Morning Call For Thursday, May 4

OVERNIGHT MARKETS AND NEWS

June E-mini S&Ps (ESM17 +0.26%) this morning are trading mildly higher by +0.25% on carry-over support from strong European stocks. The markets are looking forward to a scheduled Obamacare repeal-and-replace vote today by the House. House Republican leaders say they have the votes but the vote count is expected to be close.

The Euro Stoxx 50 index today is up +0.84% on positive earnings news and increased confidence that centrist Emmanuel Macron will win Sunday's French presidential election against far-right Marine Le Pen. The two candidates brawled last night in their only debate with one snap poll deeming Macron the winner of the debate by 63%-34%. The polls show Macron with continued support of about 60%-40%, little changed from recent levels. Oddschecker has the betting odds at 90%-15% in favor of Macron against Le Pen.

China's Shanghai Composite index today fell -0.25% on continued concern about the government's crackdown on leverage and its increased regulatory scrutiny. Chinese stocks were also undercut by news that the April Caixin China services PMI fell by -0.7 points to 51.5 from 52.2 in March. The Japanese markets today were closed for a second day for a national holiday. The other main Asian stock markets today closed mixed: Hong Kong -0.05%, Taiwan +0.12%, Australia -0.27%, Singapore -0.28%, South Korea +0.97%, India +0.77%, Turkey -0.19%.

U.S. STOCK PREVIEW

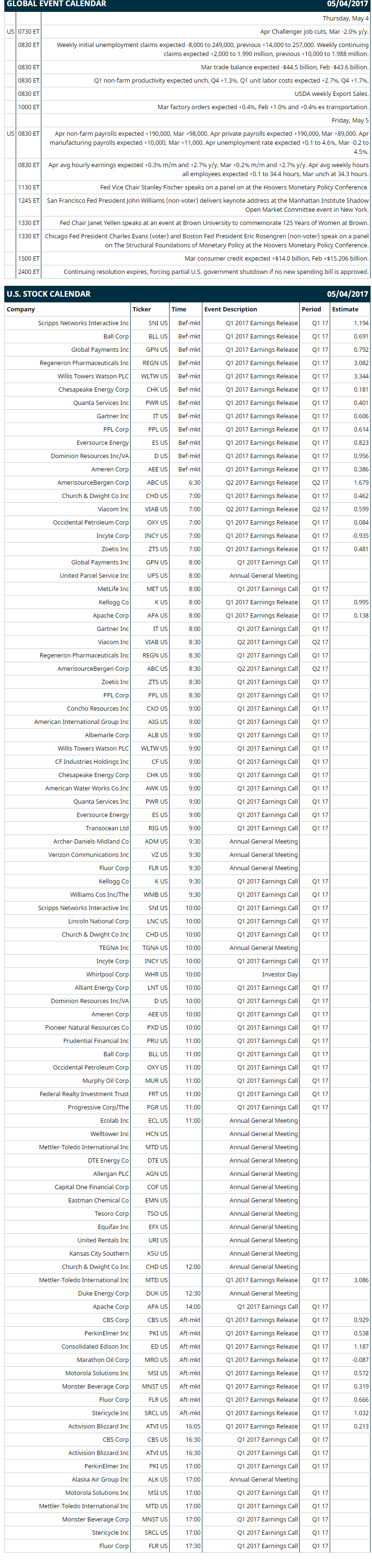

Key U.S. news today includes: (1) Apr Challenger job cuts (Mar -2.0% y/y), (2) weekly initial unemployment claims (expected -8,000 to 249,000, previous +14,000 to 257,000) and continuing claims (expected +2,000 to 1.990 million, previous +10,000 to 1.988 million), (3) Mar U.S. trade deficit (expected -$44.5 billion, Feb -$43.6 billion), (4) Q1 non-farm productivity (expected unch, Q4 +1.3%) and Q1 unit labor costs (expected +2.7%, Q4 +1.7%), (5) Mar factory orders (expected +0.4%, Feb +1.0% and +0.4% ex transportation), (6) USDA weekly Export Sales.

Notable S&P 500 earnings reports today include: Viacom (consensus $0.60), Scripps Networks (1.19), Regeneron (3.08), Church & Dwight (0.46), Occidental Petroleum (0.08), Kellogg (1.00), Apache (0.14), CBS (0.93), Marathon Oil (-0.09), Motorola Solutions (0.57), Monster Beverage (0.32), Fluor (0.67).

