Morning Call For Tuesday, Nov. 7

OVERNIGHT MARKETS AND NEWS

Dec E-mini S&Ps (ESZ17 -0.01%) this morning are little changed, down -0.02%, after they rose to a record nearest-futures high in overnight trade. Strength in energy stocks lifted the overall market after Dec WTI crude oil (CLZ17 -0.10%) posted a new 2-1/3 year high in overnight trade. European stocks are down slightly by -0.17% after German Sep industrial production fell more than expected. European stocks were also undercut by disappointing quarterly earnings results from BMW AG and Associated British Foods Plc. Asian stocks settled mostly higher: Japan +1.73%, Hong Kong +1.39%, China +0.75%, Taiwan +0.50%, Australia +1.02%, Singapore +0.92%, South Korea -0.19%, India -1.07%. China's Shanghai Composite climbed to a 1-week high as the rally in crude oil to a 2-1/3 year high boosted Chinese energy stocks. Japan's Nikkei Stock Index soared to a 25-3/4 year high, bolstered by strong corporate quarterly earnings results and by Monday’s rally in USD/JPY to a 7-1/2 month high. Japanese consumer stocks also gained on optimism that consumer spending may improve after Japan Sep labor cash earnings rose +0.9% y/y, its largest increase in 14 months.

The dollar index (DXY00 +0.36%) is up +0.30% at a 1-week high as an increase in the 10-year T-note yield boosts the dollar's interest rate differentials. EUR/USD (^EURUSD) is down -0.36% at a 3-1/2 month low and was pressured by the weaker-than-expected German Sep industrial production. USD/JPY (^USDJPY) is up +0.40%.

Dec 10-year T-note prices (ZNZ17 -0.06%) are down -2 ticks.

German Sep industrial production fell -1.6% m/m, weaker than expectations of -0.9% m/m and the biggest decline in 9 months.

Eurozone Sep retail sales rose +0.7% m/m, stronger than expectations of +0.6% m/m and the largest increase in 11 months.

Japan Sep labor cash earnings rose +0.9% y/y, stronger than expectations of +0.5% y/y and the biggest increase in 14 months. Sep real cash earnings fell -0.1% y/y, stronger than expectations of -0.2% y/y.

