Morning Call For November 19, 2014

OVERNIGHT MARKETS AND NEWS

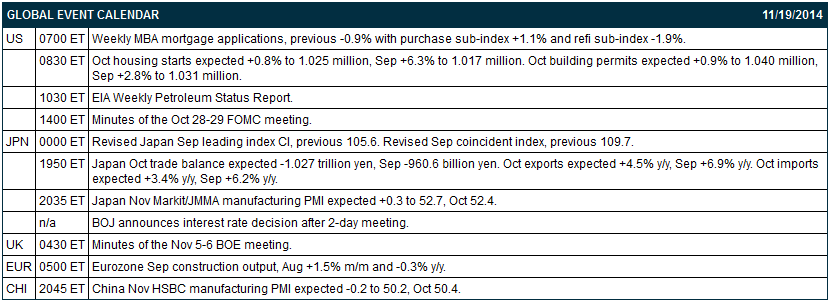

December E-mini S&Ps (ESZ14 +0.04%) this morning are down -0.05% ahead of the minutes of the Oct 28-29 FOMC meeting, while European stocks are up +0.24% at a 1-1/2 week high as health-care stocks gained on speculation of increased M&A activity. Yields on European government bonds rose after ECB policy maker Knot said he was skeptical about the benefits of quantitative easing. Asian stocks closed mostly lower: Japan -0.32%, Hong Kong -0.66%, China -0.16%, Taiwan +1.18%, Australia -0.57%, Singapore +0.63%, South Korea -0.13%, India -0.46%. Commodity prices are mixed. Dec crude oil (CLZ14 +0.20%) is up +0.27%. Dec gasoline (RBZ14 +0.90%) is up +0.75%. Dec gold (GCZ14 -0.18%) is up +0.06%. Dec copper (HGZ14+0.38%) is up +0.32%. Agriculture prices are weaker with Dec corn and Jan soybeans at 1-week lows as the U.S. harvest nears completion. The dollar index (DXY00 +0.13%) is up +0.10%. EUR/USD (^EURUSD) is unch. USD/JPY (^USDJPY) is up +0.64% at a fresh 7-year high after the BOJ concluded a 2-day policy meeting and maintained record stimulus and after BOJ Governor Kuroda warned that it's possible that core inflation may fall below 1%. Dec T-note prices (ZNZ14 -0.15%) are down -6.5 ticks.

Eurozone Sep construction output fell -1.8% m/m, the biggest decline in 20 months. On an annual basis Sep construction output fell -1.7% y/y, the most in 11 months.

Japan Oct nationwide department store sales fell-2.2% y/y, the seventh consecutive month that sales have declined year-over-year.

The Japan Sep all-industry activity index rose +1.0% m/m, right on expectations and the most in 6 months.

The Japan Sep leading index CI was left unrevised at 105.6. The Sep coincident index was revised upward to 109.8 from the originally reported 109.7.

