Morning Call For Thursday, June 1

OVERNIGHT MARKETS AND NEWS

Jun E-mini S&Ps (ESM17 +0.06%) this morning are up +0.08% and European stocks are up +0.38% ahead of the May ADP employment change, a private U.S. survey on job creation. Increased M&A activity is helping to lift equity prices after Deere agreed to buy Wirtgen Group for 4.357 billion euros ($5.1 billion). Gains were limited after San Francisco Fed President Williams said that four rate hikes may be appropriate this year if the economy strengthens. Asian stocks settled mixed: Japan +1.07%, Hong Kong +0.58%, China -0.47%, Taiwan +0.47%, Australia +0.24%, Singapore +0.78%, South Korea -0.21%, India -0.03%. China's Shanghai Composite closed lower after the May Caixin manufacturing PMI contracted by the most in 11 months. The Chinese yuan climbed to a 6-3/4 month high against the dollar as short-sellers of the yuan continue to capitulate. The yuan has rallied sharply over the past week as the PBOC has been intervening in currency markets to support the yuan since Moody's downgraded China's debt rating last week. Japan's Nikkei Stock Index rallied to a 2-week high after Japan Q1 capital spending rose more than expected by the fastest pace in over a year.

The dollar index (DXY00 +0.24%) is up +0.21%. EUR/USD (^EURUSD) is down -0.17%. USD/JPY (^USDJPY) is up +0.36%.

Sep 10-year T-note prices (ZNU17 -0.10%) are down -3 ticks.

Speaking last night in Seoul, South Korea, San Francisco Fed President Williams said that three 25 bp rate increases by the Fed this year is a reasonable view, but if the economy strengthens, four rate hikes would be appropriate.

Bundesbank President Weidmann said the ECB is starting to debate whether to reflect the Eurozone's improving economic prospects in its policy guidance and that the strengthening recovery makes it increasingly likely that the rise in the inflation rate isn't "just a flash in the pan."

The China Caixin May (flash) manufacturing PMI fell -0.7 to 49.6, weaker than expectations of -0.2 to 50.1 and the steepest pace of contraction in 11 months.

Japan Q1 capital spending rose +4.5% y/y, stronger than expectations of +4.0% y/y and the biggest increase since Q4 of 2015. Q1 capital spending ex-software rose +5.2% y/y, stronger than expectations of +4.1% y/y.

