Morning Call For October 19, 2016

OVERNIGHT MARKETS AND NEWS

Dec E-mini S&Ps (ESZ16 unch) are up +0.02% on a rally in energy producing stocks as the price of crude oil (CLX16 +1.29%) climbs +1.37% after API data released late yesterday showed U.S crude supplies declined -3.8 million bbl last week. Gains were limited and European stocks are down -0.2%after weaker-than-expected Chinese industrial output fuels global growth concerns. Also, technology stocks are weaker led by a nearly 5% decline in Intel in pre-market trading after it forecast weaker-than-expected Q4 revenue. Asian stocks settled mostly higher: Japan +0.21%, Hong Kong -0.38%, China +0.03%, Taiwan +0.67%, Australia +0.45%, Singapore +0.49%, South Korea +0.09%, India -0.24%. China's Shanghai Composite eked out a 5-week high on speculation the government may boost stimulus measures after the pace of Chinese industrial production unexpectedly slowed.

The dollar index (DXY00 -0.07%) is down -0.16%. EUR/USD (^EURUSD) is unch. USD/JPY (^USDJPY) is down -0.47% at a 1-week low.

Dec 10-year T-note prices (ZNZ16 unch) are up +0.5 of a tick at a 2-week high.

China Sep industrial production rose +6.1% y/y, weaker than expectations of +6.4% y/y.

China Q3 GDP was unchanged for the second straight quarter at 6.7% y/y, right on expectations and the slowest pace of growth in 7-1/2 years.

U.S. STOCK PREVIEW

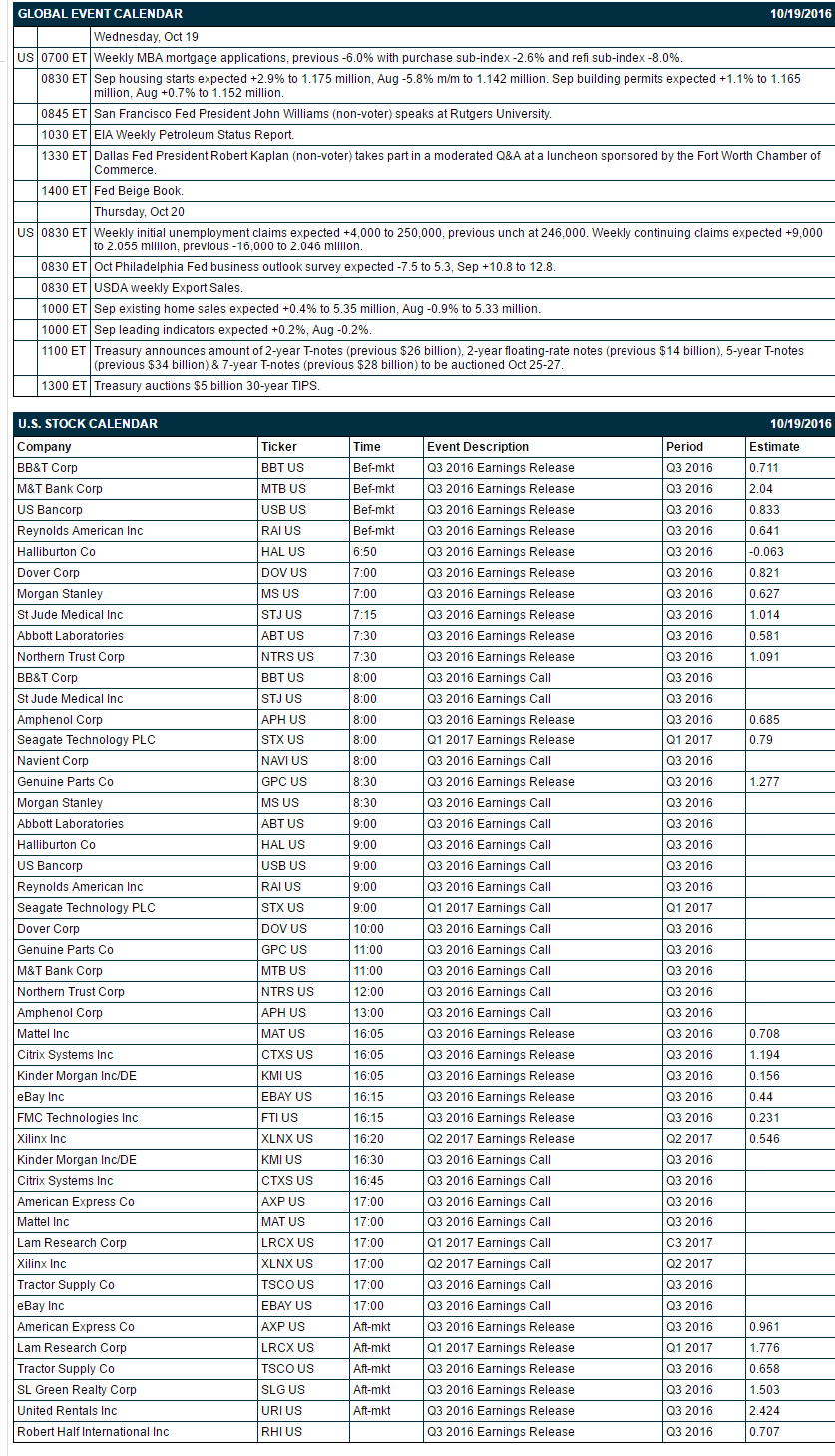

Key U.S. news today includes: (1) weekly MBA mortgage applications (previous -6.0% with purchase sub-index -2.6% and refi sub-index -8.0%), (2) Sep housing starts (expected +2.9% to 1.175 million, Aug -5.8% m/m to 1.142 million), (3) San Francisco Fed President John Williams (non-voter) speaks at Rutgers University, (4) Dallas Fed President Robert Kaplan (non-voter) takes part in a moderated Q&A at a luncheon sponsored by the Fort Worth Chamber of Commerce, (5) Fed Beige Book, (6) EIA Weekly Petroleum Status Report.

