Morning Call For Thursday, March 2

OVERNIGHT MARKETS AND NEWS

Mar E-mini S&Ps (ESH17 -0.09%) this morning are down -0.10% as they consolidate following Wednesday's rally to a new all-time high. European stocks are down -0.13% on concern that mounting price pressures may prompt the ECB to begin tapering QE. Eurozone Feb CPI rose +2.0% y/y, the fastest pace in 4 years, and Eurozone Jan PPI climbed +3.5% y/y, the largest annual increase in 4-3/4 years. Energy producing stocks are also lower as record U.S. crude inventories and a stronger dollar undercuts crude prices with Apr WTI crude (CLJ17 -0.87%) down -0.80%. Asian stocks settled mixed: Japan +0.88%, Hong Kong -0.20%, China -0.52%, Taiwan +0.18%, Australia +1.26%, Singapore +0.44%, South Korea +0.96%, India -0.50%. Japan's Nikkei Stock Index rallied to a 14-1/2 month high on carry-over support from the rally in the S&P 500 Wednesday to a new record high along with weakness in the yen that boosted exporter stocks as USD/JPY climbed to a 2-week high.

The dollar index (DXY00 +0.30%) is up +0.22% at a 1-1/2 month high after Fed Governor Brainard became the latest Fed official to support a rate hike when she said late Wednesday that a rate hike "will likely be appropriate soon." EUR/USD (^EURUSD) is down -0.25%. USD/JPY (^USDJPY) is up +0.49% at a 2-week high.

Jun 10-year T-note prices (ZNM17 -0.14%) are down -2.5 ticks.

The Eurozone Jan unemployment rate remained unchanged at 9.6%, right on expectations and a 7-1/2 year low.

Eurozone Feb CPI rose +2.0% y/y, right on expectations and the fastest pace of increase in 4 years. The Feb core CPI rose +0.9% y/y, right on expectations.

Eurozone Jan PPI rose +3.5% y/y, stronger than expectations of +3.2% y/y and the fastest pace of increase in 4-3/4 years.

U.S. STOCK PREVIEW

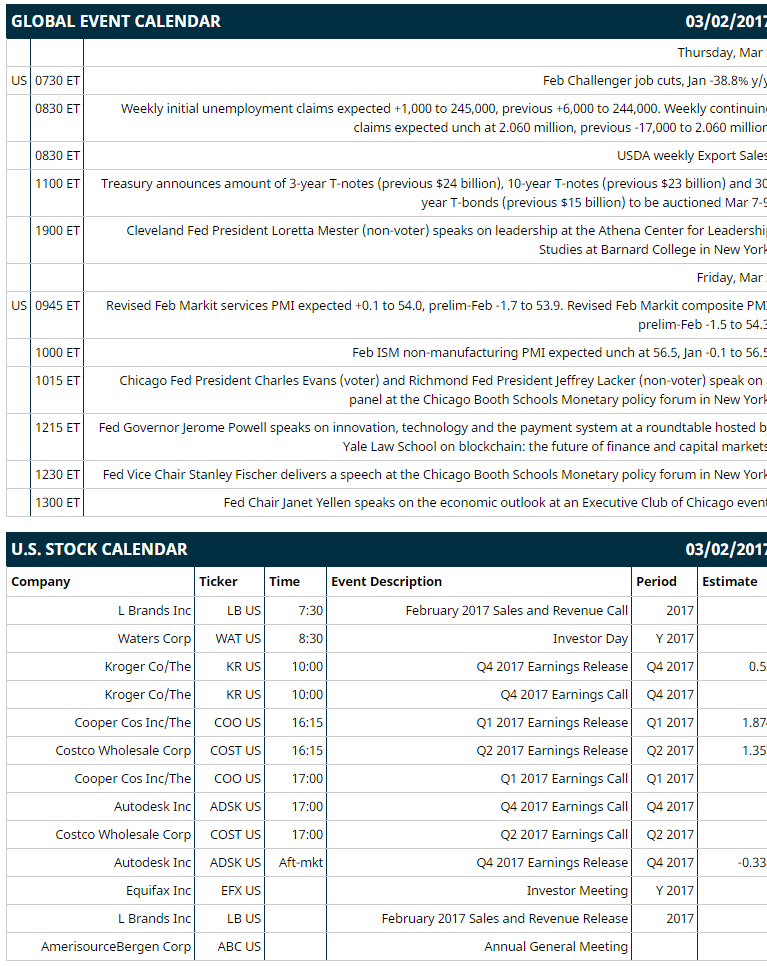

Key U.S. news today includes: (1) Feb Challenger job cuts (Jan -38.8% y/y), (2) weekly initial unemployment claims (expected +1,000 to 245,000, previous +6,000 to 244,000) and continuing claims (expected unch at 2.060 million, previous -17,000 to 2.060 million), (3) Cleveland Fed President Loretta Mester (non-voter) speaks on leadership at the Athena Center for Leadership Studies at Barnard College in New York, (4) USDA weekly Export Sales.

Notable S&P 500 earnings reports today include: Costco (consensus $1.36), Kroger (0.52), Cooper Cos (1.87), Autodesk (-0.34).

U.S. IPO's scheduled to price today: none.

Equity conferences: J.P. Morgan Gaming, Lodging, Restaurant & Leisure Management Access Forum on Thu, Bank of America Merrill Lynch Global Agriculture and Chemicals Conference on Wed-Thu, BTIG Healthcare Conference on Thu, Capital Link Master Limited Partnership Investing Forum on Thu, Simmons Energy Conference on Thu-Fri.