U.S. STOCK PREVIEW

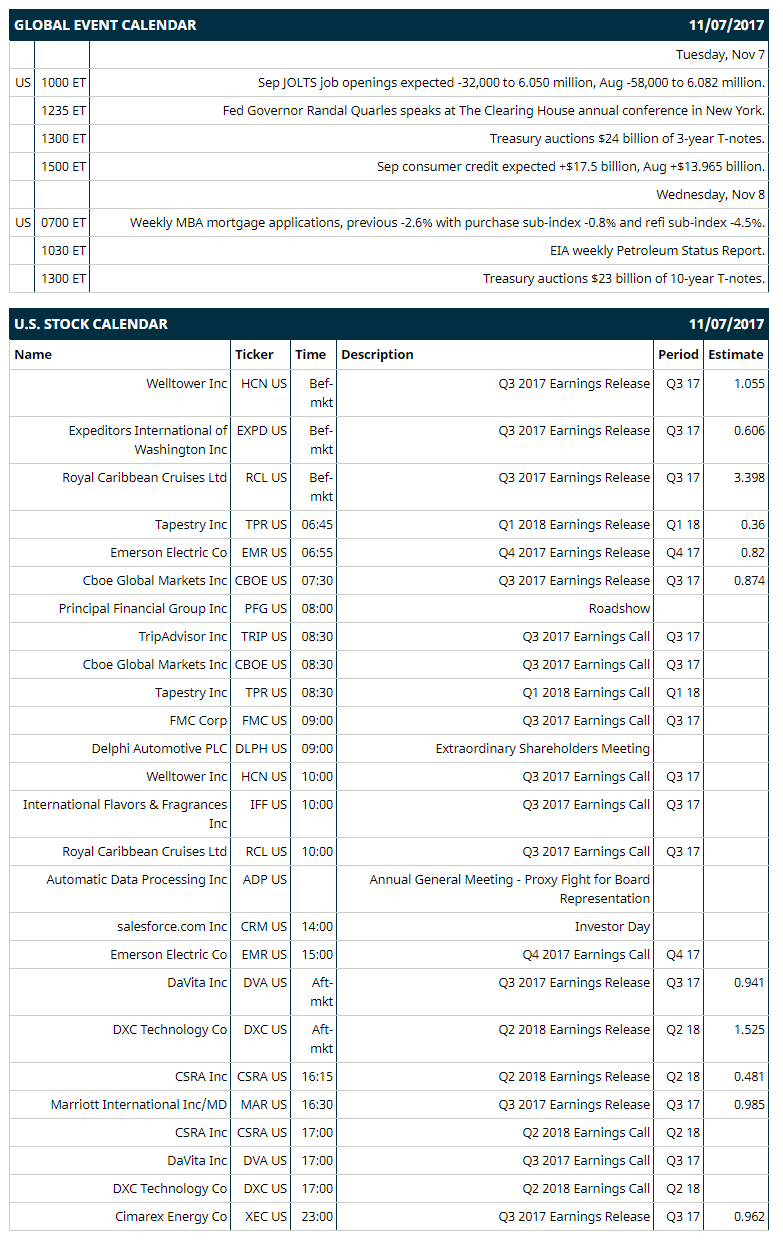

Key U.S. news today includes: (1) Sep JOLTS job openings (expected -29,000 to 2.053 million, Aug -58,000 to 6.082 million), (2) Fed Governor Randal Quarles speaks at The Clearing House annual conference in New York, (3) Treasury auctions $24 billion of 3-year T-notes, (4) Sep consumer credit (expected +$17.5 billion, Aug +$13.965 billion).

Notable S&P 500 earnings reports today include: Emerson Electric (consensus $0.82), Marriott (0.99), Welltower (1.06), Royal Caribbean Cruises (3.40), Cboe Global Markets (0.87), Expeditors Intl (0.61).

U.S. IPO's scheduled to price today: CBTX Inc (CBTX), Metropolitan Bank Holding (MCB).

Equity conferences this week: Citi Financial Technology Conference on Mon-Tue, EEI Financial Conference on Mon-Tue, Credit Suisse Health Care Conference on Tue-Wed, Bernstein Technology Innovation Summit on Tue-Wed, Stephens Fall Investment Conference on Tue-Wed, RBC Capital Markets Technology, Internet, Media and Telecommunications Conference on Tue-Wed, Robert W. Baird Global Industrial Conference on Tue-Wed, Wells Fargo Technology, Media & Telecom Conference on Tue-Wed, Deutsche Bank Gaming, Lodging & Leisure Conference on Wed.

OVERNIGHT U.S. STOCK MOVERS

Priceline Group (PCLN +0.45%) tumbled over 9% in after-hours trading after it said it sees Q4 adjusted EPS of $13.40 to $14.00, well below consensus of $15.56.

Weight Watchers International (WTW +0.27%) rallied 10% in after-hours trading after it reported Q3 EPS of 65 cents, higher than consensus of 51 cents, and then said it sees full-year EPS of $1.77 to $1.83, better than consensus of $1.46.

Red Robin Gourmet Burgers (RRGB +0.15%) sank 18% in after-hours trading after it reported Q3 adjusted EPS of 21 cents, well below consensus of 29 cents, and then forecast full-year EPS of $2.16 to $2.31 weaker than consensus of $2.80.

Las Vegas Sands (LVS +1.02%) was upgraded to 'Overweight' from 'Equal Weight' at Morgan Stanley with a price target of $72.

U.S. Silica Holdings (SLCA +3.55%) jumped 6% in after-hours trading after it reported Q3 revenue of 34 million, higher than consensus of $328.9 million.

Veritone (VERI +6.26%) tumbled over 12% in after-hours trading after it reported a Q3 net loss of -$1.31 per share, wider than consensus of -43 cents.

Lowe's (LOW -0.65%) was initiated with a recommendation of 'Overweight' at KeyBanc Capital Markets with a 12-month target price of $98.

Zayo Group Holdings (ZAYO -0.12%) slipped nearly 4% in after-hours trading after it reported Q1 EPS of 9 cents, weaker than consensus of 12 cents.

Tenet Healthcare (THC -3.29%) fell 5% in after-hours trading after it said it sees Q4 adjusted EPS of $1.20 to $1.35, below consensus of $1.55, and then lowered guidance on full-year adjusted EPS to 59 cents-74 cents from a prior view of 69 cents to 99 cents, weaker than consensus of 75 cents.