U.S. IPO's scheduled to price today: Ovid Therapeutics (OVID), KKR Real Estate Finance Trust (KREF), TPG Pace Energy Holdings (TPGE/U).

Equity conferences: Deutsche Bank Health Care Conference on Wed-Thu, Macquarie Group Ltd Business Services Conference on Thu.

OVERNIGHT U.S. STOCK MOVERS

Facebook (FB -0.64%) fell -1% in overnight trading after it said that it expects revenue growth to slow "meaningfully" when it slows the frequency of news-feed advertising later this year.

Tesla (TSLA -2.47%) said its Model 3 timeline is intact. Tesla Q1 adjusted EPA was larger than expected.

GoDaddy (GDDY -2.29%) fell -3% in after-hours trading after a new-share filing

AIG (AIG +0.02%) rallied by more than 1% in after-hours trading on positive Q1 EPS and a hike in stock buybacks.

Stamps.com (STMP +0.59%) rallied by +1.3% ion after-hours trading after providing positive annual EPS guidance.

Prudential Financial (PRU +0.86%) rallied by 1% in after-hours trading after a Q1 adjusted EPS beat.

Centurylink (CTL -2.04%) fell 4% in after-hours trading after missing Q1 earnings.

Cheesecake Factory (CAKE +1.79%) fell 8% in after-hours trading after a Q1 revenue miss.

Avis (CAR -2.06%) fell 6% in after-hours trading a Q1 earnings miss on higher costs and pricing pressure.

MARKET COMMENTS

June E-mini S&Ps (ESM17 +0.26%) this morning are trading mildly higher by +0.25% on carry-over support from strong European stocks. Wednesday's closes: S&P 500 -0.13%, Dow Jones +0.04%, Nasdaq -0.34%. The S&P 500 on Wednesday closed slightly lower on the -5 tick sell-off in June 10-year T-note futures on the increased odds for a Fed rate hike at the next meeting in June. There was also weakness in tech stocks linked to a -0.31% decline in Apple on disappointing iPhone sales. Stocks were supported by the strong US ISM non-manufacturing index (+2.3 to 57.5) and by increased confidence about the health of the U.S. economy after the Fed said that Q1 GDP weakness was transitory.

June 10-year T-notes (ZNM17 -0.22%) this morning are down -9.5 ticks on carry-over weakness from a -0.73 point drop in June bunds this morning on reduced safe-haven demand tied to increased confidence that centrist Emmanuel Macron will win Sunday's French presidential election. Wednesday's closes: TYM7 -5.00, FVM7 -5.50. Jun 10-year T-notes on Wednesday closed lower on the increased odds for a Fed rate hike at its June 13-14 meeting after the Fed brushed off weak Q1 GDP growth. T-notes were also undercut by firm economic data with the as-expected +177,000 increase in April ADP jobs and the +2.3 point increase to 57.5 in the U.S. ISM non-manufacturing index.

The dollar index (DXY00 -0.07%) this morning is slightly lower by -0.09 (-0.09%), EUR/USD (^EURUSD) is up +0.0045 (+0.41%), and USD/JPY (^USDJPY) is up +0.17 (+0.15%). The euro is seeing some strength from Emmanuel Macron's favorable showing in yesterday's debate. Wednesday's closes: Dollar index +0.233 (+0.24%), EUR/USD -0.0044 (-0.40%), USD/JPY +0.754 (+0.67). The dollar index on Wednesday closed mildly higher on the mildly hawkish FOMC meeting and increased odds for a June rate hike. The dollar was also boosted by the strong U.S. ISM non-manufacturing index and as-expected ADP report.

June WTI crude oil prices (CLM17 -1.34%) are down -0.58 (-1.21%) and June gasoline (RBM17 -1.98%) is down -0.0277 (-1.81%). Wednesday's closes: Jun crude +0.16 (+0.34%), Jun gasoline +0.0202 (+1.33%). Jun crude oil and gasoline on Wednesday closed higher on the tighter-than-expected product inventory reports with gasoline inventories up +191,000 bbls (vs expectations of +1.0 million bbls) and distillate inventories down -562,000 (vs expectations of +1.5 million bbls). Crude oil prices were undercut by the +0.3% rise in U.S. crude oil production to a 1-3/4 yr high of 9.293 million bpd.

Disclosure: None.