U.S. STOCK PREVIEW

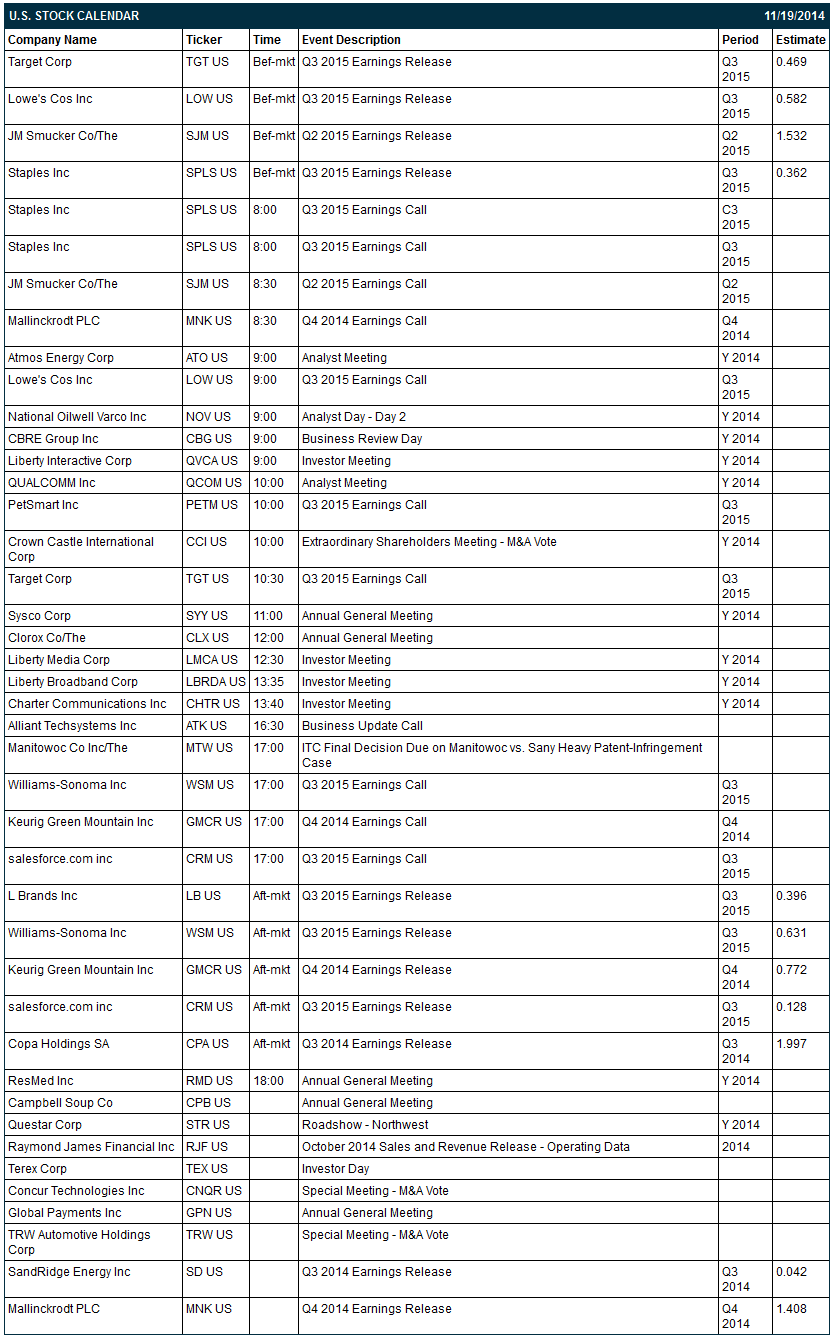

Today’s Oct housing starts report is expected to show a +0.8% increase to 1.025 million, adding to the +6.3% increase to 1.017 million seen in September. The markets suspect that today’s minutes from the Oct 28-29 FOMC meeting may be a bit bearish since the FOMC at that meeting ended QE3, upgraded its assessment of the labor market, and slightly revised its interest rate guidance language. There are 11 of the Russell 1000 companies report earnings today with notable reports including: Target (consensus $0.47), Lowe's (0.58), Staples (0.36), L Brands (0.40), Williams-Sonoma (0.63), Salesforce.com (0.13).

Equity conferences during the remainder of the week include: Morgan Stanley Global Consumer & Retail Conference on Tue-Wed, Stifel Healthcare Conference on Tue-Wed, UBS Global Technology Conference on Tue-Wed, Los Angeles Auto Show-Press & Trade Days on Tue-Thu, Citi Financial Technology Conference on Wed, Jefferies Global Healthcare Conference on Wed, World Internet Conference on Wed, Keefe, Bruyette, & Woods Securities Brokerage & Market Structure Conference on Wed, Vertical Research Partners Paper and Packaging Conference on Wed, Barclays Global Automotive Conference on Wed-Thu, Citigroup Global Financial Conference on Wed-Thu, Goldman Sachs Global Metals & Mining/Steel Conference on Thu, Wells Fargo Securities E-Cig Conference on Thu, Morgan Stanley European Technology, Media & Telecoms Conference on Fri.

OVERNIGHT U.S. STOCK MOVERS

Consolidated Edison (ED +0.78%) was downgraded to 'Sell' from 'Neutral' at UBS.

Columbia Sportswear (COLM +0.48%) was upgraded to 'Buy' from 'Neutral' at Citigroup.

