Morning Call For September 28, 2015

OVERNIGHT MARKETS AND NEWS

December E-mini S&Ps (ESZ15 -0.51%) are down -0.68% and European stocks are down -1.60%, led by weakness in mining companies as the price of copper (ZNZ15 +0.21%) slid to a 1-month low. Chinese growth concerns weighed on stocks as well after China Aug industrial profits fell by the most in 4 years. Weakness in European automakers was another negative for European stocks, led by a -6% decline in shares of Volkswagen AG, as the company remains embroiled in the emissions-cheating scandal. Asian stocks settled mixed: Japan -1.32%, China +0.27%, Hong Kong, Taiwan and South Korea closed for holiday, Australia +1.42%, Singapore -1.44%, India -0.95%. China's Shanghai Composite erased losses of as much as 1.6% and closed higher as a rally in technology companies overshadowed data that showed industrial companies' profits fell by the most since the data began in 2011.

The dollar index (DXY00 +0.07%) is unch. EUR/USD (^EURUSD) is down -0.18% after ECB Executive Board member Lautenschlaeger said it's "too early" to talk about expanding QE. USD/JPY (^USDJPY) is down -0.43% as eh slide in stocks boosts the safe-haven demand for the yen.

Dec T-note prices (ZNZ15 +0.21%) are up +8.5 ticks.

ECB Executive Board member Lautenschlaeger said there are "some recovery signs" in the interbank money market and "it is too early to talk about concrete measures about broadening QE."

China Aug industrial profits were down -8.8% y/y, the largest decline since the data series began in 2011. Jan through Aug industrial profits are down -1.9% y/y to 3.77 trillion yuan.

U.S. STOCK PREVIEW

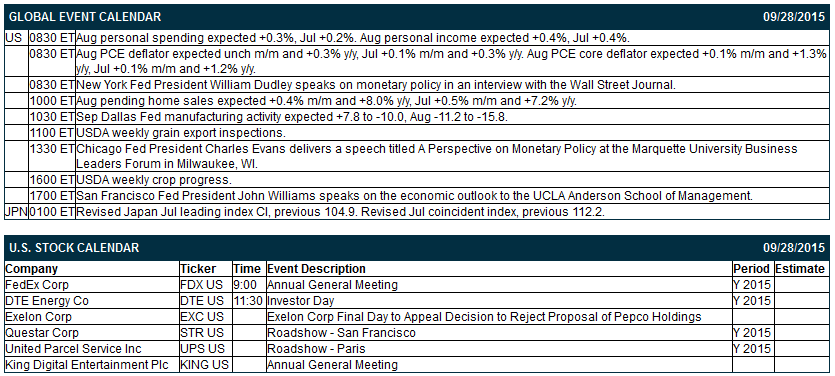

Key U.S. news today includes: (1) Aug personal spending (expected +0.3%), Aug personal income (expected 0.4%), Aug PCE deflator (expected unch m/m and +0.3% y/y), Aug PCE core deflator (expected +0.1% m/m and +1.2% y/y), (2) Aug pending home sales (expected +0.5% m/m and +7.8% y/y), (3) Sep Dallas Fed manufacturing activity (expected +6.8 to -9.0), (4) New York Fed President William Dudley speaks on monetary policy in an interview with the Wall Street Journal, (5) Chicago Fed President Charles Evans delivers a speech titled “A Perspective on Monetary Policy” at the Marquette University Business Leaders Forum in Milwaukee, WI, (6) San Francisco Fed President John Williams speaks on the economic outlook to the UCLA Anderson School of Management.

Five of the companies in the Russell 2000 index report earnings today: Cal-Maine Foods (consensus $3.14), Vail Resorts (-1.89), Comtech Communications (0.39), Synnex (1.44), Energy XXI Ltd. (-1.25).

U.S. IPO's scheduled to price today include: none.

Equity conferences this week include: BMO Capital Markets North American Real Estate Conference on Mon, Invest Japan Seminar 2015 on Mon, ESMO European Cancer Congress on Mon, Johnson Rice & Co Energy Conference on Mon-Wed, Deutsche Bank Leveraged Finance Conference on Tue, Jefferies West Coast Electronic Payments Summit on Tue, Wolfe Research Power and Gas Leaders Conference on Tue-Wed, D. A. Davidson & Co Engineering & Construction Conference on Wed, Leerink Partners Rare Disease Roundtable Conference on Thu.

