Morning Call For Thursday, May 11

OVERNIGHT MARKETS AND NEWS

Jun E-mini S&Ps (ESM17 -0.14%) this morning are down -0.16% and European stocks are down -0.19% as the BOE cut its UK GDP estimate and raised its UK CPI forecast. The BOE, as expected, kept its benchmark interest rate unchanged at 0.25% and maintained its asset purchase target at 435 billion pounds, but cut its 2017 UK GDP forecast to 1.9% from 2.0% and raised its 2017 CPI forecast to 2.7% from 2.4%. Losses in equities were contained on strength in energy producing stocks and mining companies as Jun WTI crude oil (CLM17 +1.33%) rose +1.52% and Jul COMEX copper (HGN17 +1.92%) climbed +1.88%, both at 1-week highs. Asian stocks settled higher: Japan +0.31%, Hong Kong +0.44%, China +0.29%, Taiwan +0.33%, Australia +0.05%, Singapore +0.65%, South Korea +1.20%, India +0.01%. Stock markets in India and South Korea climbed to record highs, while Japan's Nikkei Stock index rose to a 17-month high and China's Shanghai Composite recovered from a 7-month low and closed higher on speculation the government intervened to prop up stocks late in the session.

The dollar index (DXY00 -0.03%) is down -0.04%. EUR/USD (^EURUSD) is up +0.05% after the European Commission raised its 2017 Eurozone GDP forecast. USD/JPY (^USDJPY) is down -0.22%.

Jun 10-year T-note prices (ZNM17 +0.05%) are up +3 ticks.

The European Commission raised its Eurozone 2017 GDP forecast to 1.7%, up from a forecast of +1.6% in Feb, and said risks to Eurozone growth are more balanced, though they remain tilted to the downside.

New York Fed President Dudley (voter) said that the U.S. economic recovery continues apace and that the Fed expects to gradually raise interest rates. He added that later this year or in 2018 the Fed is likely to start shrinking its balance sheet, although it won't shrink back to its pre-crisis size.

