Morning Call For Monday, June 12

OVERNIGHT MARKETS AND NEWS

Sep E-mini S&Ps (ESU17 -0.23%) this morning are down -0.23% and European stocks are down -0.97% at a 3-week low as last Friday's sell-off in U.S. technology stocks spreads across the globe. Apple is down 2% in pre-market trading, adding to Friday's -3.9% plunge, after Mizuho Securities downgraded Apple to 'Neutral' from 'Buy.' Technology stocks that supply Apple are declining as well with ASML Holding falling 4% and leading European technology stocks lower. Expectations for a 25 bp increase in the fed funds target range at Wednesday's FOMC meeting is also fueling long liquidation in equities. Asian stocks settled lower: Japan -0.52%, Hong Kong -1.24%, China -0.59%, Taiwan -0.88%, Australia closed for holiday, Singapore -0.18%, South Korea -1.01%, India -0.53%. Losses in technology stocks led declines in Asian markets as Samsung Electronics slid almost 2% and Tencent Holdings Ltd tumbled 2.5%.

The dollar index (DXY00 -0.20%) is down -0.10%. EUR/USD (^EURUSD) is up +0.22%. USD/JPY (^USDJPY) is down -0.35%.

Sep 10-year T-note prices (ZNU17 -0.07%) are down -4.5 ticks.

Japan May machine tool orders rose +24.4% y/y, the sixth consecutive monthly increase.

Japan May PPI was unch m/m and +2.1% y/y, weaker than expectations of +0.1% m/m and +2.2% y/y.

U.S. STOCK PREVIEW

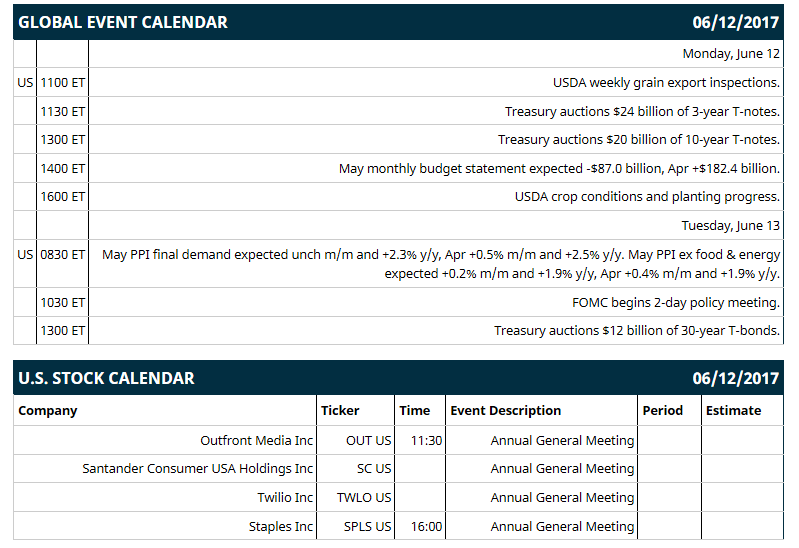

Key U.S. news today includes: (1) Treasury auctions $24 billion of 3-year T-notes and $20 billion of 10-year T-notes, (2) May monthly budget statement (expected -$91.5 billion, Apr +$182.4 billion), (3) USDA weekly grain export inspections, (4) USDA crop conditions and planting progress.

Notable Russell 2000 earnings reports today include: None.

U.S. IPO's scheduled to price today: None.

Equity conferences: American Diabetes Association Conference on Mon, J.P. Morgan Global Leaders Forum on Tue, Citi Industrials Conference on Tue-Wed, Morgan Stanley Financial Services Conference on Tue-Wed, William Blair & Company Growth Stock Conference on Tue-Thu, Deutsche Bank dbAccess Global Consumer Conference on Tue-Thu, Golddman Sachs European Payment Conference on Tue-Thu, Goldman Sachs Global Health Care Conference on Tue-Thu, Piper Jaffray Consumer Conference on Wed, Vertical Research Partners Materials Conference on Wed, RBC Capital Markets Financial Technology Investor Day on Wed, Drexel Hamilton Aerospace & Defense Conference on Thu, Stifel, Nicolaus & Co Industrials Conference on Thu, NASDAQ Investor Program on Thu.

OVERNIGHT U.S. STOCK MOVERS

Apple (AAPL -3.88%) is down 2% in pre-market trading after it was downgraded to 'Neutral' from 'Buy' at Mizuho Securities.