Notable S&P 500 earnings reports today include: Morgan Stanley (consensus $0.63), AMEX (-0.96), Halliburton (-0.06), Abbott Labs (0.58), Citrix (1.19), Kinder Morgan (0.16), eBay (0.44).

U.S. IPO's scheduled to price today: Forterra (FRTA), iRhythm Technologies (IRTC).

Equity conferences during the remainder of this week include: none.

OVERNIGHT U.S. STOCK MOVERS

Intel (INTC +1.23%) is down nearly 5% in pre-market trading after it forecast Q4 revenue of $15.2 billion-$16.2 billion, and the midpoint trailed estimates of $15.9 billion.

Norwegian Cruise Line Holdings Ltd. (NCLH +2.08%) was downgraded to 'Hold' from 'Buy' at SunTrust.

EI du Pont de Nemours (DD +1.22%) was rated a new 'Buy' at Nomura with a 12-month target price of $78.

GoDaddy (GDDY +0.82%) was rated a new 'Buy' at Cantor Fitzgerald with a 12-month price target of $42.

Yahoo! (YHOO -0.26%) gained over 1% in after-hours trading after it reported Q3 adjusted EPS of 20 cents, higher than consensus of 14 cents.

Cree (CREE +1.61%) sold-off over 9% in after-hours trading after it reported Q1 adjusted EPS of 9 cents, below consensus of 11 cents, and forecast Q2 adjusted EPS continuing operations of 4 cents-10 cents, well below consensus of 14 cents.

Intuitive Surgical (ISRG +1.73%) fell 2% in after-hours trading on disappointment that it reported Q3 worldwide procedure growth of 14%, right on expectations.

Manhattan Associated (MANH +1.92%) tumbled 9% in after-hours trading after it lowered guidance on full-year revenue to $603 million-$609 million from a July view of $615 million-$620 million.

Interactive Brokers Group (IBKR +1.33%) lost almost 1% in after-hours trading after it reported Q3 comprehensive EPS of 30 cents, below consensus of 32 cents.

Meridian Bioscience (VIVO +0.27%) sank 10% in after-hours trading after it forecast fiscal 2017 adjusted EPS of 81 cents-85 cents, weaker than consensus of 91 cents.

Puma Biotechnology (PBYI +0.67%) dropped 5% in after-hours trading after it proposed an offering of $150 million of stock.

Sunesis Pharmaceuticals (SNSS -2.86%) slid nearly 7% in after-hours trading after it proposed an offering of common stock and preferred stock, although no size was given.

MARKET COMMENTS

Dec E-mini S&Ps (ESZ16 unch) this morning are up +0.50 of a point (+0.02%). Tuesday's closes: S&P 500 +0.62%, Dow Jones +0.42%, Nasdaq +0.91%. The S&P 500 on Tuesday closed higher on carryover support from a rally in China's Shanghai Composite to a 5-week high after China Sep aggregate financing, the broadest measure of credit, posted its biggest increase in 6 months. There was also strength in mining stocks and raw-material producers after gold and silver prices rose to 1-week highs. Stocks were also boosted by benign inflation pressures that may delay a Fed rate hike after U.S. Sep core CPI rose +0.1% m/m and +2.2% y/y, slightly weaker than expectations of +0.2% m/m and +2.3% y/y.

Dec 10-year T-notes (ZNZ16 unch) this morning are up +0.5 of a tick at a 2-week high. Tuesday's closes: TYZ6 +5.50, FVZ6 +3.00. Dec 10-year T-notes on Tuesday rose to a 1-1/2 week high and closed higher on the smaller-than-expected increase in U.S. Sep core CPI, which bolsters the case for the Fed to delay an interest rate increase. T-notes were also boosted by the as-expected -2 point decline in the U.S. Oct NAHB housing market index to 63 from 65.

The dollar index (DXY00 -0.07%) this morning is down -0.158 (-0.16%). EUR/USD (^EURUSD) is unchanged. USD/JPY (^USDJPY) is down -0.49(-0.47%) at a 1-week low. Tuesday's closes: Dollar index +0.007 (+0.01%), EUR/USD -0.0019 (-0.17%), USD/JPY -0.02 (-0.02%). The dollar index on Tuesday closed little changed. The dollar index was undercut by the slightly weaker-than-expected U.S. Sep core CPI, which may push the Fed to further delay an interest rate increase. There was also strength in the British pound as GBP/USD climbed to a 1-week high after UK Sep CPI rose more than expected, which may limit further BOE easing moves.

Nov WTI crude oil (CLX16 +1.29%) this morning is up +69 cents (+1.37%) and Nov gasoline (RBX16 -0.35%) is down -0.0021 (-0.14%). Tuesday's closes: Nov crude +0.35 (+0.70%), Nov gasoline +0.0101 (+0.68%). Nov crude oil and gasoline on Tuesday closed higher with Nov gasoline at a 1-3/4 month high. Crude oil prices were boosted by a weaker dollar and by IEA Executive Director Birol's comment that OPEC's plan to limit production is an "important development" and may see the market rebalancing "much sooner" than the end of 2017. Gains were limited on expectations for Wednesday's EIA crude inventories to increase by +1.87 million bbl.

Disclosure: None.