Morning Call For October 5, 2016

OVERNIGHT MARKETS AND NEWS

Dec E-mini S&Ps (ESZ16 +0.01%) are down -0.08% and European stocks are down -0.65% on the prospects for tighter Fed policy after Chicago Fed President Evans said Tuesday night that he expected the Fed to raise interest rates by the end of the year. Government bond markets around the world sold-off on the prospects of tighter central bank policy with 10-year German bunds falling to a 3-week low on Tuesday's report that the ECB will begin to taper bond purchases before it ends QE. Stock losses were contained as energy producing companies rose with the price of crude oil (CLX16 +1.54%) up +1.68% at a 3-1/4 month high after API data released late Tuesday showed U.S. crude inventories fell -7.6 million bbl last week. Asian stocks settled mixed: Japan +0.50%, Hong Kong +0.42%, China closed for holiday, Taiwan -0.17%, Australia -0.57%, Singapore -0.10%, South Korea -0.07%, India-0.40%. Japan's Nikkei Stock Index moved up to a 1-month high on strength in exporters stocks after USD/JPY climbed to a 4-week high.

The dollar index (DXY00 -0.14%) is down -0.09%. EUR/USD (^EURUSD) is up +0.18%. USD/JPY (^USDJPY) is up +0.22% at a 4-week high.

Dec 10-year T-note prices (ZNZ16 unch) are down -3 ticks at a 3-week low.

Chicago Fed President Evans said he expects the Fed to increase interest rates once by the end of the year and that a Fed rate hike "would most likely be the December" FOMC meeting, but "could be the earlier meeting."

U.S. STOCK PREVIEW

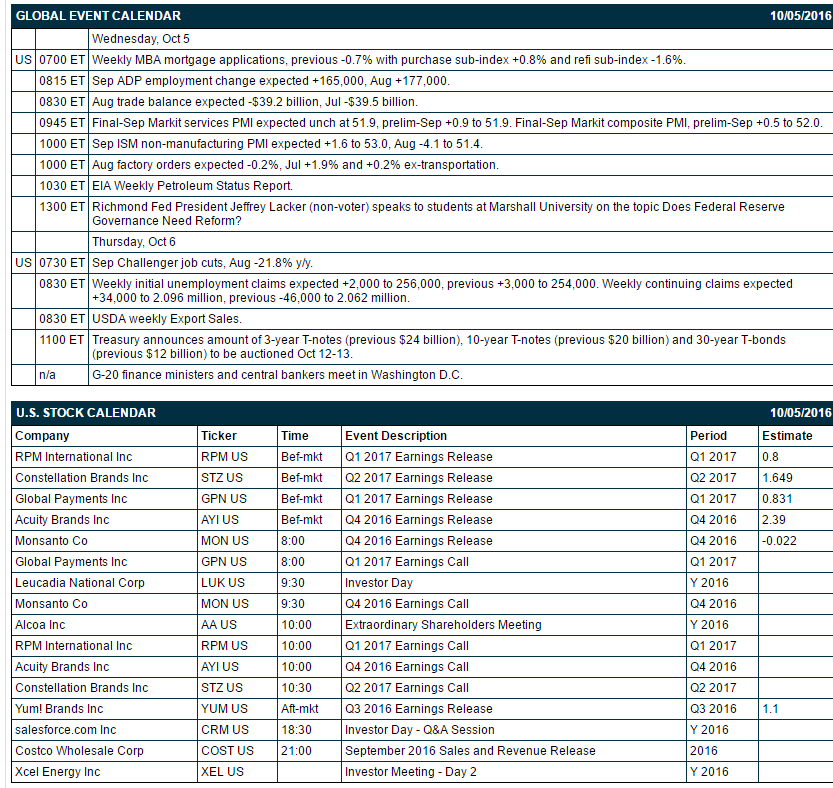

Key U.S. news today includes: (1) weekly MBA mortgage applications (previous -0.7% with purchase sub-index +0.8% and refi sub-index -1.6%), (2) Sep ADP employment change (expected +165,000, Aug +177,000), (3) Aug trade balance (expected -$39.2 billion, Jul -$39.5 billion), (4) final-Sep Markit services PMI (expected unch at 51.9, prelim-Sep +0.9 to 51.9), (5) Sep ISM non-manufacturing PMI (expected +1.6 to 53.0, Aug -4.1 to 51.4), (6) Aug factory orders (expected -0.2%, Jul +1.9% and +0.2% ex-transportation), (7) Richmond Fed President Jeffrey Lacker (non-voter) speaks to students at Marshall University on the topic “Does Federal Reserve Governance Need Reform?” and (8) EIA Weekly Petroleum Status Report.

Russell 1000 companies that report earnings today: Yum Brands (consensus $1.10), Constellation Brands (1.65), Global Payments (0.83), RPM Intl (0.80), Accuity Brands (2.39), Monsanto (-0.02).

U.S. IPO's scheduled to price today: AquaVenture Holdings (WAAS), Advanced Disposal Services (ADSW), Coupa Software (COUP), Obalon Therapeutics (OBLN).