U.S. STOCK PREVIEW

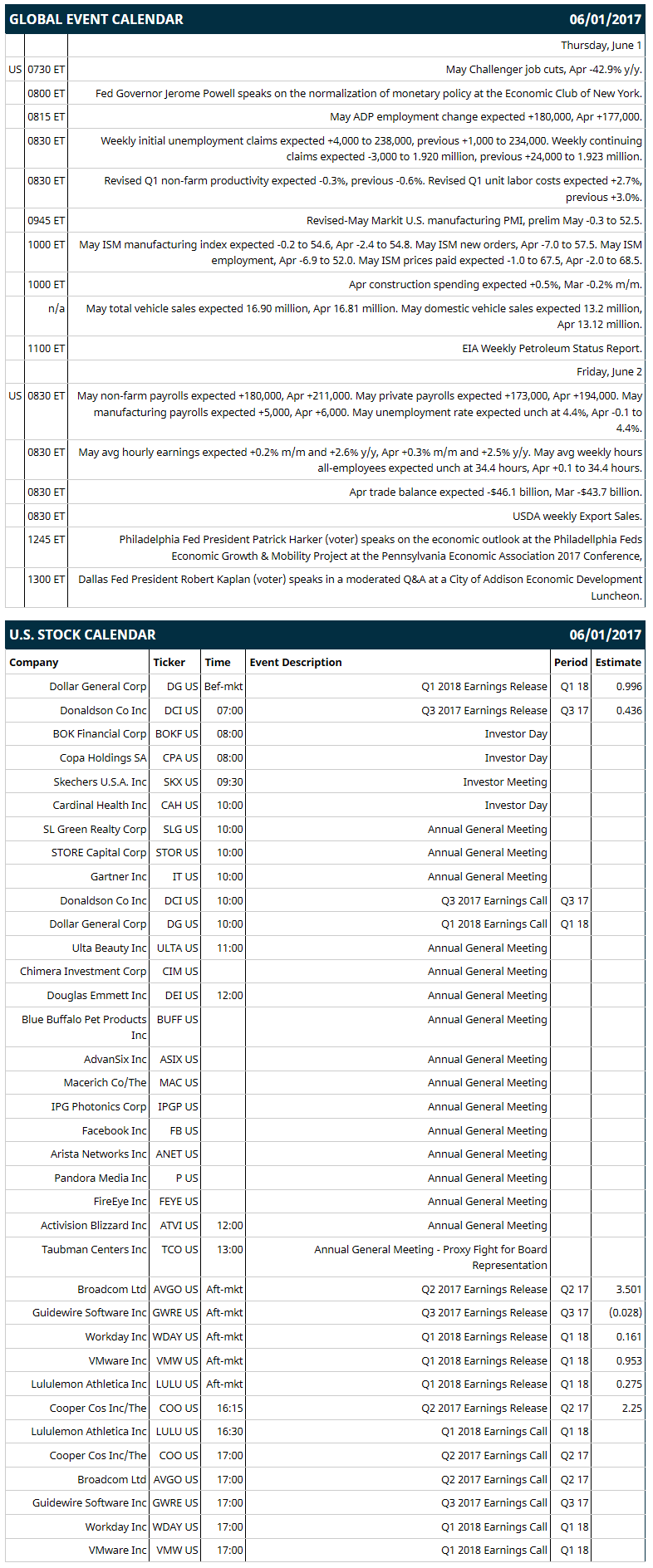

Key U.S. news today includes: (1) May Challenger job cuts (Apr -42.9% y/y), (2) Fed Governor Jerome Powell speaks on the normalization of monetary policy at the Economic Club of New York, (3) May ADP employment (expected +180,000, Apr +177,000), (4) weekly initial unemployment claims (expected +4,000 to 238,000, previous +1,000 to 234,000) and continuing claims (expected -3,000 to 1.920 million, previous +24,000 to 1.923 million), (5) revised Q1 non-farm productivity (expected -0.3%, previous -0.6%) and revised Q1 unit labor costs (expected +2.7%, previous +3.0%), (6) revised-May Markit U.S. manufacturing PMI (prelim May -0.3 to 52.5), (7) May ISM manufacturing index (expected -0.2 to 54.6, Apr -2.4 to 54.8) (8) Apr construction spending (expected +0.5%, Mar -0.2% m/m), (9) May total vehicle sales (expected 16.90 million, Apr 16.81 million), (1) EIA Weekly Petroleum Status Report.

Notable Russell 2000 earnings reports today include: VMware (consensus $0.95), Dollar General (1.00), Donaldson (0.44), Lululemon Athletica (0.28), Coopers Cos (2.25), Broadcom (3.50), Guidewire Software (-0.03), Workday (0.16),

U.S. IPO's scheduled to price today: KBL Merger Corp IV (KBLMU).

Equity conferences: Cowen & Co Technology, Media & Telecom Conference on Wed-Thu, RBC Capital Markets Consumer and Retail Conference on Wed-Thu, KeyBanc Capital Markets Industrial, Automotive & Transportation Conference on Wed-Thu, Sanford C. Bernstein & Co. Strategic Decision Conference on Wed-Fri, American Society of Clinical Oncology Meeting on Fri.

OVERNIGHT U.S. STOCK MOVERS

Goodyear Tire (CTB +0.14%) rose nearly 5% in pre-market trading after it was upgraded to 'Overweight' from 'Underweight' at Morgan Stanley with a price target of $52.

Illinois Tool Works (ITW +0.09%) climbed over 2% in pre-market trading after it was upgraded to 'Buy' from 'Sell' at Goldman Sachs with a price target of $155.

Flour (FLR -0.38%) was upgraded to 'Buy' from 'Neutral' at D.A. Davidson & Co with a 12-month target price of $55.

