Morning Call For Tuesday, January 16

OVERNIGHT MARKETS AND NEWS

Mar E-mini S&Ps (ESH18 +0.39%) are up +0.41% at a fresh record nearest-futures high as growth optimism fuels gains in global equity markets. Gains in technology stocks are leading the overall market higher as quarterly earnings season ramps up this week. European stocks are up +0.59% at a 2-1/4 month high, German bunds rallied, and EUR/USD retreated after Reuters reported the ECB is unlikely to change its forward guidance until at least the March meeting. Asian stocks settled mostly higher: Japan +1.00%, Hong Kong +1.81%, China +0.77%, Taiwan +0.27%, Australia -0.47%, Singapore +0.39%, South Korea +0.80%, India -0.21%. Japan's Nikkei Stock Index climbed to a 26-year high as exporter stocks rallied after the yen weakened when Japanese Finance Minister Aso said: "sudden moves in exchange rates are a problem." USD/JPY had dropped to a 4-month low and the dollar index sold-off to a 3-year low on Monday with U.S. markets closed for Martin Luther King Jr. Day.

The dollar index (DXY00 -0.35%) is down -0.27%, but remains above Monday's 3-year low. EUR/USD (^EURUSD) is down -0.30%. USD/JPY (^USDJPY) is up +0.08%.

Mar 10-year T-note prices (ZNH18 +0.13%) are up +6 ticks as they move higher on carry-over strength from a rally in German bunds.

Reuters reports that three unidentified people with knowledge of the matter said the ECB is unlikely to drop a pledge to keep buying bonds at the Jan 25 meeting as rate-setters need more time to assess the outlook for the economy and the euro. Any fundamental change to guidance is likely to come later with the Mar meeting as the more likely option.

The German Dec wholesale price index rose +1.8% y/y, the smallest year-on-year increase in 13 months.

UK Dec CPI rose +0.4% m/m and +3.0% y/y, right on expectations. The Dec core CPI rose +2.5% y/y, weaker than expectations of +2.6% y/y.

Japan Dec PPI rose +0.2% m/m and +3.1% y/y, weaker than expectations of +0.4% m/m and +3.2% y/y.

U.S. STOCK PREVIEW

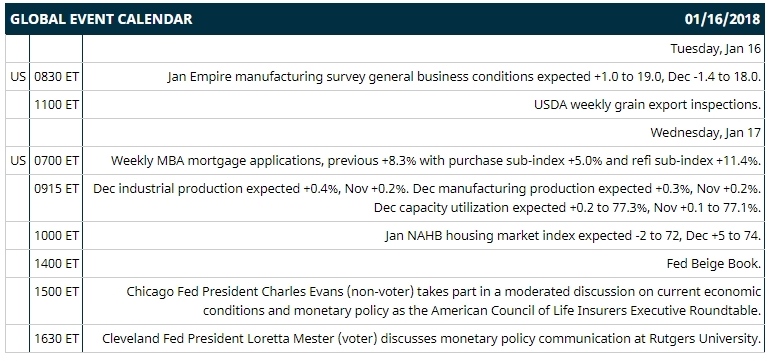

Key U.S. news today includes: (1) Jan Empire manufacturing index (expected +1.0 to 19.0, Dec -1.4 to 18.0), (2) USDA weekly grain export inspections.

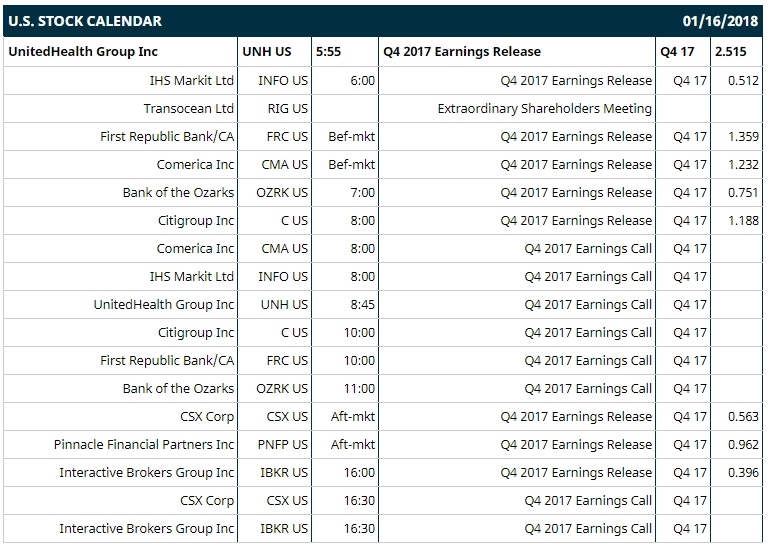

Notable Russell 1000 earnings reports today include: Citigroup (consensus $1.19), UnitedHealth Group (2.52), Comerica (1.23), CSX (0.56), Interactive Brokers (0.40).

U.S. IPO's scheduled to price today: none.

Equity conferences this week: Deutsche Bank Global Auto Industry Conference on Tue-Wed, Needham & Co. Growth Conference on Wed, ACI Future of Polyolefins Summit on Wed.

