Morning Call For Monday, Jan. 30

OVERNIGHT MARKETS AND NEWS

Mar E-mini S&Ps (ESH17 -0.26%) are down -0.28% and European stocks are down -0.90% on concern the Trump administration's isolationist policies may slow global trade. Many international companies, such as Apple and Google, have said that President Trump's executive order halting immigration from seven African and Middle Eastern countries threatens to choke the free flow of workers and commerce. European stocks fell even after Eurozone Jan business confidence rose to a 5-3/4 year high. Asian stocks settled mostly lower: Japan -0.51%, Australia -0.92%, India -0.12%, Hong Kong, China, Taiwan, Singapore and South Korea were all closed for holiday. Asian stocks were undercut on trade concerns over President Trump's policies and Japanese stocks were also pressured after Japan Dec retail sales fell more than expected.

The dollar index (DXY00 +0.39%) is up +0.25%. EUR/USD (^EURUSD) is down -0.32%. USD/JPY (^USDJPY) is down -0.39%.

Mar 10-year T-note prices (ZNH17 -0.04%) are down -2 ticks.

Eurozone Jan business confidence rose +0.4 to 108.2, stronger than expectations of unch at 107.8 and a 5-3/4 year high.

Japan Dec retail sales fell -1.7% m/m, weaker than expectations of -0.5% m/m and the biggest decline in 10 months.

U.S. STOCK PREVIEW

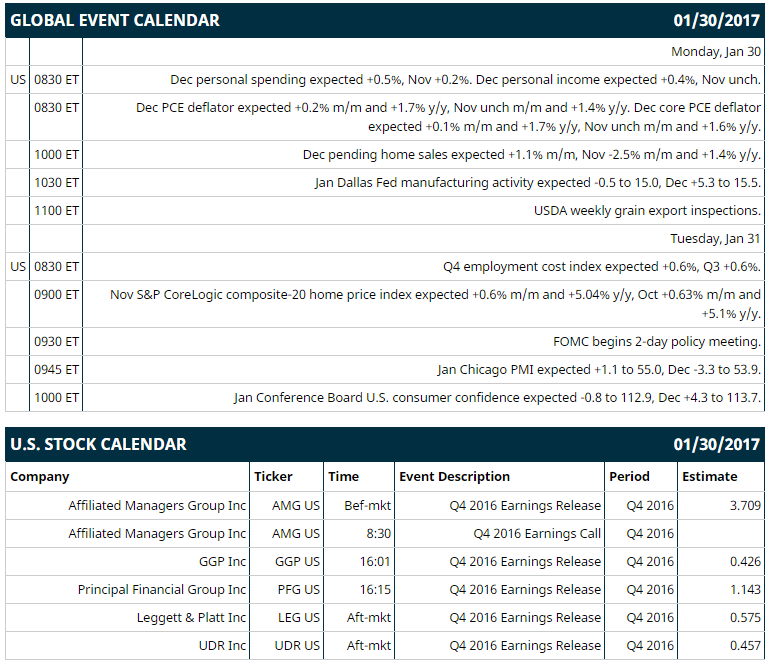

Key U.S. news today includes: (1) Dec personal spending (expected +0.5%, Nov +0.2%) and Dec personal income (expected +0.4%, Nov unch), (2) Dec PCE deflator (expected +0.2% m/m and +1.7% y/y, Nov unch m/m and +1.4% y/y) and Dec core PCE deflator (expected +0.1% m/m and +1.7% y/y, Nov unch m/m and +1.6% y/y), (3) Dec pending home sales (expected +1.1% m/m, Nov -2.5% m/m and +1.4% y/y), (4) Jan Dallas Fed manufacturing activity index (expected -0.5 to 15.0, Dec +5.3 to 15.5), (5) USDA weekly grain export inspections.

Notable S&P 500 earnings reports today include: Principal Financial Group (consensus 0.58), Affiliated Managers Group (3.71), GGP (0.43), LEggett & Platt (0.58), UDR (0.46).

U.S. IPO's scheduled to price today: none.

Equity conferences: none.

