Morning Call For Thursday, April 27

OVERNIGHT MARKETS AND NEWS

Jun E-mini S&Ps (ESM17 +0.17%) this morning are little changed, up +0.06%, after Preisident Trump ruled out a withdrawal from NAFTA. European stocks are down -0.40% ahead of today's ECB meeting and press conference from ECB President Draghi that may provide clues as to when thee ECB may begin to exit from its QE program. Weakness in crude oil prices undercut energy producing stocks fell with Jun WTI crude oil (CLM17 -1.09%) down -0.97%. A 3% fall in Deutsche Bank is leading losses in European bank stocks after the Deutsche Bank's debt and equity trading missed estimates for Q1. Losses in European stocks were contained after Eurozone Apr economic confidence rose to a 9-1/2 year high. Asian stocks settled mixed: Japan -0.19%, Hong Kong +0.49%, China +0.36%, Taiwan +.04%, Australia +0.16%, Singapore -0.08%, South Korea +0.20%, India -0.34%. China's Shanghai Composite recovered from a 3-month low and closed higher after China Mar industrial profits posted their biggest increase in 3-1/2 years.

The dollar index (DXY00 -0.05%) is down -0.05%. EUR/USD (^EURUSD) is down -0.05%. USD/JPY (^USDJPY) is up +0.23%.

Jun 10-year T-note prices (ZNM17 -0.01%) are down -0.5 of a tick.

The BOJ, as expected, kept its stimulus policies unchanged, but lowered its inflation projection for the fiscal year that starts this month to 1.4% from 1.5%, and raised its GDP forecast to 1.6% from 1.5%. BOJ Governor Kuroda said that CPI probably won't stabilize above 2% until after fiscal 2018 and that it's premature to discuss an exit from its easing policies. He said the 2% inflation target must be met first and then the BOJ will communicate properly about an exit when that time comes.

China Mar industrial profits surged +23.8% y/y, the largest increase in 3-1/2 years.

Eurozone Apr economic confidence rose +1.6 to 109.6, stronger than expectations of +0.3 to 108.2 and a 9-1/2 year high.

U.S. STOCK PREVIEW

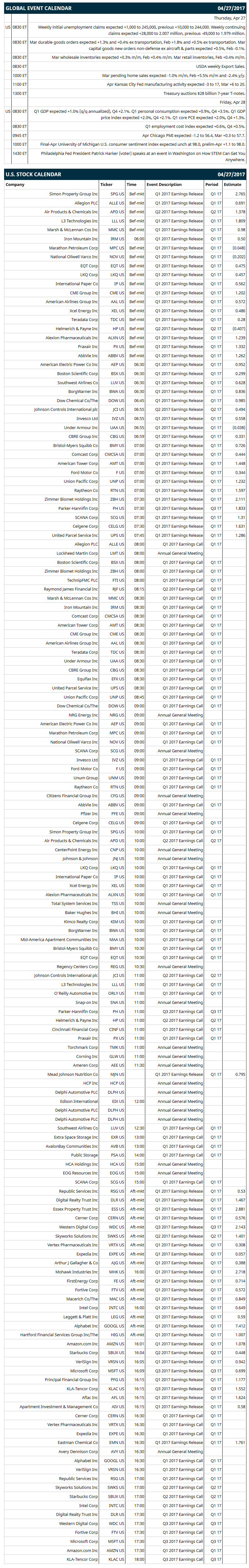

Key U.S. news today includes: (1) weekly initial unemployment claims (expected +1,000 to 245,000, previous +10,000 to 244,000) and continuing claims (expected +31,000 to 2.010 million, previous -49,000 to 1.979 million), (2) Mar durable goods orders (expected +1.3% and +0.4% ex transportation, Feb +1.8% and +0.5% ex transportation), (3) Mar wholesale inventories (expected +0.3% m/m, Feb +0.4% m/m), (4) Mar pending home sales (expected -0.5% m/m, Feb +5.5% m/m and -2.4% y/y), (5) Apr Kansas City Fed manufacturing activity index (expected -3 to 17, Mar +6 to 20), (6) Treasury auctions $28 billion of 7-year T-notes, (7) USDA weekly Export Sales.

Notable S&P 500 earnings reports today include: Alphabet (consensus $7.41), Amazon (1.08), Microsoft (0.70), Starbucks (0.45), UPS (1.29), Marathon Petroleum (-0.05), International Paper (0.56), CME Group (1.20), American Airlines (0.57), AbbVie (1.26), Southwest Airlines (0.63), Dow Chemical (0.99), Under Armour (-0.04), Bristol-Meyers Squibb (0.73), Comcast (0.44), Ford (0.34), Raytheon (1.60), Expedia (0.06), Intel (0.65).

U.S. IPO's scheduled to price today: Zymeworks (ZYME), Cloudera (CLDR), Emerald Expositions Events (EEX), Carvana (CVNA), NCS Multistage Holdings (NCSM).

Equity conferences: Capital Link's Closed-End Funds & Global ETFs Forum on Thu, Burkenroad Reports l Investment Conference on Fri.

OVERNIGHT U.S. STOCK MOVERS

McDonald's (MCD -0.61%) was upgraded to 'Buy' from 'Hold' at Argus with a price target of $158.

O'Reilly Automotive (ORLY +0.42%) fell 2% in after-hours trading after it reported Q1 sales of $2.16 billion, below consensus of $2.22 billion.

