Morning Call For Monday, Nov. 20

OVERNIGHT MARKETS AND NEWS

Dec E-mini S&Ps (ESZ17 -0.06%) this morning are down -0.02% on concern over passage of U.S. tax reform legislation. European stocks are up +0.23%, led by strength in automakers, after Volkswagen AG raised its 2020 sales growth forecast to 25%, up from a forecast of 20% in March. The upside in European stocks was limited after German Chancellor Merkel's attempt to form a new government collapsed after a month of coalition talks fell apart over disputes about migration policies that prompted the Free Democrats to walk out of the negotiations late Sunday night. That may spur Chancellor Merkel to ask German President Steinmeier to order a second national election, most likely in the spring, or form a minority government headed by her Christian Democratic bloc. Asian stocks settled mixed: Japan -0.60%, Hong Kong +0.21%, China +0.28%, Taiwan -0.35%, Australia -0.19%, Singapore +0.12%, South Korea =0.38%, India +0.05%. China's Shanghai Composite rebounded from a 1-1/2 month low and closed higher as property developers and home building stocks rallied after China Oct new home prices increased from Sep.

The dollar index (DXY00 +0.08%) is up +0.12%. EUR/USD (^EURUSD) is down -0.12%. USD/JPY (^USDJPY) is up +0.13%.

Dec 10-year T-note prices (ZNZ17 +0.10%) are up +2 ticks.

China Oct new home prices rose in 50 of the 70 cities tracked by the government, an improvement from 44 of the 70 that rose in Sep.

German Oct PPI rose +0.3% m/m and +2.7% y/y, right on expectations.

The Japan Oct trade balance shrank to a surplus of +285.4 billion yen, narrower than expectations of +330.0 billion yen. Oct exports rose +14.0% y/y, weaker than expectations of +15.7% y/y. Oct imports rose +18.9% y/y, weaker than expectations of +20.2% y/y.

U.S. STOCK PREVIEW

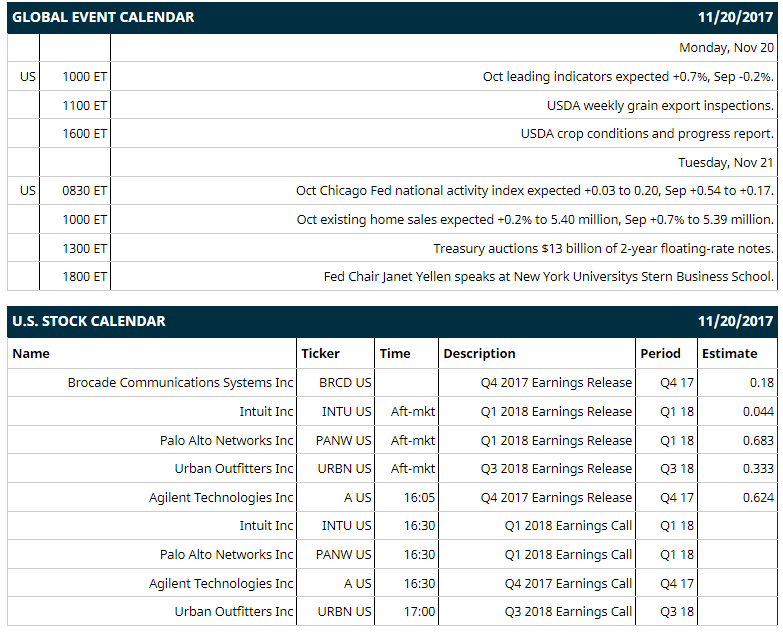

Key U.S. news today includes: (1) Oct leading indicators (expected +0.7%, Sep -0.2%), (2) USDA weekly grain export inspections, (3) USDA crop conditions and progress report.

Notable Russell 2000 earnings reports today include: Intuit (consensus $0.04), Brocade Communicates (0.18), Palo Alto (0.68), Urban Outfitters (0.33), Agilent Technologies (0.62).

U.S. IPO's scheduled to price today: none.

Equity conferences this week: none.

OVERNIGHT U.S. STOCK MOVERS

Wal-Mart (WMT -2.16%) was downgraded to 'Neutral' from 'Buy' at Goldman Sachs.

Monster Beverage (MNST +0.27%) was downgraded to 'Negative' from 'Neutral' at Susquehanna Financial with a price target of $51.

Verizon (VZ +1.45%) was upgraded to 'Outperform' from 'Market Perform' at Wells Fargo Securities with a target price of $50.

General Motors (GM +0.64%) was upgraded to 'Buy' from 'Neutral' at Guggenheim Securities.