OVERNIGHT U.S. STOCK MOVERS

MB Financial (MBFI -1.09%) was downgraded to 'Market Perform' from ‘Outperform' at KBW with a price target of $46.

NetApp (NTAP +0.43%) was upgraded to 'Buy' from 'Neutral' at Goldman Sachs with a 12-month target price of $43.

Royal Caribbean Cruises Ltd. (RCL -1.13%) was upgraded to 'Buy' from 'Hold' at Argus with a price target of $116.

Temper Sealy International (TPX -2.89%) is indicated to open down 6% after it was downgraded to 'Underperform' from 'Outperform' at Raymond James.

Colgate-Palmolive (CL -5.22%) was downgraded to 'Neutral' from 'Buy' at Citigroup.

American Express (AXP -0.10%) was upgraded to 'Outperform' from 'Market Perform' at KBQ with a price target of $91.

Dick's Sporting Goods (DKS -2.01%) was upgraded to 'Buy' from 'Neutral' at Goldman Sachs with a 12-month target price of $62.

Regulus Therapeutics (RGLS unch) was downgraded to 'Hold' from 'Buy' at Needham & Co.

Array BioPharma (ARRY +1.27%) was downgraded to 'Market Perform' from 'Outperform' at Leerink Partners with a 12-month target price of $11.

Lowe's (LOW +0.03%) gained almost 1% in after-hours trading after it announced a new $5 billion share repurchase program.

Cannell Capital reported a 5% stake in Build-A-Bear Workshop (BBW +2.95%) .

Arctic Cat (ACAT +2.56%) was upgraded to 'Market Perform' from 'Underperform' at BMO Capital Markets with a price target of $18.50.

MARKET COMMENTS

Mar E-mini S&Ps (ESH17 -0.26%) this morning are down -6.50 points (-0.25%). Friday's closes: S&P 500 -0.09%, Dow Jones -0.04%, Nasdaq +0.22%. The S&P 500 on Friday closed lower on growth concerns after U.S. Q4 GDP rose +1.9% (q/q annualized), weaker than expectations of +2.2%. There was also weakness in energy producers after crude oil fell -1.13%. Supportive factors included the +0.8% increase in U.S. December capital goods orders nondefense ex-aircraft (stronger than expectations of +0.2%) and the +0.5-point increase in the U.S. Jan University of Michigan consumer sentiment to a 13-year high of 98.5 (stronger than expectations of unchanged at 98.1).

Mar 10-year T-notes (ZNH17 -0.04%) this morning are down -2 ticks. Friday's closes: TYH7 +6.50, FVH7 +3.50. Mar 10-year T-notes on Friday closed higher on the the weaker-than-expected U.S. Q4 GDP report of +1.9% and on increased safe-haven demand with the sell-off in stocks. T-notes were undercut by the rise in the Jan University of Michigan U.S. consumer sentiment index to a 13-year high.

The dollar index (DXY00 +0.39%) this morning is up +0.25 (+0.25%). EUR/USD (^EURUSD) is -0.0034 (-0.32%). USD/JPY (^USDJPY) is -0.45 (-0.39%). Friday's closes: Dollar index +0.15 (+0.15%), EUR/USD +0.0017 (+0.16%), USD/JPY +0.57 (+0.50%). The dollar index on Friday closed higher on the stronger-than-expected U.S. Dec capital goods orders nondefense ex-aircraft report, a proxy for capital spending, which shows firms are more confident in the economic outlook. The dollar was also boosted by the increase in U.S. Jan University of Michigan consumer sentiment to a 13-year high.

Mar WTI crude oil prices (CLH17 +0.26%) this morning are up +13 cents (+0.24%) and Mar gasoline (RBH17 -0.37%) is -0.0068 (-0.44%). Friday's closes: Mar crude -0.61 (-1.13%), Mar gasoline -0.0175 (-1.12%). Mar crude oil and gasoline on Friday closed lower on a stronger dollar and on the weaker-than-expected U.S. Q4 GDP report. Crude oil prices were also undercut by the increase in U.S. active oil rigs by 16 in the week ended Friday to a 14-1/2 month high of 566 rigs.

Disclosure: None.