Buffalo Wild Wings (BWLD -0.25%) slid nearly 3% in after-hours trading after it reported Q1 EPS of $1.25, below consensus of $1.69.

Graco (GGG +1.47%) rallied 5% in after-hours trading after it reported Q1 net sales of $340.6 million, better than consensus of $315.1 million.

F5 Networks (FFIV -0.64%) dropped nearly 8% in after-hours trading after it reported Q2 net revenue of $518.2 million, weaker than consensus of $523.1 million.

ServiceNow (NOW +0.75%) climbed almost 5% in after-hours trading after it reported Q1 adjusted EPS of 24 cents, well above consensus of 17 cents.

Xilinx (XLNX -1.15%) gained over 4% in after-hours trading after it reported Q4 EPS of 57 cents, better than consensus of 54 cents.

Citrix Systems (CTXS +0.08%) lost nearly 5% in after-hours trading after it reported Q1 net revenue of $662.7 million, below consensus of $664.3 million, and said it sees Q2 revenue of $685 million-$695 million, weaker than consensus of $695.3 million.

PayPal Holdings (PYPL -0.67%) rose over 5% in pre-market trading after it raised guidance on 2017 adjusted EPS to $1.74-$1.79 from a prior view of $1.69-$1.74.

Ethan Allen Interiors (ETH +0.48%) fell 4% in after-hours trading after it reported Q3 adjusted EPS of 23 cents, below consensus of 27 cents.

Netgear (NTGR -2.93%) lost 5% in after-hours trading after it reported its Q2 adjusted operating margin was 8%-9%, weaker than consensus of 11%.

Mellanox Technologies Ltd (MLNX -0.10%) slumped over 10% in after-hours trading after it reported Q1 adjusted EPS of 29 cents, well below consensus of 49 cents.

H&R Block (HRB -1.44%) gained almost 3% in after-hours trading after it said total tax return volume fell -0.1% through Apr 21 compared with the IRS reported decline of -0.3%.

CryoLife (CRY +3.08%) rallied nearly 7% in after-hours trading after it reported Q1 adjusted EPS of 9 cents, much stronger than consensus of 4 cents.

Ultra Clean Holdings (UCTT -1.13%) jumped 10% in after-hours trading after it reported Q1 adjusted EPS of 47 cents, above consensus of 42 cents, and then forecast Q2 adjusted EPS of 49 cents-55 cents, higher than consensus of 36 cents.

American Superconductor (AMSC +4.05%) plunged over 40% in after-hours trading after it reported preliminary Q4 revenue of $15 million-$!6 million, well below its prior view of $22 million-$26 million on Inox "dislocation."

MARKET COMMENTS

Jun E-mini S&Ps (ESM17 +0.17%) this morning are up +1.50 points (+0.06%). Wednesday's closes: S&P 500 -0.05%, Dow Jones -0.10%, Nasdaq -0.13%. The S&P 500 fell back from a 1-3/4 month high and settled lower on a lack of details from Treasury Secretary Mnuchin about the administration's tax plan and how it would be paid for. There were also global growth concerns after Politico reported that President Trump may issue an executive order to withdraw the U.S. from NAFTA.

Jun 10-year T-notes (ZNM17 -0.01%) this morning are down -0.05 of a tick. Wednesday's closes: TYM7 +5.00, FVM7 +2.50. Jun 10-year T-notes on Wednesday closed higher on the retreat in stock prices which closed lower after Treasury Secretary Mnuchin failed to provide specifics on President Trump's tax plan. T-note prices were undercut by weak demand for the Treasury's $34 billion 5-year T-note auction that had a bid-to-cover ratio of 2.34, weaker than the 12-auction average of 2.43.

The dollar index (DXY00 -0.05%) this morning is down -0.049 (-0.05%). EUR/USD (^EURUSD) is down -0.0005 (-0.05%) and USD/JPY (^USDJPY) is up +0.26 (+0.23%). Wednesday's closes: Dollar index +0.26 (+0.26%), EUR/USD -0.0022 (-0.20%), USD/JPY -0.03 (-0.03%). The dollar index on Wednesday closed higher on Treasury Secretary Mnuchin's claim that that the Trump administration's proposal to cut the corporate tax rate to 15% should help boost U.S. GDP to 3%. There was also weakness in EUR/USD on long liquidation ahead of Thursday's ECB meeting.

Jun WTI crude oil prices (CLM17 -1.09%) this morning are down -48 cents (-0.97%) and Jun gasoline (RBM17 -1.82%) is -0.0287 (-1.80%). Wednesday's closes: Jun crude +0.06 (+0.12%), Jun gasoline -0.0317 (-1.95%). Jun crude oil and gasoline on Wednesday settled mixed with Jun gasoline at a 1-1/4 month low. Crude oil prices were undercut by the +0.1% increase in U.S. crude production in the week of Apr 21 to 9.265 million bpd, a 1-1/2 year high, and the +3.37 million bbl increase in EIA gasoline supplies (well above expectations of +500,000 bbl). Crude oil found support on the -3.64 million bbl decline in EIA crude inventories (vs expectations -1.75 million bbl) and the unexpected +1.2 increase in U.S. refinery utilization to 94.1% of capacity, more than expectations of a -0.4 point decline and the fastest pace in 17-months, which should reduce crude inventories in the weeks ahead with the ramped-up production.

(Click on image to enlarge)

Disclosure: None.