Morning Call For Monday, Nov. 6

OVERNIGHT MARKETS AND NEWS

Dec E-mini S&Ps (ESZ17 -0.02%) this morning are down slightly by -0.05%. Losses in the overall market were limited with strength in energy stocks as Dec WTI crude oil climbs +0.54% to a new 2-1/3 year high. Crude oil rose on speculation that Saudi Arabia is more likely to back extending cuts in crude production following this weekend's anti-corruption purge by Saudi Crown Prince Mohammed bin Salman who had security forces arrest princes, ministers and former top officials in a sweeping anti-corruption drive. European stocks are down -0.33% as they follow declines in U.S. stock indexes, although losses were limited after German Sep factory orders rose more than expected and after Eurozone Nov Sentix investor confidence climbed to a 10-1/4 year high. Asian stocks settled mixed: Japan +0.04%, Hong Kong -0.02%, China +0.49%, Taiwan -0.13%, Australia -0.10%, Singapore -0.01%, South Korea -0.42%, India +0.14%. Japan's Nikkei Stock Index posted a fresh 21-1/3 year high as exporter stocks rallied after USD/JPY rose to a 7-1/2 month high.

The dollar index (DXY00 +0.08%) is unchanged. EUR/USD (^EURUSD) is down -0.10% at a 1-week low as fall in the German bund yield to a 1-3/4 month low undercut the euro's interest rate differentials. USD/JPY (^USDJPY) is unchanged after it rose to a 7-1/2 month high in overnight trade after BOJ Governor Kuroda stressed the need for continued easing from the BOJ when he said we are "still a long way" from achieving our 2% inflation target.

Dec 10-year T-note prices (ZNZ17 +0.12%) are up +7.5 ticks on carry-over support from a rally in German 10-year bunds to a 1-3/4 month high.

ECB Executive Board member Praet said that "a substantial amount of monetary accommodation continues to be necessary to secure the gradual convergence of inflation towards our inflation aim."

The Eurozone Nov Sentix investor confidence rose +4.3 to 34.0, stronger than expectations of +1.3 to 31.0 and the highest in 10-1/4 years.

Eurozone Sep PPI rose +0.6% m/m and +2.9% y/y, stronger than expectations of +0.4% m/m and +2.7% y/y with the +0.6% m/m gain the largest monthly increase in 8-months.

German Sep factory orders rose +1.0 m/m and +9.5% y/y, stronger than expectations of -1.1% m/m and +7.1% y/y with the +9.5% y/y gain the largest year-on-year increase in 6-1/3 years.

U.S. STOCK PREVIEW

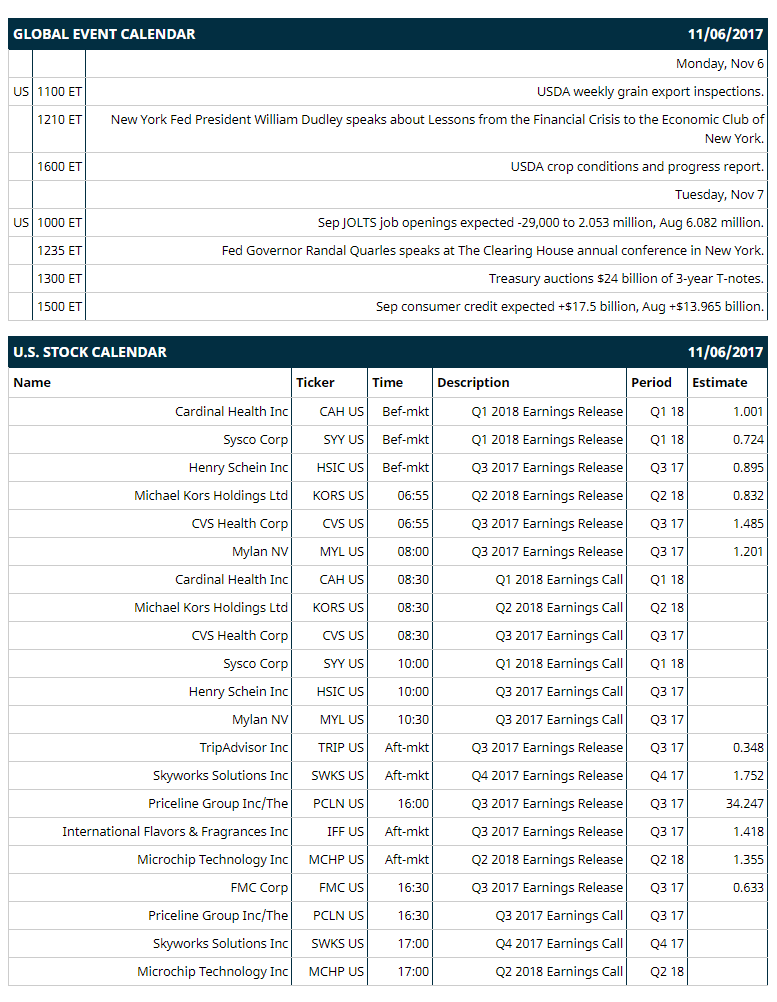

Key U.S. news today includes: (1) New York Fed President William Dudley speaks about “Lessons from the Financial Crisis” to the Economic Club of New York, (2) USDA weekly grain export inspections, (3) USDA crop conditions and progress report.

Notable S&P 500 earnings reports today include: Priceline (consensus $34.25), CVS Health (1.49), Intl Flavors (1.42), Cardinal Health (1.00), Sysco (0.72), FMC Corp (0.63), TripAdvisor (0.35).

U.S. IPO's scheduled to price today: none.

