Morning Call For Tuesday, August 15

OVERNIGHT MARKETS AND NEWS

Sep E-mini S&Ps (ESU17 +0.26%) this morning are up +0.20% and European stocks are up +0.40% as tensions between the U.S. and North Korea wane, which is fueling gains in global equity markets. The VIX volatility index fell for a third day and Dec COMEX gold prices (GCZ17 -0.81%) declined -0.81% on reduced safe-haven demand after a North Korean media report signaled that North Korean President Kim Jong Un had decided not to launch missiles toward Guam. Gains in European stocks were contained after German Q2 GDP expanded at a slower than expected pace, while weakness in energy stocks limited the upside in U.S. markets as Sep WTI crude oil (CLU17 -0.46%) slid -0.38% to a 3-week low. GBP/USD fell -0.69% to a 1-month low on weaker-than-expected UK Jul CPI, which may keep the BOE from tapering its QE program. Asian stocks settled mostly higher: Japan +1.11%, Hong Kong -0.28%, China +0.43%, Taiwan +0.84%, Australia +0.47%, Singapore -0.42%, South Korea and India closed for holiday. Chinese stocks also found support on stronger-than-expected China Jul aggregate financing, the broadest measure of credit, and Japanese exporters led gains in the Nikkei Stock Index as USD/JPY rose for a second day.

The dollar index (DXY00 +0.36%) is up +0.34%. EUR/USD (^EURUSD) is down -0.21%. USD/JPY (^USDJPY) is up +0.71%.

Sep 10-year T-note prices (ZNU17 -0.22%) are down -9 ticks.

German Q2 GDP rose +0.6% q/q, weaker than expectations of +0.7% q/q.

UK Jul CPI of -0.1% m/m and +2.6% y/y was weaker than expectations of unch m/m and +2.7% y/y. Jul core CPI rose +2.4% y/y, weaker than expectations of +2.5% y/y.

China Jul new yuan loans rose 825.5 billion yuan, stronger than expectations of +800.0 billion yuan. Jul aggregate financing increased by 1.22 trillion yuan, stronger than expectations of 1.00 trillion yuan.

U.S. STOCK PREVIEW

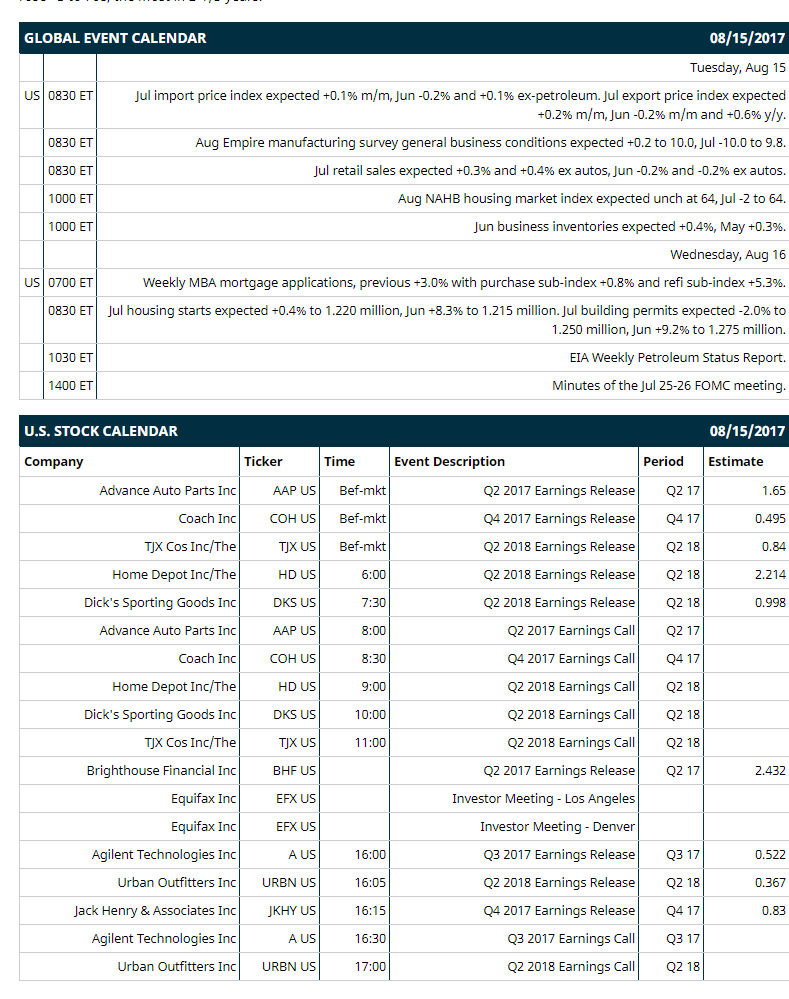

Key U.S. news today includes: (1) Jul import price index (expected +0.1% m/m, Jun -0.2% and +0.1% ex-petroleum), Jul export price index (expected +0.2% m/m, Jun -0.2% m/m and +0.6% y/y), (2) Aug Empire manufacturing survey general business conditions (expected +0.2 to 10.0, Jul -10.0 to 9.8), (3) Jul retail sales (expected +0.3% and +0.4% ex autos, Jun -0.2% and -0.2% ex autos), (4) Aug NAHB housing market index (expected unch at 64, Jul -2 to 64), (5) Jun business inventories (expected +0.4%, May +0.3%).

