Morning Call For Monday, Jan. 9

OVERNIGHT MARKETS AND NEWS

Mar E-mini S&Ps (ESH17 -0.10%) are down -0.11% and European stocks are down -0.62% as a slide in crude oil prices drags energy producing stocks lower. Feb WTI crude oil (CLG17 -1.96%) is down -1.83% as an increase in U.S. drilling activity reduces the impact of OPEC production cuts after data from Baker Hughes last Friday showed U.S. oil drillers added rigs for a 10th straight week last week to the highest level in a year. Weakness in airline stocks is another negative for European equities with Lufthansa AG down 5% after the company failed to provide forward earnings guidance, unlike past years, which suggests a highly uncertain yield environment. Asian stocks settled mixed. Japan closed for holiday, Hong Kong +0.25%, China +0.54% at a 3-1/2 week high, Taiwan -0.32%, Australia +0.90%, Singapore +0.64%, South Korea +0.21%, India -0.12%.

The dollar index (DXY00 +0.10%) is up +0.10%. EUR/USD (^EURUSD) is down -0.07%. USD/JPY (^USDJPY) is down -0.26%. GBP/USD is down -1.05% at a 2-1/4 month low on concern over a hard Brexit after UK Prime Minister May signaled regaining control of immigration is among her top Brexit priorities.

Mar 10-year T-note prices (ZNH17 +0.20%) are up +7.5 ticks.

San Francisco Fed President William said that short-term fiscal stimulus "is not needed" and that "if the economy underperforms we will raise interest rates slower" and if the economy grows faster, "then we will have to raise rates faster."

The Eurozone Nov unemployment rate was unch at 9.8%, right on expectations and the lowest in 7-1/3 years.

Eurozone Jan Sentix investor confidence rose +8.2 to 18.2, stronger than expectations of +2.8 to 12.8 and the highest in 17 months.

U.S. STOCK PREVIEW

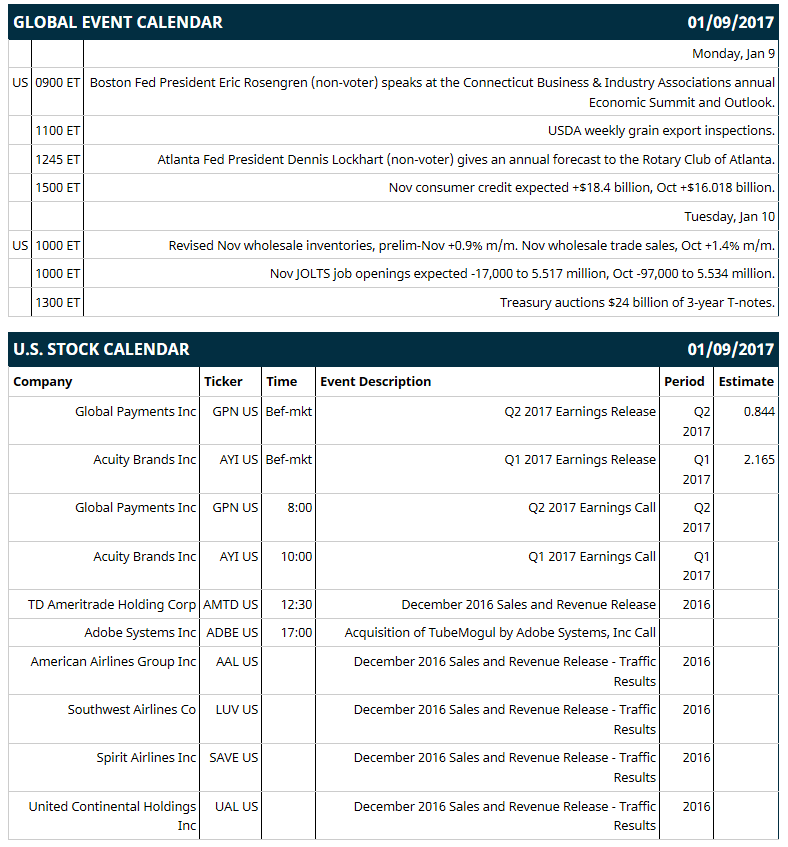

Key U.S. news today includes: (1) Boston Fed President Eric Rosengren (non-voter) speaks at the Connecticut Business & Industry Association’s annual Economic Summit and Outlook, (2) Atlanta Fed President Dennis Lockhart (non-voter) gives an annual forecast to the Rotary Club of Atlanta, (3) Nov consumer credit (expected +$18.4 billion, Oct +$16.018 billion), (4) USDA weekly grain export inspections.

Russell 1000 earnings reports today include: Acuity Brands (consensus $2.17), Global Payments (0.84).

U.S. IPO's scheduled to price today: none.

