Morning Call For Monday, Nov. 27

OVERNIGHT MARKETS AND NEWS

Dec E-mini S&Ps (ESZ17 -0.04%) this morning are up +0.09% at a new record nearest-futures high on signs of sustainability in the U.S. economic recovery as consumers continue to spend after Adobe Systems reported that Black Friday online spending was a record $5.03 billion, up +16.9% y/y. Adobe also estimates that today's Cyber Monday shopping day will be the biggest online shopping day in history, with $6.6 billion in predicted sales, up +16.5% y/y. European stocks are up +0.24% as political risks in Germany eased on signs that the SPD party will join Chancellor Merkel's Christian Democratic party in a "Grand Coalition." Asian stocks settled mostly lower: Japan -0.24%, Hong Kong -0.60%, China -0.94%, Taiwan -0.95%, Australia +0.10%, Singapore -0.17%, South Korea -1.76%, India +0.13%. China's Shanghai Composite tumbled to a 3-month low as concern over the government's attempt to tighten liquidity led to long liquidation in Chinese large-cap stocks.

The dollar index (DXY00 -0.08%) is down -0.12% at a 2-month low. EUR/USD (^EURUSD) is up +0.03% at a 2-month high on optimism Chancellor Merkel's Christian Democratic party can form a coalition with the German SPD party. USD/JPY (^USDJPY) is down -0.33%.

Dec 10-year T-note prices (ZNZ17 unch) are down -3 ticks.

Japan Oct PPI services prices rose +0.8% y/y, weaker than expectations of +0.9% y/y.

China Oct industrial profits rose +25.1% y/y and Jan-Oct industrial profits are up +23.3% y/y.

U.S. STOCK PREVIEW

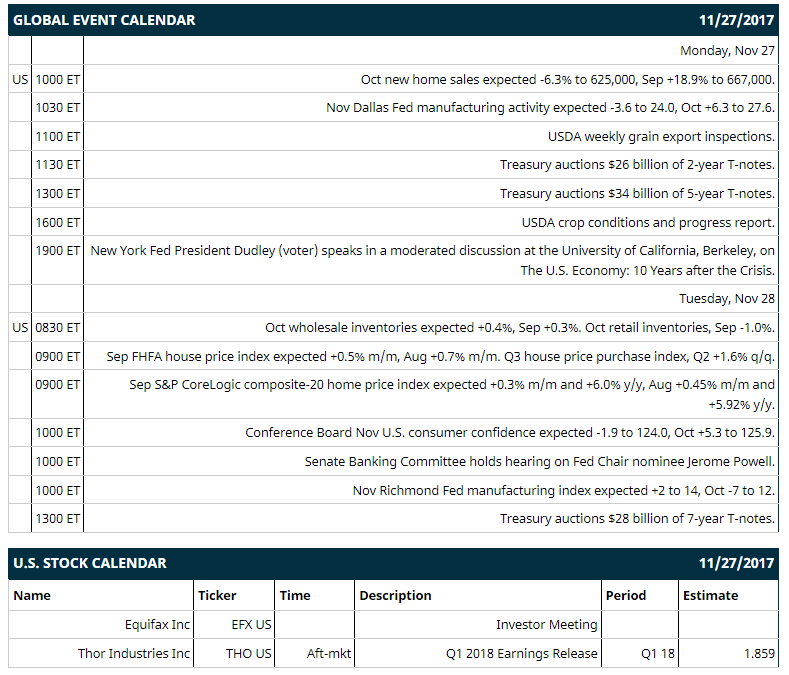

Key U.S. news today includes: (1) Oct new home sales (expected -6.3% to 625,000, Sep +18.9% to 667,000), (2) Nov Dallas Fed manufacturing activity (expected -3.6 to 24.0, Oct +6.3 to 27.6), (3) Treasury auctions $26 billion of 2-year T-notes and $34 billion of 5-year T-notes, (4) New York Fed President Dudley (voter) speaks in a moderated discussion at the University of California, Berkeley, on ‘The U.S. Economy: 10 Years after the Crisis,’ (5) USDA weekly grain export inspections, (6) USDA crop conditions and progress report.

Notable Russell 1000 earnings reports today include: Thor Industries (consensus $1.86).

U.S. IPO's scheduled to price today: none.

Equity conferences this week: MUFG Securities Equity Energy Tour on Mon, Credit Suisse Global TMT Conference on Mon-Wed, Credit Suisse Technology Media & Telecom Conference on Tue, UBS Global Real Estate CEO/CFO Conference on Tue, Piper Jaffray Health Care Conference on Tue-Wed, ACI European Base Oils & Lubricants Interactive Summit on Wed, Citi Basic Materials Conference on Wed-Thu, Bank of America Merrill Lynch Leveraged Finance Conference on Wed-Thu, Credit Suisse Industrials Conference on Wed-Thu, Evercore ISI Inaugural Biopharma Catalyst/Deep Dive Conference on Wed-Thu, ACI Cyber Security Oil, Gas, Power Conference on Thu, Deutsche Bank MedTools and Diagnostics One-on-One Day on Thu, HSBC High Yield Conference on Thu.

