Morning Call For Thursday, May 25

OVERNIGHT MARKETS AND NEWS

Jun E-mini S&Ps (ESM17 +0.27%) this morning are up +0.27% at a new record nearest-futures high and extended Wednesday's rally after Wednesday afternoon's minutes of the May 2-3 FOMC meeting indicated policy makers wanted more evidence that recent weakness in economic growth is transitory before raising interest rates further. Global stocks rallied on the dovish FOMC meeting minutes with European stocks up +0.29% as market anxiety has fallen as well and is another supportive factor for stock prices after the VIX volatility index fell for a sixth day to a 2-week low. Jul WTI crude oil climbed to a 1-month high after OPEC was said to agree to extend its production cuts for another 9 months, although prices sold-off on disappointment that they didn't cut further and Jul WTI crude (CLN17 -1.27%) is now down -1.71% on fund liquidation. Asian stocks settled higher: Japan +0.36%, Hong Kong +0.80%, China +1.43%, Taiwan +0.64%, Australia +0.36%, Singapore +0.10%, South Korea +1.16%, India +1.48%. South Korea's Kospi Stock Index posted a new all-time high, while China's Shanghai Composite and Japan's Nikkei Stock Index rallied to 1-week highs on carry-over support from Wednesday's rally in U.S. equities. Chinese stocks also rose on reports that state-backed funds were buying shares.

The dollar index (DXY00 -0.09%) is down -0.10%. EUR/USD (^EURUSD) is down -0.02%. USD/JPY (^USDJPY) is up +0.30%.

Jun 10-year T-note prices (ZNM17 +0.06%) are up +1.5 ticks.

Speaking in Tokyo, Chicago Fed President Evans (voter) said the U.S. has essentially returned to full employment, although "stubborn" inflation has been slow to hit target.

U.S. STOCK PREVIEW

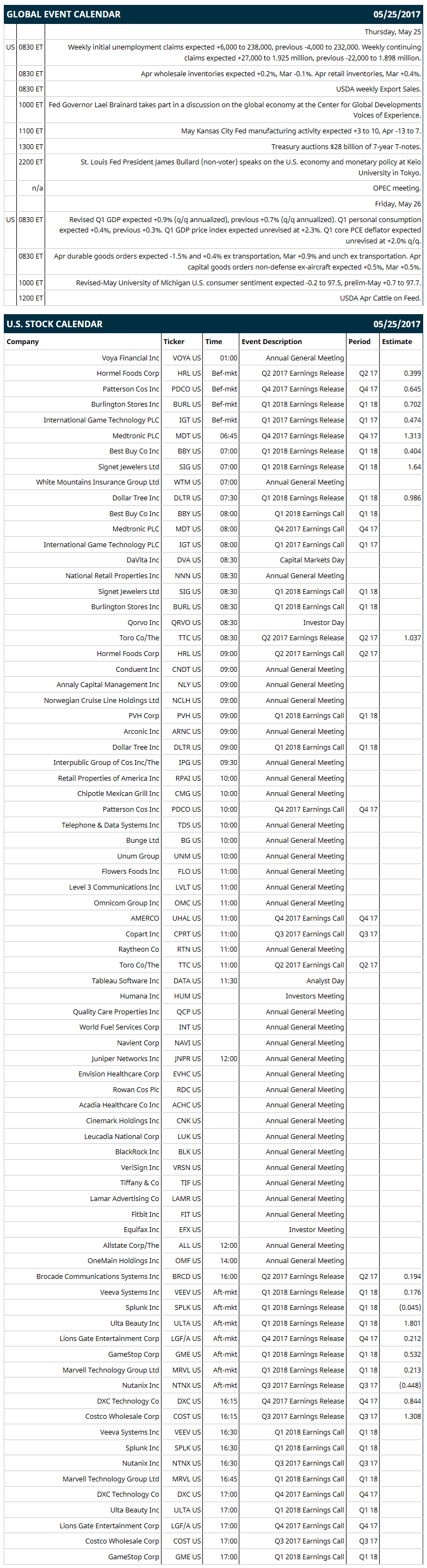

Key U.S. news today includes: (1) weekly initial unemployment claims (expected +6,000 to 238,000, previous -4,000 to 232,000) and continuing claims (expected +27,000 to 1.925 million, previous -22,000 to 1.898 million), (2) Apr wholesale inventories (expected +0.2%, Mar -0.1%), (3) Fed Governor Lael Brainard takes part in a discussion on the global economy at the Center for Global Development’s Voices of Experience, (4) May Kansas City Fed manufacturing activity (expected +3 to 10, Apr -13 to 7), (5) Treasury auctions $28 billion of 7-year T-notes, (6) St. Louis Fed President James Bullard (non-voter) speaks on the U.S. economy and monetary policy at Keio University in Tokyo, (7) OPEC meeting, (8) USDA weekly Export Sales.

Notable Russell 2000 earnings reports today include: Best Buy (consensus $0.40), Dollar Tree (0.99), Hormel Foods (0.40), Patterson Cos (0.65), Burlington Stores (0.70), Intl Game Technology (0.47), Medtronic (1.31), Signet Jewelers (1.64), Toro (1.04), GameStop (0.53), Marvell Technology (0.21), Lions Gate Entertainment (0.21), Ulta Beauty (1.80).

U.S. IPO's scheduled to price today: none.

Equity conferences: UBS Global Health Care Conference on Mon-Thu; UBS Auto & Auto Supplier 1x1 Conference on Thu.

