Morning Call For September 26, 2016

OVERNIGHT MARKETS AND NEWS

Dec E-mini S&Ps (ESZ16 -0.45%) are down -0.46% and European stocks are down -1.47%. Deutsche Bank AG is down over 6% at a record low and is leading losses in European banking shares on speculation that Germany's biggest bank may need to raise capital. Focus Magazine reported Saturday that German Chancellor Merkel has ruled out any state assistance for Deutsche Bank ahead of national elections next year. Stock losses were contained on increased M&A activity after Germany's Lanxess AG acquired Chemtura for $2.1 billion. Also, German business sentiment improved after the Sep IFO business climate rose more than expected to a 2-1/3 year high. Asian stocks settled mostly lower: Japan -1.25%, Hong Kong -1.56%, China-1.76%, Taiwan -0.97%, Australia unch, Singapore -0.25%, South Korea -0.34%, India -1.30%. China's Shanghai Composite fell to a 1-1/2 month low on long liquidation pressures ahead of a week-long holiday next week in China, while losses in technology stocks undercut other Asian markets after a German market data firm said that iPhone 7 unit sales were 25% lower than the previous year's sales of an older model.

The dollar index (DXY00 -0.15%) down -0.13%. EUR/USD (^EURUSD) is up +0.17%. USD/JPY (^USDJPY) is down -0.62%.

Dec 10-year T-note prices (ZNZ16 +0.11%) are up +4 ticks at a 2-week high.

The German Sep IFO business climate rose +3.2 to 109.5, stronger than expectations of +0.1 to 106.3 and the highest in 2-1/3 years.

U.S. STOCK PREVIEW

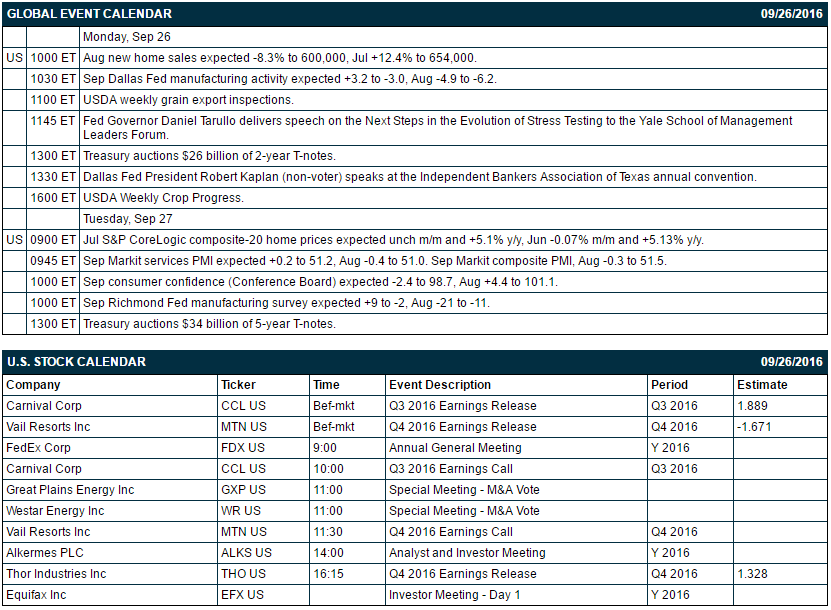

Key U.S. news today includes: (1) Aug new home sales (expected -8.3% to 600,000, Jul +12.4% to 654,000), (2) Sep Dallas Fed manufacturing activity (expected +3.2 to -3.0, Aug -4.9 to -6.2), (3) Treasury auction of $26 billion of 2-year T-notes, (4) Fed Governor Daniel Tarullo delivers speech on the “Next Steps in the Evolution of Stress Testing” to the Yale School of Management Leaders Forum, (5) Dallas Fed President Robert Kaplan (non-voter) speaks at the Independent Bankers Association of Texas’ annual convention, (6) USDA weekly grain export inspections, (7) USDA Weekly Crop Progress.

Russell 1000 companies that report earnings today: Carnival (consensus $1.89), Vail Resorts (1.67), Thor Industries (1.33).

U.S. IPO's scheduled to price today: none.

