Morning Call For November 26, 2014

OVERNIGHT MARKETS AND NEWS

December E-mini S&Ps (ESZ14 +0.07%) this morning are up +0.11% and European stocks are up +0.27% ahead of U.S. data on Oct personal spending and Oct durable goods orders. EUR/USD is weaker and the yields on European government bonds fell to record lows on the prospects of further easing by the ECB. Asian stocks closed mostly higher: Japan -0.14%, Hong Kong +1.12%, China +1.39%, Taiwan +0.07%, Australia +1.15%, Singapore +0.14%, South Korea +0.11%, India +0.17%. China's Shanghai Stock Index posted a new 3-year high on prospects for private investment and speculation of additional stimulus measures after the PBOC unexpectedly cut interest rates last Friday. Commodity prices are mixed. Jan crude oil (CLF15 -0.05%) is down -0.03% at a 1-week low on speculation OPEC will refrain from production cuts when it meets tomorrow in Vienna after Saudi Arabian Oil Minister Ali Al-Naimi said the "market will stabilize itself." Jan gasoline (RBF15 +0.25%) is up +0.22%. Dec gold (GCZ14 -0.05%) is unch. Dec copper (HGZ14 +0.22%) is up +0.25% as it recovers from a 4-1/3 year low. Agriculture prices are higher. The dollar index (DXY00 -0.03%) is up +0.06%. EUR/USD (^EURUSD) is down -0.14%. USD/JPY (^USDJPY) is down -0.18%. Dec T-note prices (ZNZ14 +0.09%) are up +1 tick at a 1-month high on carry-over support from a rally in German bunds to a 5-week high.

ECB Vice President Constancio said the ECB may consider buying sovereign debt next quarter if current stimulus proves insufficient, which reflects a growing consensus of ECB members who feel the need to wait to see the impact of existing measures before expanding stimulus.

The German Oct import price index fell -0.3% m/m and -1.2% y/y, a slower pace of decline than expectations of -0.5% m/m and -1.5% y/y.

UK Nov CBI reported sales fell -4 to 27, a bigger decline than expectations of -3 to 28

UK Q3 GDP was left unrevised at _0.7% q/q and +3.0% y/y. Q3 exports were revised lower to -0.4% q/q from the originally reported -0.1% q/q and Q3 imports were revised higher to +1.4% q/q from the originally reported +0.7% q/q.

UK Q3 total business investment unexpectedly declined -0.7% q/q, less than expectations of +2.3% q/q and the biggest drop in over 2 years. On an annual basis, Q3 business investment rose +6.3% y/y, less than expectations of +9.7% y/y.

UK Sep index of services rose +0.5% m/m and +0.8% 3-mo/3-mo, better than expectations of +0.4% m/m and +0.7% 3-mo/3-mo.

U.S. STOCK PREVIEW

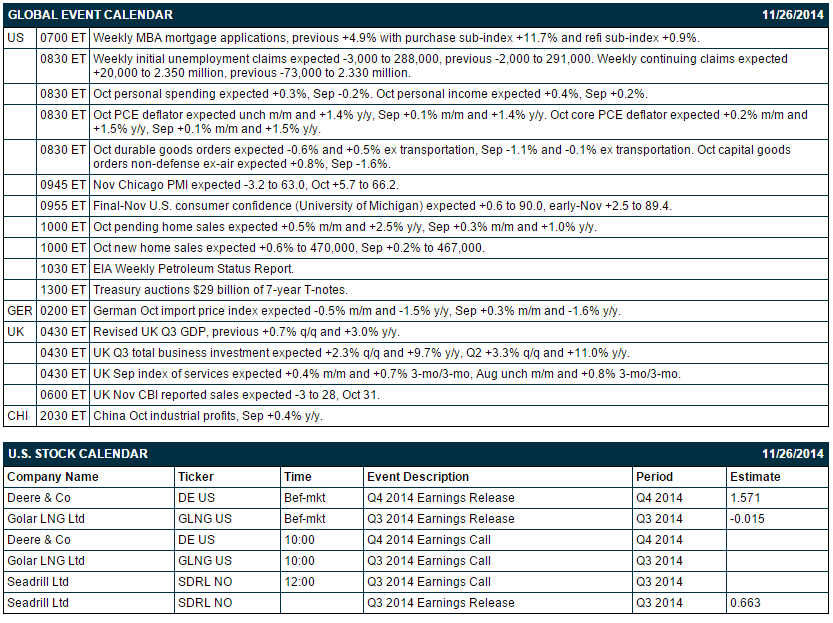

Today’s weekly initial unemployment claims report is expected to show a small decline of -3,000 to 288,000, adding to last week’s decline of -2,000 to 291,000. Today’s Oct PCE deflator, the Fed’s preferred inflation measure, is expected to be unchanged from September at +1.4% y/y and for today’s Oct core PCE deflator to be unchanged at +1.5% y/y. Today’s Oct durable goods orders report is expected to show a -0.6% decline but a +0.5% increase ex-transportation, improving from Sep’s report of -1.1% and -0.1% ex-transportation. Today’s Oct new home sales report is expected to show a +0.9% increase to 471,000, thus posting a fresh 6-1/4 year high after the series rose by +0.2% in September to the current 6-1/4 year high of 467,000. Today’s final-Nov U.S. consumer confidence index from the University of Michigan is expected to show a +0.6 point increase to 90.0 from the early-Nov level of 89.4. There are 33 of the Russell 1000 companies that report earnings today: Deere (consensus $1.57), Seadrill (0.66), Golar LNG (-0.02).

