Morning Call For Monday, Oct. 16

OVERNIGHT MARKETS AND NEWS

Dec E-mini S&Ps (ESZ17 unch) this morning are up +0.04% at a new all-time nearest-futures high and European stocks are also up +0.04%. Strength in commodity producing stocks is lifting the overall market with Nov WTI crude oil (CLX17 +1.32%) up +1.38% at a 2-week high and Dec COMEX copper (HGZ17 +2.71%) up +2.79% at a 3-year high. Crude oil rallied on concern that tensions between Iraq and Kurdish forces may disrupt crude oil flows after Iraqi soldiers seized facilities including a refinery near the city of Kirkuk from Kurdish forces. Copper prices soared on fund buying spurred on by speculation that Chinese demand for commodities will firm after China Sep producer prices rose +6.9% y/y, the fastest pace of increase in 6-months. Dec COMEX gold (GCZ17 +0.27%) is up +0.25% at a 2-week high after comments from Fed Chair Yellen Saturday boosted demand for gold as an inflation hedge when she said her "best guess" is that consumer prices will soon accelerate after a period of surprising softness. Asian stocks settled mostly higher: Japan +0.47%, Hong Kong +0.76%, China -0.36%, Taiwan +0.47%, Australia +0.56%, Singapore +0.12%, South Korea +0.14%, India +0.62%. Japan's Nikkei Stock Index rallied to a 2-year high on signs the BOJ will keep its overly easy monetary policies in place after BOJ Governor Kuroda said, "the BOJ will persistently pursue aggressive monetary easing" in its attempts to boost inflation.

The dollar index (DXY00 +0.04%) is up +0.08% after Fed Chair Yellen said that "the ongoing strength of the economy will warrant gradual increases" in the Fed funds rate. EUR/USD (^EURUSD) is down -0.14%. USD/JPY (^USDJPY) is down -0.04%.

Dec 10-year T-note prices (ZNZ17 unch) are down -0.5 of a tick.

Fed Chair Yellen said Saturday that her "best guess" is that consumer prices will soon accelerate after a period of surprising softness and that "these soft readings will not persist" and that "the ongoing strength of the economy will warrant gradual increases" in the Fed funds rate.

BOJ Governor Kuroda said, "achieving the 2% price stability target is still a long way off and the BOJ will persistently pursue aggressive monetary easing."

China Sep CPI rose +1.6% y/y, right om expectations. Sep PPI rose +6.9% y/y, stronger than expectations of +6.4% y/y and the fastest pace of increase in 6-months.

China Sep new yuan loans rose +1.27 trillion yuan, stronger than expectations of +1.20 trillion yuan. Sep aggregate financing rose +1.820 trillion yuan, stronger than expectations of +1.572 trillion yuan and the biggest increase in 6-months.

U.S. STOCK PREVIEW

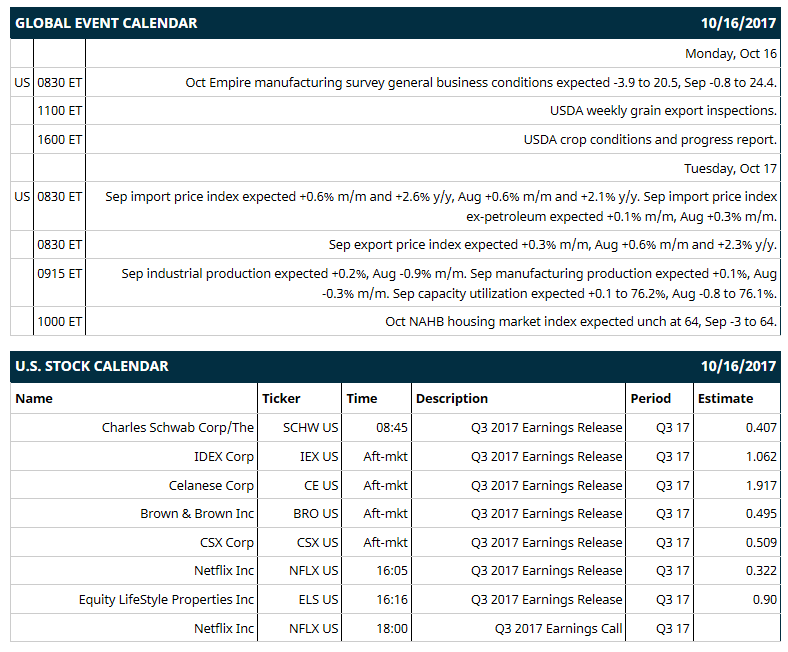

Key U.S. news today includes: (1) Oct Empire manufacturing index (expected -3.9 to 20.5, Sep -0.8 to 24.4), (2) USDA weekly grain export inspections, (3) USDA crop conditions and progress report.

Notable Russell 1000 earnings reports today include: Schwab (consensus $0.41), Netflix (0.32), IDEX (1.06), Celanese (1.92), Brown & Brown (0.50), CSX (0.51), Equity LifeStyle Properties (0.90).

U.S. IPO's scheduled to price today: none.

Equity conferences this week: WEPTAC Conference on Mon, International Association for the Study of Lung Cancer World Conference - Abstra on Mon-Wed, BIO Investor Forum on Tue, METALCON Conference on Thu, SAP Retail Executive Forum on Thu, American Association for the Study of Liver Diseases Liver Meeting on Fri.