Equity conferences this week include: Deutsche Bank Leveraged Finance Conference on Tue, JMP Securities Financial Services & Real Estate Conference on Tue, Wolfe Research Power and Gas Leaders Conference on Tue-Wed, Leerink Partners Rare Disease & Immuno Oncology Roundtable Conference on Wed-Thu.

OVERNIGHT U.S. STOCK MOVERS

Disney (DIS -0.15%) was downgraded to 'Hold' from 'Buy' at Drexel Hamilton LLC.

Twitter (TWTR +21.42%) was downgraded to 'Underperform' from 'Market Perform' at Oppenheimer & Co.

Oshkosh (OSK -10.58%) was upgraded to 'Neutral' from 'Underperform' at Credit Suisse.

NetApp was (NTAP -0.83%) upgraded to 'Buy' from 'Hold' at Cross Research with a 12-month target price of $45.

CBOE Holdings agreed to buy BATS Global Markets (BATS +19.86%) for $3.2 billion in a cash and stock transaction.

Chemtura (CHMT +2.29%) surged 17% in pre-market trading after the company was acquired by Lanxess AG for about $2.1 billion.

Sally Beauty Holdings (SBH +0.57%) climbed 5% in after-hours trading after it was announced that it will replace RR Donnelley in the S&P MidCap 400 Index at the close of trading Tuesday, September 27.

RR Donnelley & Sons (RRD -1.15%) jumped over 5% in after trading after it was announced that it will replace Sizmek in the S&P SmallCap 600 at the close of trading Tuesday, September 27.

Smith & Wesson (SWHC -0.18%) slid over 2% in after-hours trading after it said its proposal for the U.S. Army's Modular Handgun System (MHS) was not selected to advance to the next phase of competition.

Rowan Cos, Plc (RDC -4.98%) was downgraded to 'Neutral' from 'Outperform' at Credit Suisse.

MARKET COMMENTS

Dec E-mini S&Ps (ESZ16 -0.45%) this morning are down -10.00 points (-0.46%). Friday's closes: S&P 500 -0.57%, Dow Jones -0.71%, Nasdaq -0.66%. The S&P 500 on Friday closed lower on the unexpected -0.6 point decline in the U.S. Markit Sep manufacturing PMI to 51.4, weaker than expectations of unchanged at 52.0. Stocks were also undercut by hawkish comments from Boston Fed Rosengren who said that delaying an interest rate increase puts the U.S. economic recovery in jeopardy. Energy producer stocks were undercut by -3.97% slide in crude oil prices.

Dec 10-year T-notes (ZNZ16 +0.11%) this morning are up +4 ticks at a 2-week high. Friday's closes: TYZ6 +5.50, FVZ6 +4.25. Dec 10-year T-notes on Friday closed higher on increased safe-haven demand with the sell-off in stocks and on the unexpected decline in the U.S. Sep Markit manufacturing PMI. T-notes were undercut by higher inflation expectations as the 10-year T-note breakeven inflation rate climbed to a 3-1/2 month high.

The dollar index (DXY00 -0.15%) this morning is down -0.121 (-0.13%). EUR/USD (^EURUSD) is up +0.0019 (+0.17%). USD/JPY (^USDJPY) is down-0.63 (-0.62%). Friday's closes: Dollar index +0.029 (+0.03%), EUR/USD +0.0018 (+0.16%), USD/JPY +0.26 (+0.26%). The dollar index on Friday closed higher on Boston Fed Rosengren's hawkish comment that he favors raising interest rates soon since delaying a rate hike may threaten the economic recovery. The dollar was also boosted by weakness in GBP/USD which tumbled to a 1-1/4 month low on speculation that the UK is heading for a swift exit from the EU after British foreign secretary Johnson said UK plans to trigger Article 50 of the Lisbon Treaty early next year.

Nov WTI crude oil (CLX16 +0.94%) this morning is up +42 cents (+0.94%) and Nov gasoline (RBX16 +1.13%) is up +0.0226 (+1.67%). Friday's closes: Nov crude -1.84 (-3.97%), Nov gasoline -0.0230 (-1.67%). Nov crude and gasoline on Friday closed lower on a stronger dollar and on Saudi Arabia's statement that it does not expect a decision on crude output when OPEC holds an informal meeting in Algiers. Nov crude posted a 1-week high in Thursday night's trading when Saudi Arabia offered to reduce its crude production if Iran agreed to freeze its crude output.

Disclosure: None.