Morning Call For Thursday, Nov. 16

OVERNIGHT MARKETS AND NEWS

Dec E-mini S&Ps (ESZ17 +0.34%) this morning are up +0.31%, led by a nearly 3% gain in Wal-Mart in pre-market trading after it reported better-than-expected Q3 adjusted earnings and boosted its full-year earnings outlook. European stocks are up +0.57% as global stocks regained their footing following losses earlier in the week. Strength in automakers is leading European stocks higher after Eurozone Oct new car registrations rose +5.9% y/y, the biggest increase in 5-months. Asian stocks settled mostly higher: Japan +1.47%, Hong Kong +0.58%, China -0.10%, Taiwan -0.05%, Australia +0.16%, Singapore -0.81%, South Korea +0.66%, India +1.06%. China's Shanghai Composite slid to a 1-week low, but recovered most of its losses after the PBOC injected cash into the financial system. The PBOC pumped in 310 billion yuan ($47 billion) through reverse-repurchase agreements on Thursday, the biggest one-day injection in 10 months, which eased interest rate concerns after the China 10-year note rose above 4% Tuesday for the first time in 3-years. The Nikkei Stock Index bounced back sharply following its slide Wednesday to a 2-week low as strength in quarterly corporate earnings boosted stocks.

The dollar index (DXY00 +0.14%) is up +0.16%. EUR/USD (^EURUSD) is down -0.20% after ECB Executive Board member Praet said inflation developments are subdued despite solid growth. USD/JPY (^USDJPY) is up +0.26%.

Dec 10-year T-note prices (ZNZ17 -0.20%) are down -7.5 ticks.

ECB Executive Board member Praet said "we have not yet accomplished our mission, and so we must remain patient and persistent" on monetary policy as inflation developments are subdued despite solid growth.

Eurozone Oct new car registrations rose +5.9% y/y to 1,169,672, the largest increase in 5-months. Year-to-date Eurozone new car registrations are up +3.9% y/y at 12,830,216.

