Morning Call For Tuesday, Jan. 31

OVERNIGHT MARKETS AND NEWS

Mar E-mini S&Ps (ESH17 -0.16%) are down -0.12%, led by weakness in energy producing stocks, with Mar WTI crude oil (CLH17 -0.19%) down -0.25% at a 1-week low. Crude prices are under pressure on expectations that tomorrow's weekly EIA data will show U.S. crude inventories rose +3.0 million bbl. European stocks are up +0.20% on signs of strength in the European economy after Q4 Eurozone GDP expanded at a stronger-than-expected +1.8% y/y pace and the Dec Eurozone unemployment rate unexpectedly fell to a 7-1/2 year low of 9.6%. Asian stocks settled lower: Japan -1.69%, Australia -0.72%, Singapore -0.59%, South Korea -0.88%, India -0.70%, Hong Kong, China and Taiwan all closed for holiday. Japanese stocks closed lower as they followed Monday's losses in U.S. and European equity markets. The BOJ, as expected, kept interest rates and its asset purchase target unchanged following today's policy meeting.

The dollar index (DXY00 -0.45%) is down -0.29%. EUR/USD (^EURUSD) is up +0.63% after Eurozone Jan CPI rose more than expected at the fastest pace in 3-3/4 years and after President Trump's trade advisor Navarro said that Germany is using a "grossly undervalued" euro to its trade advantage. USD/JPY (^USDJPY) is down -0.33%.

Mar 10-year T-note prices (ZNH17 +0.09%) are little changed, down -0.5 of a tick.

The Eurozone Dec unemployment rate unexpectedly fell -0.1 to 9.6%, better than expectations of no change at 9.8% and the lowest in 7-1/2 years.

The Eurozone Jan CPI estimate climbed +1.8% y/y, stronger than expectations of +1.5% y/y and the fastest pace of increase in 3-3/4 years. The Jan core CPI rose +0.9% y/y, right on expectations.

Eurozone Q4 GDP of +0.5% q/q and +1.8% y/y was slightly stronger than expectations of +0.5% q/q and +1.7% y/y.

Japan Dec industrial production rose +0.5% m/m, stronger than expectations of +0.3% m/m.

The Japan Dec jobless rate remained unch at 3.1%, right on expectations. The Dec job-to-applicant ratio rose +0.02 to 1.43, better than expectations of +0.01 to 1.42 and the highest in 25-1/3 years.

U.S. STOCK PREVIEW

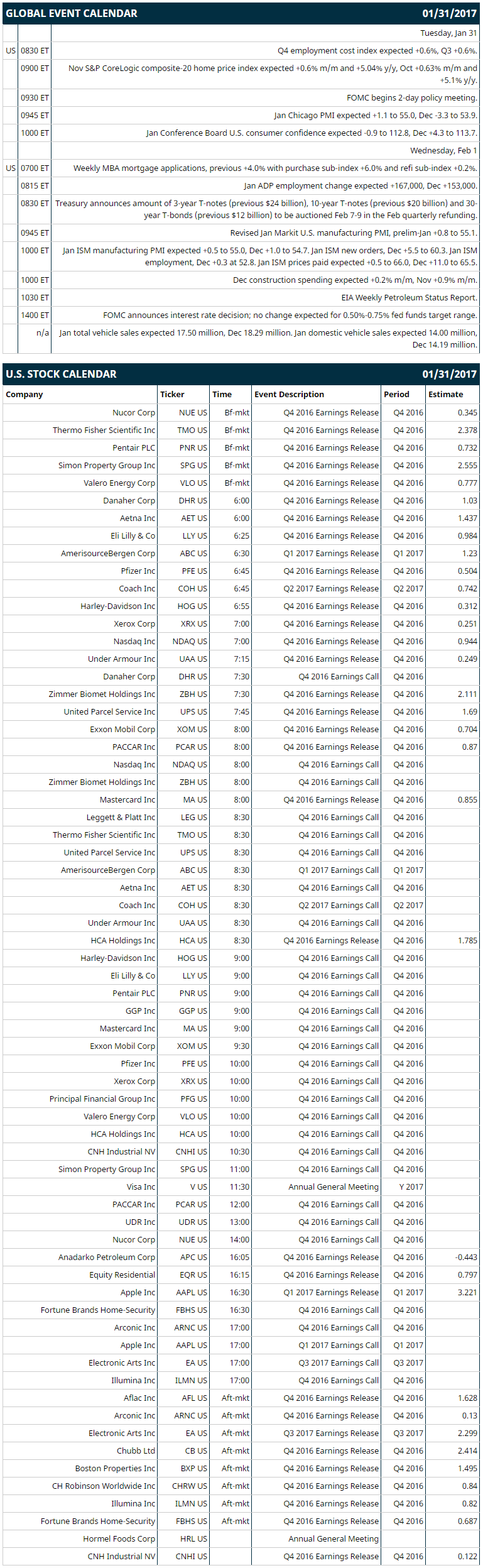

Key U.S. news today includes: (1) Q4 employment cost index (expected +0.6%, Q3 +0.6%), (2) Nov S&P CoreLogic composite-20 home price index (expected +0.6% m/m and +5.04% y/y, Oct +0.63% m/m and +5.1% y/y), (3) FOMC begins 2-day policy meeting, (4) Jan Chicago PMI (expected +1.1 to 55.0, Dec -3.3 to 53.9), (5) Jan Conference Board U.S. consumer confidence (expected -0.9 to 112.8, Dec +4.3 to 113.7).

