Morning Call For Nov. 4, 2014

OVERNIGHT MARKETS AND NEWS

December E-mini S&Ps (ESZ14 -0.17%) this morning are down -0.10% and European stocks are down -0.16% after the EU cut its Eurozone GDP and inflation forecasts for this year and next. Also, energy producers are lower after the price of WTI crude oil tumbled to a 3-year low. Asian stocks closed mixed: Japan +2.73%, Hong Kong -0.29%, China +0.02%, Taiwan -0.17%, Australia +0.24%, Singapore -0.28%, South Korea -0.88%, India closed for holiday. Japanese markets reopened from Monday's holiday and stock prices surged as the Nikkei Stock Index climbed to a 7-year high. Exporters rallied on Monday's slide in the yen to a 6-3/4 year low against the dollar and the overall Japanese stock market found support on the action of Japan's pension fund, the world's biggest, to double the amount of stocks it allocates to its fund. Commodity prices are mostly lower. Dec crude oil (CLZ14-2.89%) is down -2.68% at a 3-year low after Saudi Arabia’s cut the price of crude it sells to the U.S. in an attempt to preserve its share of OPEC output. Dec gasoline (RBZ14 -2.41%) is down -2.23% at a 4-year low. Dec gold (GCZ14 -0.08%) is up +0.15%. Dec copper (HGZ14 -1.21%) is down -0.33%. Agriculture prices are weaker as the pace of the U.S. harvest picked up. The dollar index (DXY00 -0.18%) is down -0.18%. EUR/USD (^EURUSD) is up +0.26% after Eurozone Sep producer prices unexpectedly rose. USD/JPY (^USDJPY) is down -0.57%. Dec T-note prices (ZNZ14 +0.19%) are up +5.5 ticks on carry-over support from a rally in German bunds as the 10-year bund yield fell to a 2-week low after the EU cut its GDP and inflation forecasts.

The European Commission said the recovery in the Eurozone is "not only subdued but also fragile" as it cut its Eurozone 2014 GDP forecast to +0.8% from a May forecast of +1.2% and lowered its 2015 Eurozone GDP estimate to 1.1% from a May estimate of +1.7%. The commission also lowered its Eurozone 2014 inflation estimate to +0.5% from +0.8% and cut its 2015 inflation forecast to 0.8% from +1.2%.

Eurozone Sep PPI unexpectedly rose +0.2% m/m, higher than expectations of unch m/m, and on an annual basis Sep PPI fell -1.4% y/y, less than expectations of -1.5% y/y.

The UK Oct Markit/CIPS construction PMI fell -2.8 to 61.4, a bigger drop than expectations of -0.7 to 63.5 and the slowest pace of expansion in 5 months.

Japan Oct vehicle sales fell -9.1% y/y, the largest decline in six months and the third straight month that vehicle sales have fallen.

The Japan Oct Markit/JMMA manufacturing PMI was revised lower to 52.4 from the originally reported 52.8, still the fastest pace of expansion in 7 months.

