Morning Call For Tuesday, April 25

OVERNIGHT MARKETS AND NEWS

Jun E-mini S&Ps (ESM17 +0.17%) this morning are up +0.17% and European stocks are up +0.19% at a 20-month high on positive carry-over from Sunday's presidential elections in France. The results of the election have reduced market uncertainty as pro-EU candidate Macron holds a substantial lead in the polls ahead of France's May 7 runoff election against anti-EU candidate Le Pen for the French presidency. The easing of political risks in Europe has fueled a slide in the VIX volatility index to a 2-1/2 month low, which is supporting gains in equities. The markets will digest quarterly earnings results today from some 45 companies in the S&P 500. Asian stocks settled higher: Japan +1.08%, Hong Kong +1.31%, China +0.16%, Taiwan +1.27%, Australia closed for holiday, Singapore +0.63%, South Korea +1.22%, India +0.97%. Japan's Nikkei Stock Index rallied to a 3-week high on signs that the BOJ, which meets tomorrow and Thursday, will continue its QE program after BOJ Deputy Governor Iwata said the BOJ will continue with policies to reach its 2% CPI target and that it is too early to talk about exit from its monetary easing program.

The dollar index (DXY00 -0.04%) is down -0.05%. EUR/USD (^EURUSD) is up +0.11%. USD/JPY (^USDJPY) is up +0.60%.

Jun 10-year T-note prices (ZNM17 -0.19%) are down -7.5 ticks as a sell-off in 10-year German bund prices to a 3-1/2 week low undercuts T-notes.

U.S. STOCK PREVIEW

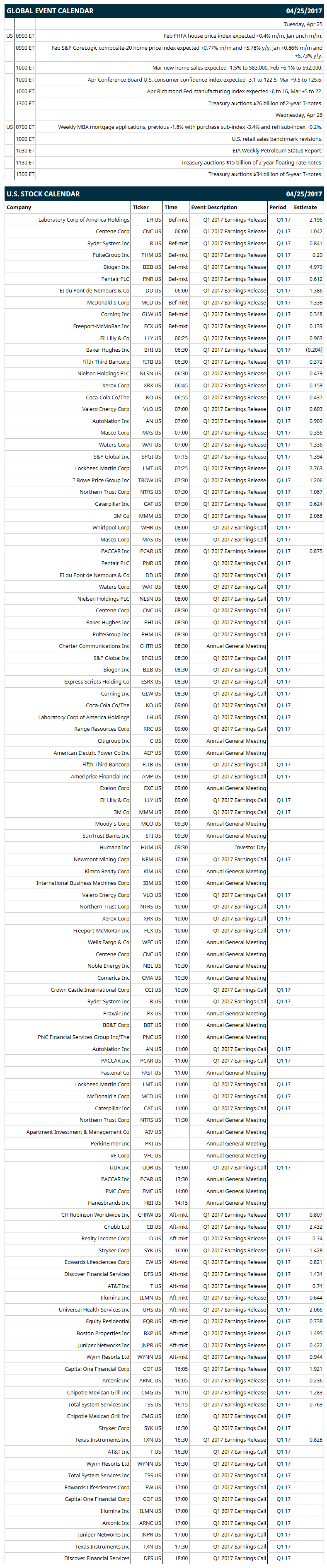

Key U.S. news today includes: (1) Feb FHFA house price index (expected +0.4% m/m, Jan unch m/m), (2) Feb S&P CoreLogic composite-20 home price index (expected +0.77% m/m and +5.78% y/y, Jan +0.86% m/m and +5.73% y/y), (3) Mar new home sales (expected -1.5% to 583,000, Feb +6.1% to 592,000), (4) Apr Conference Board U.S. consumer confidence index (expected -3.1 to 122.5, Mar +9.5 to 125.6), (5) Apr Richmond Fed manufacturing index (expected -6 to 16, Mar +5 to 22), (6) Treasury auctions $26 billion of 2-year T-notes.

Notable S&P 500 earnings reports today include: AT&T (consensus $0.74), Capital One (1.92), Caterpillar (0.62), McDonald's (1.34), Coca-Cola (0.44), Lockheed Martin (2.76), Baker Hughes (-0.20), PulteGroup (0.29).

U.S. IPO's scheduled to price today: Floor & Decor Holdings (FND).

Equity conferences: Capital Link's Closed-End Funds & Global ETFs Forum on Thu, Burkenroad Reports l Investment Conference on Fri.

OVERNIGHT U.S. STOCK MOVERS

JPMorgan Chase (JPM +3.53%) was upgraded to 'Buy' from 'Neutral' at Guggenheim with a price target of $96.

Humana (HUM +0.04%) climbed nearly 3% in after-hours trading after it raised guidance on 2017 adjusted EPS to at least $11.10 from a February 14 estimate of $10.80-$11.00.

Whirlpool (WHR +1.92%) lost 2% in after-hours trading after it reported Q1 adjusted EPS of $2.50, weaker than consensus of $2.65, and then lowered guidance on full-year EPS to $14.75-$15.50 from a January 26 estimate of $15.25-$16.25.

