Morning Call For Monday, May 15

OVERNIGHT MARKETS AND NEWS

Jun E-mini S&Ps (ESM17 +0.13%) this morning are up +0.10% as energy producing stocks rallied after Jun WTI crude oil (CLM17 +3.05%) surged +2.91% to a 2-week high when Saudi Arabia and Russia said they favored extending a crude oil production-cut deal for another nine months, longer than expectations of six months. European stocks are down -0.30% as the markets gauge the effect of a massive cyber-attack on European businesses. More than 200,000 computers from at least 150 countries have so far been infected with a ransomware, according to Europol. It has affected the UK's National Health Service, Russia's Ministry of Interior, Chinese government agencies, Germany's Deutsche Bahn rail system, automakers Renault SA and Nissan Motor, and other company and hospital computer systems. Asian stocks settled mostly higher: Japan -0.07%, Hong Kong +0.86%, China +0.22%, Taiwan +0.50%, Australia +0.03%, Singapore +0.27%, South Korea +0.21%, India +0.44%. China's Shanghai Composite climbed to a 1-week high after Chinese President Xi Jinping unveiled an infrastructure spending plan at the Belt and Road Forum in Beijing. Gains were limited, though, after data on China Apr industrial production and retail sales missed estimates.

The dollar index (DXY00 -0.36%) is down -0.35%. EUR/USD (^EURUSD) is up +0.34%. USD/JPY (^USDJPY) is up +0.04%.

Jun 10-year T-note prices (ZNM17 +0.01%) are up +2 ticks at a 1-week high.

Japan Apr PPI rose +0.2% m/m and +2.1% y/y, stronger than expectations of -0.1% m/m and +1.8% y/y with the +2.1% y/y gain the largest year-on-year increase in 2-1/3 years.

China Apr industrial production rose +6.5% y/y, weaker than expectations of +7.0% y/y.

China Apr retail sales rose +10.7% y/y, weaker than expectations of +10.8% y/y.

U.S. STOCK PREVIEW

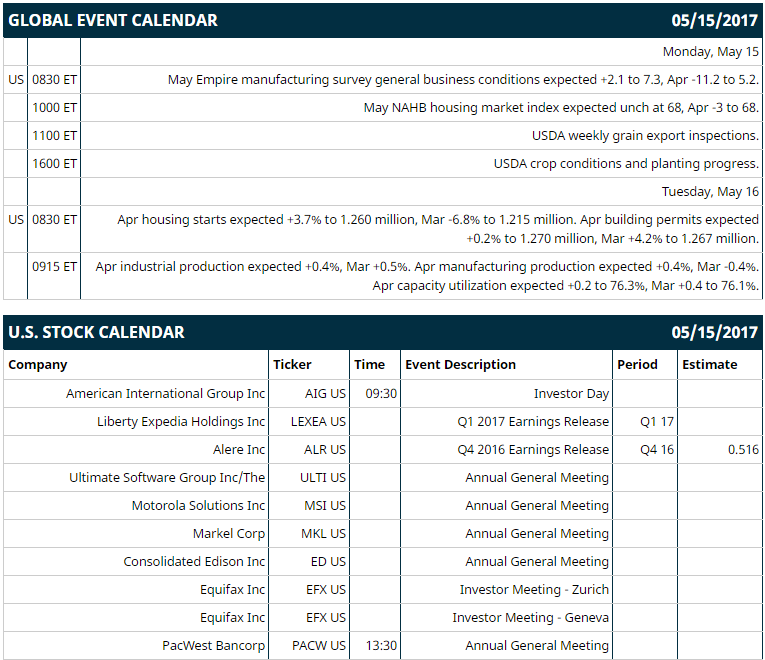

Key U.S. news today includes: (1) May Empire manufacturing index (expected +2.1 to 7.3, Apr -11.2 to 5.2), (2) May NAHB housing market index (expected unch at 68, Apr -3 to 68), (3) USDA weekly grain export inspections, (4) USDA crop conditions and planting progress.

Notable Russell 2000 earnings reports today include: Alere (consensus $0.52).

U.S. IPO's scheduled to price today: none.

Equity conferences: JP Morgan Denver Energy Bus Tour on Mon-Tue, Bank of America Merrill Lynch Global Mining Metals & Steel Conference on Tue, Deutsche Bank Clean Tech Utility & Power Conference on Tue, Needham Emerging Technology Conference on Tue-Wed, Goldman Sachs Basic Materials Conference on Tue-Wed, Bank of America Merrill Lynch Health Care Conference on Tue-Thu, Barclays Americas Select Franchise Conference on Tue-Fri, Stephens Energy Executive Summit on Wed, BMO Capital Markets Farm to Market Conference on Wed-Thu, J.P. Morgan Homebuilding & Building Products Conference on Wed-Thu, MoffettNathanson Media & Communications Summit on Wed-Thu, RBC Capital Markets Canadian Automotive, Transportation & Industrials Conference on Thu, Barclays Water Symposium - Panel on Thu.