Delphi Automotive Plc (DLPH -0.54%) was upgraded to 'Buy' from 'Neutral' at Bank of America/Merrill Lynch with a price target of $120.

Cardinal Health (CAH +0.16%) was downgraded to 'Underweight' from 'Equal weight' at Morgan Stanley with a price target of $51.

Resolute Energy (REN +4.02%) was upgraded to 'Overweight' from suspended coverage at Barclays with a 12-month target price of $37.

Jack in the Box (JACK +0.56%) was downgraded to 'Neutral' from 'Outperform' at Wedbush.

WGL Holdings (WGL -0.17%) reported a Q4 operating loss of -17 cents per share, narrower than consensus of -20 cents.

Advanced Accelerator Applications SA (AAAP -0.05%) American depository receipts were downgraded to 'Neutral' from 'Overweight' at JPMorgan Chase.

Pointer Telocation (PNTR -1.13%) was downgraded to 'Neutral' from 'Buy' at Roth Capital Partners.

Johnson & Johnson (JNJ -0.63%) said patients treated with its Invokana for type 2 diabetes had a 43% reduced risk for all-cause mortality and hospitalization for heart failure after an average of 1.6 years, compared to similar patients treated with a non-SGLT2i medication.

California Resources (CRC +4.46%) fell 4% in after-hours trading after it entered into an equity distribution pact with Morgan Stanley to sell up to 6 million shares of common stock from time to time.

Etsy (ETSY +0.30%) gained almost 1% in after-hours trading after the company announced a $100 million stock buyback program.

MARKET COMMENTS

Dec S&P 500 E-mini stock futures (ESZ17 -0.06%) this morning are down -0.50 points (-0.02%). Friday's closes: S&P 500 -0.26%, Dow Jones -0.43%, Nasdaq -0.39%. The S&P 500 on Friday closed lower on some concern that Senate Republicans may not have the support to pass tax reform legislation and the -7 point decline in the U.S. Nov Kansas City Fed manufacturing activity to 16, weaker than expectations of -2 to 21. Stocks were supported by news that U.S. Oct housing starts rose +13.7% to a 1-year high of 1.29 million, stronger than expectations of +5.6% to 1.19 million.

Dec 10-year T-note prices (ZNZ17 +0.10%) this morning are up +2 ticks. Friday's closes: TYZ7 +1.50, FVZ7 +0.25. Dec 10-year T-notes on Friday closed higher on the the decline in stocks, which boosted the safe-haven demand for T-notes, and on reduced inflation expectations after the 10-year T-note breakeven inflation rate fell to a 1-week low.

The dollar index (DXY00 +0.08%) this morning is up +0.111 (+0.12%). EUR/USD (^EURUSD) is down -0.0014 (-0.12%) and USD/JPY (^USDJPY) is up +0.15 (+0.13%). Friday's closes: Dollar Index -0.270 (-0.29%), EUR/USD +0.0020 (+0.17%), USD/JPY -0.96 (-0.85%). The dollar index on Friday closed lower on the slump in stocks, which sent USD/JPY to a 1-month low on increased safe-haven demand for the yen. The dollar was also undercut by the decline in the 10-year T-note yield, which reduced the dollar's interest rate differentials.

Dec crude oil (CLZ17 -0.55%) this morning is down -20 cents (-0.35%) and Dec gasoline (RBZ17 -0.91%) is -0.0056 (-0.32%). Friday's closes: Dec WTI crude +1.41 (+2.56%), Dec gasoline +0.0310 (+1.81%). Dec crude oil and gasoline on Friday closed higher on a weaker dollar and on comments by Saudi Arabian Energy Minister Khalid Al-Falih that OPEC should announce an extension of output cuts when it meets on Nov 30.

Metals prices this morning are lower with Dec gold (GCZ17 -0.35%) -5.9 (-0.46%), Dec silver (SIZ17 -1.08%) -0.213 (-1.23%) and Dec copper (HGZ17 -0.18%) -0.002 (-0.07%). Friday's closes: Dec gold +18.3 (+1.43%), Dec silver +0.301 (+1.76%), Dec copper +0.0190 (+0.62%). Metals prices on Friday closed higher with Dec gold and Dec silver at 1-month highs. Metals prices were boosted by a weaker dollar and the stronger-than-expected U.S. Oct housing starts and building permits, which is positive for copper consumption. Copper prices were also supported by tighter supplies after LME copper inventories fell -3,850 MT to a 2-month low of 247,700 MT.

(Click on image to enlarge)

Disclosure: None.