Morning Call For Thursday, Sept. 14

OVERNIGHT MARKETS AND NEWS

Dec E-mini S&Ps (ESZ17 -0.06%) this morning are down -0.05% and European stocks are down -0.15% as signs of cooling in the Chinese economy undercut global stocks. Commodities and base metals fell after China Aug industrial production grew at a +6.0% y/y pace, the slowest this year, which pushed Dec COMEX copper prices (HGZ17 -1.41%) down -1.39% to a 3-1/2 week low and dragged mining stocks lower. Losses in the overall market were contained as energy stocks rose with Oct WTI crude oil (CLV17 +0.99%) up +0.71% at a 5-week high after OPEC data showed its compliance with production cuts rose to 96% in Aug from 91% in Jul. As expected, the BOE in a 7-2 vote kept its benchmark interest rate at 0.25% and maintained its asset purchase target at 435 billion pounds, but said it sees scope for stimulus reduction in the coming months. Asian stocks settled mixed: Japan -0.29%, Hong Kong -0.42%, China -0.38%, Taiwan +0.20%, Australia -0.10%, Singapore -0.29%, South Korea +0.81%, India +0.17%.

The dollar index (DXY00 -0.15%) is down -0.21%. EUR/USD (^EURUSD) is up +0.09%. USD/JPY (^USDJPY) is up +0.01%.

Dec 10-year T-note prices (ZNZ17 -0.04%) are up +2 ticks.

ECB Executive Board member Praet said that the ECB must be persistent in keeping up stimulus for the Eurozone as economic growth fails to boost consumer prices. He added that, "We are undoubtedly experiencing a solid, broad-based and resilient economic recovery that is contributing to a narrowing of the output and unemployment gaps, but a seeming disconnect between growth and inflation remains."

China Aug industrial production rose +6.0% y/y, weaker than expectations of +6.6% y/y and the smallest pace of increase this year.

U.S. STOCK PREVIEW

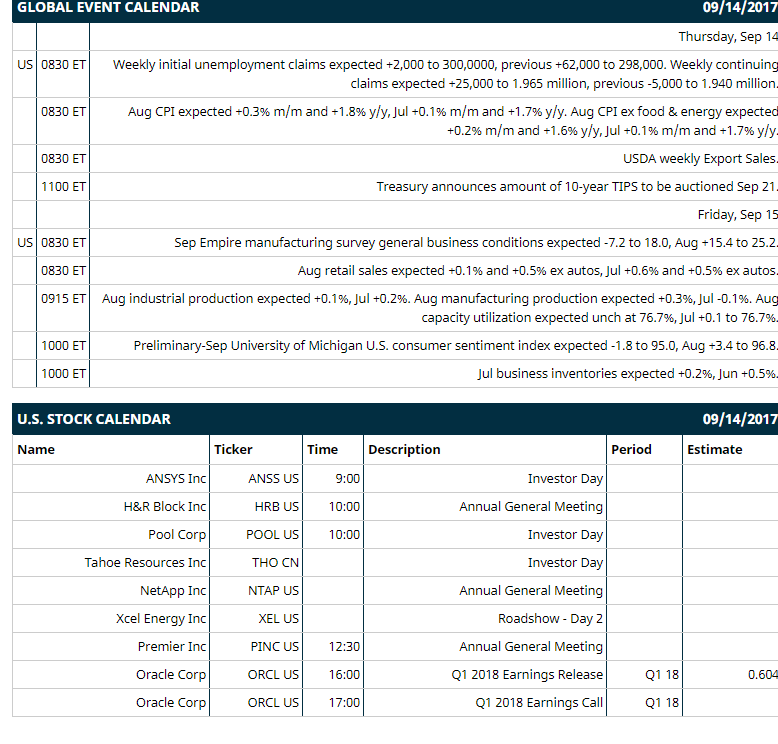

Key U.S. news today includes: (1) weekly initial unemployment claims (expected +2,000 to 300,0000, previous +62,000 to 298,000) and continuing claims (expected +25,000 to 1.965 million, previous -5,000 to 1.940 million), (2) Aug CPI (expected +0.3% m/m and +1.8% y/y, Jul +0.1% m/m and +1.7% y/y) and Aug core CPI (expected +0.2% m/m and +1.6% y/y, Jul +0.1% m/m and +1.7% y/y), (3) USDA weekly Export Sales.

Notable Russell 1000 earnings reports today include: Oracle (consensus 0.60).

U.S. IPO's scheduled to price today: none.

Equity conferences this week: Goldman Sachs Communacopia Conference on Tue-Thu, Bank of America Merrill Lynch Global Health Care Conference on Wed-Thu, Morgan Stanley Industrials Conference on Wed-Thu, Morgan Stanley Laguna Conference on Wed-Thu, Royal Bank of Canada Global Industrials Conference on Wed-Thu, BMO Capital Markets Back To School Conference on Thu, C. L. King & Associates Best Ideas Conference on Thu, Pareto Oil & Offshore Conference on Thu.

OVERNIGHT U.S. STOCK MOVERS

Hertz Global Holdings (HTZ +1.40%) was downgraded to 'Underweight' from 'Equalweight' at Morgan Stanley on valuation.

Beazer Homes (BZH -1.05%) was upgraded to 'Overweight' from 'Neutral' at JP Morgan Chase with a price target of $21.

Toll Brothers (TOL -0.82%) was downgraded to 'Neutral' from 'Overweight' at JP Morgan Chase.

eBay (EBAY +0.24%) was initiated a new 'Buy' at D.A. Davidson with an 18-month target price of $45.