OVERNIGHT U.S. STOCK MOVERS

Cisco (CSCO -0.54%) climbed nearly 2% in pre-market trading after it was upgraded to 'Overweight' from 'Equal-Weight' at Morgan Stanley with a price target of $39.

Johnson & Johnson (JNJ +0.36%) was upgraded to 'Overweight' from 'Neutral' at JP Morgan Chase with a price target of $140.

Acadia Health (ACHC +0.59%) was downgraded to 'Market Perform' from 'Outperform' at Leerink Partners LLC.

JC Penney (JCP -13.99%) was downgraded to 'Hold' from 'Buy' at Deutsche Bank.

TD Ameritrade (AMTD -1.30%) was upgraded to 'Outperform' from ‘Market Perform' at Wells Fargo with a price target of $44.

Starbucks (SBUX -0.56%) was upgraded to 'Buy' from 'Hold' at Deutsche Bank with a price target of $69.

Xylem (XYL +0.20%) was upgraded to 'Overweight' from 'Equal Weight' at Barclays with a price target of $59.

Cimarex Energy (XEC -0.84%) was upgraded to 'Buy' from 'Hold' at Williams Capital with a price target of $160.

Buffalo Wild Wings (BWLD -0.19%) was upgraded to 'Buy' from 'Hold' at Deutsche Bank with a price target of $180.

Tesla (TSLA +0.53%) is down over 2% in pre-market trading after it was downgraded to 'Equal-Weight' from 'Overweight.'

Avis Budget Group (CAR -1.65%) fell 2% in after-hours trading after CFO David Wyshner resigned, effective next month, to pursue other opportunities.

Progressive (PGR -0.62%) announced that its board authorized the repurchase of up to 25 million of its common shares.

Allscripts Healthcare Solutions (MDRX -2.53%) announced that Dennis Olis has been named interim CEO and will replace Melinda Whittington who is leaving the company.

MARKET COMMENTS

June E-mini S&Ps (ESM17 +0.13%) this morning are up +2.50 points (+0.10%). Friday's closes: S&P 500 -0.15%, Dow Jones -0.11%, Nasdaq +0.22%. The S&P 500 on Friday closed lower on concerns about U.S. consumer spending after Apr retail sales rose +0.4% and +0.3% ex autos, weaker than expectations of +0.6% and +0.5% ex autos. There was also weakness in retail stocks, led by an 11% plunge in Nordstrom's, after it reported an unexpected -0.8% decline in Q1 comparable-store-sales, weaker than consensus of unchanged. Stocks found support on news that the May University of Michigan U.S. consumer sentiment rose +0.7 to 97.7, stronger than expectations of unch at 97.0.

June 10-year T-notes (ZNM17 +0.01%) this morning are up +2 ticks at a 1-week high. Friday's closes: TYM7 +17.50, FVM7 +12.00. Jun T-=notes on Friday rose to a 1-week high and settled higher on the weaker-than-expected U.S. Apr CPI and Apr retail sales, which takes some of the urgency away for future Fed rate hikes. T-note prices were also supported by comments from Chicago Fed President Evans who said inflation pressures are "still under-running" the Fed's 2% objective.

The dollar index (DXY00 -0.36%) this morning is down -0.238 (-0.35%). EUR/USD (^EURUSD) is up +0.0037 (+0.34%) and USD/JPY (^USDJPY) is up +0.05 (+0.04%). Friday's closes: Dollar index -0.371 (-0.37%), EUR/USD -0.0007 (-0.06%), USD/JPY -0.42 (-0.37%). The dollar index on Friday closed lower on the weaker-than-expected U.S. Apr retail sales and Apr CPI reports, which may delay a Fed rate hike, and Chicago Fed President Evans' comment that downside risks to inflation "still predominate."

June WTI crude oil prices (CLM17 +3.05%) this morning are up +$1.39 a barrel (+2.91%) at a 2-week high and June gasoline (RBM17 +2.36%) is +0.0307 (+1.95%) at a 2-week high. Friday's closes: Jun crude +0.01 (+0.02%), Jun gasoline +0.0139 (+0.89%). Jun crude oil and gasoline on Friday closed higher with Jun gasoline at a 2-week high. Crude oil prices were boosted by a weaker dollar and by the jump in the crack spread to a 2-week high, which may boost refinery demand for crude oil to refine into gasoline. Crude oil prices were undercut by last Friday's report from Baker Hughes that active U.S. oil rigs in the week of May 12 rose 9 to 712, a 2-year high.

Disclosure: None.