U.S. STOCK PREVIEW

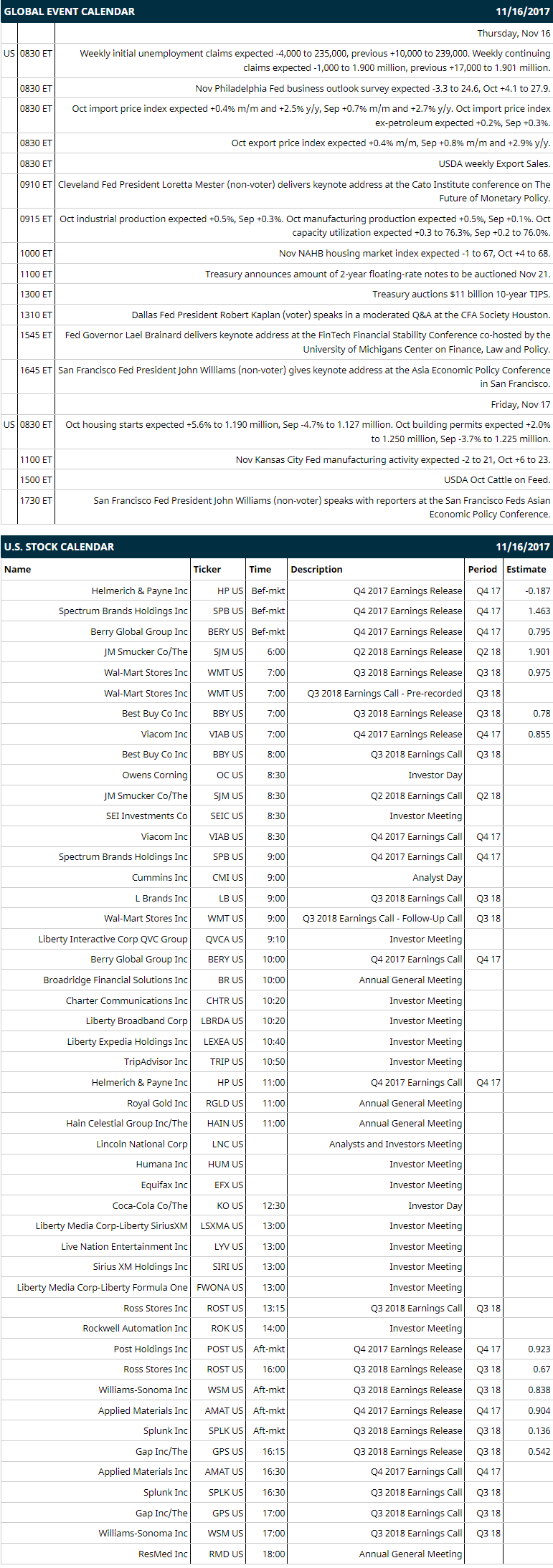

Key U.S. news today includes: (1) weekly initial unemployment claims (expected -4,000 to 235,000, previous +10,000 to 239,000) and continuing claims (expected -1,000 to 1.900 million, previous +17,000 to 1.901 million), (2) Nov Philadelphia Fed business outlook index (expected -3.8 to 24.1, Oct +4.1 to 27.9), (3) Oct import price index (expected +0.3% m/m and +2.5% y/y, Sep +0.7% m/m and +2.7% y/y), (4) Cleveland Fed President Loretta Mester (non-voter) delivers keynote address at the Cato Institute conference on “The Future of Monetary Policy,” (5) Oct industrial production (expected +0.5%, Sep +0.3%) (6) Nov NAHB housing market index (expected -1 to 67, Oct +4 to 68), (7) Treasury auctions $11 billion 10-year TIPS, (8) Dallas Fed President Robert Kaplan (voter) speaks in a moderated Q&A at the CFA Society Houston, (9) Fed Governor Lael Brainard delivers keynote address at the FinTech Financial Stability Conference co-hosted by the University of Michigan’s Center on Finance, Law and Policy, (10) San Francisco Fed President John Williams (non-voter) gives keynote address at the Asia Economic Policy Conference in San Francisco, (11) USDA weekly Export Sales.

Notable Russell 2000 earnings reports today include: Wal-Mart (consensus $0.98), Best Buy (0.78), Gap (0.54), Ross Stores (0.67), Williams-Sonoma (0.84), Viacom (0.86), Applied Materials (0.90), JM Smucker (1.90).

U.S. IPO's scheduled to price today: Bluegreen Vacations (BXG), Stitch Fix (SFIX), Molino Canuelas (MOLC), Scpharmaceuticals (SCPH), Level Brands (LEVB), SailPoint Technologies Holdings (SAIL).

Equity conferences during the remainder of this week: Jefferies London Health Care Conference on Wed-Thu, Morgan Stanley European Technology, Media & Telecom Conference on Wed-Thu, Deutsche Bank Lithium Supply Chain and Energy Storage Conference on Thu, MKM Partners Entertainment, Travel & Technology Conference on Thu, Bank of America Merrill Lynch Global Energy Conference on Thu-Fri, Gabelli & Co Financial Services Conference on Fri.

OVERNIGHT U.S. STOCK MOVERS

Wal-Mart Stores (WMT -1.38%) rose nearly 3% in pre-market trading after it reported Q3 adjusted EPS of $1.00, better than consensus of 98 cents, and then raised guidance on full-year EPS to $4.38-$4.46 from an Oct 10 view of $4.30-$4.40, the mid-point above consensus of $4.38.

Dollar General (DG -1.14%) was upgraded to 'Buy' from 'Hold' at Deutsche Bank with a 12-month target price of $93.

NetApp (NTAP +0.44%) rose 8% in after-hours trading after it reported Q2 net revenue of $1.42 billion, higher than consensus of $1.38 billion, and then said it sees Q3 net revenue of $1.43 billion to $1.58 billion, the mid-point above consensus of $1.44 billion.

RH US (RH -6.08%) jumped 10% in after-hours trading after it reported preliminary Q3 adjusted net revenue of $592.5 million, above estimates of $588.3 million, and then boosted 2017 adjusted net income guidance to $82 million-$87 million from a prior view of $70 million to $77 million.

L Brands (LB -0.02%) fell nearly 3% in after-hours trading after it said it sees Q4 EPS of $1.95 to $2.10, the mid-point below consensus of $2.03.

Cisco Systems (CSCO +0.21%) climbed over 4% in after-hours trading after it reported Q1 adjusted EPS of 61 cents, above consensus of 60 cents, and then said it sees Q2 adjusted EPS of 58 cents to 60 cents, the mid-point above consensus of 58 cents.

Mindbody (MB +0.78%) was initiated as a 'Buy' at D.A. Davidson with an 18-month target price of $42.

Norwegian Cruise Line Holdings Ltd (NCLH -0.05%) fell over 1% in after-hours trading after it announced the launch of a secondary public offering of 10 million shares of its common stock by funds affiliated with Apollo Global Management LLC and Star NCLC Holdings Ltd.