Avis Budget Group (CAR +1.10%) dropped 11% in after-hours trading after it lowered guidance on full-year adjusted EPS to $2.45 to $2.65 from a prior view of $2.40 to $2.85, weaker than consensus of $2.69.

TripAdvisor (TRIP +1.67%) dropped nearly 9% in after-hours trading after it reported Q3 revenue of $439 million, weaker than consensus of $451.7 million.

Lannett (LCI +2.42%) jumped over 8% in after-hours trading after it said it sees full-year net sales of $710 million to $720 million, well above consensus of $654.9 million.

AMC Entertainment Holdings (AMC +2.52%) slid 7% in after-hours trading after it said it sees 2017 revenue of $5.00 billion to $5.20 billion, the mid-point below consensus of $5.16 billion.

TrueCar (TRUE +1.55%) plunged 26% in after-hours trading after it reported Q3 revenue of $82.4 million, weaker than consensus of $86.9 million, and then forecast full-year revenue of $321 million to $323 million, below consensus of $328.6 million.

Manitowoc (MTW +1.20%) rose nearly 5% in after-hours trading after it reported Q3 revenue of $399.4 million, better than consensus of $385.1 million.

MARKET COMMENTS

Dec S&P 500 E-mini stock futures (ESZ17 -0.01%) this morning are down -0.50 points (-0.02%). Monday's closes: S&P 500 +0.13%, Dow Jones +0.04%, Nasdaq +0.29%. The S&P 500 on Monday climbed to a new record high and closed higher on strength in technology stocks led by a +1.0% gain in Apple to a record high. There was also strength in energy stocks after the price of crude oil climbed +3.07% to a 2-1/3 year high.

Dec 10-year T-note prices (ZNZ17 -0.06%) this morning are down -2 ticks. Monday's closes: TYZ7 +6.50, FVZ7 +2.50. Dec 10-year T-notes on Monday posted a fresh 2-week high and closed higher on carry-over support from a rally in 10-year German bunds to a 1-3/4 month high and on increased safe-haven demand from geopolitical tensions in the Middle East after Saudi Arabia said an attempted missile attack on Riyadh's airport could be an act of war by Iran.

The dollar index (DXY00 +0.36%) this morning is up +0.284 (+0.30%) at a 1-week high. EUR/USD (^EURUSD) is down -0.0042 (-0.36%) at a 3-1/2 month low and USD/JPY (^USDJPY) is up +0.45 (+0.40%). Monday's closes: Dollar Index -0.184(-0.19%), EUR/USD +0.0002 (+0.02%), USD/JPY -0.36 (-0.32%). The dollar index on Monday fell back from a 1-week high and closed lower on increased safe-haven demand for the yen as USD/JPY declined on tensions between Iran and Saudi Arabi after Saudi Arabi said a weekend attempted missile strike at Riyadh's airport could be an act of war by Iran. The dollar was also undercut by the decline in the 10-year T-note yield to a 2-week low, which undercuts the dollar's interest rate differentials.

Dec crude oil (CLZ17 -0.10%) this morning is down -2 cents (-0.03%) and Dec gasoline (RBZ17 -0.51%) is -0.0079 (-0.43%). Monday's closes: Dec WTI crude +1.71 (+3.07%), Dec gasoline +0.0366 (+2.04%). Dec crude oil and gasoline on Monday closed higher with Dec crude at a 2-1/3 year high. Crude oil prices were boosted by geopolitical concerns that may lead to disruption of Middle Eastern crude supplies after Saudi Arabia blamed Iran for an attempted missile attack on Riyadh's international airport and said it could be considered an "act of war."

Metals prices this morning are weaker with Dec gold (GCZ17 -0.39%) -4.5 (-0.35%), Dec silver (SIZ17 -1.25%) -0.195(-1.13%) and Dec copper (HGZ17 -1.06%) -0.032 (-1.00%). Monday's closes: Dec gold +12.4 (+0.98%), Dec silver +0.401 (+2.38%), Dec copper +0.0400 (+1.28%). Metals on Monday closed higher on a weaker dollar and the -1,950 MT decline in LME copper inventories to a 1-3/4 month low of 268,450 MT, a sign of tighter supplies.

Disclosure: None.