Morning Call For Thursday, Dec. 22

OVERNIGHT MARKETS AND NEWS

Mar E-mini S&Ps (ESH17 -0.09%) are down -0.09% and European stocks are down -0.04% in quiet trade. A -1.18% decline in Mar COMEX copper (HGH17 -0.92%) to a 1-month low is undercutting mining stocks, while a -0.40% fall in Feb WTI crude oil (CLG17 -0.53%) is putting pressure on energy producing stocks. Asian stocks settled mixed: Japan -0.09%, Hong Kong -0.80%, China +0.07%, Taiwan -0.93%, Australia +0.54%, Singapore -0.68%, South Korea -0.05%, India -1.00%.

The dollar index (DXY00 -0.10%) is down -0.07%. EUR/USD (^EURUSD) is up +0.26% after the ECB in its monthly bulletin said that it sees the recovery in the Eurozone continuing and that headline inflation will pick up in 2017. USD/JPY (^USDJPY) is down -0.20%

Mar 10-year T-note prices (ZNH17 -0.05%) are down -2 ticks.

The ECB in its monthly economic bulletin said that it sees a moderate, firming Eurozone recovery proceeding and that headline inflation to pick up strongly at the turn of the year.

U.S. STOCK PREVIEW

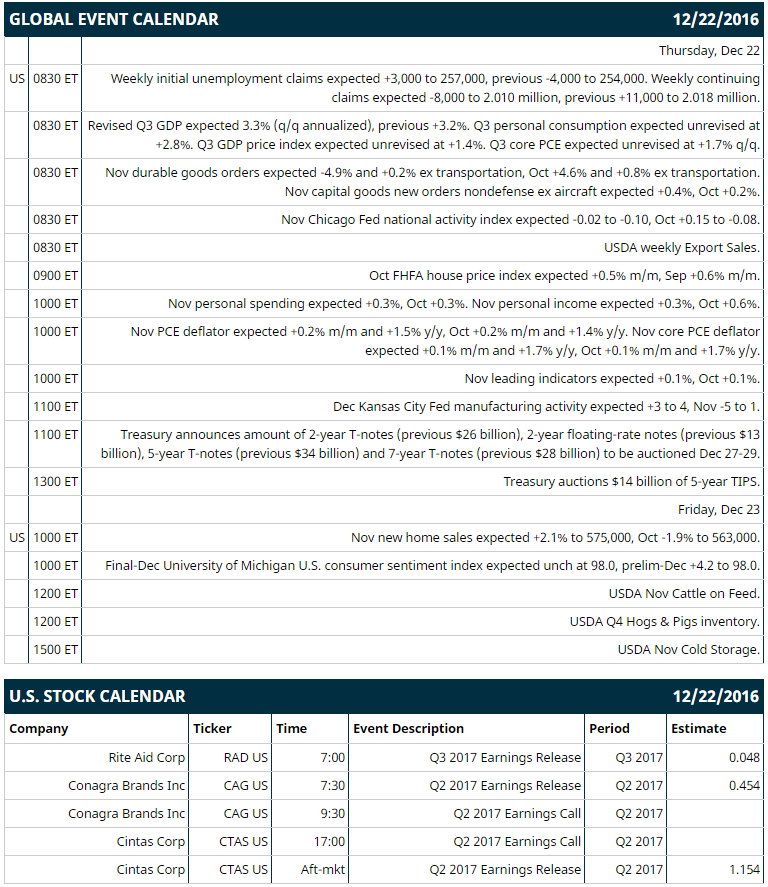

Key U.S. news today includes: (1) weekly initial unemployment claims (expected +3,000 to 257,000, previous -4,000 to 254,000) and continuing claims (expected -8,000 to 2.010 million, previous +11,000 to 2.018 million), (2) revised Q3 GDP expected 3.3% (q/q annualized) vs previous +3.2% (3) Nov durable goods orders (expected -4.9% and +0.2% ex transportation, Oct +4.6% and +0.8% ex transportation), (4) Nov Chicago Fed national activity index (expected -0.02 to -0.10, Oct +0.15 to -0.08), (5) Oct FHFA house price index (expected +0.5% m/m, Sep +0.6% m/m), (6) Nov personal spending (expected +0.3%, Oct +0.3%) and Nov personal income (expected +0.3%, Oct +0.6%), (7) Nov PCE deflator (expected +0.2% m/m and +1.5% y/y, Oct +0.2% m/m and +1.4% y/y) and Nov core PCE deflator (expected +0.1% m/m and +1.7% y/y, Oct +0.1% m/m and +1.7% y/y), (8) Nov leading indicators (expected +0.1%, Oct +0.1%), (9) Dec Kansas City Fed manufacturing activity (expected +3 to 4, Nov -5 to 1), (10) Treasury auctions $14 billion of 5-year TIPS, and (11) USDA weekly Export Sales.