OVERNIGHT U.S. STOCK MOVERS

Ciena (CIEN +0.67%) was upgraded to 'Buy' from 'Neutral' at Bank of America/Merrill Lynch with a 12-month target price of $28.

Everest Re (RE -0.72%) was upgraded to 'Outperform' from 'Underperform' at Keefe, Bruyette & Woods.

Norfolk Southern (NSC +0.60%) was downgraded to 'Sell' from 'Hold' at Loop Capital Markets with a price target of $120.

Western Digital (WDC -0.14%) was downgraded to 'Equal-Weight' from 'Overweight' at Morgan Stanley.

Allergan (AGN -0.74%) was resumed with an 'Outperform' at Leerink Partners LLC with a 12-month target price of $237.

Buffalo Wild Wings (BWLD -0.07%) was downgraded to 'Neutral' from 'Buy' at UBS, citing valuation.

Square (SQ +0.10%) was downgraded to 'Sell' from 'Neutral' at BTIG LLC with a 12-month target price of $30.

Eminence Capital reported that it raised its passive stake in Wendy's (WEN -0.65%) to 5.2% from 3.68%.

Macy's (M +2.13%) slipped almost 1% in after-hours trading after a glitch in the company's credit-card processing Black Friday spurred long lines which prompted some customers to abandon purchases due to the long wait times.

Johnson Controls International Plc (JCI +0.33%) may move higher this morning after vice president of the company, William Jackson, filed a Form 4 with the SEC that he purchased 20,000 shares of JCI at an average price of $36 on Nov 21.

Broadfin Capital reported that it reduced its stake in Recro Pharma (REPH unch) to 15.31% from 16.21%.

Marathon Patent Group (MARA +172.94%) jumped 14% in after-hours trading on top of a 173% surge Friday after it reported a Q3 operating loss of -$3.9 million versus an operating loss of -$10.7 million for Q3 of 2016.

MARKET COMMENTS

Dec S&P 500 E-mini stock futures (ESZ17 -0.04%) this morning are up +2.25 points (+0.09%) at a new record nearest-futures high. Friday's closes: S&P 500 +0.21%, Dow Jones +0.14%, Nasdaq +0.36%. The S&P 500 on Friday climbed to a new record high and closed higher on a rally in consumer retail stocks due to optimism for strong holiday sales as Black Friday begins the all-important holiday shopping season. There was also strength in energy stocks after crude oil prices climbed +1.60% to a 2-1/3 year high.

Dec 10-year T-note prices (ZNZ17 unch) this morning are down -3 ticks. Friday's closes: TYZ7 -4.50, FVZ7 -2.75. Dec 10-year T-notes on Friday closed lower on the rally in the S&P 500 to a new record high and on the jump in crude oil prices to a 2-1/3 year high, which boosts inflation expectations.

The dollar index (DXY00 -0.08%) this morning is down -0.11 (-0.12%) at a 2-month low. EUR/USD (^EURUSD) is up +0.0004 (+0.03%) at a 2-month high and USD/JPY (^USDJPY) is down -0.37 (-0.33%). Friday's closes: Dollar Index -0.438 (-0.37%), EUR/USD +0.0080 (+0.68%), USD/JPY +0.30 (+0.27%). The dollar index on Friday fell to a 2-month low and closed lower on the unexpected decline in the U.S. Nov Markit manufacturing PMI, which is dovish for Fed monetary policy. There was also strength in EUR/USD, which rose to a 2-month high after the German Nov IFO business climate unexpectedly rose to the highest since the data series began in 1991.

Jan crude oil (CLF18 -1.05%) this morning is down -49 cents (-0.83%) and Jan gasoline (RBF18 -0.49%) is -0.0054 (-0.30%). Friday's closes: Jan WTI crude +0.93 (+1.60%), Jan gasoline +0.0187 (+1.06%). Jan crude oil and gasoline on Friday closed higher with Jan crude at a 2-1/3 year high and Jan gasoline at a 1-1/2 week high. Crude oil prices were boosted by the slump in the dollar index to a 2-month low and by a report that said Russia and OPEC have outlined a deal to extend their crude production cuts until the end of next year. Crude oil prices were also boosted by the rally in the S&P 500 to a new record high, which bolsters optimism in the economic outlook that may lead to increased energy demand.

Metals prices this morning are mixed with Dec gold (GCZ17 +0.51%) +6.2 (+0.48%), Dec silver (SIZ17 +0.52%) +0.078 (+0.46%) and Dec copper (HGZ17 -1.29%) -0.039 (-1.21%). Friday's closes: Dec gold -4.9 (-0.38%), Dec silver -0.120 (-0.70%), Dec copper +0.0320 (+1.02%). Metals on Friday settled mixed with Dec copper at a 3-week high. Metals prices were boosted by the slide in the dollar index to a 2-month low. Copper was also boosted by strikes by copper miners in Chile and Peru and by tighter copper supplies as LME copper inventories fell -5,475 MT to a 2-1/4 month low of 213,600 MT. Metals prices were undercut by the rally in the S&P 500 to a new record high, which curbs safe-haven demand for precious metals.

(Click on image to enlarge)

Disclosure: None.