Morning Call For Monday, Sept. 25

OVERNIGHT MARKETS AND NEWS

Dec E-mini S&Ps (ESZ17 -0.04%) this morning are down -0.06% and European stocks are down -0.06% on German Chancellor Merkel's weaker-than-expected win in the German elections on Sunday. The result of the elections means that Chancellor Merkel's Christian Democratic Party (CDU) must forge a coalition to govern over the next 4-years. The German Social Democrats opted to go into opposition and not renew their coalition with the CDU which means Chancellor Merkel may have to form an alliance with the Green and Free Democrat Party. European stocks were also under pressure after the German Sep IFO business climate unexpectedly declined. Asian stocks settled mostly lower: Japan +0.50%, Hong Kong -1.36%, China -0.33%, Taiwan -1.09%, Australia +0.03%, Singapore -0.13%, South Korea -0.10%, India -0.93%. China's Shanghai Composite fell to a 1-month low, led by losses in property stocks, after eight Chinese cities added housing curbs. The Xinhua News Agency reported that eight cities will ban home resales within two to three years of purchase, which dampened speculation the government would begin to ease property restrictions. Japanese stocks closed higher after the Japan Sep Nikkei manufacturing PMI rose to a 4-month high and after Japanese Prime Minster Abe announced an $18 billion economic package and said he'll dissolve the lower house of parliament on Sep 28 for a general election on Oct 22.

The dollar index (DXY00 +0.40%) is up +0.42%. EUR/USD (^EURUSD) is down -0.59%. USD/JPY (^USDJPY) is up +0.11%.

Dec 10-year T-note prices (ZNZ17 +0.15%) are up +7 ticks.

ECB Executive Board member Mersch said, "Once we have seen a sufficiently sustained adjustment in the path of inflation, we will continue to prudently adjust our tool-box of monetary policy instruments, as we have been doing since Dec last year."

The German Sep IFO business climate unexpectedly fell -0.7 to 115.2, weaker than expectations of +0.1 to 116.0.

The Japan Sep Nikkei manufacturing PMI rose +0.4 to 52.6, the strongest pace of growth in 4 months.

U.S. STOCK PREVIEW

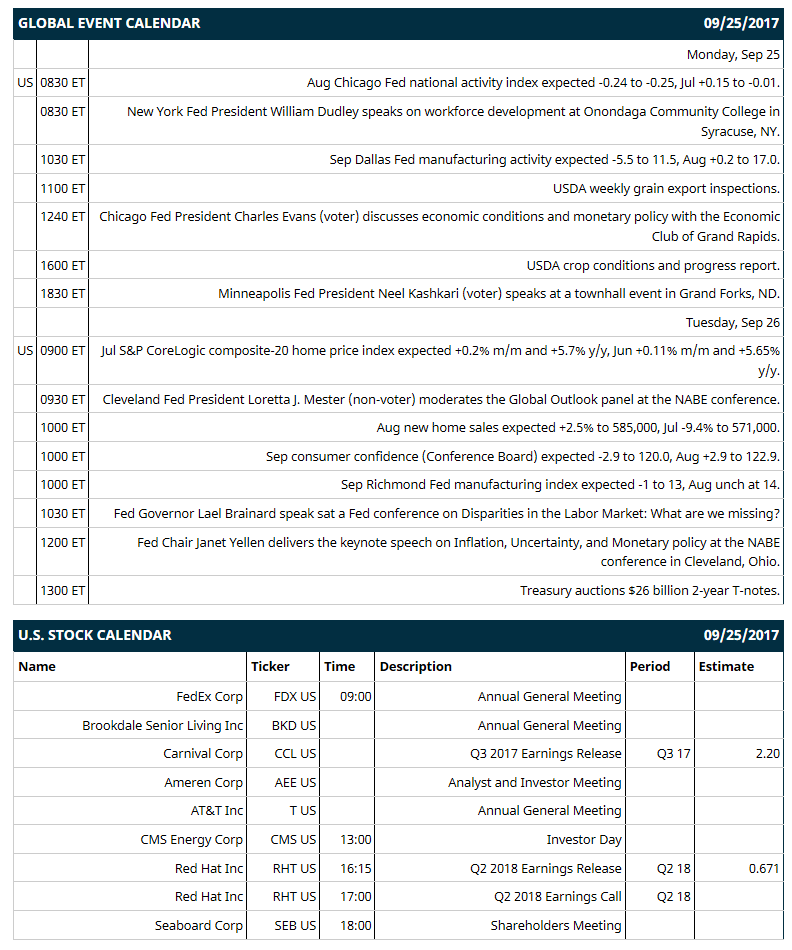

Key U.S. news today includes: (1) Aug Chicago Fed national activity index (expected -0.24 to -0.25, Jul +0.15 to -0.01), (2) New York Fed President William Dudley speaks on workforce development at Onondaga Community College in Syracuse, NY, (3) Sep Dallas Fed manufacturing activity index (expected -5.5 to 11.5, Aug +0.2 to 17.0), (4) Chicago Fed President Charles Evans (voter) discusses economic conditions and monetary policy with the Economic Club of Grand Rapids, (5) Minneapolis Fed President Neel Kashkari (voter) speaks at a townhall event in Grand Forks, ND, (6) USDA weekly grain export inspections, (7) USDA crop conditions and progress report.

Notable Russell 1000 earnings reports today include: Carnival (consensus $2.20), Red Hat (0.67).

U.S. IPO's scheduled to price today: none.

