Morning Call For Tuesday, May 23

OVERNIGHT MARKETS AND NEWS

Jun E-mini S&Ps (ESM17 +0.18%) this morning are up +0.14% and European stocks are up +0.68% on signs of strength in the European economy. The Eurozone May Markit manufacturing PMI unexpectedly rose +0.5 to 57.0, the fastest pace of expansion since the data series began in 2014, while confidence in the economic outlook soared after the German May IFO business climate rose +1.6 to 114.6, the highest since the data series began in 1991. Gains in equities were limited on weakness in energy producing stocks as Jul WTI crude oil (CLN17 -0.41%) tumbled -0.72% after details of the Trump administration's budget proposal call for the U.S. to sell off half of its 687.7 million bbl Strategic Oil Reserve. Asian stocks settled mixed: Japan -0.33%, Hong Kong +0.05%, China -0.45%, Taiwan +0.11%, Australia -0.19%, Singapore +0.28%, South Korea +0.24%, India -0.67%.

The dollar index (DXY00 +0.01%) is down -0.05%. EUR/USD (^EURUSD) is up +0.01% at a new 6-1/4 month high. USD/JPY (^USDJPY) is down -0.02%.

Jun 10-year T-note prices (ZNM17 unch) are up +0.5 of a tick.

The German May IFO business climate rose +1.6 to 114.6, stronger than expectations of +0.2 to 113.1 and the highest since the data series began in 1991.

The Eurozone May Markit manufacturing PMI unexpectedly rose +0.5 to 57.0, stronger than expectations of -0.2 to 56.5 and the fastest pace of expansion since the data series began in 2014.

The Eurozone May Markit composite PMI was unch at 56.8, stronger than expectations of -0.1 to 56.7 and the fastest pace of expansion in 6 years.

The German May Markit/BME manufacturing PMI unexpectedly rose +1.2 to 59.4, stronger than expectations of -0.2 to 58.0 and the fastest pace of expansion in 6 years.

