Morning Call For Tuesday, Dec. 19

OVERNIGHT MARKETS AND NEWS

Mar E-mini S&Ps (ESH18 +0.06%) this morning are up +0.07% as the prospects of U.S. tax cuts buoys stocks. The House is scheduled to vote on the Republican tax-reform package today before its gets sent to the Senate for a vote. Gains in energy stocks are also boosting the overall market with Feb WTI crude oil (CLG18 +0.61%) up +0.52% as the Forties Pipeline System remains closed for repairs, which halts the delivery of 450,000 bpd of Brent crude oil from North Sea oil fields. European stocks are down -0.14% after a gauge of German business confidence fell more than expected. Asian stocks settled mixed: Japan -0.15%, Hong Kong +0.70%, China +0.88%, Taiwan -0.37%, Australia +0.54%, Singapore -0.30%, South Korea +0.05%, India +0.70%. India's S&P BSE Sensex Stock Index climbed to a record high on speculation Prime Minister Modi's government will take steps to boost jobs and incomes in rural India after Modi's party won by a slim margin in the Gujarat state elections.

The dollar index (DXY00 -0.15%) is down -0.12%. EUR/USD (^EURUSD) is up +0.31%. USD/JPY (^USDJPY) is unchanged.

Mar 10-year T-note prices (ZNH18 -0.03%) are unchanged.

ECB Governing Council member Hansson said it's important for the ECB to move gradually when adjusting policy guidance as wage growth and price growth remain slow.

The German Dec IFO business climate unexpectedly fell -0.4 to 117.6, weaker than expectations of no change at 117.5.

Eurozone Q3 labor costs rose +1.6% y/y, weaker than the +1.8% y/y increase from Q2.

Eurozone Oct construction output fell -0.4% m/m, the first decline in 7 months.

U.S. STOCK PREVIEW

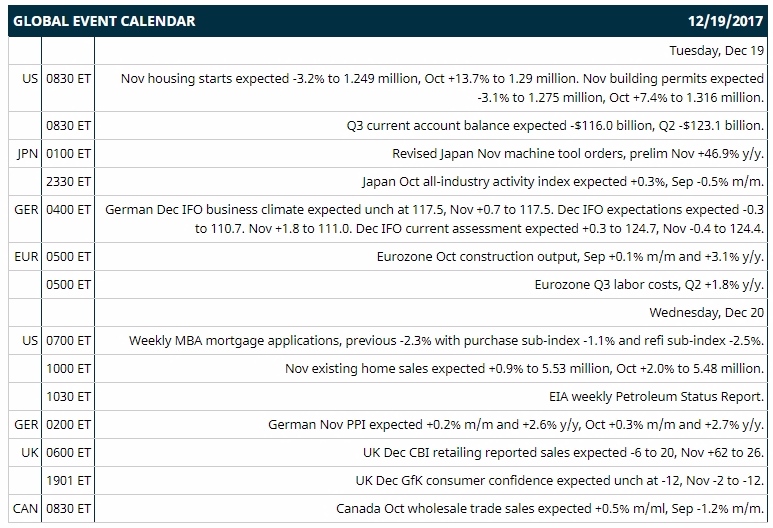

Key U.S. news today includes: (1) Nov housing starts (expected -3.2% to 1.249 million, Oct +13.7% to 1.29 million), (2) Q3 current account balance (expected -$116.0 billion, Q2 -$123.1 billion).

Notable Russell 1000 earnings reports today include: FedEx (consensus $2.89), Micron Technology (2.20), FactSet (1.97), Darden Restaurants (0.70), Red Hat (0.70), Carnival (0.51).

U.S. IPO's scheduled to price today: Adail Pharmaceuticals (ADIL), Hancock Jaffe Laboratories (HJLI), Advantage Insurance (AVI).

Equity conferences this week: none.

OVERNIGHT U.S. STOCK MOVERS

Darden Restaurants (DRI +2.41%) may move higher this morning after it reported Q2 comparable sales rose +3.1%, better than consensus of +1.3%, and then said it sees full-year adjusted EPS of $4.45 to $4.53, higher than consensus of $4.44.

Cimarex (XEC +1.18%) was initiated with a recommendation of 'Outperform' at Baird with a 12-month target price of $137.

Macerich (MAC +0.31%) was upgraded to 'Outperform' from 'Market Perform' at Wells Fargo Securities with a price target of $72.50.

Aerie Pharmaceuticals (AERI -1.19%) lost 2% in after-hours trading after it said it will launch the use of its Rhopressa for treatment of elevated intraocular pressure in patients with open-angle glaucoma or ocular hypertension by mid-Q2, later than an earlier projection of late-Feb.

