Morning Call For November 1, 2016

OVERNIGHT MARKETS AND NEWS

Dec E-mini S&Ps (ESZ16 +0.25%) are up +0.29% and European stocks are up +0.34% after an unexpected increase in China Oct manufacturing activity eased global growth concerns. The China Oct manufacturing PMI unexpectedly rose +0.8 to 51.2, the fastest pace of expansion in 2-1/4 years. Gains were limited as crude oil prices (CLZ16 -0.11%) posted a fresh 1-month low, which undercut energy producing stocks. Crude oil prices remain under pressure after last week's talks in Vienna between OPEC and non-OPEC members failed to result in a cut in oil production targets. Dec ROB gasoline futures prices (RBZ16 +11.07%) are up over 10% after a fire and explosion at a Colonial Pipeline mainline in Alabama, the largest U.S. fuel pipeline in the U.S., was shut. The Colonial Pipeline mainline supplies gasoline and refined products to New York Harbor from Houston and an extended shutdown may mean shortages of gasoline and refined products on the U.S. East Coast. Asian stocks settled mostly higher: Japan +0.10%, Hong Kong +0.93%, China +0.71%, Taiwan -0.19%, Australia -0.51%, Singapore -0.01%, South Korea +0.02%, India -0.19%. Japan's Nikkei Stock Index climbed to a 6-month high on positive economic data from China, along with a dovish policy statement from the BOJ, which bolsters speculation the BOJ may boost stimulus measures.

The dollar index (DXY00 -0.31%) is down -0.25% at a 1-week low. EUR/USD (^EURUSD) is up +0.21% at a 1-week high. USD/JPY (^USDJPY) is up +0.11%.

Dec 10-year T-note prices (ZNZ16 -0.08%) are down -3.5 ticks.

The BOJ kept its monetary policy and its asset purchase targets unchanged following today's policy meeting and said that "risks to both economic activity and prices are skewed to the downside." The BOJ also said that consumer prices ex-fresh food would "increase toward 2%" in the second half of a period that runs through March 2019, later than a previous target date of March 2018.

The China Oct manufacturing PMI unexpectedly rose +0.8 to 51.2, stronger than expectations of -0.1 to 50.3 and the fastest pace of expansion in 2-1/4 years.

