Morning Call For Thursday, June 22

OVERNIGHT MARKETS AND NEWS

Sep E-mini S&Ps (ESU17 -0.04%) this morning are down -0.07% and European stocks are down -0.31% as this week's sell-off in crude oil prices to a 7-1/4 month low weighs on energy stocks. Also, Brexit concerns are brought back to the forefront as EU leaders start a 2-day summit in Brussels. Stock losses were contained as mining stocks strengthened after Jul COMEX copper (HGN17 +0.23%) rose +0.19% to a 1-week high. The markets await today's speech from Fed Governor Powell who will speak before a Senate Banking Committee on fostering economic growth. Also, the Fed will release results of part one of its annual bank stress tests after the markets close today. Asian stocks settled mixed: Japan -0.14%, Hong Kong -0.08%, China -0.28%, Australia +0.71%, Singapore +0.43%, South Korea +0.63%, India +0.02%. China's Shanghai Composite rallied to a 2-month high after Wednesday's decision by MSCI to include 222 Chinese companies in its global benchmark indexes next year lifted stock prices. However, a report that Chinese regulators had asked some banks to provide information on overseas loans to companies prompted profit-taking and Chinese stocks shed their gains and closed lower.

The dollar index (DXY00 unch) is down -0.03%. EUR/USD (^EURUSD) is down -0.04%. USD/JPY (^USDJPY) is down -0.06%.

Sep 10-year T-note prices (ZNU17 -0.04%) are up +0.5 of a tick.

UK Jun CBI trends total orders unexpectedly rose +7 to 16, stronger than expectations of -2 to 7 and the highest since Aug of 1988. Jun CBI trends selling prices was unch at 23, stronger than expectations of -3 to 20.

U.S. STOCK PREVIEW

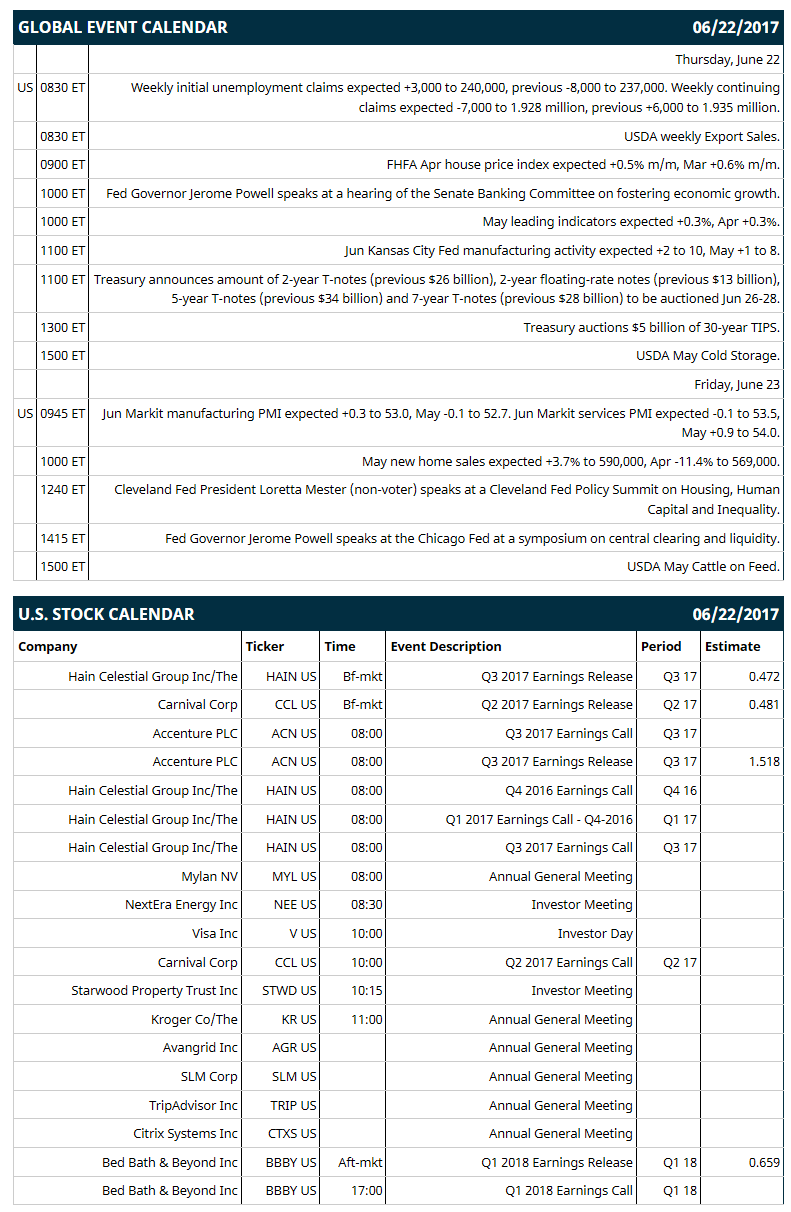

Key U.S. news today includes: (1) weekly initial unemployment claims (expected +3,000 to 240,000, previous -8,000 to 237,000) and continuing claims (expected -7,000 to 1.928 million, previous +6,000 to 1.935 million), (2) FHFA Apr house price index (expected +0.5% m/m, May +0.6% m/m), (3) Fed Governor Jerome Powell speaks at a hearing of the Senate Banking Committee on fostering economic growth, (4) May leading indicators (expected +0.3%, Apr +0.3%), (5) Jun Kansas City Fed manufacturing activity (expected +2 to 10, May +1 to 8), (6) Treasury auctions $5 billion of 30-year TIPS, (7) USDA weekly Export Sales, (8) USDA May Cold Storage.

