Morning Call For Thursday, August 31

OVERNIGHT MARKETS AND NEWS

Sep E-mini S&Ps (ESU17 +0.21%) this morning are up +0.24% at a 2-week high on signs of strength in the global economy after the China Aug manufacturing PMI unexpectedly strengthened. European stocks are up +0.73%, led by strength in mining stocks, as optimism in the global economic outlook lifts the price of Sep COMEX copper (HGU17 +0.91%) by +0.98% to a new 2-3/4 year high. The closure of most refineries along the Texas Gulf Coast from Tropical Storm Harvey continues to boost gasoline prices with nearest-futures Sep ROB gasoline (RBU17 +5.59%) up +2.06% to a fresh 2-year high. Asian stocks settled mixed: Japan +0.72%, Hong Kong -0.44%, China -0.08%, Taiwan +0.15%, Australia +0.79%, Singapore +0.37%, South Korea -0.44%, India +0.27%. Japan's Nikkei Stock Index climbed to a 2-week high as exporter stocks rallied due to weakness in the yen after USD/JPY jumped to a 2-week high.

The dollar index (DXY00 +0.36%) is up +0.31%. EUR/USD (^EURUSD) is down -0.25% after a report from Reuters said that the recent surge in EUR/USD to a 2-1/2 year high is worrying some ECB members, which raises the chances that the ECB will be slow to taper QE. USD/JPY (^USDJPY) is up +0.33% at a 2-week high.

Sep 10-year T-note prices (ZNU17 -0.02%) are down -2.5 ticks.

The Eurozone Aug CPI estimate rose +1.5% y/y, stronger than expectations of +1.4% y/y. Aug core CPI rose +1.2% y/y, right on expectations.

The Eurozone Jul unemployment rate remained unch at 9.1%, right on expectations.

China Aug manufacturing PMI unexpectedly rose +0.3 to 51.7, stronger than expectations of -0.1 to 51.3.

U.S. STOCK PREVIEW

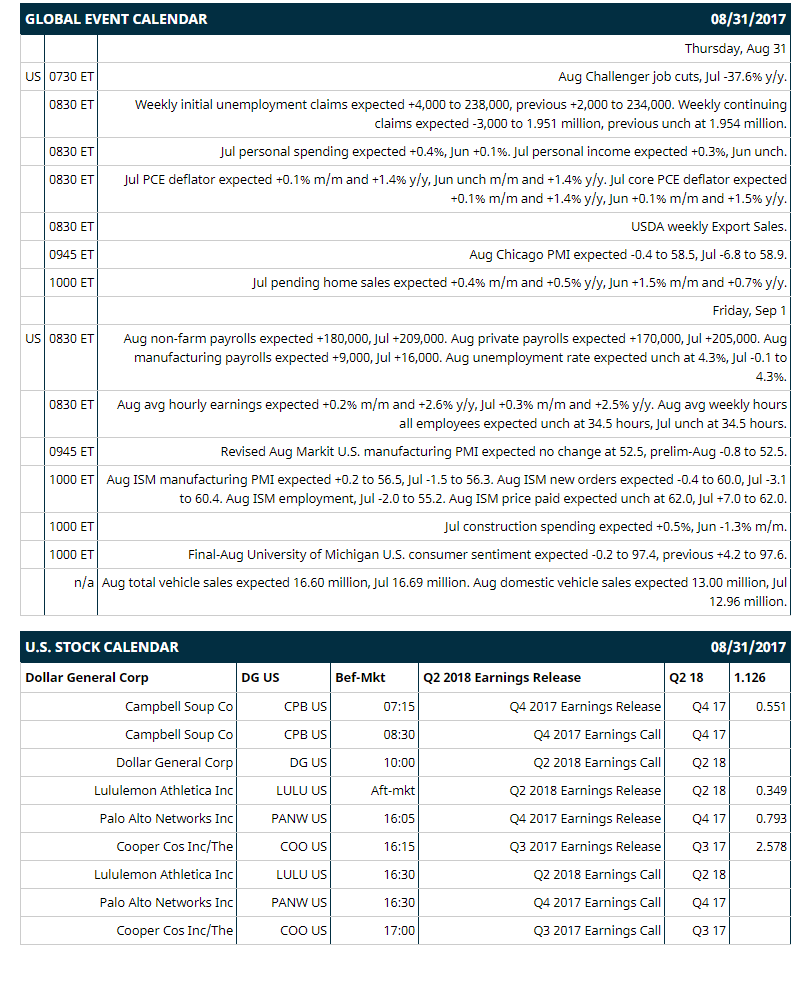

Key U.S. news today includes: (1) Aug Challenger job cuts (Jul -37.6% y/y), (2) weekly initial unemployment claims (expected +4,000 to 238,000, previous +2,000 to 234,000) and continuing claims (expected -3,000 to 1.951 million, previous unch at 1.954 million), (3) Jul personal spending (expected +0.4%, Jun +0.1%) and Jul personal income (expected +0.3%, Jun unch), (4) Jul PCE deflator (expected +0.1% m/m and +1.4% y/y, Jun unch m/m and +1.4% y/y) and Jul core PCE deflator expected (+0.1% m/m and +1.4% y/y, Jun +0.1% m/m and +1.5% y/y), (5) Aug Chicago PMI (expected -0.4 to 58.5, Jul -6.8 to 58.9), (6) Jul pending home sales (expected +0.4% m/m and +0.5% y/y, Jun +1.5% m/m and +0.7% y/y), (7) USDA weekly Export Sales.