Russell 1000 earnings reports today include: Cintas (consensus $1.15), Rite Aid (0.05), Conagra (0.45).

U.S. IPO's scheduled to price today: none.

Equity conferences this week: none.

OVERNIGHT U.S. STOCK MOVERS

Finish Line (FINL -8.74%) was downgraded to 'Hold' from 'Buy' at Canaccord Genuity.

Akamai Technologies (AKAM -1.21%) was rated a new 'Buy' at Guggenheim Securities with a 12-month target price of $75.

Microsoft (MSFT unch) was rated a new 'Overweight' at Piper Jaffray with a price target of $80.

Cubic (CUB -0.41%) was initiated with a 'Buy' at Drexel Hamilton LLC with a 12-month target price of $58.

Micron Technology (MU -0.34%) rallied over 9% in after-hours trading after it said it sees fiscal year Q2 adjusted EPS of 58 cents-68 cents, well above consensus of 46 cents.

Bed Bath & Beyond (BBBY -1.39%) lost over 2% in after-hours trading after it said Q3 comparable same store sales unexpectedly fell -1.4%, weaker than consensus of a +0.5% increase.

Power Integrations (POWI -1.10%) was rated a new 'Buy' at Drexel Hamilton LLC with a 12-month target price of $79.

Herman Miller (MLHR -0.98%) fell over 6% in after-hours trading after it reported Q2 net sales of $577.5 million, less than consensus of $593 million. and said it sees Q3 EPS of 31 cents-35 cents, weaker than consensus of 46 cents.

Red Hat (RHT +0.50%) plunged 12% in after-hours trading after it forecast Q4 revenue of $614 million-$622 million, below consensus of $638.2 million, and then lowered guidance on fiscal 2017 revenue to $2.40 to $2.41 billion, less than consensus of $2.42 billion.

Alexion Pharmaceuticals (ALXN +1.94%) slipped 1% in after-hours trading after its Soliris drug failed to prevent complications in a trial of kidney transplant patients.

CalAmp Corp. (CAMP +1.22%) dropped nearly 6% in after-hours trading after it reported Q3 adjusted EPS of 21 cents, below consensus of 26 cents.

XOMA Corp. (XOMA -3.00%) jumped 13% in after-hours trading after it generated up to $22 million through the sale of royalty streams from two license agreements to HealthCare Royalty Partners.

MARKET COMMENTS

Mar E-mini S&Ps (ESH17 -0.09%) this morning are down -2.00 points (-0.09%). Wednesday's closes: S&P 500 -0.25%, Dow Jones -0.16%, Nasdaq -0.10%. The S&P 500 on Wednesday closed lower on carry-over weakness from a slide in European stocks that were pulled down by a sell-off in Spanish bank stocks after the EU Court of Justice ruled that borrowers in Spain who paid too much interest on home loans are entitled to a refund from their banks. There was also weakness in energy producer stocks after the price of crude oil fell -1.48%. Stocks were boosted by an unexpected +0.7% increase in U.S. Nov existing home sales to 5.61 million (stronger than expectations of -1.8% to 5.50 million and the most in 9-3/4 years) and by reduced market anxiety after the VIX volatility index fell to a 16-1/2 month low.

Mar 10-year T-notes (ZNH17 -0.05%) this morning are down -2 ticks. Wednesday's closes: TYH7 +5.50, FVH7 +3.00. Mar 10-year T-notes on Wednesday closed higher on carry-over support from a rally in German bunds to a 3-week high and on increased safe-haven demand after stocks fell.

The dollar index (DXY00 -0.10%) this morning is down -0.070 (-0.07%). EUR/USD (^EURUSD) is up +0.0027 (+0.26%). USD/JPY (^USDJPY) is up +0.10 (+0.09%). Wednesday's closes: Dollar index -0.270 (-0.26%), EUR/USD +0.0036 (+0.35%), USD/JPY -0.31 (-0.26%). The dollar index on Wednesday closed lower on a decline in U.S. Treasury yields, which reduced the dollar's interest rate differentials. There was also strength in EUR/USD after Eurozone Dec consumer confidence rose to a 1-1/2 year high.

Feb WTI crude oil prices (CLG17 -0.53%) this morning are down -21 cents (-0.40%) and Feb gasoline (RBG17 -1.46%) is -0.0219 (-1.35%). Wednesday's closes: Feb crude -0.79 (-1.48%), Feb gasoline +0.0005 (+0.03%). Feb crude oil and gasoline on Wednesday settled mixed. Crude oil prices fell after weekly EIA crude inventories unexpectedly rose +2.26 million bbl versus expectations for a -2.5 million bbl decline. Crude oil prices were boosted by a weaker dollar and by the unexpected -1.31 million bbl decline in EIA gasoline stockpiles (vs expectations for a +1.375 million bbl increase).

Disclosure: None.