Equity conferences this week: BioTechnology Industry Organization Europe Conference on Mon, Citi Financial Technology Conference on Mon-Tue, EEI Financial Conference on Mon-Tue, Credit Suisse Health Care Conference on Tue-Wed, Bernstein Technology Innovation Summit on Tue-Wed, Stephens Fall Investment Conference on Tue-Wed, RBC Capital Markets Technology, Internet, Media and Telecommunications Conference on Tue-Wed, Robert W. Baird Global Industrial Conference on Tue-Wed, Wells Fargo Technology, Media & Telecom Conference on Tue-Wed, Deutsche Bank Gaming, Lodging & Leisure Conference on Wed.

OVERNIGHT U.S. STOCK MOVERS

Cavium (CAVM +3.42%) jumped 14% in pre-market trading after the WSJ reported that Marvell Technology is in advanced talks to combine with Cavium. Marvell Technology (MRVL +1.26%) dropped 9% in pre-market trading on the news.

Dish Network (DISH -0.41%) was upgraded to 'Buy' from 'Hold' at Pivotal Research Group LLC with a price target of $65.

Berkshire Hathaway ({=BRK-A=}) lost almost 1% in after-hours trading after it reported Q3 operating EPS of $2,094, below consensus of $2,347.

Qualcomm (QCOM +12.71%) gained over 1% in after-hours trading after Nomura said that Broadcom paying $70 a share for Qualcomm feels a "little low."

Host Hotels (HST +0.87%) was upgraded to 'Outperform' from 'Market Perform' at Wells Fargo Securities with a price target of $21.

Hyatt Hotels (H +0.97%) were downgraded to 'Neutral' from 'Outperform' at B Riley FBR.

Twitter (TWTR +0.96%) was upgraded to 'Neutral' from 'Sell' at Citigroup.

Electronics for Imaging (EFII +0.64%) was downgraded to 'Equal-Weight' from 'Overweight' at Barclays.

Hilton (HLT +0.99%) was downgraded to 'Market Perform' from 'Outperform' at Wells Fargo Securities.

TherapeuticsMD (TXMD -5.42%) rose over 3% in after-hours trading after it said it will provide a "TX-004HR regulatory update" with its Q3 earnings conference call Monday morning.

Sprint (S +3.73%) was downgraded to 'Underweight' from 'Sector Weight' at Keybanc Capital Markets with a 12-month target price of $5.50.

MARKET COMMENTS

Dec S&P 500 E-mini stock futures (ESZ17 -0.02%) this morning are down -1.25 points (-0.05%). Friday's closes: S&P 500 +0.31%, Dow Jones +0.10%, Nasdaq +0.95%. The S&P 500 on Friday rose to a new record high and closed higher on strength in technology stocks, led by a +2.6% rally in Apple to a new record high, after it reported better-than-expected Q4 revenue and forecasted higher-than-expected Q1 revenue. Stocks were also supported by the U.S. Sep factory orders report of +1.4% (stronger than expectations of +1.2%) and the unexpected +0.3 point increase in the U.S. Oct ISM non-manufacturing index to as 12-year high of 60.1 (stronger than expectations of -1.3 to 58.5).

Dec 10-year T-note prices (ZNZ17 +0.12%) this morning are up +7.5 ticks. Friday's closes: TYZ7 +0.50, FVZ7 -1.00. Dec 10-year T-notes on Friday closed little changed. T-note prices found carry-over support from a rally in German bunds to a 1-3/4 month high. T-note prices were also boosted by the +2.4% y/y increase in U.S. Oct average hourly earnings, weaker than expectations of +2.7% y/y and the smallest year-on-year increase in 20 months. T-note prices were undercut by the unexpected rise in the Oct ISM non-manufacturing index to a 12-year high.

The dollar index (DXY00 +0.08%) this morning is unch. EUR/USD (^EURUSD) is down -0.0012 (-0.10%) at a 1-week low and USD/JPY (^USDJPY) is unch. Friday's closes: Dollar Index +0.256 (+0.27%), EUR/USD -0.0050 (-0.43%), USD/JPY -0.01(-0.01%). The dollar index on Friday closed higher on the U.S. Oct payrolls report, which was close to expectations and boosted expectations for the Fed to raise interest rates next month. There was also weakness in EUR/USD after dovish comments from ECB Governing Council member Nowotny who said, "it's too early" to discuss putting an end date to stimulus measures.

Dec crude oil (CLZ17 +0.68%) this morning is yp +30 cents (+0.54%) at anew 2-1/3 year high and Dec gasoline (RBZ17+0.10%) is -0.0016 (-0.09%). Friday's closes: Dec WTI crude +1.10 (+2.02%), Dec gasoline +0.0237 (+1.34%). Dec crude oil and gasoline on Friday closed higher with Dec crude at a 2-1/3 year high. Crude oil prices were boosted by the Baker Hughes report that U.S. active oil rigs fell by -8 rigs in the week of Nov 3 to 729 rigs, the fewest in 5 months. Crude oil prices were also boosted by the rally in the crack spread to a 1-1/2 month high, which may spur demand for crude from refineries to refine into gasoline.

Metals prices this morning are higher with Dec gold (GCZ17 +0.16%) +4.0 (+0.32%), Dec silver (SIZ17 +0.21%) +0.071 (+0.42%) and Dec copper (HGZ17 +0.95%) +0.032 (+1.03%). Friday's closes: Dec gold -8.9 (-0.70%), Dec silver -0.303(-1.77%), Dec copper -0.0260 (-0.83%). Metals on Friday closed lower on a stronger dollar and on the stronger-than-expected U.S. Sep factory orders and Oct ISM non-manufacturing reports, which bolstered the case for Fed rate hike next month.

Disclosure: None.