Morning Call For Wednesday, August 16

OVERNIGHT MARKETS AND NEWS

Sep E-mini S&Ps (ESU17 +0.17%) this morning are up +0.21% and European stocks are up +0.87% on economic optimism after Eurozone Q2 GDP rose at a +0.6% q/q pace, right on expectations. In addition, the UK labor market strengthened after UK Jul jobless claims posted their biggest decline in 5-months and as the UK Jun unemployment rate unexpectedly fell -0.1 to 4.4%, a 42-year low. A +0.27% rally in the price of Sep WTI crude oil (CLU17 +0.27%) is also giving energy stocks a boost after API data late Tuesday showed U.S. crude inventories plunged by -9.2 million bbl last week. German bund prices fell to a 1-week low after a Reuters report said ECB President Draghi will not deliver a fresh policy message at the annual Fed symposium later this month in Jackson Hole, WY. Asian stocks settled mixed: Japan -0.12%, Hong Kong +0.86%, China -0.15%, Taiwan -0.20%, Australia +0.48%, Singapore -0.48%, South Korea +0.73%, India +1.02%.

The dollar index (DXY00 +0.13%) is up +0.17%. EUR/USD (^EURUSD) is down -0.29%. USD/JPY (^USDJPY) is up +0.14% at a 1-week high.

Sep 10-year T-note prices (ZNU17 -0.06%) are down -3.5 ticks to a 1-week low.

According to Reuters, ECB President Draghi will not deliver a new policy message at the Kansas City Fed's annual symposium in Jackson Hole, WY, later this month and will honor the ECB Governing Council's decision to hold off on discussion until the autumn, according to unidentified people familiar with situation.

The UK ILO unemployment rate unexpectedly fell -0.1 to 4.4% for the three months through Jun, stronger than expectations of no change at 4.5% and the lowest in 42-years.

UK Jul jobless claims fell -4,200, the biggest decline in 5-months.

Eurozone Q2 GDP rose at a +0.6% q/q pace, right on expectations.

U.S. STOCK PREVIEW

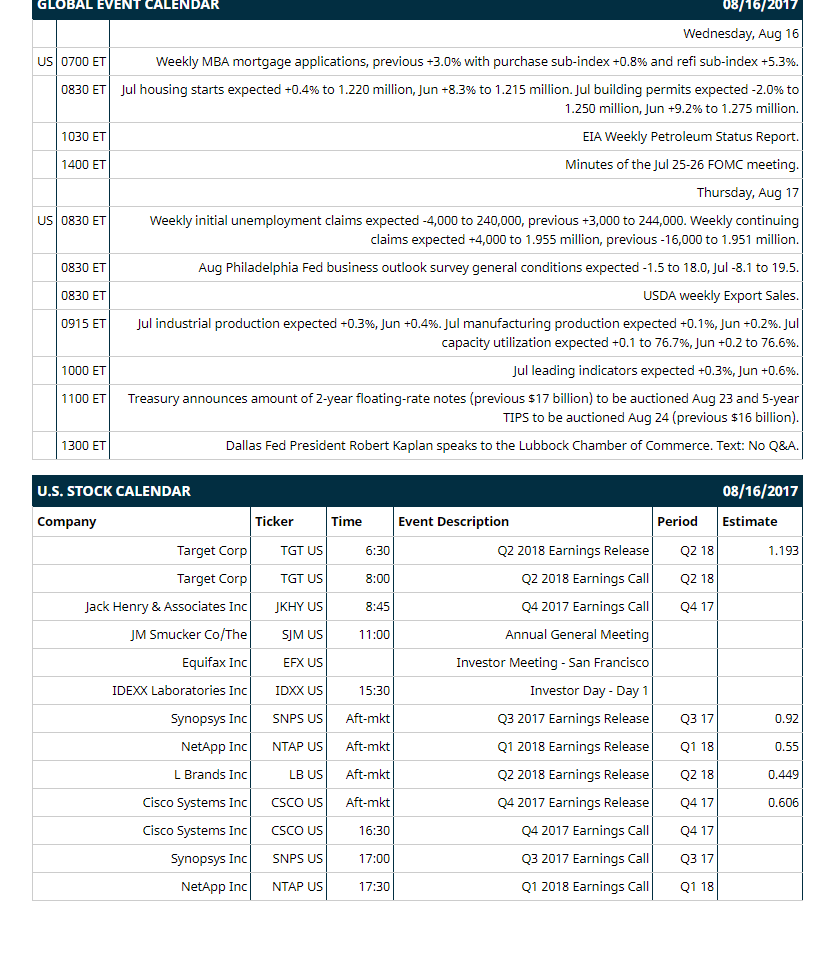

Key U.S. news today includes: (1) Weekly MBA mortgage applications, (previous +3.0% with purchase sub-index +0.8% and refi sub-index +5.3%), (2) Jul housing starts (expected +0.4% to 1.220 million, Jun +8.3% to 1.215 million), Jul building permits (expected -2.0% to 1.250 million, Jun +9.2% to 1.275 million), (3) EIA Weekly Petroleum Status Report, (4) Minutes of the Jul 25-26 FOMC meeting.

Notable Russell 1000 earnings reports today include: Target (consensus $1.19), Synopsys $0.92, NetApp $0.55, L Brands $0.45, Cisco Systems $0.61.

U.S. IPO's scheduled to price today: None.

Equity conferences this week: Citi Insurance & Asset Managers Forum on Wed, Barclays Kohler Conference on Wed, Wedbush Pacgrow Health Care Conference on Wed.