OVERNIGHT U.S. STOCK MOVERS

Time Warner (TWX +0.70%) was downgraded to 'Hold' from 'Buy' at Loop Capital with a price target of $107.50

Broadcom Ltd (AVGO +2.00%) rallied 4% in pre-market trading after it reported Q1 adjusted EPS continuing operations of $3.63, better than consensus of $3.48.

Shake Shack (SHAK +0.81%) fell 4% in after-hours trading after it said it sees full-year revenue of $349 million-$353 million, below consensus of $354.5 million.

Monster Beverage (MNST +1.38%) jumped 14% in pre-market trading after it reported Q4 sales of $753.8 million, stronger than consensus of $722.1 million.

Planet Fitness (PLNT +1.58%) dropped almost 6% in after-hours trading after it said it sees full-year adjusted EPS of 72 cents-75 cents, below consensus of 75 cents.

Glaukos (GKOS +0.64%) rallied over 7% in after-hours trading after it said it sees full-year net sales of $160 million-$165 million, better than consensus of $147.5 million.

Retrophin (RTRX +1.08%) dropped 5% in after-hours trading after it said it sees fiscal 2017 net revenue of $150 million-$160 million, less than consensus of $162.7 million.

Box Inc. (BOX +3.63%) slipped nearly 3% in after-hours trading after it said it sees a Q1 adjusted loss of -14 cents to -15 cents a share, wider than consensus of -12 cents.

Health Insurance Innovations (HIIQ -0.56%) climbed 4% in after-hours trading after it reported Q4 EPS of 35 cents, well above consensus of 18 cents.

Juno Therapeutics (JUNO +5.28%) dropped 6% in after-hours trading after it reported a Q4 adjusted loss of -65 cents a share, wider than consensus of -63 cents.

Pacific Ethanol (PEIX +6.37%) rose 4% in after-hours trading after it reported Q4 revenue of $441.7 million, above consensus of $423.8 million.

Nektar Therapeutics (NKTR -0.54%) lost nearly 3% in after-hours trading after it reported Q4 revenue of $37.5 million, below consensus of $40.7 million.

Kratos Defense & Security Solutions (KTOS -2.67%) slid 4% in after-hours trading after it announced a proposed public offering of common stock, although no amount was given.

Casella Waste Systems (CWST +3.68%) jumped 7% in after-hours trading after it said it sees 2017 revenue of $577 million-$587 million, better than consensus of $575.3 million.

Synergy Pharmaceuticals (SGYP -1.90%) lost nearly 3% in after-hours trading after it reported a Q4 loss of -31 cents a share, wider than consensus of -18 cents.

AXT Inc. (AXTI +5.63%) tumbled nearly 10% in after-hours trading after it announced a proposed public offering of common stock.

MARKET COMMENTS

Mar E-mini S&Ps (ESH17 -0.09%) this morning are down -2.50 points (-0.10%). Wednesday's closes: S&P 500 +1.37%, Dow Jones +1.46%, Nasdaq +1.14%. The S&P 500 on Wednesday rallied to a new record high and settled higher on signs of strength in Chinese manufacturing activity after the China Feb manufacturing PMI unexpectedly rose +0.3 to 51.6, stronger than expectations of -0.1 to 51.2. There was also positive U.S. data in the form of the +1.7 point increase in the U.S. Feb ISM manufacturing index to 57.7 (stronger than expectations of +0.2 to 56.2 and the fastest pace of expansion in 2-1/2 years) and the +0.4% increase in Jan personal income (stronger than expectations of +0.3%, which may help sustain the U.S. recovery).

Jun 10-year T-notes (ZNM17 -0.14%) this morning are down -2.5 ticks. Wednesday's closes: TYM7 -27.50, FVM7 -18.25. Jun 10-year T-notes on Wednesday fell to a 1-1/2 week low and closed lower on the sharp rise in expectations to 80% for a Fed rate hike at its next meeting on March 14-15. T-notes were also undercut by the stronger-than-expected U.S. Feb ISM manufacturing index (+1.7 to a 2-1/2 year high of 57.7) and by the rally in the S&P 500 to a fresh all-time high, which curbs the safe-haven demand for T-notes.

The dollar index (DXY00 +0.30%) this morning is up +0.22 (+0.22%) at a 1-1/2 month high. EUR/USD (^EURUSD) is down -0.0026 (-0.25%). USD/JPY (^USDJPY) is up +0.56 (+0.49%) at a 2-week high. Wednesday's closes: Dollar index +0.66 (+0.65%), EUR/USD -0.0029 (-0.27%), USD/JPY +0.96 (+0.85%). The dollar index on Wednesday climbed to a 1-1/2 month high and closed higher on the sharp increase in expectations for a March Fed rate hike and on the increase in the 10-year T-note yield to a 1-1/2 week high, which improves the dollar's interest rate differentials.

Apr WTI crude oil prices (CLJ17 -0.87%) this morning are down -43 cents (-0.80%) and Apr gasoline (RBJ17 -1.41%) is -0.0287 (-1.71%). Wednesday's closes: Apr crude -0.18 (-0.33%), Apr gasoline -0.0514 (-2.97%). Apr crude oil and gasoline on Wednesday closed lower on the rally in the dollar index to a 1-1/2 month high and the +0.3% increase in U.S. crude production in the week of Feb 24 to 9.032 million bpd, an 11-month high. Losses were contained after EIA crude inventories rose +1.501 million bbl, less than expectations of +3.0 million bbl.

Disclosure: None.