Equity conferences this week include: J.P. Morgan Healthcare Conference on Mon-Thu, Deutsche Bank Global Auto Industry Conference on Tue-Wed, Needham & Company Growth Conference on Tue-Wed, ICR Conference on Tue-Wed, Evercore ISI Utility Conference on Thu.

OVERNIGHT U.S. STOCK MOVERS

Coca-Cola (KO -0.02%) was downgraded to 'Sell' from 'Neutral' at Goldman Sachs.

VMware (VMW +2.57%) was downgraded to 'Neutral' from 'Buy' at UBS.

Dr Pepper Snapple (DPS -0.48%) was upgraded to 'Neutral' from 'Sell' at Goldman Sachs with a 12-month target price of $93.

Hormel (HRL +0.50%) was initiated with an 'Overweight' at Piper Jaffray with a 12-month target price of $40.

Teva Pharmaceutical Industries Ltd. (TEVA -7.53%) was downgraded to 'Market Perform' from 'Outperform' at Wells Fargo.

Eagle Pharmaceuticals (EGRX -8.55%) was downgraded to 'Underperform' from 'Neutral' at Mizuho Securities USA with a 12-month target price of $64.

Ameriprise Financial (AMP +1.69%) was upgraded to 'Outperform' from 'Neutral' at Credit Suisse with a price target of $152.

Oasis Petroleum (OAS -1.95%) was upgraded to 'Outperform' from 'Neutral' at Macquarie Research with a 12-month target price of $19.

Endologix (ELGX -7.92%) said a patient death does not appear to be related to its AFX device and that the patient that died experienced a "Type 1B endoleak" which is usually due to natural disease progression. ELGX had fallen over 7% Friday after a FDA report showed the patient's death may have been due to its AFX system.

Fiat Chrysler Automobiles (FCAU +6.22%) slid 1% in after-hours trading after it recalled over 86,000 older-model SUVs to replace driver and passenger-side airbags.

Aquinox Pharmaceuticals (AQXP +3.68%) lost over 1% in after-hours trading after it registered 10.5 million shares for holders.

Quidel (QDEL -0.63%) dropped over 6% in after-hours trading after it reported preliminary Q4 revenue of $52 million-$53 million, below consensus of $64.1 million.

Stage Stores (SSI -2.68%) tumbled 10% in after-hours trading after it said comparable store sales fell -7.3% for the 9-week period ending December 31 and then said it sees a 2017 adjusted loss of -70 cents to -85 cents a share, a wider loss than a November 17 estimate of -15 cents to -40 cents.

MARKET COMMENTS

Mar E-mini S&Ps (ESH17 -0.10%) this morning are down -2.50 points (-0.11%). Friday's closes: S&P 500 +0.5%, Dow Jones +0.32%, Nasdaq +0.85%. The S&P 500 on Friday rallied to a record high and settled higher on the Dec payroll report of +156,000, which was mildly below expectations of +175,000 but was offset by the +26,000 upward revision in Nov payrolls to +204,000 from +178,000. Stocks were also boosted by the +2.9% y/y increase in U.S. Dec avg hourly earnings, which is positive for consumer income and spending.

Mar 10-year T-notes (ZNH17 +0.20%) this morning are up +7.5 ticks. Friday's closes: TYH7 -13.50, FVH7 -9.75. Mar-10-year T-notes fell back from a 1-month high and closed lower on the +2.9% y/y increase in U.S. Dec average hourly earnings, the largest year-on-year gain in 7-1/2 years and a sign of wage pressures.

The dollar index (DXY00 +0.10%) this morning is up +0.10 (+0.10%). EUR/USD (^EURUSD) is down -0.0007 (-0.07%). USD/JPY (^USDJPY) is down -0.30 (-0.26%). Friday's closes: Dollar index +0.700 (+0.69%), EUR/USD -0.0075 (-0.71%), USD/JPY +1.67 (+1.45%). The dollar index on Friday closed higher on the stronger-than-expected U.S. Dec average hourly earnings report of +2.9% y/y, which bolsters the case for additional Fed rate hikes. There was also strength in USD/JPY as a rally in stocks reduced the safe-haven demand for the yen.

Feb WTI crude oil prices (CLG17 -1.96%) this morning are down -99 cents (-1.83%) and Feb gasoline (RBG17 -1.87%) is -0.0302 (-1.85%). Friday's closes: Feb crude +0.23 (+0.43%), Feb gasoline -0.0037 (-0.23%). Feb crude oil and gasoline on Friday settled mixed. Crude oil prices were undercut by a stronger dollar and by a 4-rig increase in active U.S. oil rigs to a 1-year high of 529 rigs. Crude oil prices were boosted by the adequate U.S. Dec payroll report and by a report that Saudi Arabia plans full compliance with its Jan 1 production cut in order to encourage other OPEC members do the same.

(Click on image to enlarge)

Disclosure: None.