Morning Call For October 26, 2015

OVERNIGHT MARKETS AND NEWS

December E-mini S&Ps (ESZ15 -0.16%) are down -0.11% and European stocks are down -0.39% as the markets digests last Thursday's and Friday's sharp gains. U.S. and European stocks were disappointed that China's unexpected interest rate cut failed to inspire sharp gains in Asian stock markets. Losses were limited, though, after a gauge of German Oct business confidence fell less than expected. Also, increased M&A activity gave stocks a lift after Duke Energy bought Piedmont Natural Gas for $4.9 billion. Asian stocks settled mostly higher: Japan +0.65%, Hong Kong -0.15%, China +0.50%, Taiwan +0.82%, Australia -0.07%, Singapore +0.48%, South Korea +0.38%, India -0.40%. Japan's Nikkei Stock index rose to a 1-3/4 month high and China's Shanghai Composited climbed to a 2-month high. The markets will watch this week's gathering in Beijing of Chinese leaders where Chinese President Xi Jinping will lay out his 5-year plan for economic growth.

The dollar index (DXY00 -0.25%) is down -0.29%. EUR/USD (^EURUSD) is up +0.13% as it rebounded from a 2-1/2 month high on the stronger-than-expected German Oct IFO business confidence. USD/JPY (^USDJPY) is down -0.35%.

Dec T-note prices (ZNZ15 +0.04%) are down -2 ticks.

The German Oct IFO business climate fell -0.3 to 108.2, a smaller decline than expectations of -0.7 to 107.8.

U.S. STOCK PREVIEW

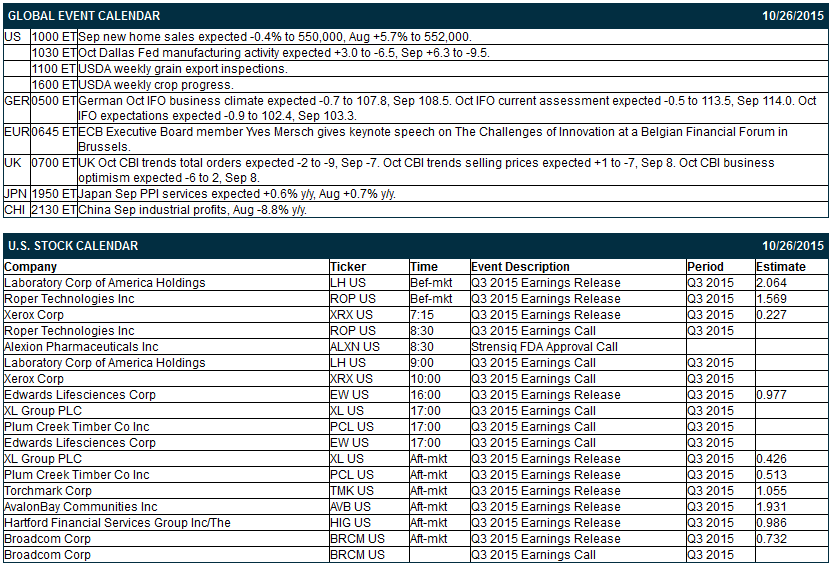

Key U.S. news today includes: (1) Sep new home sales (expected -0.4% to 550,000, Aug +5.7% to 552,000), and (2) Oct Dallas Fed manufacturing activity (expected +3.0 to -6.5, Sep +6.3 to -9.5).

There are 10 of the S&P 500 companies that report earnings today: Lab Corp of America (2.06), Roper Technologies (1.57), Xerox (0.23), Edwards Lifesciences (0.98), XL Group (0.43), Plum Creek Timber (0.51), Torchmark (1.06), AvalonBay Communities (1.93), Hartford Financial (0.99), Broadcom (0.73).

U.S. IPO's scheduled to price today: none.

Equity conferences this week include: Hart Energy DUG Eagle Ford Conference on Mon-Tue, and Money20/20 Conference on Mon-Wed.

OVERNIGHT U.S. STOCK MOVERS

Valeant Pharmaceuticals (VRX +5.72%) slid 14% in pre-market trading ahead of an investor call by the company designed to refute "unsupported speculation" of improper transactions.

