+0.17%). Tuesday's closes: Dollar Index +0.147 (+0.16%), EUR/USD -0.0007 (-0.06%), USD/JPY +0.46 (+0.42%). The dollar index on Tuesday rebounded from a 2-1/2 year low and closed slightly higher after it became clear there would be no U.S./Japan military retaliation against North Korea for firing a missile over Japan. The dollar was also supported by the unexpected increase in U.S. Aug consumer confidence to a 5-month high. The dollar earlier plunged to a 2-1/2 year low on heightened North Korean tensions that fueled safe-haven demand for the yen as USD/JPY dropped to a 4-1/4 month low after North Korea fired a missile over Japan. The dollar was also undercut by the fall in the 10-year T-note yield to a 9-1/2 month low, which undercuts the dollar's interest rate differentials.

Oct crude oil (CLV17 -0.54%) this morning is down -28 cents (-0.60%) and Oct gasoline (RBV17 +1.45%) is up +0.0521 (+3.25%). Tuesday's closes: Oct WTI crude -0.13 (-0.28%), Oct gasoline +0.0306 (+1.95%). Oct crude oil and gasoline on Tuesday settled mixed with Oct crude falling to a 1-month low. Crude oil prices continued to be undercut by concern that the closure of refineries along the Gulf Coast due to Tropical Storm Harvey will cause a massive buildup in crude supplies at Cushing, OK, delivery point for WTI futures. Crude oil prices were boosted by the slump in the dollar index to a 2-1/2 year low and by gasoline supply concerns as Tropical Storm Harvey forced the closure of refineries on the Texas Gulf coast, home to 10% of U.S. refining capacity.

Metals prices this morning are mixed with Dec gold (GCZ17 -0.21%) -1.6 (-0.12%), Sep silver (SIU17 -0.24%) +0.004 (+0.02%) and Sep copper (HGU17 -0.15%) -0.008 (-0.26%). Tuesday's closes: Dec Gold +3.6 (+0.27%), Sep silver -0.015(-0.09%), Sep copper +0.0180 (+0.59%). Metals on Tuesday settled mixed with Dec gold at a 9-1/2 month high, Sep silver at a 2-1/2 month high, and Sep copper at a 2-3/4 nearest-futures high. Metals prices were boosted by the fall in the dollar index to a 2-1/2 year low and by North Korea's firing of a missile over Japan, which boosted safe-haven demand for precious metals. Copper prices were boosted by the decline in LME copper inventories by -7,800 MT to a 5-3/4 month low of 233,025 MT. Precious metals fell back from their best levels after stock prices recovered.

Disclosure: None.