Morning Call For Tuesday, Sept. 12

OVERNIGHT MARKETS AND NEWS

Dec E-mini S&Ps (ESZ17 +0.18%) this morning are up +0.16% at a new contract high and European stocks are up +0.68% at a 1-month high led by strength in technology stocks. Chipmakers and suppliers to Apple are leading global stock markets higher ahead of the unveiling today of Apple's new iPhones and watch. The rally in equities has reduced the safe-haven demand for gold with Dec COMEX gold (GCZ17 -0.56%) down -0.61% at a 1-week low. GBP/USD jumped +0.84% to a 1-year high after UK core Aug CPI rose a more-than-expected +2.7% y/y, a 5-1/2 year high, which may prod the BOE into tightening monetary policy. Asian stocks settled mostly higher: Japan +1.18%, Hong Kong +0.06%, China +0.09%, Taiwan +0.36%, Australia +0.58%, Singapore +0.22%, South Korea +0.19%, India +0.87%. China's Shanghai Composite eked out a new 1-1/2 year high on signs of renewed optimism in the Chinese economic outlook after Premier Li Keqiang said that China's economy will maintain its momentum and that the leverage ratio has "decreased somewhat." Li Keqiang also added that cuts to excess capacity are exceeding expectations and that new growth drivers are replacing old ones in China's economy at a faster pace. Japan's Nikkei Stock Index rose to a 4-week high as exporter stocks led the way higher on the prospects of stronger earnings as USD/JPY climbed to a 1-week high.

The dollar index (DXY00 +0.12%) is up +0.10%. EUR/USD (^EURUSD) is down -0.18%. USD/JPY (^USDJPY) is up +0.40% at a 1-week high as the rally in global bourses reduced the safe-haven demand for the yen.

Dec 10-year T-note prices (ZNZ17 -0.21%) are down -9.5 ticks to a 1-week low as strength in global stocks curbs the safe-haven demand for government debt.

UK Aug CPI rose +0.6% m/m and +2.9% y/y, stronger than expectations of +0.5% m/m and +2.8% y/y. Aug core CPI rose +2.7% y/y, stronger than expectations of +2.5% y/y and the fastest pace of increase in 5-1/2 years.

U.S. STOCK PREVIEW

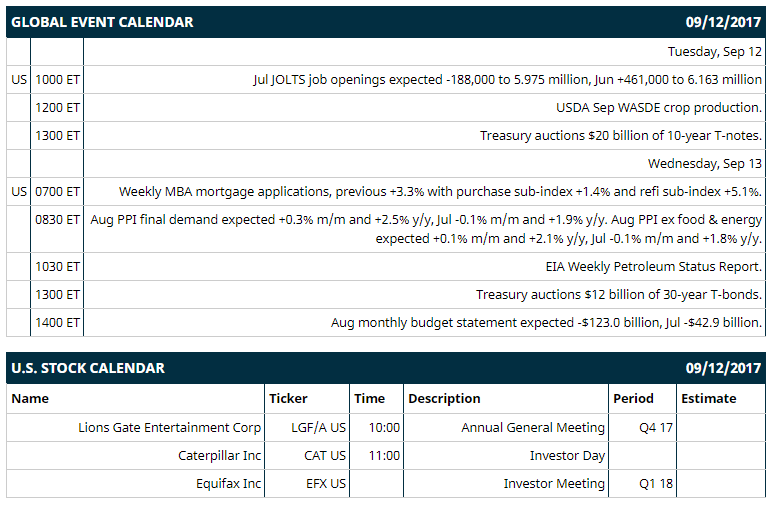

Key U.S. news today includes: (1) Jul JOLTS job openings (expected -188,000 to 5.975 million, Jun +461,000 to 6.163 million), (2) Treasury auctions $20 billion of 10-year T-notes, (3) USDA Sep WASDE crop production.

Notable Russell 1000 earnings reports today include: none.

U.S. IPO's scheduled to price today: none.

Equity conferences this week: Morgan Stanley Global Healthcare Conference on Mon-Wed, Capital Link Shipping, Marine Services & Offshore Forum on Tue, Citi Global Technology Conference on Tue, Raymond James North America Equities Conference on Tue, UBS Best of Americas Conference on Tue, Wells Fargo Net Lease REIT Forum on Tue, Barclays Global Financial Services Conference on Mon-Wed, Bank of America Merrill Lynch Global Real Estate Conference on Tue-Wed, Credit Suisse Basic Materials Conference on Tue-Wed, Deutsche Bank Technology Conference on Tue-Wed, Goldman Sachs Communacopia Conference on Tue-Thu, Bank of America Merrill Lynch European Credit Conference on Wed, KeyBank Capital Markets Basic Materials Conference on Wed, Bank of America Merrill Lynch Global Health Care Conference on Wed-Thu, Morgan Stanley Industrials Conference on Wed-Thu, Morgan Stanley Laguna Conference on Wed-Thu, Royal Bank of Canada Global Industrials Conference on Wed-Thu, BMO Capital Markets Back To School Conference on Thu, C. L. King & Associates Best Ideas Conference on Thu, Pareto Oil & Offshore Conference on Thu.