Notable Russell 1000 earnings reports today include: Dollar General (consensus $1.13), Campbell Soup (0.55), Lululemon (0.35), Palo Alto Networks (0.79), Cooper Cos (2.58).

U.S. IPO's scheduled to price today: none.

Equity conferences this week: none.

OVERNIGHT U.S. STOCK MOVERS

FMC Corp (FMC +0.06%) was upgraded to 'Buy' from 'Underperform' at Bank of America/Merrill Lynch with a price target of $103.

Hasbro (HAS +0.47%) was upgraded to 'Overweight' from not rated at Keybanc Capital Markets with a 12-month target price of $112.

Owens Corning (OC +2.24%) was upgraded to 'Outperform' from 'Market Perform' at Wells Fargo Securities with a target price of $83.

Patterson-UTI (PTEN +0.70%) was initiated with a 'Buy' at Societe Generale with a 12-month target price of $22.

Workday (WDAY +3.00%) climbed 3% in after-hours trading after it reported Q2 adjusted EPS of 24 cents, well above consensus of 15 cents.

Five Below (FIVE +1.44%) jumped almost 6% in after-hours trading after it reported Q2 EPS of 30 cents, better than consensus of 26 cents, and then said it sees full-year EPS of $1.62 to $1.66, higher than consensus of $1.29.

YY Inc. (YY +2.26%) gained over 1% in after-hours trading after it was initiated with a 'Buy' at Goldman Sachs with a 12-month target price of $101.

Momo Inc. (MIMO) rose over 2% in after-hours trading after it was initiated with a 'Buy' at Goldman Sachs with a 12-month target price of $56.

Semtech (SMTC +3.72%) dropped over 10% in after-hours trading after it said it sees Q3 adjusted net sales of $152 million to $160 million, below consensus of $160.5 million.

Box Inc. (BOX +1.87%) slid nearly 3% in after-hours trading after it said it sees Q3 revenue of $128 million to $129 million, less than consensus of $129.1 million, and then said it sees full-year revenue of $503 million to $506 million, the mid-point below consensus of $505.7 million.

Shoe Carnival (SCVL +4.12%) jumped 12% in after-hours trading after it reported Q2 net sales of $235.1 million, above consensus of $231.3 million, and then said it expects full-year net sales of $1.01 billion to $1.02 billion, better than consensus of $1.0 billion.

DryShips (DRYS -11.63%) plunged 20% in after-hours trading after it reported a Q2 loss per share of -$37.12 and after it said it received a subpoena from the SEC for information related to its sale of stock between June 2016 and July 2017.

MARKET COMMENTS

Sep S&P 500 E-mini stock futures (ESU17 +0.21%) this morning are up +6.00 points (+0.24%) at a 2-week high. Wednesday's closes: S&P 500 +0.46%, Dow Jones +0.12%, Nasdaq +1.21%. The S&P 500 on Wednesday moved up to a 1-1/2 week high and closed higher on the upward revision to U.S. Q2 GDP to 3.0% (q/q annualized) from 2.6% and on the +237,000 increase in Aug ADP employment, stronger than expectations of +185,000 and the biggest increase in 5 months.

Sep 10-year T-note prices (ZNU17 -0.02%) this morning are down -2.5 ticks. Wednesday's closes: TYU7 -3.50, FVU7 -2.50.Sep 10-year T-notes on Wednesday closed lower on the stronger-than-expected U.S. Q2 GDP and Aug ADP employment reports, which bolster the case for the Fed's next rate hike. T-notes were also undercut by reduced safe-haven demand with the rally in stocks and reduced North Korean tensions.

The dollar index (DXY00 +0.36%) this morning is up +0.291 (+0.31%). EUR/USD (^EURUSD) is down -0.0030 (-0.25%) and USD/JPY (^USDJPY) is up +0.36 (+0.33%) at a 2-week high. Wednesday's closes: Dollar Index +0.635 (+0.69%), EUR/USD -0.0007 (-0.06%), USD/JPY +0.46 (+0.42%). The dollar index on Wednesday closed higher on reduced North Korean tensions that undercut the safe-haven demand for the yen and pushed USD/JPY up to a 2-week high. The dollar was also boosted by the stronger-than-expected U.S. Q2 GDP and ADP employment reports, which bolster the case for additional Fed rate hikes.

Oct crude oil (CLV17 +0.41%) this morning is up +22 cents (+0.48%) and Oct gasoline (RBV17 +2.33%) is +0.0337 (+2.06%). Wednesday's closes: Oct WTI crude -0.48 (-1.03%), Oct gasoline +0.0356 (+2.22%). Oct crude oil and gasoline on Wednesday settled mixed. Crude oil prices were supported by the -5.39 million bbl decline in weekly EIA crude inventories to a 1-1/2 year low, a bigger draw than expectations of -1.75 million bbl. Nearest-futures gasoline prices (U17) rallied to a new 2-year high as Tropical Storm Harvey has shut down nearly one-quarter of U.S. refining output. Crude oil prices were undercut by a stronger dollar and by the +689,000 bbl increase in crude supplies at Cushing.

Metals prices this morning are mixed with Dec gold (GCZ17 -0.14%) -2.2 (-0.17%), Sep silver (SIU17 -0.25%) -0.024(-0.14%) and Sep copper +0.030 (+0.98%) at a fresh 2-3/4 year high. Wednesday's closes: Dec gold -4.8 (-0.36%), Sep silver -0.022 (-0.13%), Sep copper (HGU17 +0.91%) -0.0165 (-0.54%). Metals on Wednesday closed lower on a stronger dollar and on strength in stocks, which reduced the safe-haven demand for precious metals.

Disclosure: None.