Notable S&P 500 earnings reports today include: Apple (consensus $3.22), Mastercard (0.85), Exxon (0.70), UPS (1.69), Nasdaq (0.94), Harley-Davidson (0.31), Aetna (1.44), Valero (0.78).

U.S. IPO's scheduled to price today: Laureate Education (LAUR), Invitation Homes (INVH).

Equity conferences: none.

OVERNIGHT U.S. STOCK MOVERS

Buffalo Wild Wings (BWLD +0.81%) slid over 1% in pre-market trading after it was downgraded to 'Sell' from 'Underperform' at CLSA.

CBOE Holdings (CBOE +0.05%) was upgraded to 'Buy' from 'Underperform' at Bank of America/Merrill Lynch with a price target of $85.

T-Mobile US (TMUS -2.07%) was initiated a new 'Buy' at Evercore ISI with a price target of $72, citing the best organic growth prospects in the wireless industry and M&A potential.

Advanced Energy Industries (AEIS +0.40%) climbed 5% in after-hours trading after it reported Q4 adjusted EPS continuing operations of $1.06, well above consensus of 81 cents.

Teva Pharmaceutical Industries Ltd (TEVA -0.20%) sank 11% in after-hours trading after it lost a ruling that invalidated four patents on its top-selling multiple sclerosis drug Copaxone.

Graco (GGG -0.16%) climbed 2% in after-hours trading after it reported Q4 adjusted EPS of $1.00, well above consensus of 86 cents.

Integrated Device Technology (IDTI -0.45%) dropped 4% in after-hours trading after it said it expects Q4 revenue of $170-million-$180 million, at the low end of consensus of $179 million.

Werner Enterprises (WERN +0.91%) rallied 5% in after-hours trading after it reported Q4 EPS of 30 cents, better than consensus of 26 cents.

Sanmina (SANM +1.22%) jumped 8% in after-hours trading after it reported Q1 adjusted EPS of 75 cents, higher than consensus of 67 cents, and then said it sees Q2 adjusted EPS of 67 cents-72 cents, above consensus of 66 cents.

DHT holdings (DHT +7.96%) rose nearly 5% in after-hours trading after it reported Q4 Ebitda of $46.7 million, higher than consensus of $40.8 million.

Rambus (RMBS +0.65%) lost nearly 3% in after-hours trading after it forecast Q1 revenue of $93 million-$98 million, the midpoint below consensus of $95.7 million.

Greenbrier Cos (GBX -2.68%) fell over 4% in after-hours trading after it announced a $175 million offering of senior convertible notes due 2024,

Summit Midstream Partners LP (SMLP +0.97%) slid 4% in after-hours trading after it announced a secondary public offering of 4 million common units.

Roadrunner Transportations Systems (RRTS -1.70%) slumped over 12% in after-hours trading after it said it will amend its 2015 annual report and 2016 quarterly reports through Q3 after it found accounting errors it estimates will require adjustments to results of $20 million-$25 million.

MARKET COMMENTS

Mar E-mini S&Ps (ESH17 -0.16%) this morning are down -2.75 points (-0.12%). Monday's closes: S&P 500 -0.60%, Dow Jones -0.61%, Nasdaq -0.75%. The S&P 500 on Monday closed lower on the +0.3% increase in U.S. Dec personal income (slightly weaker than expectations of +0.4%) and on weakness in tech stocks on the potential for workforce disruption related to the Trump administration's immigration restrictions. In addition, energy producing stocks fell as crude oil fell -1.02%. A supportive factors was the +1.6% m/m increase in U.S. Dec pending home sales, stronger than expectations of +1.0% and biggest increase in 8 months.

Mar 10-year T-notes this morning (ZNH17 +0.09%) are down -0.5 of a tick. Monday's closes: TYH7 +1.50, FVH7 +0.75. Mar 10-year T-notes on Monday closed higher on increased safe-haven demand for T-notes after stocks sold off. Gains were limited by the strongest increase in U.S. Dec pending home sales in 8 months.

The dollar index (DXY00 -0.45%) this morning is down -0.29 (-0.29%). EUR/USD (^EURUSD) is up +0.0067 (+0.63%). USD/JPY (^USDJPY) is -0.37 (-0.33%). Monday's closes: Dollar index -0.1- (-0.10%), EUR/USD -0.0004 (-0.04%), USD/JPY -1.33 (-1.16%). The dollar index on Monday posted a 1-week high but shed its gains and closed lower. The dollar index was undercut by the sell-off in stocks, which boosted the safe-haven demand for the yen, and by concern about global reaction to the Trump administration's new immigration restrictions. The dollar was also undercut by the decline in U.S. T-note yields, which reduced the dollar's interest rate differentials. EUR/USD fell to a 1-week low after German Jan CPI rose less than expected.

Mar WTI crude oil prices (CLH17 -0.19%) this morning are down -13 cents (-0.25%) at a 1-week low and Mar gasoline (RBH17 +0.93%) is +0.0145 (+0.95%). Monday's closes: Mar crude -0.54 (-1.02%), Mar gasoline -0.0187 (-1.21%). Mar crude oil and gasoline on Monday closed lower with Mar gasoline at a 1-1/2 month low. Crude oil prices were undercut by negative carry-over from Friday’s data from Baker Hughes that showed U.S. active oil rigs rose by 16 in the week ended Jan 20 to a 14-1/2 month high of 566 rigs. In addition, the crack spread fell to a 2-month low, which may curb refinery demand for crude to refine into gasoline.

Disclosure: None.