JM Smucker (SJM +0.44%) reported Q2 EPS of $1.53, right on consensus, although Q2 revenue of $1.48 billion was less than consensus of $1.49 billion.

Lowe's (LOW -0.61%) rose 2% in pre-market trading after it reported Q3 EPS of 59 cents, better than consensus of 58 cents,and then raised guidance on fiscal 2014 EPS to $2.68, above consensus of $2.63.

Staples (SPLS -1.62%) climbed 2% in pre-market trading after it reported Q3 EPS of 37 cents, higher than consensus of 36 cents.

Mallinckrodt PLC (MNK +0.42%) reported Q4 EPS of $1.68, well above consensus of $1.41.

Integrated Core Strategies reported a 5.1% passive stake in Aegerion (AEGR +2.86%) .

PetSmart (PETM +0.01%) rose nearly 2% in after-hours trading after it reported Q3 EPS of $1.02, higher than consensus of 94 cents, and then raised guidance on fiscal 2014 EPS to $4.39-$4.43, above consensus of $4.33.

La-Z-Boy (LZB -0.70%) jumped over 4% in after-hours trading after it reported Q2 EPS of 36 cents, better than consensus of 34 cents.

Jack in the Box (JACK +1.72%) rose over 2% in after-hours trading after it reported Q4 operating EPS of 54 cents, above consensus of 53 cents.

Vipshop (VIPS -1.17%) reported Q3 EPS of 8 cents, better than consensus of 7 cents.

MARKET COMMENTS

Dec E-mini S&Ps (ESZ14 +0.04%) this morning are down -1.00 point (-0.05%). The S&P 500 index on Tuesday pushed up to a new record high and closed higher: S&P 500 +0.51%, Dow Jones +0.23%, Nasdaq +0.67%. Supportive factors included (1) carry-over support from a rally in European equity markets after the German Nov ZEW survey expectations of economic growth rose for the first time in 11 months and posted a 4-month high, and (2) strength in homebuilders after the NAHB Nov housing market index rose +4 to 58, better than expectations of +1 to 55.

Dec 10-year T-notes (ZNZ14 -0.15%) this morning are down -6.5 ticks. Dec 10-year T-note futures prices on Tuesday closed higher: TYZ4 +5.50, FVZ4 +3.25. Bullish factors included (1) increased safe-haven demand on concern about escalation of the crisis in Ukraine after Ukraine President Poroshenko said his country is ready for “total war” with Russian President Putin’s troops, and (2) carry-over support from a rally in European government bonds when ECB President Draghi said that sovereign-bond buying could be a stimulus measure to improve the Eurozone’s “abysmal” economic performance.

The dollar index (DXY00 +0.13%) this morning is up +0.086 (+0.10%). EUR/USD (^EURUSD) is unch. USD/JPY (^USDJPY) is up +0.75 (+0.64%) at a fresh 7-year high. The dollar index on Tuesday closed lower. Closes: Dollar index -0.351 (-0.40%), EUR/USD +0.00859 (+0.69%), USD/JPY +0.209 (+0.18%). Bearish factors included (1) strength in EUR/USD after the German Nov ZEW survey pf expectations of economic growth rose to a 4-month high, and (2) weakness in the yen as USD/JPY posted a new 7-year high after Japanese Prime Minister Abe called for an early election and suspended a planned sales-tax increase.

Dec WTI crude oil (CLZ14 +0.20%) this morning is up +20 cents (+0.27%) and Dec gasoline (RBZ14 +0.90%) is up +0.0153 (+0.75%). Dec crude and Dec gasoline on Tuesday settled mixed. Closes: CLZ4 -1.03 (-1.36%), RBZ4 +0.0169 (+0.83%). Supportive factors included (1) a weak dollar, and (2) the rally in the S&P 500 to a record high, which may boost confidence in the economic outlook and energy demand. Negative factors included (1) speculation that OPEC will be unable to agree on production cuts at next week’s meeting, and (2) a report from Goldman Sachs that said a “large” production cut by OPEC to prop up prices isn’t in the cartel’s interest as it would likely bolster an expansion of U.S. shale oil production.

Disclosure: None