OVERNIGHT U.S. STOCK MOVERS

Apple (AAPL +0.63%) was upgraded to 'Overweight' from 'Sector Weight' at KeyBanc Capital Markets with a price target of $187.

Sally Beauty Holdings (SBH -0.85%) was upgraded to 'Buy' from 'Neutral' at D.A. Davidson with a 12-month target price of $21.

Norfolk Southern (NSC -1.53%) and CSX Corp. (CSX -1.40%) were both downgraded to 'Market Perform' from 'Outperform' at Wells Fargo Securities.

Valero Energy (VLO +0.22%) was downgraded to 'Hold' from 'Buy' at Jeffries.

Bristol-Myers Squibb ({=BMY was downgraded to 'Hold' from 'Buy' at Jeffries.

Citigroup (C -0.36%) was downgraded to 'Sell' from 'Hold' at Societe Generale with a price target of $65.

Alteryx (AYX +0.14%) was initiated a new 'Buy' at Bank of America/Merrill Lynch with a price target of $26.

Phillips 66 (PSX +0.10%) was downgraded to 'Underperform' from 'Hold' at Jeffries.

Adobe Systems (ADBE +0.21%) was downgraded to 'Hold' from 'Buy' at Deutsche Bank.

Intuitive Surgical (ISRG -0.07%) fell 4% in after-hours trading after TransEnterix, a competitor of Intuitive's for robotic surgery, said its Senhance System was approved by the FDA. TransEnterix TRXC soared 66% in after-hours trading on the news.

Aratana Therapeutics (PETX unch) surged 15% in after-hours trading after the company said it was making its Entyce drug commercially available to veterinarians in the U.S. for appetite stimulation in dogs.

MARKET COMMENTS

Dec S&P 500 E-mini stock futures (ESZ17 unch) this morning are up +1.00 points (+0.04%) at a new record nearest-futures high. Friday's closes: S&P 500 +0.09%, Dow Jones +0.13%, Nasdaq +0.379%. The S&P 500 on Friday climbed to a new record high and settled higher on carry-over support from a rally in European stocks after a report said the ECB will extend its QE program until Sep of 2018. Stocks were also boosted by slack inflation pressures that may keep the Fed on the sidelines after U.S. Sep core CPI rose +0.1% m/m and +1.7% y/y, weaker than expectations of +0.2% m/m and +1.8% y/y. Stocks also found support on the unexpected +6.0 point rise in the Oct University of Michigan U.S. consumer sentiment index to a 13-3/4 year high.

Dec 10-year T-note prices (ZNZ17 unch) this morning are down -0.5 of a tick. Friday's closes: TYZ7 +10.00, FVZ7 +5.25. Dec 10-year T-notes on Friday rallied to a 2-week high and closed higher on carry-over support from a rally in German bunds to a 2-1/2 week high on reports the ECB will extend its QE program to Sep of 2018. T-note prices were also boosted by the the weaker-than-expected U.S. Sep core CPI report of +1.7% y/y, the slowest pace of increase in 2-1/2 years, which was dovish for Fed policy. T-notes were also boosted by reduced inflation expectations after the 10-year T-note breakeven inflation rate fell to a 1-week low.

The dollar index (DXY00 +0.04%) this morning is up +0.076 (+0.08%). EUR/USD (^EURUSD) is down -0.0017 (-0.14%) and USD/JPY (^USDJPY) is down -0.04 (-0.04%). Friday's closes: Dollar Index +0.042 (+0.05%), EUR/USD -0.0010 (-0.08%), USD/JPY -0.46 (-0.41%). The dollar index on Friday rebounded from a 2-week low and closed slightly higher on the unexpected jump in Oct University of Michigan U.S. consumer sentiment index to a 13-3/4 year high. There was also weakness in EUR/USD after a report said the ECB will extend its QE program until Sep of 2018. The dollar was undercut by the weaker-than-expected U.S. Sep core CPI, which was dovish for Fed policy.

Nov crude oil (CLX17 +1.32%) this morning is up +7 1cents (+1.38%) at a 2-week high and Nov gasoline (RBX17 +0.99%) is +0.0182 (+1.12%) at a 2-week high. Friday's closes: Nov WTI crude +0.85 (+1.68%), Nov gasoline +0.0390 (+2.46%). Nov crude oil and gasoline on Friday closed higher with Nov crude at a 2-week high. Crude oil prices were boosted by the decline in the dollar index to a 2-week low and by strength in Chinese demand after China Sep crude imports jumped +13% m/m to 9.04 million bpd, the second-highest on record.

Metals prices this morning are higher with Dec gold (GCZ17 +0.27%) +3.2 (+0.25%) at a 2-week high, Dec silver (SIZ17 +0.34%) +0.049 (+0.28%) at a 2-week high and Dec copper (HGZ17 +2.71%) +0.088 (+2.79%) at a 3-year high. Friday's closes: Dec gold +8.1 (+0.62%), Dec silver +0.145 (+0.84%), Dec copper +0.0135 (+0.43%). Metals on Friday closed higher with Dec gold at a 2-week high, Dec silver at a 3-week high, and Dec copper at a 5-week high. Metals prices were boosted by the fall in the dollar index to a 2-week low and the reduced chances of a Fed rate hike in Dec after U.S. core CPI fell to a 2-1/2 year low of +1.7% y/y. Copper was boosted by news that China Sep copper imports rose by +10% m/m and +26.5% y/y to 430,000 MT.

Disclosure: None.