Duke Energy (DUK -1.76%) agreed to buy Piedmont Natural Gas (PNY -1.42%) for $4.9 billion.

LabCorp (LH +2.23%) reported Q3 EPS of $2.07, better than consensus of $2.06.

Hologic (HOLX +1.07%) was rated a new 'Buy' at Gabelli & Co.

Xerox (XRX +0.49%) reported Q3 adjusted EPS of 24 cents, higher than consensus of 23 cents.

Equity Residential (EQR -0.31%) reported Q3 EPS of 89 cents, above consensus of 88 cents.

Pepco Holdings (POM -0.38%) reported Q3 EPS of 33 cents, well below consensus of 45 cents.

Roper Technologies (ROP +0.77%) reported Q3 EPS of $1.61, higher than consensus of $1.57.

American Exporess (AXP +2.88%) was downgraded to 'Sell' from 'Neutral' at UBS with a price target of $67.

Enersys (ENS +0.30%) was downgraded to 'Market Perform" from 'Outperform' at William Blair.

Trinity Industries (TRN +5.55%) rose over 2% in after-hours trading after it said it will resume shipments of its guardrail systems after they met safety standards in crash tests.

Alexion (ALXN +2.64%) rose over 3% in after-hours trading after it received FDA approval for treatment of a rare genetic bone disease with its Strensiq drug.

Pandora (P -35.44%) fell over 1% in after-hours trading on negative carry-over from Friday's 35% plunge after it issued a Q4 sales forecast of $325 million-$330 million, weaker than consensus pf $351.5 million.

MARKET COMMENTS

Dec E-mini S&Ps (ESZ15 -0.16%) this morning are down -2.25 points (-0.11%). Friday's closes: S&P 500 +1.10%, Dow Jones +0.90%, Nasdaq +2.68%. The S&P 500 on Friday rallied to a 2-1/4 month high and settled higher on China's interest rate cut and on strength in technology stocks after Amazon, Microsoft and Google all reported better-than-expected quarterly profits. Stocks also received a boost from the unexpected +0.9 point increase in the Oct Markit manufacturing PMI to a 5-month high of 54.0, stronger than expectations of -0.4 to 52.7.

Dec 10-year T-notes (ZNZ15 +0.04%) this morning are down -2 ticks. Friday's closes: TYZ5 -16.50, FVZ5 -10.75. Dec T-note prices on Friday tumbled to a 2-week low on reduced safe-haven demand with the rally in the S&P 500 to a 2-1/4 month high and on increased optimism about China's economy after the Chinese central bank cut interest rates and bank reserve requirements.

The dollar index (DXY00 -0.25%) this morning is down -0.284 (-0.29%). EUR/USD (^EURUSD) is up +0.0014 (+0.13%). USD/JPY (^USDJPY) is down -0.42 (-0.35%). Friday's closes: Dollar Index +0.749 (+0.78%), EUR/USD -0.0091 (-0.82%), USD/JPY +0.78 (+0.65%). The dollar index on Friday climbed to a 2-month high and settled higher on the unexpected interest rate cut by the PBOC and on the continued decline in EUR/USD to a 2-1/4 month low after Thursday's comments from ECB President Draghi who said the ECB may review additional stimulus measures at their December meeting. USD/JPY rallied to a 6-week high as a rally in stocks undercut the safe-haven demand for the yen.

Dec crude oil (CLZ15 +0.61%) this morning is up +19 cents (+0.43%) and Dec gasoline (RBZ15 +0.69%) is up +0.0077 (+0.59%). Friday's closes: CLZ5 -0.65 (-1.43%), RBZ5 -0.0067 (-0.51%). Dec crude oil and gasoline prices on Friday closed lower with Dec crude at a 3-week low. Crude oil prices were undercut by the rally in the dollar index to a 2-month high and the ongoing supply glut with U.S. crude supplies more than 100 million bbl above the 5-year seasonal average. Crude oil prices found some underlying support after China unexpectedly cut interest rates, which may boost growth and energy demand.

Click on image to enlarge

Disclosure:None.