Morning Call For Tuesday, August 22

OVERNIGHT MARKETS AND NEWS

Sep E-mini S&Ps (ESU17 +0.13%) this morning are up +0.07% and European stocks are up +0.47%, led by a rally in mining stocks, as Sep COMEX copper (HGU17 +0.70%) climbs +0.67% to a new 2-3/4 year nearest-futures high. Gains in European stocks were limited after a gauge of German investor confidence fell to a 10-month low. The German Aug ZEW survey expectations of economic growth fell -7.5 to 10.0, weaker than expectations of -2.5 to 15.0, amid concern that the diesel scandal at Volkswagen AG along with recent strength in EUR/USD will weigh on the German economy, Europe's largest. Asian stocks settled mostly higher: Japan -0.05%, Hong Kong +0.91%, China +0.10%, Taiwan +0.64%, Australia +0.42%, Singapore +0.52%, South Korea +0.39%, India +0.11%. China's Shanghai Composite erased early losses and rose to a 2-1/2 week high on optimism that Chinese insurance stocks and pharmaceutical companies will report better-than-expected quarterly earnings results. Japan's Nikkei Stock Index fell to a new 3-1/2 month low on a lack of support for stocks in the Nikkei Stock Index as the BOJ has said it will reduce investments in the Nikkei Stock Index and buy more exchange-traded funds tracking the Topix index.

The dollar index (DXY00 +0.43%) is up +0.45%. EUR/USD (^EURUSD) is down -0.55% on the weaker-than-expected German Aug ZEW survey. USD/JPY (^USDJPY) is up +0.32%.

Sep 10-year T-note prices (ZNU17 -0.16%) are down -5 ticks.

The German Aug ZEW survey expectations of economic growth fell -7.5 to 10.0, weaker than expectations of -2.5 to 15.0 and a 10-month low.

UK Jul public sector net borrowing unexpectedly fell -0.8 billion pounds, weaker than expectations of +0.3 billion pounds and the first decline in 5 months.

U.S. STOCK PREVIEW

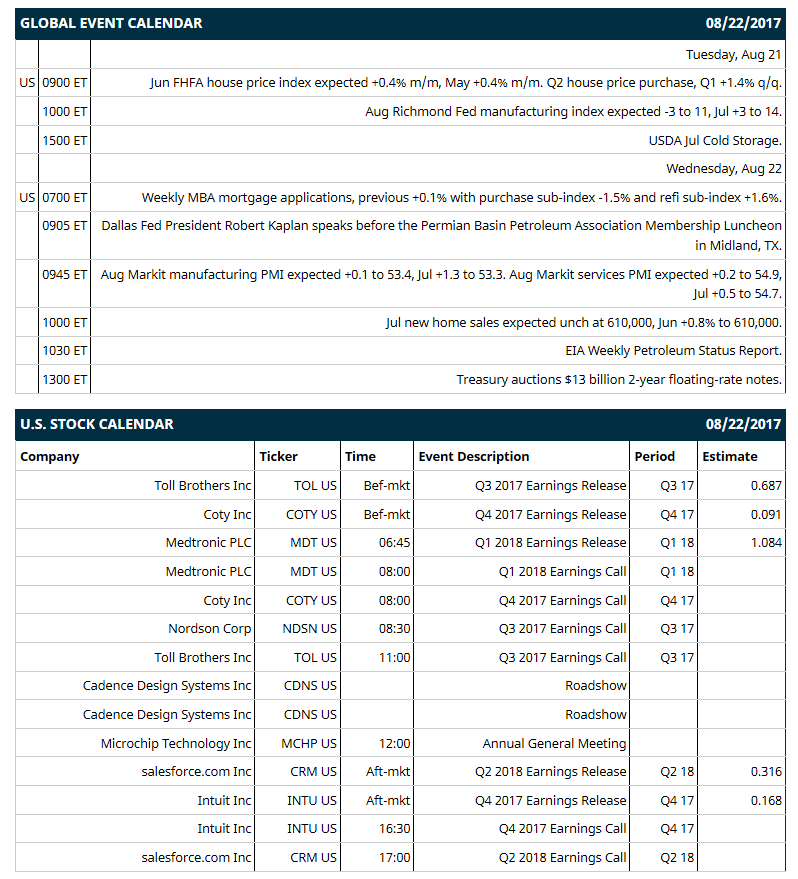

Key U.S. news today includes: (1) Jun FHFA house price index (expected +0.4% m/m, May +0.4% m/m), (2) Aug Richmond Fed manufacturing index (expected -3 to 11, Jul +3 to 14), (3) USDA Jul Cold Storage.

Notable Russell 1000 earnings reports today include: Toll Brothers (consensus $0.69), Coty (0.09), Medtronics (1.08), salesforce.com (0.32), Intuit (0.17).

U.S. IPO's scheduled to price today: none.

Equity conferences this week: Bank of America Merrill Lynch Industrial, Energy and Infrastructure Conference on Tue, CFA Society of Minnesota Intellisight Conference on Tue-Wed, Healthcare Information & Management Systems Society Southeast Summit on Wed, Heikkinen Energy Conference on Wed, Raymond James SMID Cap Growth Conference on Wed, Southern California Investor Conference on Thu.