OVERNIGHT U.S. STOCK MOVERS

Campbell Soup (CPB -0.52%) was upgraded to 'Buy' from 'Hold' at Citigroup.

Gilead (GILD -0.05%) was upgraded to 'Outperform' from 'Market Perform' at Wells Fargo Securities with a price target of $96.

Northrop Grumman (NOC +1.81%) was upgraded to 'Outperform' from 'Market Perform' at Wells Fargo Securities with a price target of $360.

Qualcomm (QCOM -0.08%) was upgraded to 'Buy' from 'Neutral' at Nomura Instinet with a price target of $75.

Ciena (CIEN +0.27%) was upgraded to 'Buy' from 'Neutral' at Goldman Sachs.

Under Armour (UAA -1.18%) fell 2% in pre-market trading after it was downgraded to 'Underperform' from 'Neutral' at Macquarie with a price target of $8.

Viacom (VIAB +9.57%) was downgraded to 'Sell' from 'Neutral' at Rosenblatt Securities.

Atara Biotherapeutics (ATRA +27.54%) rose 2% in after-hours trading on top of the 28% it rallied during Friday's session on optimism in its "off-the-shelf" T-cell therapy.

Marvell Technology Group Ltd (MRVL +2.98%) was rated a new 'Buy' at William O'Neil & Co.

Inspired Entertainment (INSE +1.64%) may move lower this morning when it announced after the close of trading Friday that it will offer up to 21.2 million shares of its common stock for holders.

Kadmon Holdings (KDMN +9.30%) fell 4% in after-hours trading after it filed for up to $40 million in a controlled equity offering.

eGain (EGAN -2.56%) may move lower this morning when it announced after the close of trading Friday that it filed a $40 million common stock shelf.

MARKET COMMENTS

Mar S&P 500 E-mini stock futures (ESH18 +0.39%) this morning are up +11.50 points (+0.41%) at a new record nearest-futures high. Friday's closes: S&P 500 +0.67%, Dow Jones +0.89%, Nasdaq +0.75%. The S&P 500 on Friday rallied to a new record high and closed higher on signs of strength in the global economy after China Dec exports rose +10.9% y/y, stronger than expectations of +10.8% y/y, and on optimism that Q4 S&P 500 quarterly earnings results will surprise to the upside. Stocks were undercut by the U.S. Dec core CPI report of +0.3% m/m and +1.8% y/y, which was stronger than expectations of +0.2% m/m and +1.7% y/y and was hawkish for Fed policy.

Mar 10-year T-note prices (ZNH18 +0.13%) this morning are up +6 ticks. Friday's closes: TYH8 -6.00, FVH8 -4.75. Mar 10-year T-notes on Friday fell to a new contract low and closed lower on negative carry-over from a slump in 10-year German bunds to a 6-month low, and on the stronger-than-expected U.S. Dec core CPI report, which bolsters the case for additional Fed tightening.

The dollar index (DXY00 -0.35%) this morning is down -0.245 (-0.27%). EUR/USD (^EURUSD) is down -0.0037 (-0.30%) and USD/JPY (^USDJPY) is up +0.09 (+0.08%). Friday's closes: Dollar Index -0.878 (-0.96%), EUR/USD +0.0170 (+1.41%), USD/JPY -0.20 (-0.18%). The dollar index on Friday tumbled to a 3-year low and closed lower on strength in EUR/USD which soared to a 3-year high on reduced European political risks after German Chancellor Merkel reached a preliminary accord on a coalition government, and on strength in GBP/USD which rallied to a 1-1/2 year high after Spanish and Dutch finance ministers said they were working together for a deal for a soft Brexit that keeps Britain as close to the EU as possible.

Feb crude oil (CLG18 -0.45%) this morning is down -35 cents (-0.54%) and Feb gasoline (RBG18 -0.47%) is -0.0132(-0.71%). Friday's closes: Feb WTI crude +0.50 (+0.78%), Feb gasoline +0.0125 (+0.68%). Feb crude oil and gasoline on Friday closed higher on the slump in the dollar index to a 3-year low and on the rally in the S&P 500 to a new record high, which shows confidence in the economic outlook that is positive for energy demand.

Metals prices this morning are mixed with Feb gold (GCG18 +0.12%) +1.0 (+0.07%) at a new 4-month high, Mar silver (SIH18 -0.04%) -0.036 (-0.21%), and Mar copper (HGH18 -0.75%) -0.027 (-0.82%) at a 3-week low. Friday's closes: Feb gold +12.4 (+0.94%), Mar silver +0.175 (+1.03%), Mar copper -0.0145 (-0.45%). Metals on Friday settled mixed with Feb gold at a 4-month high. Metals prices were undercut by the rally in the S&P 500 to a new record high, which curbs the safe-haven demand for precious metals, and on the +6,998 MT increase in weekly Shanghai copper inventories to a 6-week high of 167,429 MT. The main bullish factor was the fall in the dollar index to a 3-year low.

Disclosure: None.