Notable Russell 2000 earnings reports today include: Bed Bath & Beyond (consensus $0.66), Accenture (1.52), Carnival (0.48), Hain Celestial (0.47).

U.S. IPO's scheduled to price today: Four Springs Capital Trust (FSPR), Granite Point Mortgage Trust (GPMT).

Equity conferences this week: Tudor Picker & Holt Hotter N Hell Energy Conference on Tue-Thu, SunTrust Robinson Utilities & Power Summit on Thu, Wells Fargo Securities 5G Forum on Thu.

OVERNIGHT U.S. STOCK MOVERS

CarMax (KMX +0.81%) was downgraded to 'Neutral' from 'Positive' at Susquehanna.

Texas Roadhouse (TXRH -1.42%) was upgraded to 'Outperform' from 'Market Perform' at BMO Capital Markets with a price target of $58.

Cinemark Holdings (CNK -0.70%) was downgraded to 'Underperform' from 'Neutral' at Credit Suisse.

Splunk (SPLK +0.37%) was upgraded to 'Buy' from 'Neutral' at Guggenheim with a price target of $70.

Abercrombie & Fitch (ANF -1.31%) was upgraded to 'Hold' from 'Sell' at Wunderlich Securities.

Southwest Airlines (LUV +1.16%) was upgraded to 'Buy' from 'Hold' at Argus with a price target of $68.

Oracle (ORCL +1.07%) rallied nearly 10% in pre-market trading after it reported Q4 adjusted EPS of 89 cents, higher than consensus of 78 cents

FB Financial (FBK -0.47%) filed to sell 4.81 million shares for holders.

Steelcase (SCS -1.21%) plunged 18% in after-hours trading after it reported Q1 revenue of $735.1 million, weaker than consensus of $744.5 million, and then said it sees Q2 revenue of $750 million-$780 million, below consensus of $799.5 million.

Hain Celestial Group (HAIN +0.39%) climbed over 3% in after-hours trading ahead of the release of its Q1 EPS results before trading on Thursday.

Taylor Morrison Home (TMHC -1.27%) fell over 2% in after-hours trading after it announced that it had commenced an underwritten public offering of 10.0 million shares of its Class A common stock.

Jernigan Capital (JCAP -0.98%) dropped 8% in after-hours trading after announced that it had commenced an underwritten public offering of 3.0 million shares of its common stock.

New Residential Investment (NRZ -0.50%) rose over 2% in after-hours trading after it raised its quarterly dividend to 50 cents a share from 48 cents, the second time this year it has raised its dividend.

MARKET COMMENTS

Sep E-mini S&Ps (ESU17 -0.04%) this morning are down -1.75 points (-0.07%). Wednesday's closes: S&P 500 -0.06%, Dow Jones -0.27%, Nasdaq +0.98%. The S&P 500 on Wednesday closed lower on carry-over weakness from a drop in European stocks and on the -2.25% slide in crude oil prices to a 7-1/4 month low, which pushed energy stocks lower. Bullish factors included strength in technology stocks and the unexpected +1.1% increase in U.S. May existing home sales to 5.62 million, stronger than expectations of -0.4% to 5.55 million.

Sep 10-year T-notes (ZNU17 -0.04%) this morning are up +0.5 of a tick. Wednesday's closes: TYU7 -2.50, FVU7 -1.25. Sep 10-year T-notes on Wednesday closed lower on the unexpected increase in U.S. May existing home sales and on negative carry-over from a slide in UK 10-year gilt prices after the BOE's chief economist said he is leaning toward raising interest rates later this year.

The dollar index (DXY00 unch) this morning is down -0.028 (-0.03%). EUR/USD (^EURUSD) is down -0.0004 (-0.04%) and USD/JPY (^USDJPY) is down -0.07 (-0.06%). Wednesday's closes: Dollar index -0.201 (-0.21%), EUR/USD +0.0034 (+0.31%), USD/JPY -0.07 (-0.06%). The dollar index on Wednesday closed lower on short-covering in GBP/USD which rose after BOE chief economist Haldane said that risks of keeping monetary policy too loose are rising and that he considered voting for a rate hike this month. There was also short-covering in EUR/USD after 2 days of losses.

Aug WTI crude oil prices (CLQ17 +0.61%) this morning are up +19 cents (+0.45%) and Aug gasoline (RBQ17 +0.87%) is +0.0090 (+0.64%). Wednesday's closes: Aug crude -0.98 (-2.25%), Aug gasoline -0.0147 (-1.04%). Aug crude oil and gasoline on Wednesday closed lower with Aug crude at a 7-1/4 month low and Aug gasoline at a 6-1/2 month low. Crude oil prices were undercut by increased U.S. crude output as U.S. crude production in the week of Jun 16 rose +0.2% to 9.35 million bpd, the most in 1-3/4 years, and by the +1.08 million bbl increase in EIA distillate inventories, a bigger increase than expectations of +500,0000 bbl.

(Click on image to enlarge)

Disclosure: None.