U.S. STOCK PREVIEW

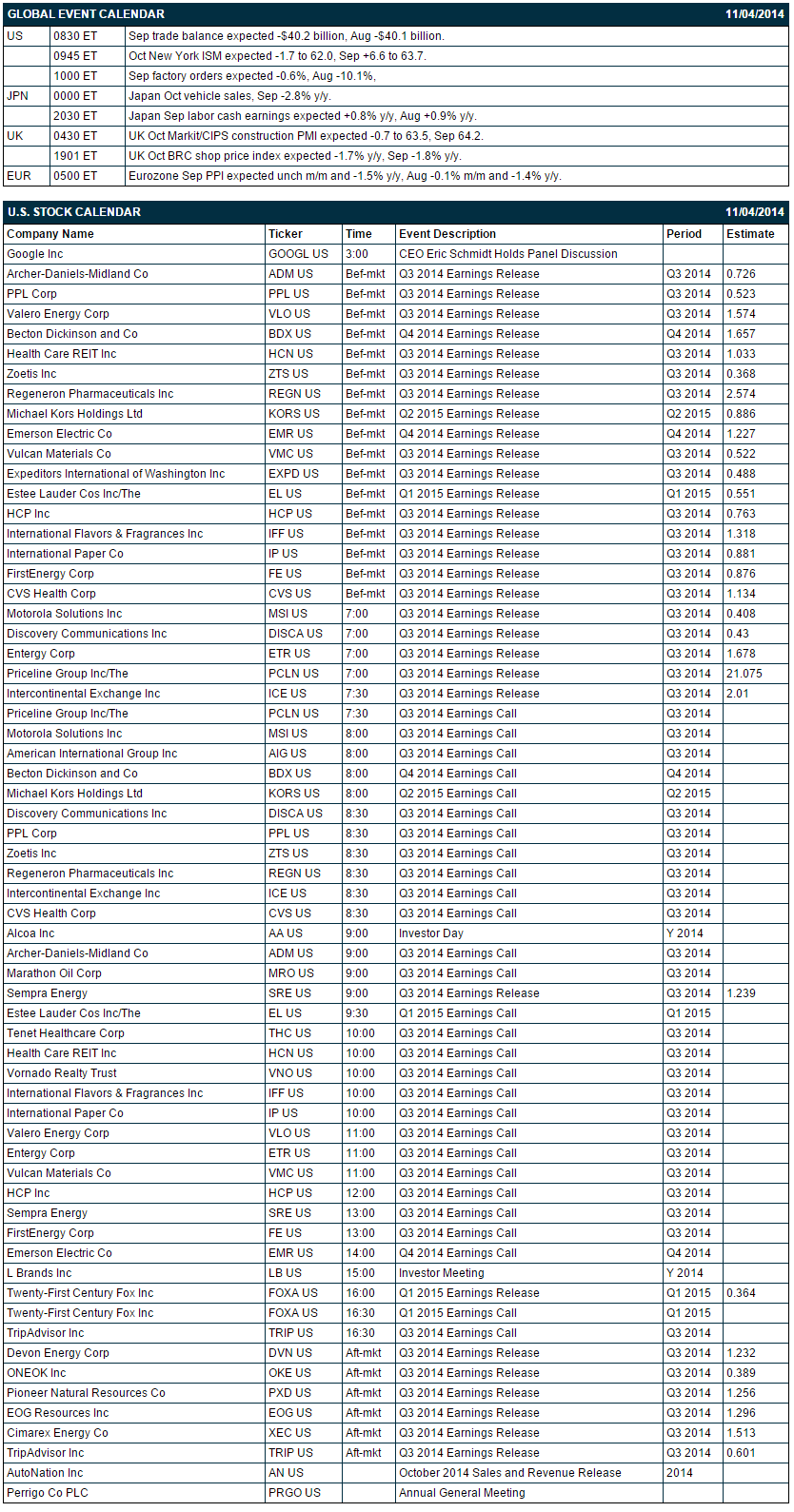

Today’s Sep U.S. trade deficit is expected to expand slightly to -$40.2 billion from -$40.1 billion in August. The market is expecting today’s Sep factory orders report to show a -0.6% decline, adding to the sharp decline of -10.1% seen in August.

There are 30 of the S&P 500 companies that report earnings today with notable reports including: Motorola Solutions (0.41), Priceline (21.08), ICE (2.01), ADM (0.73), Emerson Electric (1.23), International Paper (0.88), TripAdvisor (0.60). Equity conferences this week include: Latin Markets Hedge Fund Americas Forum on Tue-Wed, Gabelli & Company Automotive Aftermarket Symposium on Tue, Raymond James Global Airline Transportation Conference on Thu, BancAnalysts Association of Boston Conference on Thu-Fri.

OVERNIGHT U.S. STOCK MOVERS

Intercontinental Exchange (ICE +0.72%) reported Q3 EPS of $2.12, above consensus of $2.01.

Atlas Pipeline Partners (APL -1.31%) reported Q3 EPS of 13 cents, much better than consensus of a -1 cent loss.

JPMorgan Chase (JPM +0.66%) said the Department of Justice is conducting a criminal investigation of the company's Forex trading.

RockTenn (RKT +0.70%) reported Q4 adjusted EPS of $1.31, higher than consensus of $1.05.

Lockheed Martin (LMT +0.09%) has been awarded a $271.82 milllion government contract modification to a previously awarded contract to provide the government of Taiwan with installation of 142 aircraft kits to upgrade their fleet of F-16 aircraft.

AmTrust (AFSI +4.08%) reported Q3 EPS non-GAAP of $1.79, well above consensus of $1.14.