OVERNIGHT U.S. STOCK MOVERS

RBC's chief market strategist cut his 2015 S&P 500 target to 2100 from 2325 and cut his 2015 EPS target to $120 from $128 due to commodity weakness and slower global growth.

Liberty Global Plc (LBTYA -0.48%) fell 2% in pre-market trading after Vodaphone Group Plc said talks about an exchange of assets with the companies have ended.

Comcast (CMCSA -0.49%) climbed nearly 3% in pre-market trading after it said it will buy a 51% stake in USJ. Co.

Cal-Maine (CALM +0.88%) reported Q1 EPS of $2.95, weaker than consensus of $3.14.

Citigroup (C +2.89%) was upgraded to 'Outperform' from 'Neutral' at Credit Suisse with a price target of $62.

Alcoa (AA -1.20%) jumped over 4% in pre-market trading after the company announced that it will separate into two public companies.

Stoneridge (SRI -5.35%) was raised to 'Bu' from 'Hold' at BB&T with a price target of $14.

A large study found that Bristol-Myers Squibb's (BMY -2.52%) drug Opdivo extended the lives of patients with advanced kidney cancer in a Phase 3 study.

Novo Nordisk A/S (NVO -0.18%) won FDA approval for its once-a-day Tresiba injection for adults with type 1 and 2 diabetes mellitus and also won approval for its Ryzodeg insulin drug.

Huntsman (HUN -0.86%) said that lower prices for titanium-dioxide, strength in the dollar, and "soft" demand in the Asia Pacific region will weigh on Q3 and Q4 earnings.

According to a Krebs on Security report, gift shops and restaurants at a "large number" of Hilton Hotel (HLT -0.43%) and franchise properties across the U.S. have been tied to a pattern of credit card fraud.

QLogic (QLGC -0.41%) said its board approved a restructuring plan that cuts jobs and consolidates and eliminates certain engineering activities.

MARKET COMMENTS

Dec E-mini S&Ps (ESZ15 -0.51%) this morning are down -13.00 points (-0.68%). Friday's closes: S&P 500 -0.05%, Dow Jones +0.70%, Nasdaq -0.85%. The S&P 500 Friday erased an early rally and settled little changed after a slide in the biotechnology sector dragged down health-care stocks. A 1.60% fall in China's Shanghai Composite also undercut the market. Stocks had opened higher after Fed Chair Yellen said the Fed is on course to raise interest rates this year, which suggests the U.S. economy is strong enough to handle higher interest rates. Another supportive factor was the upward revision to U.S. Q2 GDP to 3.9% q/q annualized from +3.7% q/q annualized as Q2 personal consumption was revised upward to +3.6% from +3.2%.

Dec 10-year T-notes (ZNZ15 +0.21%) this morning are up +8.5 ticks. Friday's closes: TYZ5 -9.00, FVZ5 -5.00. Dec T-notes Friday closed lower after Fed Chair Yellen said she expects the Fed to raise interest rates sometime this year. T-notes remained lower after U.S. Q2 GDP was revised higher and after the Sep University of Michigan consumer sentiment rose more than expected.

The dollar index (DXY00 +0.07%) this morning is unchanged. EUR/USD (^EURUSD) is down -0.0020 (-0.19%). USD/JPY (^USDJPY) is down -0.52 (-0.18%). Friday's closes: Dollar Index +0.275 (+0.29%), EUR/USD -0.0035 (-0.31%), USD/JPY +0.52 (+0.43%). The dollar index rose to a 5-week high Friday on comments from Fed Chair Yellen who said she expects the Fed to raise interest rates this year and on the upward revision to U.S. Q2 GDP. Also, a rally in USD/JPY to a 2-week high boosted the dollar as an early rally in stocks curbed the safe-haven demand for the yen.

Nov crude oil (CLX15 -2.01%) this morning is down -83 cents (-1.82%)and Nov gasoline (RBX15 -2.06%) is down -0.0282 (-2.04%). Friday's closes: CLX5 +0.79 (+1.76%), RBX5 +0.0214 (+1.58%). Nov crude oil and gasoline closed higher Friday as stocks rallied, which bolstered confidence in the economic outlook and energy demand. Energy prices also found support after U.S. Q2 GDP was revised upward to +3.9% q/q annualized from +3.7% q/q annualized, which signals stronger energy consumption and demand. Gains were limited after the dollar index rose to a 5-week high.

Click on picture to enlarge

Disclosure: I have no positions in ...

more