Michael Kors (KORS +2.50%) was initiated with a 'Buy' recommendation at Needham & Co with a 12-month target price of $69.

Mindbody (MB +1.09%) fell over 1% in after-hours trading after 8 holders of the stock were offering 1.76 million of the shares via Morgan Stanley.

Agree Realty (ADC +1.93%) was upgraded to 'Outperform' from 'Market Perform' at Wells Fargo Securities with a price target of $56.

Sucampo Pharmaceuticals (SCMP -1.47%) jumped nearly 6% in after-hours trading after Nomura Instinet initiated a 'Buy' recommendation of Sucampo with a 12-month target price of $43.

National Storage Affiliates Trust (NSA +2.48%) was upgraded to 'Outperform' from 'Market Perform' at Wells Fargo Securities with a price target of $30.

Akebia Therapeutics (AKBA +1.33%) was initiated with a recommendation of 'Overweight' at Piper Jaffray with a 12-month target price of $26.

City Office REIT (CIO +0.31%) lost almost 4% in after-hours trading after it announced it had commenced an underwritten public offering of 4 million shares of its common stock.

Kratos Defense & Security Solutions (KTOS unch) gained nearly 2% in after-hours trading after it received a contract from a U.S. government agency related to unmanned drone systems with a $27 million ceiling.

McDermott International (MDR +2.15%) lost slid more than 1% in after-hours trading after it said it will merge with Chicago Bridge & Iron where shareholders of McDermott will control 53% of the resulting company and the rest going to Chicago Bridge & Iron investors.

MARKET COMMENTS

Mar S&P 500 E-mini stock futures (ESH18 +0.06%) this morning are up +2.00 points (+0.07%). Monday's closes: S&P 500 +0.54%, Dow Jones +0.57%, Nasdaq +0.73%. The S&P 500 on Monday rallied to a new record high and closed higher on optimism that Congress will pass tax reform legislation this week that cuts corporate taxes and boosts earnings. Stocks were also boosted by the unexpected +5 point increase in the U.S. Dec NAHB housing market index to an 18-1/3 year high of 74, stronger than expectations of unch at 70.

Mar 10-year T-note prices (ZNH18 -0.03%) this morning are unch. Monday's closes: TYH8 -6.00, FVH8 -0.75. Mar T-notes on Monday closed lower on the near-certain prospects for passage of tax reform and the unexpected increase in the U.S. Dec NAHB housing market index to an 18-1/3 year high.

The dollar index (DXY00 -0.15%) this morning is down -0.115 (-0.12%). EUR/USD (^EURUSD) is up +0.0036 (+0.31%) and USD/JPY (^USDJPY) is unch. Monday's closes: Dollar Index -0.237 (-0.25%), EUR/USD -0.0029 (-0.25%), USD/JPY +0.21 (+0.19%). The dollar index on Monday closed lower on strength in EUR/USD on hawkish comments from ECB Governing Council member Liikanen who said the strong recovery in the Eurozone supports inflation converging towards the ECB's target. There was also weakness in USD/JPY after Japan Nov exports rose more than expected, which shows strength in Japan's economy and is hawkish for BOJ monetary policy and supportive for the yen.

Feb crude oil (CLG18 +0.61%) this morning is up +30 cent s(+0.52%) and Feb gasoline (RBG18 +0.46%) is +0.0061 (+0.36%). Monday's closes: Feb WTI crude -0.14 (-0.24%), Feb gasoline +0.0177 (+1.07%). Feb crude oil and gasoline on Monday settled mixed. Crude oil prices were boosted by a weaker dollar and the ongoing closure of the Forties Pipeline System that has underpinned Brent crude prices. Crude oil prices were undercut by the EIA's monthly Drilling Productivity Report that projects U.S. Jan shale oil output will climb +94,000 bpd to 6.4 million bpd.

Metals prices this morning are mixed with Feb gold (GCG18 +0.23%) +1.1 (+0.09%) at a 1-1/2 week high, Mar silver (SIH18+0.34%) +0.015 (+0.09%) at a 2-week high and Mar copper (HGH18 -0.52%) -0.019 (-0.59%). Monday's closes: Feb gold +8.0 (+0.64%), Mar silver +0.142 (+0.88%), Mar copper +0.0115 (+0.37%). Metals on Monday closed higher with Feb gold and Mar silver at 1-week highs and Mar copper at a 2-1/2 week high. Metals prices were boosted by a weaker dollar and by the jump in the U.S. Dec NAHB housing market index to an 18-1/3 year high, which is supportive for copper demand.

Disclosure: None.