U.S. STOCK PREVIEW

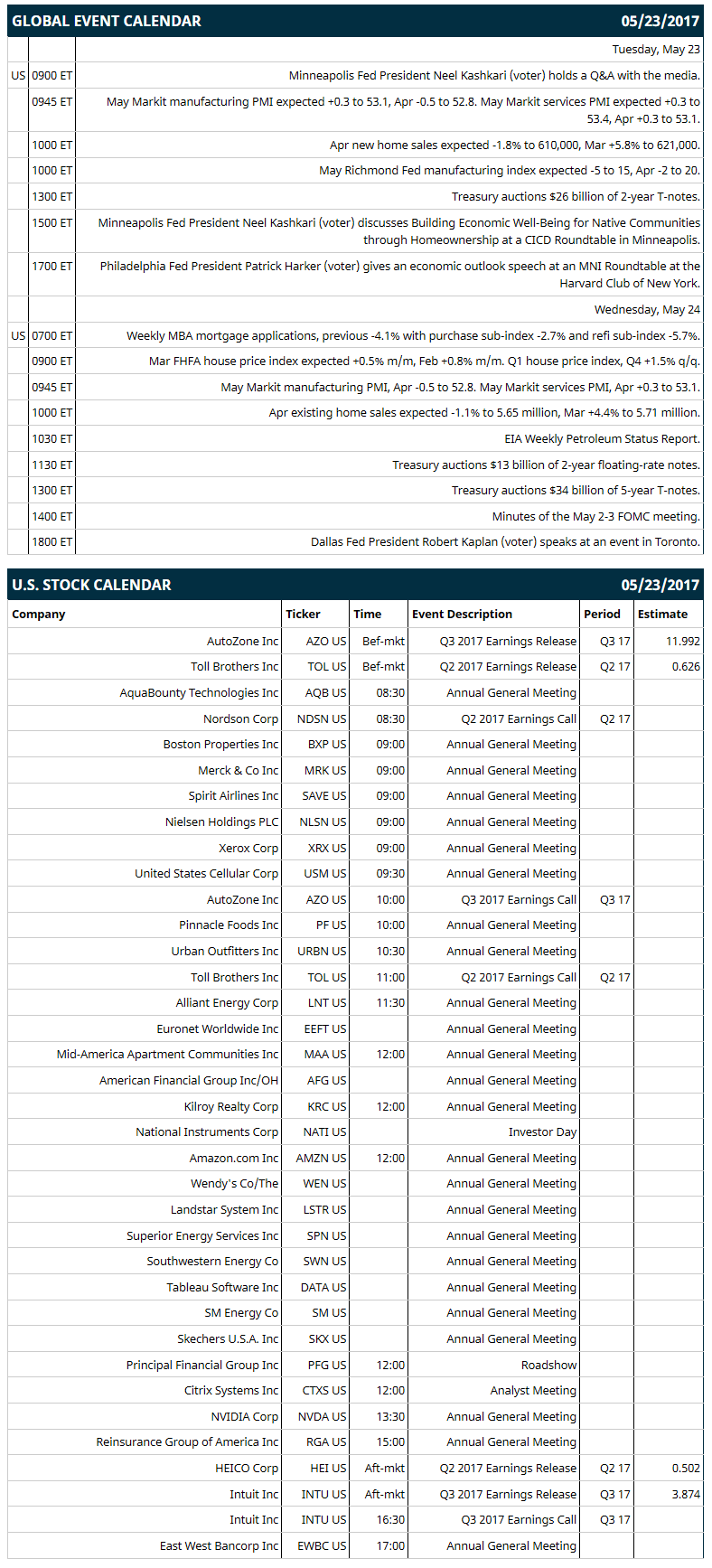

Key U.S. news today includes: (1) Minneapolis Fed President Neel Kashkari (voter) holds a Q&A with the media, (2) May Markit manufacturing PMI (expected +0.3 to 53.1, Apr -0.5 to 52.8) and May Markit services PMI (expected +0.2 to 53.3, Apr +0.3 to 53.1), (3) Apr new home sales (expected -1.8% to 610,000, Mar +5.8% to 621,000), (4) May Richmond Fed manufacturing index (expected -5 to 15, Apr -2 to 20), (5) Treasury auctions $26 billion of 2-year T-notes, (6) Minneapolis Fed President Neel Kashkari (voter) discusses “Building Economic Well-Being for Native Communities through Homeownership” at a CICD Roundtable in Minneapolis, (7) Philadelphia Fed President Patrick Harker (voter) gives an economic outlook speech at an MNI Roundtable at the Harvard Club of New York.

Notable Russell 2000 earnings reports today include: Toll Brothers (consensus $0.63), AutoZone (11.99), Intuit (3.87), HEICO (0.50).

U.S. IPO's scheduled to price today: none.

Equity conferences: Electrical Products Group Conference on Mon-Wed; J.P. Morgan Global Technology, Media and Telecom Conference on Mon-Wed; UBS Global Health Care Conference on Mon-Thu; Wolfe Global Transportation Conference on Tue-Wed; Jefferies Global Automotive Aftermarket Investor Conference on Wed; UBS Auto & Auto Supplier 1x1 Conference on Thu.

OVERNIGHT U.S. STOCK MOVERS

McKesson (MCK +1.58%) was upgraded to 'Overweight' from 'Neutral' at JPMorgan Chase with a price target of $189.

AutoZone (AZO -2.10%) is indicated to open 6% lower this morning after it reported Q3 EPS of $11.44, below consensus of $11.99 as Q3 comparable sales fell -0.8%, weaker than expectations of a +2.4% increase.

Perrigo Co. PLC (PRGO +0.81%) fell 5% in pre-market trading after it reported Q4 adjusted EPS of $1.24, weaker than expectations of $1.81, and then said it sees 2017 adjusted EPS of $4.15 to $4.50, below consensus of $4.55.

