Morning Call For Tuesday, Oct. 17

OVERNIGHT MARKETS AND NEWS

Dec E-mini S&Ps (ESZ17 -0.02%) this morning are little changed, down -0.03%, and European stocks are up +0.08%. U.S. stock indexes were consolidating their gains from Monday's rally to new all-time highs. The upside in European stocks was limited after Spain cut its 2018 GDP estimate to 2.3% from 2.6%, citing the impact of the political standoff in Catalonia. Also, the German Oct ZEW survey expectations of economic growth rose less than expected. Asian stocks settled mostly higher: Japan +0.38%, Hong Kong +0.02%, China -0.19%, Taiwan -0.47%, Australia +0.73%, Singapore +0.18%, South Korea +0.21%, India -0.08%. Chinese stocks retreated ahead of a meeting of Chinese Communist Party leaders on Wednesday, while Japan's Nikkei Stock Index rallied to a new 20-3/4 year high on optimism in the global economic outlook along with carry-over support from Monday's rally in U.S stocks to new record highs.

The dollar index (DXY00 +0.25%) is up +0.22% after several people with knowledge of the matter said that John Taylor, a known hawk, made a favorable impression on President Trump after his interview with the President for Fed Chair. EUR/USD (^EURUSD) is down -0.31% on the prospects for the ECB to extend QE after Spain cut its 2018 GDP forecasts and after the German Oct ZEW came in lower than expected. USD/JPY (^USDJPY) is down -0.02%.

Dec 10-year T-note prices (ZNZ17 -0.01%) are little changed, down -0.5 of a tick.

The German Oct ZEW survey expectations of economic growth rose +0.6 to 17.6, weaker than expectations of +3.0 to 20.0.

The UK Sep CPI of +0.3% m/m and +3.0% y/y was right on expectations with the +3.0% y/y gain the fastest year-on-year pace of increase in 5-1/2 years. The Sep core CPI rose +2.7% y/y, right on expectations and the fastest pace of growth in 5-3/4 years.