Equity conferences during the remainder of this week include: Capital Link Shipping, Marine Services & Offshore Forum on Wed, ACI European Biomass to Power Conference on Wed, Seaport Global Securities Dallas Energy Day on Thu.

OVERNIGHT U.S. STOCK MOVERS

Norwegian Cruise Line Holdings Ltd. (NCLH +0.71%) was dowmgraded to 'Neutral' from 'Buy' at UBS.

Parker-Hannifin (PH -0.84%) was upgraded to 'Buy' from 'Hold' at Stifel with a price target of $141.

State Street (STT +2.19%) was upgraded to 'Market Perform' from 'Underperform' at KBW with a price target of $69.

Gigamon (GIMO +0.33%) was downgraded to 'Neutral' from 'Buy' at DA Davidson with an 18-month target price of $59.

Twitter (TWTR -2.00%) is up over 3% in pre-market trading on heightened takeover talks from companies that include Salesforce.com, Disney and Google.

Blue Buffalo Pet Products (BUFF -0.92%) was rated a new 'Buy' at DA Davidson with a price target of $29.

Acacia Communications (ACIA +2.51%) jumped over 5% in after-hours trading after it raised guidance on Q3 adjusted EPS to 83 cents-90 cents from a September 26 view of 72 cents-81 cents.

Micron Technology (MU +0.39%) lost over 4% in pre-market trading after it reported Q4 gross margin of 18.0%, below consensus of 19.0%.

Team Health Holdings (TMH +16.46%) gained over 1% in after-hours trading after the WSJ reported the company is in talks with Blackstone and Bain about a possible sale.

Corbus Pharmaceuticals Holdings (CRBP +2.18%) rallied almost 7% in after-hours trading after it was rated a new 'Buy' at Cantor Fitzgerald with a 12-month target price of $17.

Universal Logistics Holdings (ULH -0.60%) sank over 10% in after-hours trading after it said sees Q3 EPS between 16 cents and 20 cents, well below consensus of 29 cents.

Cascadian Therapeutics (CASC +3.70%) dropped over 10% in after-hours trading after it said it plans a reverse stock split.

MARKET COMMENTS

Dec E-mini S&Ps (ESZ16 +0.01%)this morning are down -1.75 points (-0.08%). Tuesday's closes: S&P 500 -0.50%, Dow Jones -0.37%, Nasdaq-0.15%. The S&P 500 on Tuesday closed lower on the IMF's cut its U.S. 2016 GDP forecast to 1.6% from its 2.2% forecast in July. Stocks were also undercut by hawkish comments from Richmond Fed President Lacker who said he favored an immediate Fed rate hike to head off a likely pickup in inflation that would force bigger increases in interest rates later.

Dec 10-year T-notes (ZNZ16 unch) this morning are down -3 ticks at a 3-week low. Tuesday's closes: TYZ6 -14.50, FVZ6 -6.75. Dec 10-year T-notes on Tuesday fell to a 1-1/2 week low and closed lower on negative carryover from a slide in German bund prices to 1-1/2 week low after a report that the ECB is building a consensus to taper bond purchases before it decides to end QE. T-notes were also undercut by increased inflation expectations after the 10-year T-note breakeven inflation rate climbed to a 4-1/2 month high.

The dollar index (DXY00 -0.14%) this morning is down -0.084 (-0.09%). EUR/USD (^EURUSD) is up +0.0020 (+0.18%). USD/JPY (^USDJPY) is up +0.23 (+0.22%) at a 4-week high. Tuesday's closes: Dollar index +0.474 (+0.50%), EUR/USD -0.0008 (-0.06%), USD/JPY +1.25 (+1.23%). The dollar index on Tuesday rallied to a 1-3/4 month high and settled higher on Richmond Fed President Lacker's comment that he favors an immediate Fed rate hike to head off a likely pickup in inflation that would force bigger increases in interest rates later. The dollar was also boosted by weakness in the British pound against the dollar after GBP/USD tumbled to a 31-1/4 year low on Brexit concerns. EUR/USD rebounded from a 1-1/2 week low after Bloomberg reported that ECB officials said the ECB will probably wind down bond purchases before the conclusion of its QE program.

Nov WTI crude oil (CLX16 +1.54%) this morning is up +82 cents (+1.68%) at a 3-1/4 month high and Nov gasoline (RBX16 +0.98%) is up +0.0141 (+0.94%) at a 1-1/2 month high . Tuesday's closes: Nov crude +0.38 (+0.78%), Nov gasoline +0.0313 (+2.13%). Nov crude oil and gasoline on Tuesday closed higher with Nov crude at a 3-month high. Oil prices were boosted by Hurricane Matthew which has shut-in 33 million bbl of oil in storage in the Bahamas and may disrupt shipping traffic along the U.S. East Coast that may limit U.S. gasoline supplies. In addition, the crack spread rose to a 2-week high, which may boost refinery demand for crude to refine into gasoline. Crude oil prices were undercut by the rally in dollar index to a 1-3/4 month high.

Disclosure: None.