OVERNIGHT U.S. STOCK MOVERS

Alibaba (BABA +1.04%) was upgraded to 'Overweight' from 'Neutral' at Atlantic Equities LLP with a price target of $215.

VMware (VMW +0.77%) was upgraded to 'Buy' from 'Hold' at Deutsche Bank.

Tempur Sealy (TPX +0.39%) was upgraded to 'Buy' from 'Hold' a Stifel with a price target of $80.

Hain Celestial (HAIN +0.24%) was downgraded to'Neutral' from 'Positive' at Susquehanna Financial.

Inversora Carso reported a 5.1% passive stake in PBF Logistics (PBFX -0.24%) .

Estee Lauder (EL +0.53%) was upgraded to 'Buy' from 'Hold' at Argus with a price target of $125.

BHP Billiton Ltd (BHP +1.26%) reported full-year underlying profit of $6.7 billion, weaker than consensus of $7.3 billion, and said it was pursuing options to exit onshore U.S. assets.

Nordson (NDSN +0.80%) sank 10% in after-hours trading after it forecast Q4 EPS of $1.18 to $1.32, well below consensus of $1.51.

Fabrinet (FN -0.65%) fell nearly 4% in after-hours trading after it forecast Q1 revenue of $356 million-$360 million, below consensus of $375.6 million.

Zayo Group Holdings (ZAYO -0.24%) dropped over 3% in after-hours trading after it reported Q4 adjusted Ebitda of $310.8 million, below consensus of $314.7 million.

Premier Inc. (PINC -0.49%) slid over 2% in after-hours trading after it reported Q4 adjusted EPS of 50 cents, below consensus of 52 cents, and then said it sees full-year adjusted EPS of $1.98 to $2.09, weaker than consensus of $2.11.

Tarena International (TEDU +3.27%) lost over 3% in after-hours trading after it cut its full-year revenue forecast to 1.92 to 2-billion yuan from a May 22 estimate of 1.99 to 2.07 billion yuan.

Global Medical Reit (GMRE -1.75%) was downgraded to 'Neutral' from 'Buy' at D.A. Davidson.

MARKET COMMENTS

Sep S&P 500 E-mini stock futures (ESU17 +0.13%) this morning are up +1.75 points (+0.07%). Monday's closes: S&P 500 +0.12, Dow Jones +0.13%, Nasdaq -0.08%. The S&P 500 on Monday posted a 1-1/4 month low, but recovered its losses and closed slightly higher. Stocks were supported by strength in mining stocks after the price of copper rose +1.39% to a 2-3/4 year high. There was also optimism about the global economic outlook after the Bundesbank in its monthly report said, "the German economy may grow more strongly this year than was expected in June forecasts." Energy stocks were undercut by the -2.32% sell-off in crude oil prices.

Sep 10-year T-note prices (ZNU17 -0.16%) this morning are down -5 ticks. Monday's closes: TYU7 +3.00, FVU7 +2.25. Sep 10-year T-notes on Monday closed higher on the weaker-than-expected Jul Chicago Fed national activity index (-0.17 to -0.01 versus expectations of -0.03 to 0.10) and on the decline in inflation expectations after the 10-year T-note breakeven inflation rate tumbled to a 1-month low.

The dollar index (DXY00 +0.43%) this morning is up +0.422 (+0.45%). EUR/USD (^EURUSD) is down -0.0065 (-0.55%) and USD/JPY (^USDJPY) is up +0.35 (+0.32%). Monday's closes: Dollar Index -0.339 (-0.36%), EUR/USD +0.0054 (+0.46%), USD/JPY -0.20 (-0.18%). The dollar index on Monday fell to a 1-week low and closed lower on the weaker-than-expected Jul Chicago Fed national activity index and on strength in EUR/USD after the Bundesbank's monthly report stated that "the German economy may grow more strongly this year than was expected in June forecasts."

Oct crude oil (CLV17 +0.04%) this morning is up +2 cents (+0.04%) and Oct gasoline (RBV17 +0.01%) is +0.0023 (+0.15%). Monday's closes: Oct WTI crude -1.13 (-2.22%), Oct gasoline -0.0370 (-2.41%). Oct crude oil and gasoline on Monday closed lower on the fall in the S&P 500 to a new 1-1/4 month high and on concern that the global oil glut will persist after last Wednesday's EIA data showed U.S. crude production rose to a 2-year high.

Metals prices this morning are mixed with Dec gold (GCZ17 -0.46%) -4.9 (-0.38%), Sep silver (SIU17 -0.26%) -0.015 (-0.09%) and Sep copper (HGU17 +0.70%) +0.020 (+0.67%) at a new 2-3/4 nearest-futures high. Monday's closes: Dec gold +5.1 (+0.39%), Sep silver +0.015 (+0.09%), Sep copper +0.0410 (+1.39%). Metals on Monday closed higher with Sep copper at a new 2-3/4 year nearest-futures high. Metals prices were boosted by the fall in the dollar index to a 1-week low and by signs of tighter copper supplies after LME copper inventories fell -9,650 MT to a 1-1/2 month low of 261,700 MT.

(Click on image to enlarge)

Disclosure: None.