Adobe Systems (ADBE -3.21%) was downgraded to 'Sell' from 'Hold' at Pivotal Research Group LLC with a price target of $112.

Crown Castle International (CCI +0.87%) was downgraded to 'Market Perform' from 'Outperform' at Raymond James.

Pandora Media (P +1.19%) was upgraded to 'Outperform' from 'Market Perform' at FBR Capital Markets.

Regal Entertainment Group (RGC -1.27%) was downgraded to 'Sell' from 'Neutral' at MoffetNathanson.

Knight Transport (KNX +1.29%) was upgraded to 'Overweight' from 'Equal-Weight' at Stephens.

Hilton Worldwide Holdings (HLT -0.42%) climbed over 3% in after-hours trading when it was announced that it will replace Yahoo! in the S&P 500 before the opening on Monday, June 19.

Align Technology (ALGN -1.96%) will replace Teradata (TDC +0.47%) in the S&P 500 before the opening on Monday, June 19.

G1 Therapeutics (GTHX -0.43%) was initiated with a new 'Buy' at Needham with a price target of $34.

Ansys (ANSS -1.92%) will replace Ryder System R in the S&P 500 before the opening on Monday, June 19.

Coherus Biosciences (CHRS -9.03%) dropped nearly 6% in after-hours trading after two AbbVie patents on the arthritis drug Humira were rules "unpatentable" by the Patent Trial and Appeal Board.

Ocular Therapeutix (OCUL -1.41%) fell over 2% in after-hours trading after the company confirmed that CMO Jonathan Talamo resigned from his position effective June 15.

MARKET COMMENTS

Sep E-mini S&Ps (ESU17 -0.23%) this morning are down -5.50 points (-0.23%). Friday's closes: S&P 500 -0.08%, Dow Jones +0.42%, Nasdaq -2.44%. The S&P 500 index on Friday fell back from a new all-time high, posting a new 1-week low and finally closing slightly lower. The main bearish factor was the plunge in technology stocks, led by a nearly 4% fall in Apple and an 6% drop in Nvidia. Stocks found support on carry-over support from a rally in European stocks on signs of Eurozone economic strength after German Apr exports and imports both rose more than expected. There was also strength in financial stocks after the House late Thursday repealed many of the regulations of the Dodd-Frank law, which would exempt banks from stricter supervision if they hold more capital.

Sep 10-year T-notes (ZNU17 -0.07%) this morning are down -4.5 ticks. Friday's closes: TYU7 -1.00, FVU7 -1.00. Sep 10-year T-notes on Friday closed slightly lower on reduced safe-haven demand for T-notes after the S&P 500 rallied to a new record high. There was also long liquidation pressure in T-notes ahead of the Treasury's $56 billion T-note and T-bond auctions on Monday and Tuesday and the FOMC meeting on Tuesday and Wednesday.

The dollar index (DXY00 -0.20%) this morning is down -0.099 (-0.10%). EUR/USD (^EURUSD) is up +0.0025 (+0.22%) and USD/JPY (^USDJPY) is down -0.39 (-0.35%). Friday's closes: Dollar index +0.356 (+0.37%), EUR/USD -0.0019 (-0.17%), USD/JPY +0.30 (+0.27%). The dollar index on Friday rose to a 1-week high and settled higher on weakness in the pound against the dollar as GBP/USD tumbled to a 1-1/2 month low after Thursday's UK general election delivered a hung parliament, which will reduce Prime Minister May's negotiating leverage when Brexit negotiations begin with the European Union on June 19. There was also some short covering ahead of the Jun 13-14 FOMC meeting where the Fed is expected to boost the fed funds target range by 25 bp and could release some details on its plan to reduce its balance sheet.

Jul WTI crude oil prices (CLN17 +1.53%) this morning are up +56 cents (+1.22%) and July gasoline (RBN17 +1.19%) is +0.0142 (+0.95%). Friday's closes: Jul crude +0.19 (+0.42%), Jul gasoline +0.0098 (+0.66%). Jul crude oil and gasoline on Friday closed higher on the rally in the S&P 500 to a record high, which suggests optimism in the economic outlook that may lead to stronger energy demand. Crude oil prices were also supported by the rally in the crack spread to a 4-session high, which may boost refinery demand for crude to refine into gasoline. Crude oil prices were undercut by the rise in the dollar index in to a 1-week high.

(Click on image to enlarge)

Disclosure: None.