Equity conferences this week: BMO Capital Markets Real Estate Conference on Mon, North American Commercial Vehicle Conference on Mon, Cantor Fitzgerald Global Healthcare Conference on Mon-Tue, Denver Gold Forum on Mon-Tue, Ladenburg Thalmann Health Care Conference on Tue, American Society for Radiation Oncology Meeting on Tue, Johnson Rice & Co. Energy Conference on Tue, Wolfe Research Conference on Tue-Thu, Deutsche Bank Energy Conference on Wed, Barrington Research Fall Investment Conference on Wed, Bernstein Pan European Strategic Decisions Conference on Wed, LEERINK Partners Rare Disease & Immuno-Oncology Conference on Wed-Thu, B. Riley Consumer Conference on Thu.

OVERNIGHT U.S. STOCK MOVERS

AbbVie (ABBV +0.08%) was downgraded to 'Neutral' from 'Under Review' at UBS.

Under Armour (UAA -0.49%) was downgraded to 'Neutral' from 'Buy' at Guggenheim Securities.

General Motors (GM +0.82%) was upgraded to 'Buy' from 'Hold' at Deutsche Bank with a price target of $51.

Life Storage (LSI -0.35%) was downgraded to 'Underperform' from 'Neutral' at Bank of America/Merrill Lynch.

Ross Stores (ROST -0.03%) was upgraded to 'Overweight' from 'Neutral' at JPMorgan Chase with a price target of $74.

Box (BOX +4.01%) was upgraded to 'Outperform' from 'Market Perform' at Raymond James.

Transocean (RIG +2.64%) was upgraded to 'Buy' from 'Neutral' at UBS with a price target of $15.

Colgate (CL -0.25%) was upgraded to 'Overweight' from 'Equalweight' at Morgan Stanley with a price target of $84.

American Outdoor Brands (AOBC -0.99%) was upgraded to 'Outperform' from 'Neutral' at Wedbush with a target price of $19.50.

Bristol-Myers Squibb's (BMY +0.05%) Opdivo injection for intravenous use for patients with hepatocellular carcinoma has been approved by the FDA.

Facebook (FB -0.33%) said it dropped a plan to create a new class of shares, which led to the cancellation of a lawsuit by shareholders over a new share class.

Moody's Investors Service downgraded the United Kingdom's long-term credit rating to Aa2 from Aa1 and changed the outlook to stable from negative.

MARKET COMMENTS

Dec S&P 500 E-mini stock futures (ESZ17 -0.04%) this morning are down -1.50 points (-0.06%). Friday's closes: S&P 500 +0.06%, Dow Jones -0.04%, Nasdaq -0.04%. The S&P 500 on Friday closed higher on carry-over support from a rally in European stocks to a 2-3/4 month high on signs of strength in the European economy after the Eurozone Sep Markit manufacturing PMI unexpectedly rose +0.8 to 58.2. Stocks were undercut by heightened North Korean tensions after North Korean President Kim Jong Un promised the "highest level of hardline" countermeasures against the U.S. and his foreign minister suggested that could include testing of a hydrogen bomb in the Pacific Ocean.

Dec 10-year T-note prices (ZNZ17 +0.15%) this morning are up +7 ticks. Friday's closes: TYZ7 +3.50, FVZ7 +2.50. Dec 10-year T-notes on Friday closed higher on weakness in stocks that spurred safe-haven demand for T-notes after North Korea said it may test a hydrogen bomb in the Pacific Ocean. T-notes were also boosted by dovish comments from San Francisco Fed President Williams who said he expects "gradual rate increases" over the next couple of years and that in his view "a 2.5% fed funds rate is about the new normal."

The dollar index (DXY00 +0.40%) this morning is up +0.39 (+0.42%). EUR/USD (^EURUSD) is down -0.0071 (-0.59%) and USD/JPY (^USDJPY) is up +0.12 (+0.11%). Friday's closes: Dollar Index -0.088 (-0.10), EUR/USD +0.0010 (+0.08%), USD/JPY -0.49 (-0.44%). The dollar index on Friday closed lower on ramped up North Korean tensions, which boosted safe-haven demand for the yen, and on strength in EUR/USD on speculation stronger economic data may prod the ECB into tapering QE after the +0.8 point jump to 58.2 in the Eurozone Sep Markit manufacturing PMI.

Nov crude oil (CLX17 +0.81%) this morning is up +1 cent ((+0.02%) and Nov gasoline (RBX17 +1.32%) is +0.0131 (+0.81%). Friday's closes: Nov WTI crude +0.11 (+0.22%), Nov gasoline +0.0195 (+1.21%). Nov crude oil and gasoline on Friday closed higher on a weaker dollar and signs of stronger global growth that are positive for energy demand after the Eurozone Markit manufacturing PMI expanded +0.8 to 58.2.

Metals prices this morning are mixed with Dec gold (GCZ17 +0.02%) +0.2 (+0.02%), Dec silver (SIZ17 +0.01%) -0.0004 (-0.02%) and Dec copper (HGZ17 -0.31%) -0.006 (-0.19%). Friday's closes: Dec gold +2.7 (+0.21%), Dec silver -0.034 (-0.20%), Dec copper +0.0100 (+0.34%). Metals on Friday settled mostly higher on a weaker dollar and an increase in North Korean tensions that boosted safe-haven demand for precious metals. Copper was boosted by signs of tighter supplies after weekly China copper inventories fell -25,429 MT to a 9-month low of 141,318 MT.

(Click on image to enlarge)

Disclosure: None.