Morning Call For Tuesday, September 5

OVERNIGHT MARKETS AND NEWS

Sep E-mini S&Ps (ESU17 -0.22%) this morning are down -0.33% and European stocks are unchanged. Geopolitical tensions from North Korea are weighing on U.S. equities after the Asia Business Daily reported that North Korea was preparing to fire an ICBM missile by Saturday. The U.S. said it would seek the strongest possible sanctions against North Korea and wants the United Nations Security Council to vote on them Sep 11, although Russia and China said they will oppose the new sanctions. President Trump agreed to support billions of dollars in new weapons sales to South Korea after North Korea's largest nuclear test on Sunday. The escalation of North Korean tensions has fueled safe-haven demand for precious metals with Dec COMEX gold (GCZ17 +0.28%) up +0.54% at an 11-month high. Strength in mining stocks has helped European equities recover earlier losses as Dec COMEX copper (HGZ17 +1.43%) climbs +1.48% to a 3-year high. Asian stocks settled mixed: Japan -0.63%, Hong Kong unch, China +0.14%, Taiwan +0.45%, Australia +0.07%, Singapore +0.63%, South Korea -0.04%, India +0.34%. Chinese stocks shook off concerns about North Korea as the Shanghai Composite rallied to a new 1-1/2 year high after gains in metals prices boosted commodity producers and led the overall market higher.

The dollar index (DXY00 -0.05%) is down -0.15%. EUR/USD (^EURUSD) is down -0.02%. USD/JPY (^USDJPY) is down -0.36%.

Dec 10-year T-note prices (ZNZ17 +0.17%) are up +7 ticks.

The Eurozone Sep Sentix investor confidence unexpectedly rose +0.5 to 28.2, stronger than expectations of -0.7 to 27.0.

Eurozone Jul PPI was unch m/m and up +2.0% y/y, weaker than expectations of +0.1% m/m and +2.1% y/y with the +2.0% y/y gain the smallest year-on-year increase in 7 months.

Eurozone Jul retail sales fell -0.3% m/m, right on expectations and the largest decline in 16-months.

U.S. STOCK PREVIEW

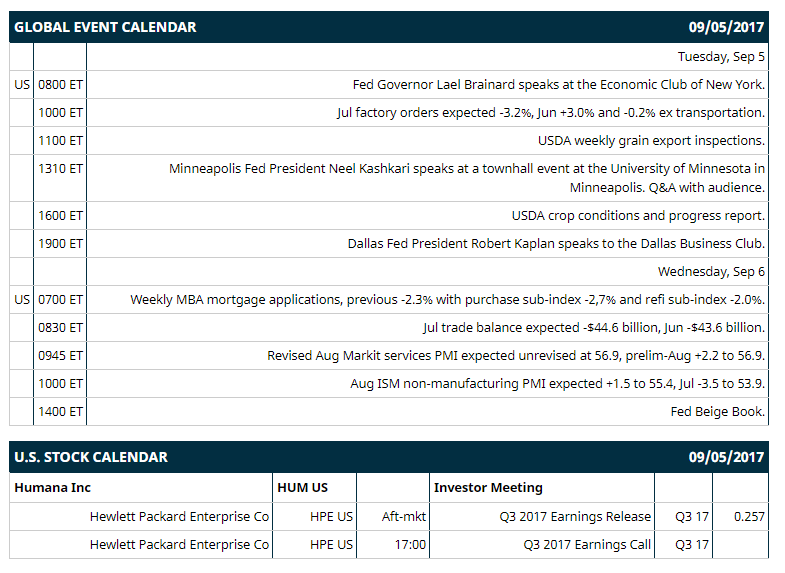

Key U.S. news today includes: (1) Fed Governor Lael Brainard speaks at the Economic Club of New York, (2) Jul factory orders (expected -3.2%, Jun +3.0% and -0.2% ex-transportation), (3) Minneapolis Fed President Neel Kashkari speaks at a town hall event at the University of Minnesota in Minneapolis, Q&A with audience, (4) Dallas Fed President Robert Kaplan speaks to the Dallas Business Club, (5) USDA weekly grain export inspections, (6) USDA crop conditions and progress report.

Notable Russell 1000 earnings reports today include: Hewlett Packard (consensus $0.26).

U.S. IPO's scheduled to price today: none.

Equity conferences this week: Barclays CEO Energy-Power Conference on Tue-Thu, Barclays Global Consumer Staples Conference on Tue-Thu, Baird Global Health Care Conference on Wed, Citi Biotech Conference on Wed, Drexel Hamilton TMT Conference on Wed, Goldman Sachs European Medtech and Healthcare Services Conference on Wed, Piper Jaffray Tech Select Conference on Wed, Raymond James U.S. Bank Conference on Wed, Simmons European Energy Conference on Wed, UBS Global Chemicals & Paper and Packaging Conference on Wed, Citigroup Biotech Conference on Wed-Thu, Cowen & Co. Global Transportation Conference on Wed-Thu, Goldman Sachs Global Retailing Conference on Wed-Thu, Keefe, Bruyette, & Woods Insurance Conference on Wed-Thu, Robert W. Baird Global Health Care Conference on Wed-Thu, Wells Fargo Securities Health Care Conference on Wed-Thu, Citi Global Technology Conference on Wed-Fri, Vertical Research Partners Global Industrials Conference on Wed-Fri, Barclays Back-to-School Consumer Conference on Thu, Gabelli & Company Aerospace & Defense Conference on Thu, Goldman Sachs Financial Technology Conference on Thu, KBW Insurance Conference on Thu, UBS Best of Americas Conference on Thu, Bank of America Merrill Lynch Media, Communications & Entertainment Conference on Thu-Fri, European Society for Medical Oncology Meeting on Fri, MUFG Securities Oil & Gas Corporate Access Day on Fri.