U.S. STOCK PREVIEW

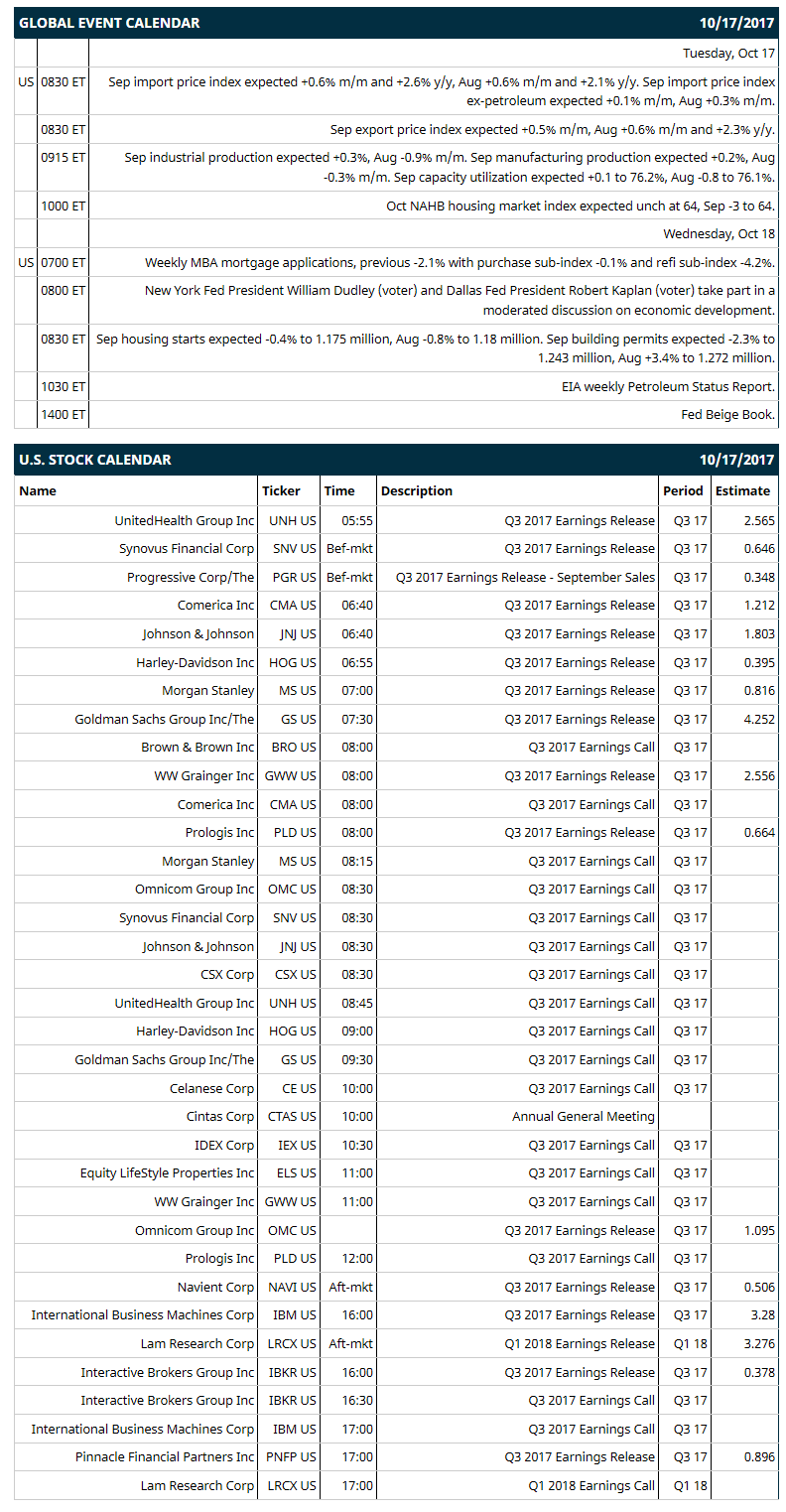

Key U.S. news today includes: (1) Sep import price index (expected +0.6% m/m and +2.6% y/y, Aug +0.6% m/m and +2.1% y/y), (2) Sep industrial production (expected +0.2%, Aug -0.9% m/m), (3) Oct NAHB housing market index (expected unch at 64, Sep -3 to 64).

Notable S&P 500 earnings reports today include: Goldman Sachs (consensus $4.25), Morgan Stanley (0.82), IBM (3.28), UnitedHealth Group (2.57, Johnson & Johnson (1.80), Navient (0.51), Harley-Davidson (0.40), Progressive Corp (0.35).

U.S. IPO's scheduled to price today: Qudian (QD).

Equity conferences this week: International Association for the Study of Lung Cancer World Conference - Abstra on Mon-Wed, BIO Investor Forum on Tue, METALCON Conference on Thu, SAP Retail Executive Forum on Thu, American Association for the Study of Liver Diseases Liver Meeting on Fri.

OVERNIGHT U.S. STOCK MOVERS

Briggs & Stratton (BGG +1.07%) was downgraded to 'Underperform' from 'Market Perform' at Raymond James.

Morgan Stanley (MS +1.33%) gained nearly 2% in pre-market trading after it reported Q3 FICC sales and trading revenue of $1.17 billion, better than consensus of $1.15 billion.

Humana (HUM -0.24%) was initiated a new 'Outperform' at BMO Capital Markets with a 12-month target price of $300.

Celgene (CELG +0.18%) was initiated a new 'Outperform' at Bernstein with a 12-month target price of $162.

Netflix (NFLX +1.60%) gained almost 2% in after-hours trading after it reported Q3 domestic streaming net adds of 850,000, more than consensus of 774,000, and then said it sees Q4 revenue of $3.27 billion, better than consensus of $3.16 billion.

Sonic (SONC +1.72%) lost over 2% in after-hours trading after it reported Q4 revenue of $123.6 million, less than consensus of $125 million.

Badger Meter (BMI -1.17%) slumped 11% in after-hours trading after it reported Q3 EPS of 27 cents, below consensus of 35 cents.

KMG Chemicals ({=KMG rose over 2% in after-hours trading after it forecast full-year net sales of $435 million-$450 million, well above consensus of $386.5 million.

Brown & Brown (BRO -0.85%) dropped 5% in after-hours trading after it reported Q3 revenue of $475.6 billion, below consensus of $476 million.

Spirit Airlines (SAVE -0.98%) climbed 5% in after-hours trading after it reported traffic in Sep was up +5.9% and that it now sees Q3 traffic down -6.5% y/y, less than a prior forecast of down -7% y/y to -8.5% y/y.