Nordson (NDSN +1.36%) reported Q2 adjusted EPS of $1.35, higher than consensus of $1.31, and said it sees Q3 adjusted EPS of $1.57-$1.71.

Hyatt Hotels (H +0.65%) announced a secondary offering of 4 million shares of Class A stock by investment funds associated with Goldman Sachs.

Valero Energy (VLO -0.05%) was initiated with an 'Overweight' at U.S. Capital Advisors with a 12-month target price of $73.

Take-Two Interactive Software (TTWO +2.16%) slumped 10% in after-hours trading when it said it will delay the release of its 'Red Dead Redemption 2' on PlayStation 4 and Xbox One until the spring of 2018, later than the fall of 2017 that it previously planned.

Agilent Technologies (A -0.09%) rose nearly 4% in after-hours trading after it reported Q2 adjusted EPS of 58 cents, better than consensus of 48 cents, and then said it sees full-year adjusted EPS of $2.15 to $2.21, the midpoint above consensus of $2.16.

Mindbody (MB unch) announced that it had commenced an underwritten registered public offering of 4.4 million shares of its Class A common stock.

Camping World Holdings (CWH -1.19%) slid almost 3% in after-hours trading after it announced a proposed offering of 10 million shares of Class A common stock which includes 3.5 million shares offered by Camping World and 6.5 million shares offered by Crestview Advisors LLC.

GlycoMimetics (GLYC -13.71%) dropped over 5% in after-hours trading after it announced that it intends to sell 6.0 million shares of its common stock in an underwritten public offering.

MARKET COMMENTS

June E-mini S&Ps (ESM17 +0.18%) this morning are up +3.25 points (+0.14%). Monday's closes: S&P 500 +0.52%, Dow Jones +0.43%, Nasdaq +0.85%. The S&P 500 on Monday closed higher on strength in energy stocks after crude oil prices rose +0.91% to a 1-month high and on increased M&A activity after Clariant AG agreed to buy Huntsman for $6.4 billion. Stocks were also supported by the +0.42 point increase in the Apr Chicago Fed national activity index to 0.49, stronger than expectations of +0.3 to 0.11 and the fastest pace of expansion in 2-1/3 years.

June 10-year T-notes (ZNM17 unch) this morning are up +0.5 of a tick. Monday's closes: TYM7 -2.00, FVM7 -0.75. Jun 10-year T-notes on Monday closed slightly lower on reduced safe-haven demand with the rally in stocks and on supply pressures as the Treasury auctions $101 billion of notes this week.

The dollar index (DXY00 +0.01%) this morning is down -0.046 (-0.05%). EUR/USD (^EURUSD) is up +0.0001 (+0.01%) at a fresh 6-1/4 month high and USD/JPY (^USDJPY) is down -0.02 (-0.02%). Monday's closes: Dollar index -0.167 (-0.17%), EUR/USD +0.0031 (+0.28%), USD/JPY +0.04 (+0.04%). The dollar index on Monday tumbled to a fresh 6-1/4 month low and closed lower on strength in EUR/USD which climbed to a 6-1/4 month high on comments from German Chancellor Merkel who said Germany's trade surplus is the result of the euro which is "too weak" because of ECB policy.

July WTI crude oil prices (CLN17 -0.41%) this morning are down -37 cents (-0.72%) and July gasoline (RBN17 -0.58%) is -0.0141 (-0.85%). Monday's closes: Jul crude +0.46 (+0.91%), Jul gasoline +0.0105 (+0.64%). Jul crude oil and gasoline on Monday rallied to 1-month highs and settled higher on the slide in the dollar index to a 6-1/4 month low and on comments by Saudi Arabian Energy Minister Khalid Al-Falih who said that all oil producers participating in a deal to curb crude output are "on board" for an extension of crude production cuts for another 9 months.

(Click on image to enlarge)

Disclosure: None.