U.S. STOCK PREVIEW

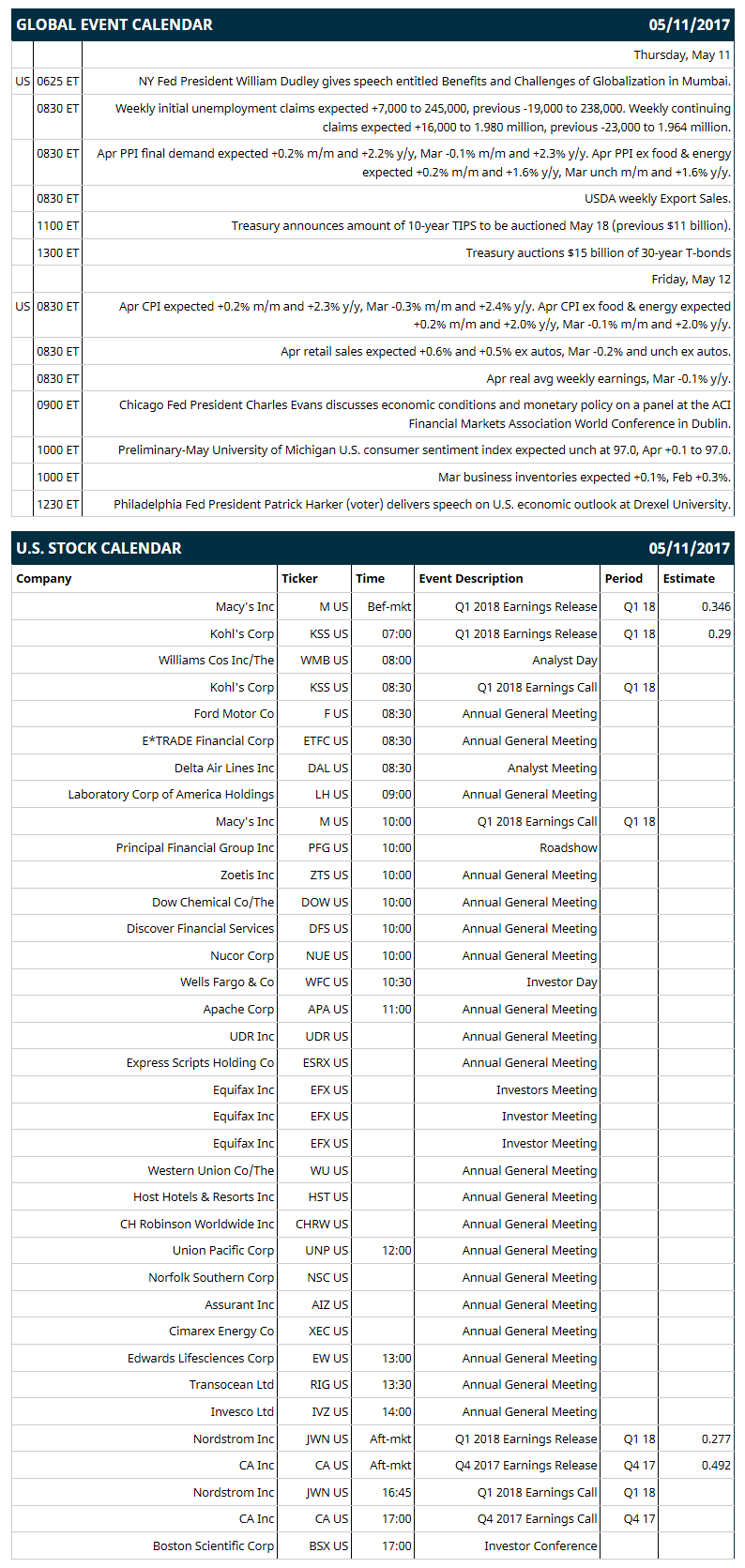

Key U.S. news today includes: (1) NY Fed President William Dudley gives speech entitled “Benefits and Challenges of Globalization” in Mumbai, (2) weekly initial unemployment claims (expected +7,000 to 245,000, previous -19,000 to 238,000) and continuing claims (expected +16,000 to 1.980 million, previous -23,000 to 1.964 million), (3) Apr PPI final demand (expected +0.2% m/m and +2.2% y/y, Mar -0.1% m/m and +2.3% y/y) and Apr PPI ex food & energy (expected +0.2% m/m and +1.6% y/y, Mar unch m/m and +1.6% y/y), (4) Treasury auctions $15 billion of 30-year T-bonds, (5) USDA weekly Export Sales.

Notable S&P 500 earnings reports today include: Macy's (consensus $0.35), Kohl's (0.29), Nordstrom (0.28), CA (0.49).

U.S. IPO's scheduled to price today: Solaris Oilfield Infrastructure (SOI), Gardner Denver Holdings (GDI), ASV LLC (ASV).

Equity conferences: 11th Annual Barrington Research Spring Investment Conference on Thu, Citi Boston Energy Conference on Thu, Deutsche Bank AutoTech Conference on Thu.

OVERNIGHT U.S. STOCK MOVERS

Snap (SNAP -1.46%) sank over 20% in pre-market trading after it reported Q1 revenue of $149.6 million, below consensus of $158.6 million.

O'Reilly Automotive (ORLY +0.68%) gained 1% in after-hours trading after it said it added $1 billion to its share buyback program for a total of $8.75 billion.

Symantec (SYMC +2.38%) dropped 7% in in after-hours trading after it said it sees Q1 adjusted EPS of 28 cents-32 cents, weaker than consensus of 38 cents, and then said it sees full-year adjusted revenue of $5.10 billion-$5.20 billion, below consensus of $5.21 billion.

Merck & Co (MRK +1.03%) rose 3% in after-hours trading after it won FDA approval for using its Keytruda drug and chemotherapy for treatment of metastatic non-squamous non-small cell lung cancer.