OVERNIGHT U.S. STOCK MOVERS

Deere & Co. (DE +0.31%) reported Q4 EPS of $1.83, well above consensus of $1.57.

Resource Capital (RSO +0.19%) was upgraded to 'Outperform' from 'Market Perform' at JMP Securities.

ReneSola (SOL -1.40%) reported a Q3 EPS loss of -6 cents, well below consensus of a 5 cent gain.

Copa Holdings (CPA +0.18%) was downgraded to 'Neutral' from 'Overweight' at JPMorgan Chase.

Cinemark (CNK +0.83%) was downgraded to 'Hold' from 'Buy' at Topeka.

Hertz (HTZ +3.65%) rallied over 2% in after-hours trading after billionaire activist investor Carl Icahn reported a 10.77% stake in the company.

Ctrip.com (CTRIP) reported Q3 adjusted EPS of 36 cents, well above consensus of 20 cents.

Adage Capital Partners reported a 5.28% passive stake in Rexnord (RXN +2.40%) .

Cubic (CUB +1.20%) reported Q4 EPS of $1.22, well above consensus of 94 cents.

Hewlett-Packard (HPQ +0.35%) slid over 1% in after-hours trading after it reported Q4 EPS of $1.06, right on consensus, although Q4 revenue of $28.40 billion was less than consensus of$28.76 billion.

Analog Devices (ADI -0.17%) climbed over 2% in after-hours trading after it reported Q4 EPS of 69 cents, better than consensus of 68 cents.

MARKET COMMENTS

Dec E-mini S&Ps (ESZ14 +0.07%) are up +2.25 points (+0.11%). The S&P 500 index on Tuesday fell back from a record high and closed lower: S&P 500 -0.12%, Dow Jones -0.02%, Nasdaq +0.09%. Stocks opened higher and pushed to a new record high after U.S. Q3 GDP was unexpectedly revised upward to +3.9% (q/q annualized) from +3.5%, better than expectations of +3.3%. Prices fell back and closed lower, however. after the unexpected -5.7point decline in U.S. Nov consumer confidence (Conference Board) to 88.7, weaker than expectations of +1.5 to 96.0 and the lowest in 5 months.

Dec 10-year T-notes (ZNZ14 +0.09%) this morning are up +1 tick at a new 1-month high. Dec 10-year T-note futures prices on Tuesday posted a 4-week high and closed higher: TYZ4 +11.00, FVZ4 +5.25. Bullish factors included (1) carry-over support from a rally in German bunds to a 5-week high after the OECD said the ECB should expand its monetary support due to the weak Eurozone economy and risk of deflation, (2) the unexpected decline in U.S. Nov consumer confidence to a 5-month low, and (3) strong demand for the Treasury’s $35 billion 5-year T-note auction that had a bid-to-cover ratio of 2.91, stronger than the 12-auction average of 2.70 and the highest in 8 months.

The dollar index (DXY00 -0.03%) this morning is up +0.056 (+0.06%). EUR/USD (^EURUSD) is down -0.0017 (-0.14%). USD/JPY (^USDJPY) is down-0.21 (-0.18%). The dollar index on Tuesday closed lower. Closes: Dollar index -0.231 (-0.26%), EUR/USD +0.00324 (+0.26%), USD/JPY -0.298(-0.25%). Bearish factors included (1) weakness in USD/JPY after BOJ Governor Kuroda said the Japanese economy is headed toward policy makers’ 2% inflation target, which reduces the chances of additional BOJ stimulus, and (2) the unexpected decline in U.S. Nov consumer confidence to a 5-month low, which was dollar-negative.

Jan WTI crude oil (CLF15 -0.05%) this morning is down -2 cents (-0.03%) at a 1-week low and Jan gasoline (RBF15 +0.25%) is up +0.0045 (+0.22%). Jan crude and Dec gasoline on Tuesday fell to 1-week lows and closed lower. Closes: CLF5 -1.69 (-2.23%), RBF5 -0.0135 (-0.67%). Negative factors included (1) the comment from the president of Russia’ state oil producer, OAO Rosneft, that even if crude prices dropped below $60 per barrel it would not force Russia to curb crude output, and (2) the unexpected decline in U.S. Nov consumer confidence to a 5-month low.

Disclosure: None