Caesars Entertainment (CZR -2.47%) may move higher on the opening today after Apollo Global Management reported a 15% stake in the company.

Abeona Therapeutics (ABEO +3.73%) slid 4% in after-hours trading after it announced a public offering of common stock, although no size was given.

Immune Design (IMDZ -7.76%) jumped 9% in after-hours trading after it said it will start a Phase 3 trial of its CMB305 drug as a vaccine for patients with synovial sarcoma.

KalVista Pharmaceuticals (KALV -2.77%) gained 3% in after-hours trading after Director Rajeev Shah reported a purchase of 850,000 shares on Oct 12 at $8.50 apiece.

MARKET COMMENTS

Dec S&P 500 E-mini stock futures (ESZ17 -0.02%) this morning are down -0.75 points (-0.03%). Monday's closes: S&P 500 +0.18%, Dow Jones +0.37%, Nasdaq +0.36%. The S&P 500 on Monday climbed to a new record high and closed higher on a rally in energy stocks as crude oil prices climbed +0.82% to a 2-week high and on strength in mining stocks after copper prices surged +3.37% to a 3-year high. Stocks were also boosted by signs of strength in the U.S. economy after the Oct Empire manufacturing index unexpectedly rose +7.8 to 30.2, stronger than expectations of -4.0 to 20.4 and a 3-year high.

Dec 10-year T-note prices (ZNZ17 -0.01%) this morning are down -0.5 of a tick. Monday's closes: TYZ7 +10.00, FVZ7 +5.25. Dec 10-year T-notes on Monday closed lower on the unexpected +7.9 point increase in the U.S. Oct Empire manufacturing index to a 3-year high of 30.2 and by comments from Fed Chair Yellen that her "best guess" is that consumer prices will soon accelerate after a period of surprising softness and that "the ongoing strength in the economy will warrant gradual increases" in the Fed funds rate.

The dollar index (DXY00 +0.25%) this morning is up +0.202 (+0.22%). EUR/USD (^EURUSD) is down -0.0037 (-0.31%) and USD/JPY (^USDJPY) is down -0.02 (-0.02%). Monday's closes: Dollar Index +0.183 (+0.20%), EUR/USD -0.0024 (-0.20%), USD/JPY +0.37 (+0.33%). The dollar index on Monday closed higher on comments on Saturday from Fed Chair Yellen who said that "the ongoing strength of the economy will warrant gradual increases" in the Fed funds rate. There was also weakness in EUR/USD after the 10-year German bund yield fell to a 1-month low, which reduces the euro's interest rate differentials.

Nov crude oil (CLX17 +0.40%) this morning is up +25 cents (+0.48%) and Nov gasoline (RBX17 +0.78%) is +0.0124 (+0.77%). Monday's closes: Nov WTI crude +0.42 (+0.82%), Nov gasoline -0.0053 (-0.33%). Nov crude oil and gasoline on Monday settled mixed with Nov crude at a 2-week high. Crude oil prices were boosted by concern that tensions between Iraq and Kurdish forces may disrupt crude oil flows after Iraqi soldiers seized oil facilities including a refinery from Kurdish forces. Crude oil prices were undercut by a stronger dollar and by Kuwaiti Oil Minister Essam al-Marzouk's comment that OPEC may not need to extend its crude production cuts beyond March 2018 if everyone complies with their quotas.

Metals prices this morning are weaker with Dec gold (GCZ17 -1.02%) -11.9 (-0.91%), Dec silver (SIZ17 -1.72%) -0.249 (-1.43%) and Dec copper (HGZ17 -0.88%) -0.033 (-1.00%). Monday's closes: Dec gold -1.6 (-0.12%), Dec silver -0.042 (-0.24%), Dec copper +0.1055 (+3.37%). Metals on Monday settled mixed with Dec copper at a 3-year nearest-futures high. Metals prices were boosted by fund buying of copper on speculation that Chinese demand will strengthen after China Sep producer prices rose +6.9% y/y, the fastest pace of increase in 6 months. There was also increased demand for gold as an inflation hedge after Fed Chair Yellen said that her "best guess" is that consumer prices will soon accelerate after a period of surprising softness. Metals prices were undercut by a stronger dollar and and by reduced safe-haven demand with the rally in the S&P 500 to a new record high.

(Click on image to enlarge)

Disclosure: None.