Morning Call For Thursday, Jan 11

OVERNIGHT MARKETS AND NEWS

Mar E-mini S&Ps (ESH18 +0.18%) this morning are up +0.08% on strength in energy stocks and as the rout in Treasuries abated. Energy stocks gained as Feb WTI crude oil (CLG18 +0.63%) climbs +0.53% to a new 3-year high after Wednesday's weekly EIA data showed U.S. crude inventories fell for an eighth week to a 2-1/3 year low. U.S. Treasury prices rose after China's State Administration of Foreign Exchange said that a report saying officials reviewing the country's foreign-exchange holdings have recommended slowing or halting purchases of U.S. Treasuries might have used a "wrong source." European stocks are down -0.07%, led by losses in retail stocks, although the downside was contained after Eurozone Nov industrial production rose more than expected. Asian stocks settled mixed: Japan -0.33%, Hong Kong +0.15%, China +0.10%, Taiwan -0.19%, Australia -0.48%, Singapore -0.22%, South Korea -0.59%, India +0.20%. Japan's Nikkei Stock Index retreated, led by losses in exporters, after USD/JPY tumbled to a 6-week low on Wednesday.

The dollar index (DXY00 +0.17%) is up +0.14%. EUR/USD (^EURUSD) is down -0.03%. USD/JPY (^USDJPY) is up +0.14%.

Mar 10-year T-note prices (ZNH18 +0.06%) are up +2.5 ticks.

The Japan Nov leading index CI rose +2.1 to a 3-3/4 year high of 108.6, right on expectations. The Nov coincident index rose +1.7 to a 10-year high of 118.1, stronger than expectations of +1.5 to 117.9.

Eurozone Nov industrial production rose +1.0% m/m, stronger than expectations of +0.8% m/m.

U.S. STOCK PREVIEW

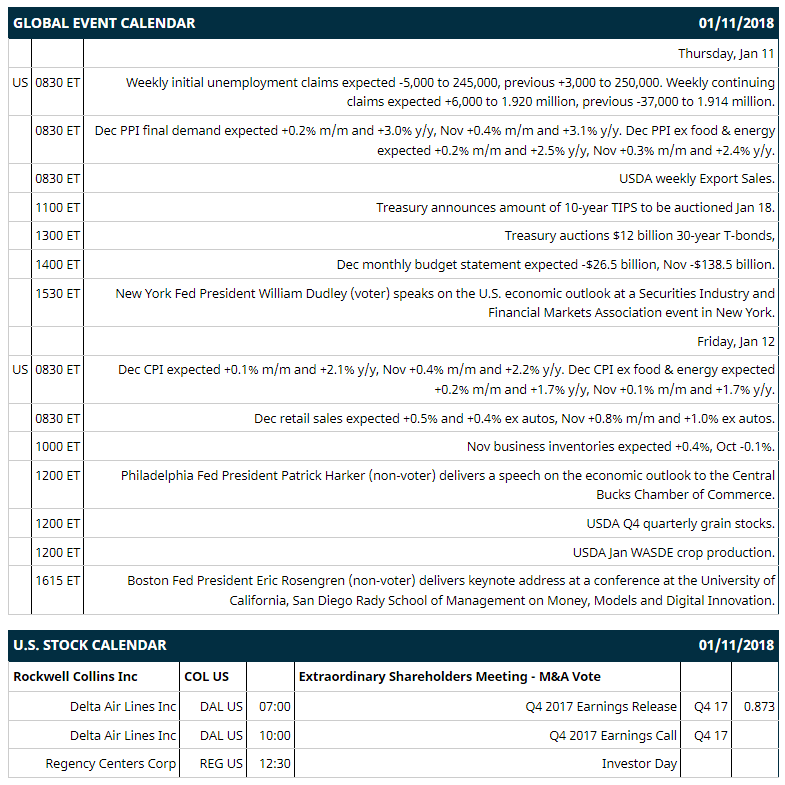

Key U.S. news today includes: (1) weekly initial unemployment claims (expected -5,000 to 245,000, previous +3,000 to 250,000) and continuing claims (expected +6,000 to 1.920 million, previous -37,000 to 1.914 million), (2) Dec PPI final demand (expected +0.2% m/m and +3.0% y/y, Nov +0.4% m/m and +3.1% y/y) and Dec PPI ex food & energy (expected +0.2% m/m and +2.5% y/y, Nov +0.3% m/m and +2.4% y/y), (3) USDA weekly Export Sales, (4) Treasury auctions $12 billion 30-year T-bonds, (5) Dec monthly budget statement (expected -$26.5 billion, Nov -$138.5 billion), (6) New York Fed President William Dudley (voter) speaks on the U.S. economic outlook at a Securities Industry and Financial Markets Association event in New York.

Notable Russell 1000 earnings reports today include: Delta Airlines (consensus $0.87).

U.S. IPO's scheduled to price today: Liberty Oilfield Services (LBRT), Industrial Logistics Properties Trust (ILPT), Platinum Eagle Acquisitions (EAGLU).

Equity conferences this week: J.P. Morgan Health Care Conference on Mon-Thu.

OVERNIGHT U.S. STOCK MOVERS

Union Pacific (UNP -0.92%) was upgraded to 'Outperform' from 'Neutral' at Daiwa Securities with a price target of $158.

VMware (VMW -0.04%) was upgraded to 'Ourperform' from 'Market Perform' at Cowen.