OVERNIGHT U.S. STOCK MOVERS

Charter Communications (CHTR -1.52%) was downgraded to 'Market Perform' from 'Outperform' at Telsey Advisory Group.

Viacom (VIAB -0.28%) was downgraded to 'Market Perform' from 'Outperform' at Wells Fargo Securities.

Carters (CRI +2.44%) was initiated a new 'Buy' at Goldman Sachs with a price target of $105.

Lowe's (LOW +1.03%) was reinstated a 'Buy' at Bank of America/Merrill Lynch with a price target of $95.

Allison Transmission Holdings (ALSN +0.89%) was downgraded to 'Sell' from 'Hold' at Deutsche Bank.

Home Depot (HD +0.61%) was reinstated a 'Buy' at Bank of America/Merrill Lynch with a price target of $170.

Disney (DIS +0.30%) was upgraded to 'Outperform' from 'Market Perform' at Wells Fargo Securities.

U.S. Steel (X +1.43%) was upgraded to 'Buy' from 'Neutral' at Bank of America/Merrill Lynch with a price target of $31.

Huntington Ingalls Industries (HII +0.50%) won a $2.8 billion contract from the U.S. Navy for overhauling the USS George Washington refueling complex in Newport News, Virginia that is expected to be completed by Aug, 2021.

DowDuPont (DWDP +0.80%) was initiated with a 'Buy' at UBS with a 12-month target price of $75.

MARKET COMMENTS

Sep S&P 500 E-mini stock futures (ESU17 -0.22%) this morning are down -8.25 points (-0.33%). Friday's closes: S&P 500 +0.20%, Dow Jones +0.18%, Nasdaq -0.01%. The S&P 500 on Friday rallied to a 3-week high and settled higher on carry-over support from a rally in China's Shanghai Composite to a 1-1/2 year high after the China Aug Caixin manufacturing PMI unexpectedly rose +0.5 to 51.6. the fastest pace of expansion in 6-months. Stocks also found support on the U.S. Aug ISM manufacturing index that rose +2.5 to 58.8, stronger than expectations of +0.2 to 56.5 and the fastest pace of expansion in 6-1/3 years. A negative factor was the U.S. Aug non-farm payrolls that rose +156,000, weaker than expectations of +180,000, and the Aug avg hourly earnings that rose +0.1% m/m and +2.5% y/y, weaker than expectations of +0.2% m/m and +2.6% y/y.

Dec 10-year T-note prices (ZNZ17 +0.17%) this morning are up +7 ticks. Friday's closes: TYZ7 -10.00, FVZ7 -4.25. Dec 10-year T-notes on Friday closed lower on the stronger-than-expected U.S. Aug ISM manufacturing index that expanded at the fastest pace in 6-1/3 years, and on the rally in the S&P 500 to a new 3-week high, which curbed safe-haven demand for T-notes. Losses were limited on the smaller-than-expected increase in U.S. Aug non-farm payrolls and in Aug average hourly earnings.

The dollar index (DXY00 -0.05%) this morning is down =0.14 (-0.15%). EUR/USD (^EURUSD) is down -0.0002 (-0.02%) and USD/JPY (^USDJPY) is down -0.40 (-0.36%). Friday's closes: Dollar Index +0.146 (+0.16%), EUR/USD -0.0050 (-0.42%), USD/JPY +0.27 (+0.25%). The dollar index on Friday closed higher on the stronger-than-expected U.S. Aug ISM manufacturing index and on weakness in EUR/USD after Bloomberg reported that Eurozone officials’ familiar with the matter said the ECB may not announce plans to taper QE until its Dec policy meeting. On the negative side was the weaker-than-expected U.S. Aug non-farm payrolls report, which may prompt the Fed to hold off on further rate hikes, and on an unexpected decline in U.S. Jul construction spending.

Oct crude oil (CLV17 +1.27%) this morning is up +65 cents (+1.37%) at a 1-week high and Oct gasoline (RBV17 -3.34%) is down -0.0597 (-3.42%). Friday's closes: Oct WTI crude +0.06 (+0.13%), Oct gasoline -0.0313 (-1.76%). Oct crude oil and gasoline on Friday settled mixed. Undercutting energy prices was the action by the U.S. Energy Department to release 1 million bbl of oil from the Strategic Petroleum Reserve to help keep a Phillips 66 refinery running in Lake Charles, LA, and the restart of several refineries along the Gulf Coast that had been shuttered due to Tropical Storm Harvey. Crude prices closed higher after the U.S. Aug ISM manufacturing index expanded at its fastest pace in 6-1/3 years, which is positive for economic growth and energy demand.

Metals prices this morning are higher with Dec gold (GCZ17 +0.28%) +7.2 (+0.54%) at an 11-month high, Dec silver (SIZ17+0.72%) +0.139 (+0.78%) at a 4-1/4 month high and Dec copper (HGZ17 +1.43%) +0.046 (+1.48%) at a 3-year high. Friday's closes: Dec Gold +8.2 (+0.62%), Dec silver +0.195 (+0.63%), Dec copper +0.0115 (+0.37%). Metals on Friday closed higher with Dec gold at a 9-3/4 month high and Dec silver at a 2-3/4 month high. Metals rallied on the weaker-than-expected U.S. Aug non-farm payrolls report, which reduces the chances for additional Fed rate hikes, and on the increase in the U.S. Aug ISM manufacturing index to a 6-1/3 year high, which signals strength in industrial metals demand.

Disclosure: None.