Express Scripts (ESRX +1.19%) plunged 12% in after-hours trading after it said its biggest customer, health insurer Anthem, is unlikely to renew its contract when it expires in 2109 following claims by Anthem that Express Scripts overcharged it by billions of dollars. Competitor CVS Health (CVS +0.97%) rose nearly 2% in after-hours trading after the news.

Alcoa (AA +5.08%) gained 2% in after-hours trading after it reported Q1 adjusted EPS of 63 cents, better than consensus of 48 cents.

Cadence Design Systems (CDNS +1.82%) dropped almost 5% in after-hours trading after it said it sees Q2 adjusted EPS of 31 cents-33 cents, below consensus of 34 cents.

U.S. Silica Holdings (SLCA +2.57%) rallied over 4% in after-hours trading after it reported Q1 adjusted EPS of 9 cents, better than consensus of 6 cents.

Canadian National Railway (CNI +1.26%) lost over 1% in after-hours trading after it reported Q1 revenue of C$3.21 billion, below consensus of C$3.23 billion.

Range Resources (RRC -0.87%) rose nearly 3% in after-hours trading after it reported Q1 adjusted EPS of 25 cents, higher than consensus of 19 cents.

Zions Bancorporation (ZION +2.72%) fell almost 2% in after-hours trading after CEO Simmons said Q1 loan growth was "lackluster" and Q1 operating costs were "seasonally higher."

Sanmina (SANM +3.50%) rose nearly 3% in after-hours trading after it said it sees Q3 adjusted EPS of 72 cents-77 cents, above consensus of 72 cents.

Barrick Gold (ABX -0.99%) fell nearly 3% in after-hours trading after it reported Q1 adjusted EPS of 14 cents, below consensus of 21 cents.

Unisys (UIS +1.83%) jumped over 10% in after-hours trading after it reported Q1 adjusted EPS of 30 cents, well above consensus of 22 cents.

Karyopharm Therapeutics (KPTI unch) slid nearly 4% in after-hours trading after it announced that it was commencing a registered underwritten public offering of $40 million in shares of its common stock.

MARKET COMMENTS

Jun E-mini S&Ps (ESM17 +0.17%) this morning are up +4.00 points (+0.17%). Monday's closes: S&P 500 +1.08%, Dow Jones +1.05%, Nasdaq +1.21%. The S&P 500 on Monday gapped up to a 2-week high and settled higher on carry-over support from the surge in European stocks to a 1-1/2 year high after Sunday's first round of presidential elections left pro-EU candidate Macron in a good position to beat anti-EU candidate Le Pen in the May 7 run-off election. Stocks were also boosted by anticipation that the Trump administration will release an outline of its tax plan on Wednesday. Stocks came off their best levels after the Mar Chicago Fed national activity index unexpectedly fell -0.19 to 0.08, weaker than expectations of +0.16 to 0.50.

Jun 10-year T-notes (ZNM17 -0.19%) this morning are down -7.5 ticks. Monday's closes: TYM7 -8.50, FVM7 -6.50. Jun 10-year T-notes on Monday gapped lower, posted a 1-1/2 week low, and closed lower. T-note prices were undercut by reduced safe-haven demand as world stocks rally and as centrist-Macron has a good chance of beating anti-EU candidate Le Pen in the May run-off election for French president. T-notes were also undercut by an increase in inflation expectations after the 10-year T-note breakeven rate jumped to a 1-week high.

The dollar index (DXY00 -0.04%) this morning is down -0.053 (-0.05%). EUR/USD (^EURUSD) is up +0.0012 (+0.11%) and USD/JPY (^USDJPY) is up +0.66 (+0.60%). Monday's closes: Dollar index -0.885 (-0.89%), EUR/USD +0.0140 (+1.30%), USD/JPY +0.68 (+0.62%). The dollar index on Monday tumbled to a 5-1/2 month low and closed lower on strength in EUR/USD which rose to a 5-1/2 month after political risks eased in Europe as pro-EU candidate Macron is now favored to beat anti-EU candidate Le Pen in the May 7 French presidential election.

Jun WTI crude oil prices (CLM17 +0.14%) this morning are up +15 cents (+0.30%) and Jun gasoline (RBM17 -0.33%) is -0.0020 (-0.12%). Monday's closes: Jun crude -0.39 (-0.79%), Jun gasoline -0.0195 (-1.19%). Jun crude oil and gasoline on Monday sold off to 3-week lows and closed lower on negative carry-over from Friday's data from Baker Hughes that showed that U.S. active oil rigs rose +5 to a 2-year high of 688 rigs. Crude oil prices were also boosted by the slide in the crack spread to a 3-session low, which may lead to a decrease in refinery demand for crude oil to refine into gasoline. Losses were contained as the dollar index fell to a 5-1/2 month low.

(Click on image to enlarge)

Disclosure: None.