Palo Alto Networks (PANW +1.36%) rallied 13% in after-hours trading after it reported Q3 revenue of $431.8 million, better than consensus of $411.87 million, and then said it sees Q4 adjusted EPS of 78 cents-80 cents, higher than consensus of 74 cents. Proofpoint (PFPT -0.74%) rose 2% and FireEye (FEYE +0.20%) and Fortinet (FTNT +0.49%) both climbed over 1% in after-hours trading on the news.

Semtech (SMTC +2.83%) dropped 3% in after-hours trading after it reported Q1 net sales of $143.8 million, below consensus of $146.17 million.

Box Inc (BOX +0.70%) climbed over 4% in after-hours trading after it reported Q1 revenue of $117.22 million, better than consensus of $114.92 million, and then raised its view on full-year revenue to $502 million-$506 million from a prior view of $500 million-$504 million.

Caesars Entertainment (CZR -1.35%) was initiated with coverage at Oppenheimer with a recommendation of "Outperform" with an 18-month price target of $15.

Hewlett Packard Enterprise (HPE -0.21%) slipped 2% in after-hours trading after it reported Q2 revenue of $9.9 billion, below consensus of $10.1 billion.

Callon Petroleum (CPE -3.66%) gained almost 1% in after-hours trading after it amended and restated a credit pact for its secured revolving credit facility that boosts the borrowing base by 30% to $650 million.

Minerva Neurosciences (NERV -3.51%) surged 15% in after-hours trading after it said it had amended its pact with Janssen Pharmaceuticals for the MIN-202 drug to treat insomnia were Minerva now has global strategic control over the development of MIN-202.

MARKET COMMENTS

June E-mini S&Ps (ESM17 +0.06%) this morning are up +2.00 points (+0.08%). Wednesday's closes: S&P 500 -0.05%, Dow Jones -0.10%, Nasdaq -0.10%. The S&P 500 on Wednesday closed lower on weakness in bank stocks after executives at both JPMorgan Chase and Bank of America said that trading revenue is likely to fall in the current quarter from a year ago due to low volatility. Other negative factors included the unexpected decline in U.S. Apr pending home sales by -1.3% m/m (weaker than expectations of +0.5% m/m) and a slump in energy stocks after crude oil prices plunged -2.70%.

Sep 10-year T-notes (ZNU17 -0.10%) this morning are down -3 ticks. Wednesday's closes: TYU7 +4.50, FVU7 +1.50. Sep T-notes on Wednesday rose to a 1-1/2 week high and closed higher on the weaker-than-expected Apr pending home sales and May Chicago PMI report.

The dollar index (DXY00 +0.24%) this morning is up +0.206 (+0.21%). EUR/USD (^EURUSD) is down -0.0019 (-0.17%) and USD/JPY (^USDJPY) is up +0.40 (+0.36%). Wednesday's closes: Dollar index -0.338 (-0.35%), EUR/USD +0.0058 (+0.52%), USD/JPY -0.07 (-0.06%). The dollar index on Wednesday fell to a 1-week low and closed lower on the slide in stocks, which boosted the safe-haven demand for the yen and sent USD/JPY down to a 1-1/2 week low. There was also strength in EUR/USD which rose to a 1-week high on comments from ECB Executive Board member Lautenschlaeger who said the Eurozone "recovery continues to firm and broaden and worries about deflation have disappeared."

July WTI crude oil prices (CLN17 +0.50%) this morning are unch and July gasoline (RBN17 +1.03%) is +0.0086 (+0.54%). Wednesday's closes: Jul crude -1.34 (-2.70%), Jul gasoline -0.0278 (-1.71%). Jul crude oil and gasoline on Wednesday closed lower with Jul crude at a 2-week low and Jul gasoline at a 1-1/2 week low. Crude oil prices were undercut by continued concern that rising U.S. crude output will offset crude production cuts by OPEC as last Friday's Baker Hughes data showed U.S. active oil rigs in the week ended May 26 rose by +2 rigs to a 2-year high of 722 rigs. Crude oil prices were also undercut by the weaker-than-expected Chicago May PMI and U.S. Apr pending home sales reports, which suggest slower U.S. growth.

(Click on image to enlarge)

Disclosure: None.