Notable Russell 1000 earnings reports today include: Advance Auto Parts (consensus $1.65), Coach $0.50, TJX Cos $0.84, Home Depot $2.21, Dick's Sporting Goods $1.00, Brighthouse Financial $2.43, Agilent Technologies $0.52, Urban Outfitters $0.37, Jack Henry & Associates $0.83.

U.S. IPO's scheduled to price today: Capitol Investment Co.

Equity conferences this week: D. A. Davidson & Co Technology Forum on Tue, Nomura Holdings Inc Instinet Media Telecom Conference on Tue, Citi Insurance & Asset Managers Forum on Wed, Barclays Kohler Conference on Wed, Wedbush Pacgrow Health Care Conference on Wed.

OVERNIGHT U.S. STOCK MOVERS

Home Depot (HD -0.40%) rose nearly 2% in pre-market trading after it reported Q2 EPS of $2.25, better than consensus of $2.21, and then raised guidance on full-year EPS to $7.29 from a prior view of $7.15.

American Eagle Outfitters (AEO -2.32%) was upgraded to 'Buy' from 'Market Perform' at FBR Capital Markets with a 12-month target price of $13.

NetApp (NTAP +1.30%) was upgraded to 'Buy' from 'Neutral' at Longbow Research with a 12-month target price of $50.

Wynn Resorts Ltd (WYNN +2.03%) was upgraded to 'Buy' from 'Hold' at Deutsche Bank.

Targa Resources (TRGP -1.31%) was upgraded to 'Buy' from 'Neutral' at Guggenheim Securities with a 12-month target price of $50.

Synchrony Financial (SYF +1.51%) climbed nearly 5% in after-hours trading after Berkshire Hathaway reported that it increased its stake in SYF to $520 million in Q2.

FibroGen (FGEN +5.76%) lost over 2% in after-hours trading after it announced that it intends to offer and sell up to $300 million of its common stock in an underwritten follow-on offering.

Allscripts Healthcare Solutions (MDRX +0.47%) gained 1% in after-hours trading after it was upgraded to 'Overweight' from 'Neutral' at Cantor Fitzgerald with a price target of $17.

Omeros (OMER +4.95%) dropped nearly 5% in after-hours trading after it filed to sell 3 million shares of its common stock in a secondary public offering.

Pandora Media (P -0.12%) rose 4% in after-hours trading after it named Sling TV CEO Roger Lynch as CEO and board member effective September 18.

Extreme Networks (EXTR +8.00%) jumped 10% in after-hours trading after it reported Q4 adjusted EPS of 17 cents, above consensus of 15 cents.

Photronics (PLAB +3.68%) plunged 16% in after-hours trading after it reported Q3 revenue of $111.6 million, below consensus of $115.2 million, and then said it sees Q4 revenue of $108 million-$116 million, weaker than expectations of $124.2 million.

MARKET COMMENTS

Sep S&P 500 E-mini stock futures (ESU17 +0.26%) this morning are up +5.00 points (+0.20%). Monday's closes: S&P 500 +1.00, Dow Jones +0.62%, Nasdaq +1.31%. The S&P 500 on Monday closed sharply higher on reduced market volatility after the VIX volatility index plunged when North Korean geopolitical risks subsided. Another supportive factor was signs of strength in the Japanese economy that benefits global growth after Japan Q2 GDP rose +4.0% (q/q annualized), stronger than expectations of +2.5% (q/q annualized) and the fastest pace of growth in over 2-years. A bearish factor was weakness in energy producers after crude oil prices fell -2.52%.

Sep 10-year T-note prices (ZNU17 -0.22%) this morning are down -9 ticks. Monday's closes: TYU7 -8.50, FVU7 -4.75. Sep 10-year T-notes on Monday closed lower on reduced safe-haven demand for T-notes as the stock market rallied sharply after North Korean tensions eased, and on signs of stronger global economic growth that may prompt the Fed to raise interest rates and the BOJ to taper QE after Japan Q2 GDP expanded at a +4.0% (q/q annualized) pace, the fastest pace of growth in over 2-years.

The dollar index (DXY00 +0.36%) this morning is up +0.318 (+0.34%). EUR/USD (^EURUSD) is down -0.0025 (-0.21%) and USD/JPY (^USDJPY) is up +0.78 (+0.71%). Monday's closes: Dollar Index +0.342 (+0.37%), EUR/USD -0.0041 (-0.35%), USD/JPY +0.44 (+0.40%). The dollar index on Monday closed higher due to weakness in EUR/USD after Eurozone Jun industrial production fell -0.6% m/m, the biggest decline in 6 months, and on the increase in 10-year T-note yields, which improves the dollar's interest rate differentials.

Sep crude oil (CLU17 -0.46%) this morning is down -18 cents (-0.38%) at a 3-week low. Sep gasoline (RBU17 -0.15%) is unch. Monday's closes: Sep WTI crude -1.23 (-2.52%), Sep gasoline -0.0363 (-2.25%). Sep crude oil and gasoline on Monday fell to 2-1/2 week lows and closed lower due to a stronger dollar, and slack Chinese crude demand after China Jul crude processing fell -4.4% to 10.76 million bpd, the smallest amount of crude processed in 10-months. Another bearish factor was negative carry-over from Friday's data from Baker Hughes that showed U.S. active oil rigs in the week ended Aug 11 rose +3 to 768, the most in 2-1/3 years.

Disclosure: None.