Twenty-First Century Fox (FOXA -1.17%) fell 2% in after-hours trading after it reported Q3 revenue of $7.56 billion, less than consensus of $7.64 billion.

Bright Horizons Family Solutions (BFAM -0.19%) lost 1% in after-hours trading after it announced a secondary offering of 4.15 million shares of common stock by selling shareholders.

Pegasystems (PEGA +3.15%) jumped 9% in after-hours trading after it reported Q1 adjusted EPS of 39 cents, well above consensus of 23 cents.

Intrexon (XON +0.62%) climbed over 4% in after-hours trading after it reported Q1 revenue of $53.7 million, higher than consensus of $49.1 million.

Aviat Networks (AVNW) plunged over 25% in after-hours trading after it reported Q3 revenue of $58.7 million, down -2.9% y/y.

U.S. Steel (X +0.87%) gained 1% in after-hours trading after CEO Mario Longhi stepped down and COO David Burritt replaced him.

Omeros (OMER +0.62%) lost almost 2% in after-hours trading after it reported Q1 revenue of $12.3 million, weaker than consensus of $13.3 million.

Arbor Realty Trust (ABR +0.46%) slid over 5% in after-hours trading after it announced plans to make a public offering of 9.5 million shares of its common stock.

MARKET COMMENTS

June E-mini S&Ps (ESM17 -0.14%) this morning are down -3.75 points (-0.16%). Wednesday's closes: S&P 500 +0.11%, Dow Jones -0.16%, Nasdaq +0.06%. The S&P 500 on Wednesday closed higher on strength in energy producer stocks after crude oil prices jumped +3.16% and on strength in technology stocks led by a +17% surge in shares of Nvidia after it reported stronger-than-expected Q1 earnings. Gains were limited by political uncertainty after President Trump fired FBI Director Comey.

June 10-year T-notes (ZNM17 +0.05%) this morning are up +3 ticks. Wednesday's closes: TYM7 -0.50, FVM7 -0.25. Jun 10-year T-notes on Wednesday closed little changed. T-notes were boosted by political uncertainty in Washington after President Trump fired FBI Director Comey and by some flight to safety after North Korea's UK ambassador said his country will proceed with nuclear tests. T-notes gave up their advance on weaker-than-expected demand for the Treasury’s $23 billion of 10-year T-notes that had a bid-to-cover of 2.33, below the 12-auction average of 2.47.

The dollar index (DXY00 -0.03%) this morning is down -0.036 (-0.04%). EUR/USD (^EURUSD) is +0.0005 (+0.05%) and USD/JPY (^USDJPY) is -0.25 (-0.22%). Wednesday's closes: Dollar index +0.011 (+0.01%), EUR/USD -0.0006 (-0.06%), USD/JPY +0.05 (+0.04%). The dollar index on Wednesday closed slightly higher on the stronger-than-expected U.S. Apr import price index report, which bolsters the case for additional Fed rate hikes. There was also weakness in EUR/USD which fell to a 1-week low after ECB President Draghi said, "underlying inflation pressures continue to remain subdued and have yet to show a convincing upward trend," which bolsters speculation the ECB is not yet ready to taper QE.

June WTI crude oil prices (CLM17 +1.33%) this morning are up +72 cents (+1.52%) at a 1-week high and June gasoline (RBM17 +1.50%) is +0.0250 (+1.62%) at a 1-1/2 week high. Wednesday's closes: Jun crude +1.45 (+3.16%), Jun gasoline +0.0501 (+3.36%). Jun crude oil and gasoline on Wednesday closed sharply higher on the -5.247 million bbl decline in EIA crude inventories (versus expectations of -2.0 million bbl) and the unexpected -150,000 bbl decline in EIA gasoline inventories (vs expectations of +300,000 bbl). On the bearish side, U.S. crude production in the week of May 5 rose +0.2% to 9.314 million bpd, a 1-1/2 year high.

(Click on image to enlarge)

Disclosure: None.