OVERNIGHT U.S. STOCK MOVERS

Apple (AAPL +1.81%) was rated a new 'Buy' at Citic Securities with a price target of $200.

Comerica (CMA +3.14%) was upgraded to 'Overweight' from 'Neutral' at Piper Jaffray with a price target of $80.

Advanced Auto Parts (AAP +0.39%) was downgraded to 'Sell' from 'Neutral' at Citigroup with a price target of $82.

DXC Technology (DXC +1.28%) was initiated a new 'Buy' at Bank of America/Merrill Lynch with a price target of $101.

Alcoa (AA +2.32%) was upgraded to 'Buy' from 'Hold' at Deutsche Bank.

Life Storage (LSI -2.89%) was initiated a new 'Underperform' at BMO Capital Markets with 12-month target price of $73

Ross Stores (ROST +1.28%) was initiated a new 'Outperform' at Bernstein with a price target of $74.

Western Digital (WDC +0.44%) climbed over 4% in after-hours trading after Nikkan Kogyo reported that Toshiba will sell its chip unit to a group that included Western Digital.

Epam Systems (EPAM +0.17%) was initiated a new 'Buy' at Bank of America/Merrill Lynch with a price target of $1110.

Public Storage (PSA -2.25%) was downgraded to 'Underperform' from 'Hold' at BMO Capital Markets.

Archer Daniels Midland (ADM +0.99%) was initiated a new 'Outperform' at Baird with a price target of $50.

Investors Real Estate (IRET +1.29%) reported Q1 FFO of 10 cents per share, better than consensus of 8 cents.

CTI Biopharma (CTIC +0.31%) was initiated a new 'Buy' at Jeffries with a price target of $7.50.

MARKET COMMENTS

Dec S&P 500 E-mini stock futures (ESZ17 +0.18%) this morning are up +4.00 points (+0.16%) at a new contract high. Monday's closes: S&P 500 +1.08%, Dow Jones +1.19%, Nasdaq +1.14%. The S&P 500 on Monday rallied to a 1-month high and closed sharply higher on reduced North Korean tensions after North Korea did not go ahead with an expected missile launch on Saturday. Stocks also rallied on less-than-expected economic damage in Florida from Hurricane Irma.

Dec 10-year T-note prices (ZNZ17 -0.21%) this morning are down -9.5 ticks to a 1-week low. Monday's closes: TYZ7 -16.00, FVZ7 -9.25. Dec 10-year T-notes on Monday gapped lower and finished with moderate losses. T-notes were undercut by the rally in the S&P 500 to a 1-month high, which curbed the safe-haven demand for T-notes, and also by an increase in inflation expectations after the 10-year T-note breakeven inflation rate rose to a 6-week high. T-notes were also undercut by supply pressures as the Treasury auctions $56 billion of T-notes and T-bonds this week.

The dollar index (DXY00 +0.12%) this morning is up +0.095 (+0.10%). EUR/USD (^EURUSD) is down -0.0022 (-0.18%) and USD/JPY (^USDJPY) is up +0.44 (+0.40%) to a 1-week high. Monday's closes: Dollar Index +0.523 (+0.57%), EUR/USD -0.0083 (-0.69%), USD/JPY +1.55 (+1.44%). The dollar index on Monday closed higher on the rally in the S&P 500 to a 1-month high, which pushed USD/JPY higher on reduced safe-haven demand for the yen. There was also weakness in EUR/USD after ECB Executive Board member Coeure warned that strength in EUR/USD could further depress inflation, which was dovish for ECB policy.

Oct crude oil (CLV17 +0.44%) this morning is up +8 cents (+0.17%) and Oct gasoline (RBV17 +1.21%) is +0.0157 (+0.96%). Monday's closes: Oct WTI crude +0.59 (+1.24%), Oct gasoline -0.0131 (-0.80%). Oct crude and gasoline on Monday settled mixed with Oct gasoline at a 1-1/2 week low. Crude oil and gasoline prices were undercut by a stronger dollar and by ramped up gasoline production as refiners on the Gulf Coast restart after being shut due to Hurricane Harvey. Crude oil prices were boosted by the rally in the S&P 500 to a 1-month high and comments from Saudi Arabian Energy Minister Khalid Al-Falih who said his country is open to the extension of OPEC crude production cuts "beyond the first quarter, if needed."

Metals prices this morning are weaker with Dec gold (GCZ17 -0.56%) -8.1 (-0.61%) to a 1-week low, Dec silver (SIZ17-0.40%) -0.107 (-0.60%) and Dec copper (HGZ17 -1.22%) -0.034 (-1.11%). Monday's closes: Dec gold -15.5 (-1.15%), Dec silver -0.221 (-1.22%), Dec copper +0.0245 (+0.81%). Metals on Monday settled mixed. Metals prices were undercut by the stronger -dollar and by reduced North Korean tensions that curbed safe-haven demand for precious metals after North Korea failed to launch a missile as expected on Saturday. Copper closed higher on signs of tighter supplies after LME copper inventories fell -4,750 MT to 208,425 MT, a 6-1/4 month low.

Disclosure: None.