KB Home (KBH +0.44%) rose almost 4% in after-hours trading after it reported Q4 revenue of $1.40 billion, higher than consensus of $1.35 billion.

Progress Software (PRGS -0.11%) jumped 7% in after-hours trading after it said it sees full-year adjusted EPS of $2.29 to $2.35, well above consensus of $1.88.

Duke Energy (DUK -1.39%) was downgraded to 'Neutral' from 'Buy' at Goldman Sachs.

Expedia (EXPE -0.08%) gained over 1% in after-hours trading after it was upgraded to 'Overweight' from 'Equal-Weight' at Morgan Stanley with a price target of $160.

Zillow Group (ZG +0.55%) rose nearly 2% in after-hours trading after it was upgraded to 'Overweight' from 'Equal-Weight' at Morgan Stanley with a price target of $50.

Advanced Energy (AEIS -1.06%) was rated a new 'Buy' at D.A. Davidson.

Dollar Tree (DLTR -0.05%) was rated a new 'Buy' at Guggenheim Securities with a 12-month target price of $125.

NiSource (NI -2.31%) was upgraded to 'Buy' from 'Neutral' at Goldman Sachs.

Southern Co (SO -1.39%) was downgraded to 'Sell' from 'Neutral' at Goldman Sachs.

Avangrid (AGR -1.88%) was rated a new 'Buy' at Goldman Sachs.

Coupa Software (COUP -0.47%) was rated a new 'Buy' at Needham & Co with a 12-month target price of $39.

Lipocene (LPCN +1.17%) plummeted over 50% in after-hours trading after a FDA advisory panel voted 13-6 that the benefit/risk of Lipocene's Tlando isn't acceptable as a testosterone replacement therapy.

MARKET COMMENTS

Mar S&P 500 E-mini stock futures (ESH18 +0.18%) this morning are up +2.25 points (+0.08%). Wednesday's closes: S&P 500 -0.11%, Dow Jones -0.07%, Nasdaq -0.23%. The S&P 500 on Wednesday closed lower on interest rate concerns after the 10-year T-note yield rose to a 9-3/4 month high of 2.59%. Stocks were also undercut by the Reuters report saying that Canadian officials are increasingly convinced that President Trump will withdraw the U.S. from the NAFTA agreement. Stocks were underpinned by strength in energy stocks after crude oil prices climbed to a 3-year high.

Mar 10-year T-note prices (ZNH18 +0.06%) this morning are up +2.5 ticks. Wednesday's closes: TYH8 -1.50, FVH8 -0.50. Mar 10-year T-notes on Wednesday fell to a new contract low and the 10-year T-note yield rose to a 9-3/4 month high. T-note prices were undercut by concern about demand for Treasuries from China, the number one holder of U.S. debt, after a Bloomberg report said officials reviewing China's foreign-exchange holdings have recommended slowing or halting purchases of U.S. Treasuries. T-note prices were also undercut by increased U.S. inflation expectations after the 10-year T-note breakeven inflation rate rose to 9-3/4 month high.

The dollar index (DXY00 +0.17%) this morning is up +0.129 (+0.14%). EUR/USD (^EURUSD) is down -0.0003 (-0.03%) and USD/JPY (^USDJPY) is up +0.16 (+0.14%). Wednesday's closes: Dollar Index -0.196 (-0.21%), EUR/USD +0.0011 (+0.09%), USD/JPY -1.21 (-1.07%). The dollar index on Wednesday closed lower on the slide in USD/JPY to a 1-1/4 month low as the yen strengthened on speculation the BOJ may be nearer to ending QE after it cut the size of its long-dated government bond purchases on Tuesday for the first time since 2016. The dollar was also undercut by dovish comments from Chicago Fed President Evans who said he wanted to delay last month's Fed rate hike until mid-2018 "just to make sure the transitory reductions in inflation go away."

Feb crude oil (CLG18 +0.63%) this morning is up +34 cents (+0.53%) at a fresh 3-year high and Feb gasoline (RBG18 +0.29%) is +0.0029 (+0.16%). Wednesday's closes: Feb WTI crude +0.61 (+0.97%), Feb gasoline -0.0035 (-0.19%). Feb crude oil and gasoline on Wednesday settled mixed with Feb crude at a 3-year high. Crude oil prices were supported by the -4.95 million bbl decline in EIA crude inventories to a 2-1/3 year low, the eighth straight weekly decline, and by the -2.4 million bbl decline in crude supplies at Cushing to a 2-3/4 year low, a bigger decline than expectations of -1.5 million bbl. Gasoline prices fell on the +4.14 million bbl increase in EIA gasoline stockpiles to a 6-month high (vs expectations of +3.5 million bbl) and on the decline in the crack spread to a 3-week low, which reduces incentive for refiners to purchase crude to refine into gasoline.

Metals prices this morning are mixed with Feb gold +0.5 (+0.04%), Mar silver -0.010 (-0.06%), and Mar copper +0.010 (+0.31%). Wednesday's closes: Feb gold +5.6 (+0.43%), Mar silver +0.025 (+0.15%), Mar copper +0.0195 (+0.61%). Metals on Wednesday closed higher with Feb gold at a 4-month high on a weaker dollar and on the slide in stocks that boosted the safe-haven demand for precious metals.

(Click on image to enlarge)

Disclosure: None.