Marathon Oil (MRO -2.34%) reported Q3 adjusted EPS of 76 cents, stronge than consensus of 59 cents.

Lone Pine Capital reported a 5.3% passive stake in Autodesk (ADSK +0.40%) .

L Brands (LB +0.44%) jumped 3% in European trading after it raised guidance on fiscal 2014 EPS to 38 cents-40 cents from 26 cents-31 cents, higher than consensus of 32 cents.

Herbalife (HLF +6.56%) slumped over 12% in after-hours trading after it reported Q3 adjusted EPS of $1.45, weaker than consensus of $1.51, and then lowered guidance on fiscal 2014 adjusted EPS to $5.80-$5.90, below consensus of $6.26.

Alleghany (Y +0.92%) reported Q3 EPS of $11.40, well above consensus of $7.60.

West Corp. (WSTC +0.09%) reported Q3 adjusted EPS of 82 cents, stronger than consensus of 74 cents.

Community Health (CYH +0.84%) reported Q3 EPS of 54 cents, well below consensus of 76 cents.

Texas Roadhouse (TXRH +1.42%) reported Q3 EPS of 27 cents, less than consensus of 29 cents.

Kaman (KAMN -1.16%) reported Q3 adjusted EPS of 60 cents, weaker than consensus of 67 cents.

AIG (AIG +0.43%) climbed over 1% in pre-market trading after it reported Q3 EPS of $1.21, higher than consensus of $1.09.

Frontier Communications (FTR -0.76%) reported Q3 adjusted EPS of 5 cents, better than consensus of 4 cents.

MARKET COMMENTS

Dec E-mini S&Ps (ESZ14 -0.17%) this morning are down -2.00 points (-0.10%). The S&P 500 index on Monday rose to a new record high but gave up its advance and closed little changed: S&P 500 -0.01%, Dow Jones -0.14%, Nasdaq +0.27%. Bullish factors included (1) the unexpected +2.3 point rise in the Oct ISM manufacturing index to 59.0, stronger than expectations of -0.5 to 56.1, and (2) strong Q3 stock earnings results with nearly 80% of reporting S&P 500 companies having beaten estimates. Stock gains were muted after the China Oct manufacturing PMI unexpectedly fell -0.3 to 50.8, less than expectations of +0.1 to 51.2 and the slowest pace of expansion in 6 months.

Dec 10-year T-notes (ZNZ14 +0.19%) this morning are up +5.5 ticks. Dec 10-year T-note futures prices on Monday slid to a 3-week low and closed lower: TYZ4 -3.00, FVZ4 -3.50. Bearish factors included (1) the unexpected increase in the Oct ISM manufacturing index, and (2) reduced safe-haven demand for T-notes after the S&P 500 posted a new record high.

The dollar index (DXY00 -0.18%) this morning is down -1.161 (-0.18%). EUR/USD (^EURUSD) is up +0.0032 (+0.26%). USD/JPY (^USDJPY) is down-0.65 (-0.57%). The dollar index on Monday rose to a new 4-1/3 year high and closed higher. Closes: Dollar index +0.392 (+0.45%), EUR/USD -0.00409(-0.33%), USD/JPY +1.724 (+1.54%). Bullish factors included (1) strength in USD/JPY which rallied to a fresh 6-3/4 year high on improved interest rate differentials for the dollar against the yen as the Fed moves toward interest rate increases while the BOJ continues to add stimulus, and (2) weakness in EUR/USD which fell to a fresh 2-year low on speculation the ECB will boost its stimulus measures after Eurozone Oct manufacturing PMI was revised lower.

Dec WTI crude oil (CLZ14 -2.89%) this morning is down -$2.11 a barrel (-2.68%) at a 3-year low and Dec gasoline (RBZ14 -2.41%) is down -0.0473(-2.23%) at a 4-year low. Dec crude and Dec gasoline on Monday closed lower with Dec crude at a 2-1/3 year low. Closes: CLZ4 -1.76 (-2.19%), RBZ4-0.0368 (-1.71%). Bearish factors included (1) the rally in the dollar index to a 4-1/3 year high, (2) the increase in OPEC Oct oil production to 30.074 million bpd, the most in 14 months, and (3) Saudi Arabia’s cut in its price of crude it sells to the U.S. in an attempt to preserve its share of OPEC output.

Disclosure: None