OVERNIGHT U.S. STOCK MOVERS

Best Buy (BBY -2.19%) jumped 10% in pre-market trading after it reported Q1 adjusted EPS of 60 cents, well above consensus of 40 cents, as Q1 enterprise comparable sales unexpectedly rose +1.6%, better than expectations of a -1.5% decline.

Chipotle Mexican Grill (CMG) was upgraded to 'Buy' from 'Hold' at Argus Research with a price target of $550.

IHS Markit Ltd (INFO +0.34%) rose nearly 5% in after-hours trading when it was announced that it will replace Tegna in the S&P 500 before the open of trading on Friday, June 2.

Independence Realty Trust (IRT +0.54%) climbed 4% in after-hours trading when it was announced that it will replace Ultratech in the S&P SmallCap 600 before the open of trading on Wednesday, May 30.

PVH Corp (PVH -0.33%) rose 3% in after-hours trading after it reported Q1 adjusted EPS of $1.65, better than consensus of $1.60, and then said it sees full-year adjusted EPS of $7.40 to $7.50, above consensus of $6.76.

Williams-Sonoma (WSM +1.10%) jumped 8% in after-hours trading after it reported Q1 adjusted EPS of 51 cents, above consensus of 49 cents, and said it sees Q2 revenue of $1.20 billion to $1.23 billion, higher than consensus of $1.19 billion.

Live Nation (LYV -0.03%) was initiated with a 'Buy' at Guggenheim Securities with a 12-month target price of $40.

Aerie Pharmaceuticals (AERI -0.74%) surge 25% in after-hours trading after it said it expects to submit an NDA for its Roclatan after it achieved primary efficacy endpoint in its Phase 3 "Mercury 2" study for treatment of patients with glaucoma and other eye diseases.

Sun Communities (SUI +0.75%) lost almost 2% in after-hours trading after it announced that it had commenced an underwritten public offering of 3.5 million shares of its common stock.

Radius Health (RDUS +0.57%) gained over 2% in after-hours trading after it announced positive results from a 24-month ActiveExtend study for its Tymlos in postmenopausal women with osteoporosis.

Bank of the Ozarks (OZRK -1.90%) fell 5% in after-hours trading after it announced an underwritten registered public offering of 6.6 million shares of its common stock.

Guess? (GES -0.80%) jumped over 13% in after-hours trading after it said Q1 Americas retail comparable sales including e-commerce fell -15%, a smaller decline than expectations of -16.5%, and then raised guidance on full-year adjusted EPS to 34 cents-44 cents from a prior view of 28 cents-40 cents.

Pure Storage (PSTG -0.28%) rallied 15% in after-hours trading after it reported Q1 revenue of $182.6 million, higher than consensus of $175.9 million, and said it sees Q2 revenue of $214 million-$222 million, the midpoint well above consensus of $214.14 million.

Costamare (CMRE -2.14%) dropped 9% in after-hours trading after it announced that it plans a public offering of 12.5 million shares of its common stock.

MARKET COMMENTS

June E-mini S&Ps (ESM17 +0.27%) this morning are up +6.50 points (+0.27%) at a new record nearest-futures high. Wednesday's closes: S&P 500 +0.25%, Dow Jones +0.36%, Nasdaq +0.47%. The S&P 500 on Wednesday rose to a 1-week high and closed higher on a slightly dovish interpretation of the May 2-3 FOMC minutes, which stated that most policy makers felt "it would be prudent" to wait to see if recent economic weakness was only temporary. Stocks were also boosted by the +6.50 tick rally in June T-notes.

June 10-year T-notes (ZNM17 +0.06%) this morning are up +1.5 ticks. Wednesday's closes: TYM7 +6.50, FVM7 +4.50. Jun 10-year T-notes on Wednesday closed higher on strong demand for the Treasury's $34 billion 5-year T-note auction that had a bid-to-cover ratio of 2.67, higher than the 12-auction average of 2.43. T-notes were also boosted by the news in the FOMC minutes that the Fed will start off slowly with its balance sheet reduction process.

The dollar index (DXY00 -0.09%) this morning is down -0.096 (-0.10%). EUR/USD (^EURUSD) is down -0.0002 (-0.02%) and USD/JPY (^USDJPY) is up +0.34 (+0.30%). Wednesday's closes: Dollar index -0.113 (-0.12%), EUR/USD +0.0036 (+0.32%), USD/JPY -0.29 (-0.26%). The dollar index on Wednesday closed lower on the weaker-than-expected U.S. Apr existing home sales report of -2.3% and the slightly dovish interpretation of the May 2-3 FOMC minutes.

July WTI crude oil prices (CLN17 -1.27%) this morning are down -88 cents (-1.71%) and July gasoline (RBN17 -0.75%) is -0.0187 (-1.13%). Wednesday's closes: Jul crude -0.11 (-0.21%), Jul gasoline -0.0084 (-0.51%). Jul crude oil and gasoline on Wednesday fell back from 1-month highs and closed lower. Crude oil prices were undercut by the +0.2% increase in U.S. crude production in the week of May 19 to 9.32 million bpd, a 1-3/4 year high, and by the -787,000 bbl decline in EIA gasoline inventories, a smaller drop than expectations of -1.075 million bbl. Crude oil prices were boosted by the -4.43 million bbl decline in EIA crude inventories (vs expectations of -2.0 million bbl) and by the -741,000 bbl decline in crude supplies at Cushing, OK, delivery point of WTI futures.

(Click on image to enlarge)

Disclosure: None.