United Natural Foods (UNFI +1.75%) climbed over 3% in after-hours trading after it reported Q4 adjusted EPS of 72 cents, higher than consensus of 70 cents.

Tenet Healthcare (THC -5.31%) jumped 11% in after-hours trading after the WSJ reported the company is exploring options including a possible sale.

US Foods Holdings (USFD +1.12%) dropped over 2% in after-hours trading after announced a secondary public offering of 40 million shares of its common stock by several investment fund holders.

William Lyon Homes (WLH -0.24%) lost over 1% in after-hours trading after it proposed a secondary offering of 3.32 million shares of its common stock for holder Paulson & Co.

Lakeland Industries (LAKE unch) rose 4% in after-hours trading after it reported Q2 EPS of 25 cents, better than consensus of 20 cents.

Vanda Pharmaceuticals (VNDA -1.45%) fell 5% in after-hours trading after it reported the endpoint of its Phase II clinical study of its Tradipitant failed to show a significant improvement in the intensity of the worst itch patients experienced.

Epizyme (EPZM -6.73%) dropped 4% in after-hours trading after it filed to sell $120 million in common stock.

Array BioPharma (ARRY +5.62%) tumbled nearly 8% in after-hours trading after it announced that it had commenced an underwritten public offering of $175 million of its common stock.

Agenus (AGEN +3.65%) climbed over 3% in after-hours trading after the company received a positive vote from the FDA's Vaccines and Related Biological Products Advisory Committee that the efficacy and safety data for its Shringrix drug for prevention of herpes zoster (shingles) in adults aged 50 and over.

Lattice Semiconductor (LSCC +3.06%) lost over 1% in after-hours trading after the Trump administration blocked a Chinese-backed investor from buying the company, citing a security risk.

MARKET COMMENTS

Dec S&P 500 E-mini stock futures (ESZ17 -0.06%) this morning are down -1.25 points (-0.05%). Wednesday's closes: S&P 500 +0.08%, Dow Jones +0.18%, Nasdaq +0.15%. The S&P 500 on Wednesday rose to a new all-time high and settled slightly higher on strength in energy stocks after crude oil prices rose +2.22%, and on optimism that the Trump administration may try to enact bipartisan support to help pass its tax reform legislation after President Trump met with top Democratic leaders to discuss his tax reform plan. A bearish factor was ramped up geopolitical concerns after North Korea said it will accelerate its plan to acquire a nuclear weapon that can strike the U.S. mainland in its first response to fresh United Nations sanctions enacted on the country Tuesday.

Dec 10-year T-note prices (ZNZ17 -0.04%) this morning are up +2 ticks. Wednesday's closes: TYZ7 -6.00, FVZ7 -4.25. Dec 10-year T-notes on Wednesday fell to a 2-1/2 week low and closed lower on supply pressures as the Treasury auctioned $12 billion in 30-year T-bonds and on the +2.22% rally in crude oil prices, which boosted inflation expectations.

The dollar index (DXY00 -0.15%) this morning is down -0.19 (-0.21%). EUR/USD (^EURUSD) is up +0.0011 (+0.09%) and USD/JPY (^USDJPY) is up +0.01 (+0.01%). Wednesday's closes: Dollar Index +0.638 (+0.69%), EUR/USD -0.0082 (-0.69%), USD/JPY +0.32 (+0.29%). The dollar index on Wednesday climbed to a 1-week high and settled higher on optimism that President Trump will be able to enact tax reform after he met top Democratic leaders on his tax reform plan, which signals a bipartisan approach that may help pass his tax reform legislation through Congress. The dollar also found support on the increase in the 10-year T-note yield to a 2-1/2 week high, which improves the dollar's interest rate differentials.

Oct crude oil (CLV17 +0.99%) this morning is up +35 cent s(+0.71%) at a 5-week high and Oct gasoline (RBV17 -0.57%) is down -0.0149 (-0.90%). Wednesday's closes: Oct WTI crude +1.07 (+2.22%), Oct gasoline -0.0090 (-0.54%). Oct crude oil and gasoline on Wednesday settled mixed. Crude prices found support on the action by the IEA to raise its 2017 global crude oil demand growth estimate by +100,000 bpd to 1.6 million bpd, a 2-year high, and on the -8.43 million bbl decline in EIA gasoline inventories to a 1-3/4 year low, more than expectations of -2.25 million bbl. On the negative side was a rally in the dollar index to a 1-week high, and the +5.89 million bbl increase in EIA crude inventories, more than expectations of +4.0 million bbl.

Metals prices this morning are mixed with Dec gold (GCZ17 -0.08%) +1.2 (+0.09%), Dec silver (SIZ17 -0.57%) -0.052(-0.29%) and Dec copper (HGZ17 -1.41%) -0.042 (-1.39%) at a 3-1/2 week low. Wednesday's closes: Dec gold -4.7 (-0.35%), Dec silver -0.023 (-0.13%), Dec copper -0.0550 (-1.81%). Metals on Wednesday closed lower with Dec gold and silver at 1-week lows and Dec copper at a 3-week low. Negative factors included a rally in the dollar index to a 1-week high and the weaker-than-expected U.S. Aug PPI ex food & energy, which reduces demand for precious metals as an inflation hedge. Another bearish factor for copper was the +27,850 MT increase in LME copper inventories to a 3-week high.

Disclosure: None.