U.S. STOCK PREVIEW

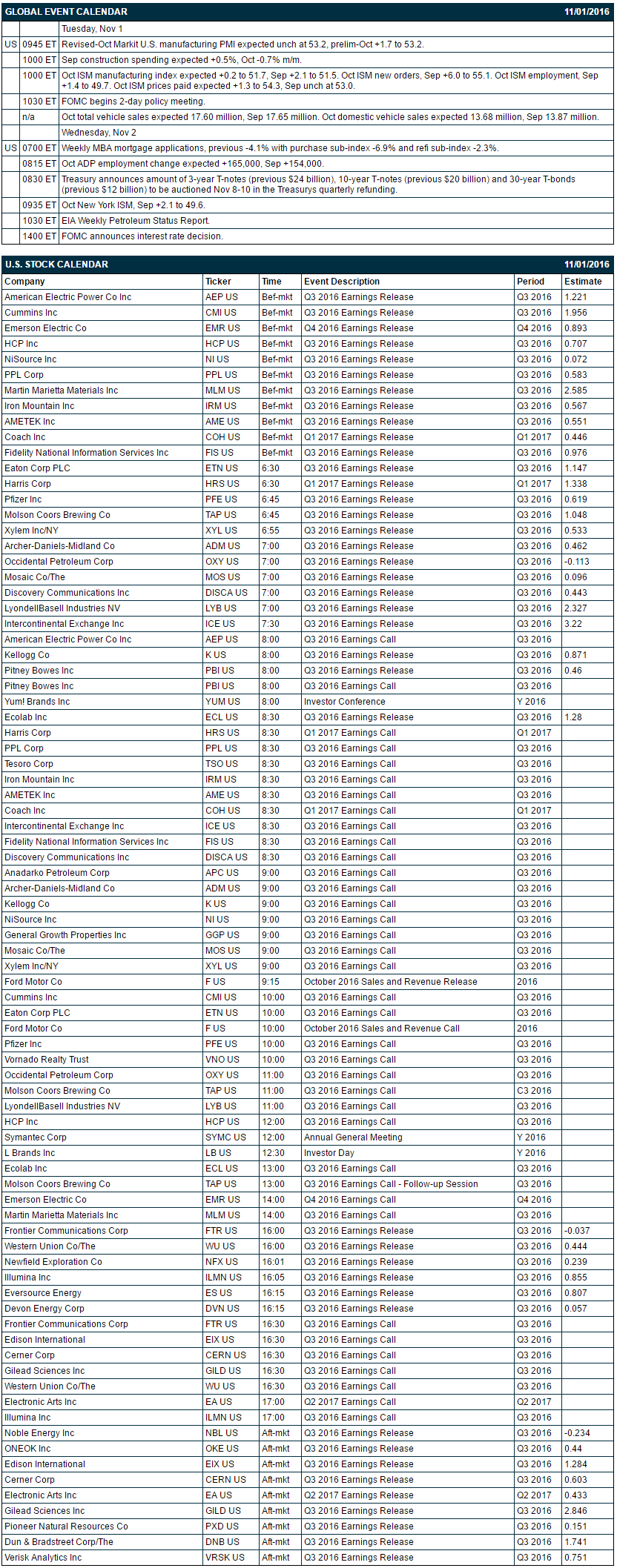

Key U.S. news today includes: (1) revised-Oct Markit U.S. manufacturing PMI (expected unch at 53.2, prelim-Oct +1.7 to 53.2), (2) Sep construction spending (expected +0.5%, Oct -0.7% m/m), (3) Oct ISM manufacturing index (expected +0.2 to 51.7, Sep +2.1 to 51.5), (4) FOMC begins 2-day policy meeting, and (5) Oct total vehicle sales (expected 17.60 million, Sep 17.65 million).

Notable S&P 500 earnings reports today include: Kellogg (consensus $0.87), Cummins (1.96), Emerson Electric (0.89), Coach (0.45), Pfizer (0.62), ADM (0.46), Occidental Petroleum (-0.11), ICE Exchange (3.22), Electronic Arts (0.43), Gilead Sciences (2.85), Dun & Bradstreet (1.74), Wynn Resorts (0.73), among others.

U.S. IPO's scheduled to price today: GDS Holdings (GDS).

Equity conferences during the remainder of this week include: Needham Next-Gen Storage Networking Conference on Wed, Goldman Sachs Industrials Conference on Wed-Thu, BancAnalysts Association of Boston Conference on Thu-Fri.

OVERNIGHT U.S. STOCK MOVERS

Wynn Resorts Ltd. (WYNN +0.39%) climbed 2% in pre-market trading after it reported Macau's gaming revenue rose +8.8% to $2.73 billion, the third straight monthly increase.

Luminex (LMNX +1.51%) rose 3% in after-hours trading after it reported Q3 adjusted EPS of 21 cents, above consensus of 20 cents, and then raised its 2016 revenue estimate to $267 million-$270 million from a July 28 estimate of $261 million-$269 million.

Twilio (TWLO -3.67%) rose nearly 2% in after-hours trading after it was rated a new 'Outperform' at Oppenheimer with an 18-month target price of $50.

Brocade Communications (BRCD +21.98%) was upgraded to 'Outperform' from 'Sector Perform' at RBC Capital Markets with a 12-month target price of $14.

Amkor Technology (AMKR +0.87%) climbed over 5% in after-hours trading after it reported Q3 EPS of 25 cents, higher than consensus of 21 cents, and said it sees full-year EPS of 55 cents, above consensus of 42 cents.