Procter & Gamble (PG -0.72%) rose 3% in after-hours trading after a recount showed billionaire investor Nelson Peltz had secured enough votes for a seat on Procter & Gamble's board.

Mattel (MAT -1.19%) lost over 1% in after-hours trading after Reuters reported that it had rebuffed Hasbro's bid for the company.

AxoGen (AXGN +0.40%) tumbled 11% in after-hours trading after it announced that it has commenced an underwritten public offering of 1.2 million shares of its common stock.

Smart Global Holdings (SGH -0.97%) surged 17% in after-hours trading after it raised guidance on Q1 sales to $250 million to $260 million from a Sep 29 view of $225 million to $240 million.

Mirati Therapeutics (MRTX +6.44%) dropped nearly 8% in after-hours trading after the company announced it will offer $75 million in stock via Barclays and Cowen.

MARKET COMMENTS

Dec S&P 500 E-mini stock futures (ESZ17 +0.34%) this morning are up +8.00 points (+0.31%). Wednesday's closes: S&P 500 -0.55%, Dow Jones -0.59%, Nasdaq -0.56%. The S&P 500 on Wednesday fell to a 3-week low and closed lower due to the selloff in global stock markets that boosted the VIX volatility index to 2-3/4 month high and spurred long liquidation in stocks. Stocks also fell after the U.S. Oct core CPI rose +1.8% y/y, stronger than expectations of +1.7% y/y and the fastest pace of increase in 6 months, which bolsters the case for a Fed rate hike next month. Weakness in energy stocks was another negative factor after crude oil prices fell -0.66%. On the positive side, U.S. Oct retail sales rose +0.2%, better than expectations of unch.

Dec 10-year T-note prices (ZNZ17 -0.20%) this morning are down -7.5 ticks. Wednesday's closes: TYZ7 +10.00, FVZ7 +3.50. Dec 10-year T-notes on Wednesday closed higher after the S&P 500 fell to a 3-week low, which boosted the safe-haven demand for T-notes, and after dovish comments from Chicago Fed President Evans who said we're facing "below-target inflation expectations."

The dollar index (DXY00 +0.14%) this morning is up +0.146 (+0.16%). EUR/USD (^EURUSD) is down -0.0024 (-0.20%) and USD/JPY (^USDJPY) is up +0.29 (+0.26%). Wednesday's closes: Dollar Index -0.014 (-0.01%), EUR/USD -0.0007 (-0.06%), USD/JPY -0.58 (-0.51%). The dollar index on Wednesday dropped to a 3-week low and closed lower after global stock markets fell, which sent USD/JPY to a 3-week low on increased safe-haven demand for the yen. Another negative for the dollar was the comments from Chicago Fed President Evans who said we're facing "below-target inflation expectations," which is dovish for Fed policy. The dollar recovered most of its losses, however, after U.S. core CPI rose more than expected, which bolsters the case for a Fed rate hike in Dec.

Dec crude oil (CLZ17 -0.13%) this morning is down -11 cents (-0.20%) and Dec gasoline (RBZ17 -0.44%) is -0.0085 (-0.49%). Wednesday's closes: Dec WTI crude -0.37 (-0.66%), Dec gasoline -0.0224 (-1.27%). Dec crude oil and gasoline on Wednesday closed lower with Dec gasoline at a 2-week low after EIA crude inventories unexpectedly rose +1.854 million bbl, more than expectations for a -2.4 million bbl decline, and after U.S. crude production in the week of Nov 10 rose +0.3% to 9.645 million bpd, the most in 46 years. Gasoline prices were also undercut after an unexpected +894,000 bbl increase in EIA gasoline stockpiles, more than expectations of a -1.5 million bbl draw.

Metals prices this morning are higher with Dec gold (GCZ17 -0.02%) +0.2 (+0.02%), Dec silver (SIZ17 +0.44%) +0.054 (+0.32%) and Dec copper (HGZ17 +0.54%) +0.005 (+0.16%). Wednesday's closes: Dec gold -5.2 (-0.41%), Dec silver -0.102 (-0.60%), Dec copper -0.0105 (-0.34%). Metals on Wednesday closed lower with Dec copper at a 5-week low as stronger-than-expected U.S. economic data on Oct CPI and Oct retail sales bolstered the case for Fed rate hike in Dec. Copper prices also came under pressure on demand concerns after Japan Q3 GDP rose less than expected.

(Click on image to enlarge)

Disclosure: None.