OVERNIGHT U.S. STOCK MOVERS

Target (TGT -2.58%) rallied over 4% in pre-market trading after it reported Q2 adjusted EPS of $1.23, higher than consensus of $1.19, and then raised guidance on full-year adjusted EPS to $4.34-$4.54, the midpoint stronger than consenus of $4.41.

Urban Outfitters (URBN -5.13%) jumped 18% in pre-market trading after it reported Q2 EPS of 44 cents, higher than consensus of 36 cents.

Dick's Sporting Goods (DKS -23.03%) was downgraded to 'Neutral' from 'Buy' at Buckingham Research Group.

Biogen (BIIB +0.65%) was added to the 'Conviction Buy List' at Goldman Sachs.

Facebook (FB +0.15%) may move higher today after it was initiated a new 'Buy' at SunTrust Robinson Humphrey with an 18-month target price of $210.

Snap (SNAP +1.11%) may move lower today after it was initiated a new 'Sell' at SunTrust Robinson Humphrey with an 18-month target price of $10.

Expedia (EXPE -0.35%) may move higher today after it was initiated a new 'Buy' at SunTrust Robinson Humphrey with an 18-month target price of $190.

Agilent Technologies (A -0.40%) rose 4% in after-hours trading after it reported Q3 net revenue of $1.11 billion, higher than consensus of $1.09 billion, and then said it sees full-year revenue of $4.44 billion-$446 billion, above consensus of $4.41 billion.

Nexstar Media Group (NXST -0.40%) lost 1% in after-hours trading after a block of 1.1 million shares of Nexstar shares were offered via Morgan Stanley for an unknown seller.

Bristol-Myers Squibb (BMY +0.43%) fell 3% in after-hours trading after a kidney cancer study of its combination of its Opdivo and Yervoy did not meet its primary endpoint of statistical significance in a Phase 3 study.

Viavi Solutions (VIAV -1.12%) lost almost 4% in after-hours trading after it said it sees Q1 adjusted EPS of 6 cents-9 cents, below consensus of 10 cents.

Intec Pharma Ltd (NTEC -4.90%) slid 3% in after-hours trading after it announced the launch of an underwritten public offering of up to $50 million in ordinary shares.

MARKET COMMENTS

Sep S&P 500 E-mini stock futures (ESU17 +0.17%) this morning are up +5.25 points (+0.21%). Tuesday's closes: S&P 500 +1.00, Dow Jones +0.62%, Nasdaq +1.31%. The S&P 500 on Tuesday closed lower after crude oil prices fell to a 3-week low, which undercut energy stocks, and on concern that recent strength in U.S. economic data will prompt the Fed to keep raising interest rates. On the positive side was reduced North Korean geopolitical risks that sent the VIX volatility index down to a 4-session low, along with U.S. Jul retail sales that rose +0.6% and +0.5% ex autos, stronger than expectations of +0.3% and +0.4% ex autos.

Sep 10-year T-note prices (ZNU17 -0.06%) this morning are down -3.5 ticks to a 1-week low. Tuesday's closes: TYU7 -12.50, FVU7 -7.50. Sep 10-year T-notes on Tuesday closed lower as a rally in stocks reduced North Korean tensions, which curbed safe-haven demand for T-notes, and on stronger-than-expected U.S. economic data on Jul retail sales, Aug Empire manufacturing survey and Aug NAHB housing market index, which may prompt the Fed to keep raising interest rates.

The dollar index this (DXY00 +0.13%) morning is up +0.159 (+0.17%). EUR/USD (^EURUSD) is down -0.0034 (-0.29%) and USD/JPY (^USDJPY) is up +0.16 (+0.14%) at a 1-week high. Tuesday's closes: Dollar Index +0.442 (+0.47%), EUR/USD -0.0045 (-0.38%), USD/JPY +1.04 (+0.95%). The dollar index on Tuesday climbed to a 3-week high on stronger than expected U.S. economic data on Jul retail sales and Aug Empire manufacturing survey, which bolsters the case for tighter Fed policy, and on weakness in EUR/USD which fell to a 2-week low after German Q2 GDP rose less than expected. The dollar also garnered support on strength in USD/JPY which rose to a 1-week high as reduced North Korean geopolitical risks curbed safe-haven demand for the yen.

Sep crude oil (CLU17 +0.27%)this morning is up +13 cents (+0.27%). Sep gasoline (RBU17 +0.34%) is +0.0059 (+0.37%). Tuesday's closes: Sep WTI crude -0.04 (-0.08%), Sep gasoline +0.0028 (+0.18%). Sep crude oil and gasoline on Tuesday settled mixed with Sep crude at a 3-week low. Crude prices were undercut by the rally in the dollar index to a 3-week high, and from the EIA Drilling Productivity Report that predicted U.S. shale-oil output will climb to an all-time high of 6.15 million bpd in Sep. Losses were limited on expectations that Wednesday's EIA crude inventories will fall by -3.5million bbl.

Metals prices this morning are mixed with Dec gold (GCZ17 -0.27%) -3.9 (-0.30%), Sep silver (SIU17 -0.35%) -0.054(-0.32%) and Sep copper (HGU17 +1.66%) +0.044 (+1.53%). Tuesday's closes: Dec gold -10.7 (-0.83%), Sep silver -0.408(-2.38%), Sep copper -0.0215 (-0.74%). Metals on Tuesday closed lower due to a stronger dollar, and on reduced North Korean geopolitical risks that sent the VIX volatility index down to a 4-session low and curbed the safe-haven demand for precious metals.

Disclosure: None.