Lockheed Martin (LMT -0.65%) received a $536.4 million modification to an existing U.S. Air Force contract.

Tenet Healthcare (THC -2.67%) dropped over 3% in pre-market trading after it reported Q3 adjusted EPS continuing operations of 16 cents, weaker than consensus of 19 cents.

Raytheon (RTN -0.42%) was awarded a $174.7 million U.S. Defense Advanced Research Projects Agency contract that will run through Oct, 2017.

Tesoro (TSO +1.74%) lost 2% in after-hours trading after it cut its 2016 capex view to $900 million, below an earlier view of $1 billion.

Green Plains Partners LP (GPP -0.93%) reported Q3 adjusted EPS of 20 cents, weaker than consensus of 28 cents.

Aegion (AEGN -1.12%) reported Q3 adjusted EPS of 32 cents, below consensus of 35 cents.

FreightCar America (RAIL +0.54%) tumbled 10% in after-hours trading after it reported Q3 EPS of break-even, well below consensus of 12 cents.

Gasoline futures (RBZ16 +11.07%) surged over 10% in overnight Globex trading after Colonial Pipeline's right of way, the biggest U.S. gasoline pipeline in the U.S., was shut down after an explosion and fire in Shelby County, Alabama.

Instructure (INST +1.64%) plunged 2% in after-hours trading after it reported Q3 adjusted revenue of $30.1 million, below consensus of $30.3 million, and said it sees Q4 revenue of $30.4 million-$31.0 million, below consensus of $32.2 million.

MARKET COMMENTS

Dec E-mini S&Ps (ESZ16 +0.25%) this morning are up +6.25 points (+0.29%). Monday's closes: S&P 500 -0.01%, Dow Jones -0.10%, Nasdaq -0.09%. The S&P 500 on Monday closed slightly lower on the -3.6 point decline in the Oct Chicago PMI to a 5-month low of 50.6 (weaker than expectations of -0.2 to 54.0) and on the +0.3% increase in U.S. Sep personal income, weaker than expectations of +0.4%. There was also weakness in the energy sector as crude oil prices tumbled -3.78% to a 1-month low. Stocks found some underlying support from M&A activity after GE agreed to combine its oil and gas business with Baker Hughes and after CenturyLink agreed to buy Level 3 for about $34 billion.

Dec 10-year T-notes (ZNZ16 -0.08%) this morning are down -3.5 ticks. Monday's closes: TYZ6 +2.50, FVZ6 +2.00. Dec 10-year T-notes on Monday closed higher on the weaker-than-expected Oct Chicago PMI report and on the slide in crude oil prices to a 1-month low, which dampened inflation expectations.

The dollar index (DXY00 -0.31%) this morning is down -0.251 (-0.25%) at a 1-week low. EUR/USD (^EURUSD) is up +0.0023 (+0.21%) at a 1-week high. USD/JPY (^USDJPY) is up +0.12 (+0.11%). Monday's closes: Dollar index +0.097 (+0.10%), EUR/USD -0.0004 (-0.04%), USD/JPY +0.08 (+0.08%). The dollar index on Monday closed higher on strength in USD/JPY as the yen moved lower after the Japan Sep industrial production and Japan Sep retail sales reports were both weaker than expected. There was also weakness in EUR/USD after German Sep retail sales unexpectedly posted its biggest decline in over 2 years.

Dec crude oil prices (CLZ16 -0.11%) are up 3 cents (+0.06%) and Dec gasoline (RBZ16 +11.07%) is up sharply by +0.1536 (+10.82%). Monday's closes: Dec crude -1.84 (-3.78%), Dec gasoline -0.0054 (-0.37%). Dec crude oil and gasoline prices on Monday sold off to 1-month lows and closed sharply lower as the weekend OPEC committee meeting failed to produce a detailed production cut agreement. Other bearish factors included the stronger dollar and expectations for Wednesday's EIA crude inventories to increase by +1.5 million bbl.

Disclosure: None.